Hedge fund managers have ramped up their bearish bets on US corn futures to record levels, driven by elevated grain supplies and the best early crop ratings in years. These factors have pressured corn prices lower.

Bloomberg data reveals that money managers have boosted their short-only positions in Chicago corn futures and options to 507,901 contracts, exceeding the previous record of 506,000 contracts in 2019. The net position, which accounts for the difference in long and short holdings, was bearish by 353,983 contracts, the largest since 2006.

Last month, Reuters reported that an above-average volume of corn remains unsold, and if these grain inventories are not depleted, then supplies could reach six-year highs by late summer 2025.

"Farmers risk waiting too long to sell as a flood of newly harvested grain is likely to drag down prices this October and November. Buyers, aware the harvest is coming, still need enough supplies to keep processing plants running and exports flowing this summer," Reuters said.

Elevated supplies have pressured prices in Chicago to under the $4 a bushel level, the lowest level since early 2020.

Bloomberg noted last week that US farmers are now holding the largest stockpiles of corn since 1988:

"The US farmers, who are the world's largest corn producers, have been holding off selling early in the season as prices of the key grain slide toward $4 a bushel for the first time since 2020."

The USDA's latest monthly World Agricultural Supply and Demand Estimates report revealed that demand for corn moved slightly higher. The report, released last Friday, has so far put a floor under prices.

The USDA's WASDE report was "enough to halt, at least temporarily, the bear market in corn prices," Sal Gilbertie, chief investment officer at Teucrium Trading, told MarketWatch.

"It looks like short sellers began to actively cover their positions upon the release of today's WASDE, which occurs just as corn in the US begins to enter the critical pollination stage of development," Gilbertie added.

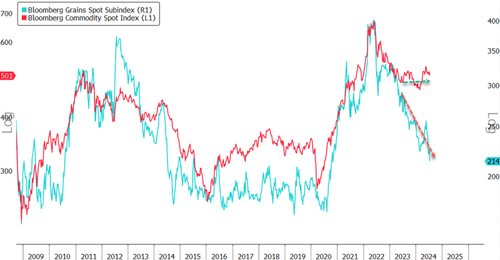

Meanwhile, Bloomberg's Mike McGlone noted grain deflation while broader commodity markets remained positively diverged:

"Volatility in the grains (corn, soybeans and wheat) is higher than broad commodities: It's the most elastic sector and prices are accelerating downward, with deflationary macroeconomic implications. Russia's invasion of Ukraine was a good test of the propensity for commodities to go down, because they went up and the trajectory at the start of 2H may prove autocorrelation forces are more powerful than ever. Our graphic shows the tendency for the Bloomberg Grains Spot Index to lead broad commodities and potential for the Bloomberg Commodity Spot Index to drop about another 30%, to simply catch up to the grains."

While falling grain prices may signal lower food costs for consumers, the combination of sliding prices and high production costs spells trouble for farmers' incomes.

Hedge fund managers have ramped up their bearish bets on US corn futures to record levels, driven by elevated grain supplies and the best early crop ratings in years. These factors have pressured corn prices lower.

Bloomberg data reveals that money managers have boosted their short-only positions in Chicago corn futures and options to 507,901 contracts, exceeding the previous record of 506,000 contracts in 2019. The net position, which accounts for the difference in long and short holdings, was bearish by 353,983 contracts, the largest since 2006.

Last month, Reuters reported that an above-average volume of corn remains unsold, and if these grain inventories are not depleted, then supplies could reach six-year highs by late summer 2025.

“Farmers risk waiting too long to sell as a flood of newly harvested grain is likely to drag down prices this October and November. Buyers, aware the harvest is coming, still need enough supplies to keep processing plants running and exports flowing this summer,” Reuters said.

Elevated supplies have pressured prices in Chicago to under the $4 a bushel level, the lowest level since early 2020.

Bloomberg noted last week that US farmers are now holding the largest stockpiles of corn since 1988:

“The US farmers, who are the world’s largest corn producers, have been holding off selling early in the season as prices of the key grain slide toward $4 a bushel for the first time since 2020.”

The USDA’s latest monthly World Agricultural Supply and Demand Estimates report revealed that demand for corn moved slightly higher. The report, released last Friday, has so far put a floor under prices.

The USDA’s WASDE report was “enough to halt, at least temporarily, the bear market in corn prices,” Sal Gilbertie, chief investment officer at Teucrium Trading, told MarketWatch.

“It looks like short sellers began to actively cover their positions upon the release of today’s WASDE, which occurs just as corn in the US begins to enter the critical pollination stage of development,” Gilbertie added.

Meanwhile, Bloomberg’s Mike McGlone noted grain deflation while broader commodity markets remained positively diverged:

“Volatility in the grains (corn, soybeans and wheat) is higher than broad commodities: It’s the most elastic sector and prices are accelerating downward, with deflationary macroeconomic implications. Russia’s invasion of Ukraine was a good test of the propensity for commodities to go down, because they went up and the trajectory at the start of 2H may prove autocorrelation forces are more powerful than ever. Our graphic shows the tendency for the Bloomberg Grains Spot Index to lead broad commodities and potential for the Bloomberg Commodity Spot Index to drop about another 30%, to simply catch up to the grains.”

While falling grain prices may signal lower food costs for consumers, the combination of sliding prices and high production costs spells trouble for farmers’ incomes.

Loading…