After several months of crushing losses, November was a very strong month for markets, with broad-based gains across equities, credit, sovereign bonds and commodities. In fact, 35 of the 38 noncurrency assets tracked by Deutsche Bank were in positive territory, which is the highest number so far this year and makes a change from the prevailing dismal market mood we’ve been used to.

As DB's Henry Allen writes in his November performance review, the positive market momentum was propelled by a number of factors, including signs that inflation momentum was beginning to ease across the key economies, with downside surprises from both the US and the Euro Area in the latest data. In the meantime, there were further signs that China was inching away from its zero Covid strategy, leading to a massive outperformance from Chinese assets. However, one asset that struggled was the US Dollar, and the unwinding risk premium meant it experienced its worst month in over a decade.

In terms of the drivers behind the various market moves, the biggest one was the downside surprise in the US CPI reading for October, which came out on November 10. That came in below expectations, and the monthly growth in core CPI was the slowest in over a year. In turn, that triggered an incredible single-day rally, with yields on 2yr Treasuries seeing their biggest daily decline since 2008, whilst the S&P 500 had its best day since April 2020. Furthermore, the report led investors to price in a growing chance that the Fed would slow down the pace of their rate hikes to just 50bps in December, following four consecutive hikes at a 75bps pace. That was cemented on the final day of the month in a speech by Fed Chair Powell, who said that "the time for moderating the pace of rate increases may come as soon as the December meeting." The positive inflation news wasn’t confined to the US either, since on the last day of the month we got the flash CPI release for the Euro Area, which fell by more than expected to +10.0%.

Against that backdrop, Allen notes that the rally in risk assets continued, and the S&P 500 is now up by more than +14% in total return terms over October and November! That’s the best performance for the index over two calendar months since late 2020, although there remain plenty of doubts about how durable this is and whether this is just another bear market rally. Meanwhile, the prospect of a downshift from the Fed saw Treasuries (+2.8%) put in their best monthly performance since March 2020, back when the pandemic started and the Fed cut rates back to the zero lower bound.

The second big positive driver for markets in November came from China, where there were growing signs that officials were inching away from the zero Covid strategy. For example, officials said they would seek to raise vaccination rates among the elderly, which was good news for markets since stronger levels of immunity are seen as raising the chances of the economy reopening. Earlier in the month, the quarantine requirement for close co tacts and inbound travellers was also cut from 10 days to 8. And on the final day of the month, Vice Premier Sun Chunlan said that “As the omicron variant becomes less pathogenic, more people get vaccinated and our experience in Covid prevention accumulates, our fight against the pandemic is at a new stage and it comes with new tasks”. All this meant Chinese assets performed very strongly, with the Shanghai Composite up +8.9%, and the Hang Seng up +26.8%. That marked the best month for the Hang Seng since October 1998.

In the UK, gilts (+2.9%) outperformed for a second month running as the turmoil stemming from the mini-budget in late September continued to unwind. Indeed, the spread of UK 10yr yields over bunds came down by a further -13.8bps over the month to 123bps. Markets reacted calmly to the government’s Autumn Statement as well, which included £55bn of fiscal tightening as the government sought to reassure investors about their fiscal credibility.

Still, despite the cross-asset rally in November, the DB strategist correctly notes that there’s plenty of pessimism in markets at this moment. For instance, the 2s10s curve that’s inverted prior to all of the last 10 US recessions is now inverted by -71bps, which is the lowest monthly close since September 1981. In addition, the Fed’s preferred curve of the near-term forward spread (measured by the 18m forward 3m yield minus the spot 3m yield) inverted in November for the first time in this cycle so far, and ended the month at -41bps.

There were also plenty of jitters around crypto-assets over the month, particularly following the bankruptcy of crypto exchange FTX, followed by BlockFi later in the month. That backdrop saw Bitcoin fall -16.2% in November to $17,105, which is its lowest monthly close since October 2020.

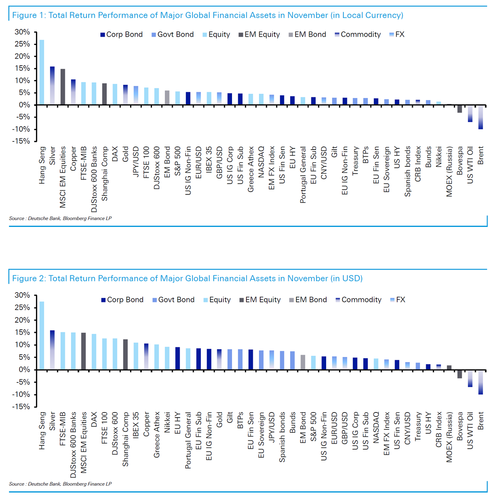

Which assets saw the biggest gains in November?

- Equities: The equity rebound from October continued into November, with the S&P 500 (+5.6%), the STOXX 600 (+6.9%) posting solid gains in total return terms. The Hang Seng strongly outperformed, and its +26.8% gain over the month was the largest since October 1998. That said, the major indices are still in negative territory on a YTD basis, with the S&P 500 down -13.1%.

- Sovereign Bonds: Fresh hopes that we might have seen the worst of inflation supported sovereign bonds this month, with Treasuries (+2.8%) seeing their best performance since March 2020. Gilts (+2.9%) outperformed in November as they continued to recover from the turmoil following the mini-budget, but they remain one of the worst YTD performers, having lost -21.6% since the start of the year.

- Credit: All of the credit indices in our sample moved higher this month across USD, EUR and GBP. That’s only the second month this year that’s happened, with July being the other time. US HY was a relative underperformer however, with just a +2.2% gain.

- Metals: Both copper (+10.5%) and gold (+8.3%) ended a run of 7 consecutive monthly declines in November. Copper was supported by hopes that China might move away from the zero Covid strategy, helping to boost demand.

Which assets saw the biggest losses in November?

- Oil: Brent crude (-9.9%) fell for the 5th time in the last 6 months, ending November at just $85.43/bbl. Even so, it’s still in positive YTD territory, having advanced +9.8% since the start of the year.

- US Dollar: Stronger risk appetite meant that the risk premium supporting the dollar unwound somewhat, with the dollar index down -5.0% over the month. That’s its worst performance since July 2020, with the dollar weakening against every other G10 currency.

- Cryptocurrencies: The FTX bankruptcy meant there was a tough backdrop for crypto-assets, and Bitcoin fell -16.2% in November, bringing its YTD decline to -63.1%. Other cryptocurrencies struggled too, with Ethereum down -17.1%.

Finally, here is a visual breakdown of the top assets in November...

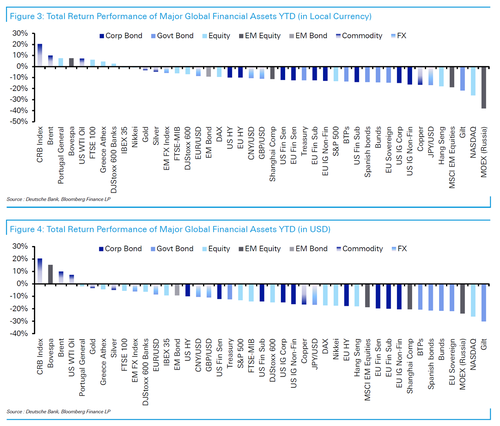

... and YTD.

More in the full report available to pro subs.

After several months of crushing losses, November was a very strong month for markets, with broad-based gains across equities, credit, sovereign bonds and commodities. In fact, 35 of the 38 noncurrency assets tracked by Deutsche Bank were in positive territory, which is the highest number so far this year and makes a change from the prevailing dismal market mood we’ve been used to.

As DB’s Henry Allen writes in his November performance review, the positive market momentum was propelled by a number of factors, including signs that inflation momentum was beginning to ease across the key economies, with downside surprises from both the US and the Euro Area in the latest data. In the meantime, there were further signs that China was inching away from its zero Covid strategy, leading to a massive outperformance from Chinese assets. However, one asset that struggled was the US Dollar, and the unwinding risk premium meant it experienced its worst month in over a decade.

In terms of the drivers behind the various market moves, the biggest one was the downside surprise in the US CPI reading for October, which came out on November 10. That came in below expectations, and the monthly growth in core CPI was the slowest in over a year. In turn, that triggered an incredible single-day rally, with yields on 2yr Treasuries seeing their biggest daily decline since 2008, whilst the S&P 500 had its best day since April 2020. Furthermore, the report led investors to price in a growing chance that the Fed would slow down the pace of their rate hikes to just 50bps in December, following four consecutive hikes at a 75bps pace. That was cemented on the final day of the month in a speech by Fed Chair Powell, who said that “the time for moderating the pace of rate increases may come as soon as the December meeting.” The positive inflation news wasn’t confined to the US either, since on the last day of the month we got the flash CPI release for the Euro Area, which fell by more than expected to +10.0%.

Against that backdrop, Allen notes that the rally in risk assets continued, and the S&P 500 is now up by more than +14% in total return terms over October and November! That’s the best performance for the index over two calendar months since late 2020, although there remain plenty of doubts about how durable this is and whether this is just another bear market rally. Meanwhile, the prospect of a downshift from the Fed saw Treasuries (+2.8%) put in their best monthly performance since March 2020, back when the pandemic started and the Fed cut rates back to the zero lower bound.

The second big positive driver for markets in November came from China, where there were growing signs that officials were inching away from the zero Covid strategy. For example, officials said they would seek to raise vaccination rates among the elderly, which was good news for markets since stronger levels of immunity are seen as raising the chances of the economy reopening. Earlier in the month, the quarantine requirement for close co tacts and inbound travellers was also cut from 10 days to 8. And on the final day of the month, Vice Premier Sun Chunlan said that “As the omicron variant becomes less pathogenic, more people get vaccinated and our experience in Covid prevention accumulates, our fight against the pandemic is at a new stage and it comes with new tasks”. All this meant Chinese assets performed very strongly, with the Shanghai Composite up +8.9%, and the Hang Seng up +26.8%. That marked the best month for the Hang Seng since October 1998.

In the UK, gilts (+2.9%) outperformed for a second month running as the turmoil stemming from the mini-budget in late September continued to unwind. Indeed, the spread of UK 10yr yields over bunds came down by a further -13.8bps over the month to 123bps. Markets reacted calmly to the government’s Autumn Statement as well, which included £55bn of fiscal tightening as the government sought to reassure investors about their fiscal credibility.

Still, despite the cross-asset rally in November, the DB strategist correctly notes that there’s plenty of pessimism in markets at this moment. For instance, the 2s10s curve that’s inverted prior to all of the last 10 US recessions is now inverted by -71bps, which is the lowest monthly close since September 1981. In addition, the Fed’s preferred curve of the near-term forward spread (measured by the 18m forward 3m yield minus the spot 3m yield) inverted in November for the first time in this cycle so far, and ended the month at -41bps.

There were also plenty of jitters around crypto-assets over the month, particularly following the bankruptcy of crypto exchange FTX, followed by BlockFi later in the month. That backdrop saw Bitcoin fall -16.2% in November to $17,105, which is its lowest monthly close since October 2020.

Which assets saw the biggest gains in November?

- Equities: The equity rebound from October continued into November, with the S&P 500 (+5.6%), the STOXX 600 (+6.9%) posting solid gains in total return terms. The Hang Seng strongly outperformed, and its +26.8% gain over the month was the largest since October 1998. That said, the major indices are still in negative territory on a YTD basis, with the S&P 500 down -13.1%.

- Sovereign Bonds: Fresh hopes that we might have seen the worst of inflation supported sovereign bonds this month, with Treasuries (+2.8%) seeing their best performance since March 2020. Gilts (+2.9%) outperformed in November as they continued to recover from the turmoil following the mini-budget, but they remain one of the worst YTD performers, having lost -21.6% since the start of the year.

- Credit: All of the credit indices in our sample moved higher this month across USD, EUR and GBP. That’s only the second month this year that’s happened, with July being the other time. US HY was a relative underperformer however, with just a +2.2% gain.

- Metals: Both copper (+10.5%) and gold (+8.3%) ended a run of 7 consecutive monthly declines in November. Copper was supported by hopes that China might move away from the zero Covid strategy, helping to boost demand.

Which assets saw the biggest losses in November?

- Oil: Brent crude (-9.9%) fell for the 5th time in the last 6 months, ending November at just $85.43/bbl. Even so, it’s still in positive YTD territory, having advanced +9.8% since the start of the year.

- US Dollar: Stronger risk appetite meant that the risk premium supporting the dollar unwound somewhat, with the dollar index down -5.0% over the month. That’s its worst performance since July 2020, with the dollar weakening against every other G10 currency.

- Cryptocurrencies: The FTX bankruptcy meant there was a tough backdrop for crypto-assets, and Bitcoin fell -16.2% in November, bringing its YTD decline to -63.1%. Other cryptocurrencies struggled too, with Ethereum down -17.1%.

Finally, here is a visual breakdown of the top assets in November…

… and YTD.

More in the full report available to pro subs.