It didn't take long for hedge funds to completely reverse their aversion towards energy.

Recall back in the middle of March, when not long after oil briefly soared to the highest level in 14 years, hedge funds just couldn't sell oil fast enough - contrary to traders of physical oil who were buying up every last drop, be it real or synthetic - they could find. It's also one of the primary reasons why despite dismal fundamentals which scream oil in the mid to upper-$100 range, the black gold would get slammed down every time it tried to make a break for it.

So fast forward to today, when oil is now well back over the price hit when Biden announced his SPR release, and energy stocks - in the words of Goldman's head of hedge fund sales Tony Pasquariello - remain the only place to hide from the market's vicious selloff. A big reason for that is that hedge funds have finally capitulated on dumping and shorting energy, and have turned full-bore oil bulls.

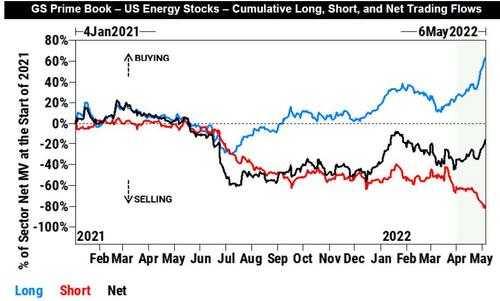

According to the latest weekly report by Goldman's Prime Brokerage group (full note available to professional subscribers), amid rising crude oil prices, Energy was the only US sector that saw positive price returns this week, outperforming the S&P 500 index by +7.7% (largest spread in 8 weeks). More importantly, it was also among the most $ net bought US sectors on the GS Prime book.

Remarkably, hedge funds bought US Energy stocks at the fastest pace since Mar ’20 amid continued sector outperformance.

According to GS Prime, "this week’s net buying in US Energy was the largest since Mar 2020 (1-Yr Z score +1.8), driven by long buys outpacing short sales nearly 4 to 1; Integrated Oil & Gas, E&P, and Oil & Gas Equip & Services were among the most net bought subindustries, while Storage & Transportation and Oil & Gas Drilling were among the most net sold."

Some more details on the recent buying flurry: hedge funds were net buyers of US Energy stocks in 4 of the past 5 weeks, driven by long buys outpacing short sales 3 to 1. More notably, the uptick in $ gross trading flow in US Energy over the past month was the largest over any 4-week period since Mar ’20.

Still, before we get calls of "hedge funds are rotating in so dump it all", here is some context: energy now makes up a paltry 4.4% of overall US Net exposure (vs. an even paltrier 2.1% at the start of 2022), and while this is the highest level since Aug ’19, it is just in the 37th %ile vs. the past five/ten years.

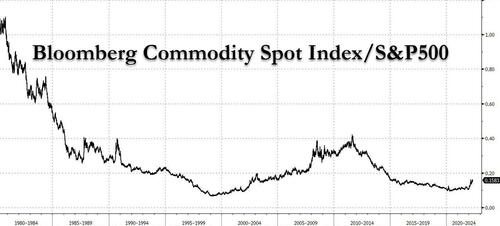

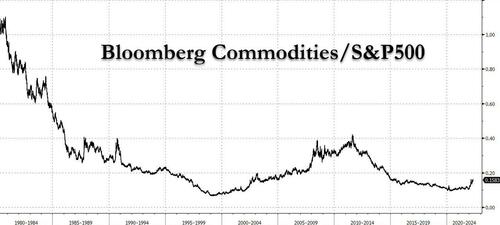

How much more can the rotation into energy be in the coming weeks and months? Well, if we are about to experience a reversion to the mean, it could be a lot because while the Bloomberg commodity spot index is clearly trading at all time highs...

... when put in the context of equities, well... see for yourselves:

It didn’t take long for hedge funds to completely reverse their aversion towards energy.

Recall back in the middle of March, when not long after oil briefly soared to the highest level in 14 years, hedge funds just couldn’t sell oil fast enough – contrary to traders of physical oil who were buying up every last drop, be it real or synthetic – they could find. It’s also one of the primary reasons why despite dismal fundamentals which scream oil in the mid to upper-$100 range, the black gold would get slammed down every time it tried to make a break for it.

So fast forward to today, when oil is now well back over the price hit when Biden announced his SPR release, and energy stocks – in the words of Goldman’s head of hedge fund sales Tony Pasquariello – remain the only place to hide from the market’s vicious selloff. A big reason for that is that hedge funds have finally capitulated on dumping and shorting energy, and have turned full-bore oil bulls.

According to the latest weekly report by Goldman’s Prime Brokerage group (full note available to professional subscribers), amid rising crude oil prices, Energy was the only US sector that saw positive price returns this week, outperforming the S&P 500 index by +7.7% (largest spread in 8 weeks). More importantly, it was also among the most $ net bought US sectors on the GS Prime book.

Remarkably, hedge funds bought US Energy stocks at the fastest pace since Mar ’20 amid continued sector outperformance.

According to GS Prime, “this week’s net buying in US Energy was the largest since Mar 2020 (1-Yr Z score +1.8), driven by long buys outpacing short sales nearly 4 to 1; Integrated Oil & Gas, E&P, and Oil & Gas Equip & Services were among the most net bought subindustries, while Storage & Transportation and Oil & Gas Drilling were among the most net sold.”

Some more details on the recent buying flurry: hedge funds were net buyers of US Energy stocks in 4 of the past 5 weeks, driven by long buys outpacing short sales 3 to 1. More notably, the uptick in $ gross trading flow in US Energy over the past month was the largest over any 4-week period since Mar ’20.

Still, before we get calls of “hedge funds are rotating in so dump it all”, here is some context: energy now makes up a paltry 4.4% of overall US Net exposure (vs. an even paltrier 2.1% at the start of 2022), and while this is the highest level since Aug ’19, it is just in the 37th %ile vs. the past five/ten years.

How much more can the rotation into energy be in the coming weeks and months? Well, if we are about to experience a reversion to the mean, it could be a lot because while the Bloomberg commodity spot index is clearly trading at all time highs…

… when put in the context of equities, well… see for yourselves: