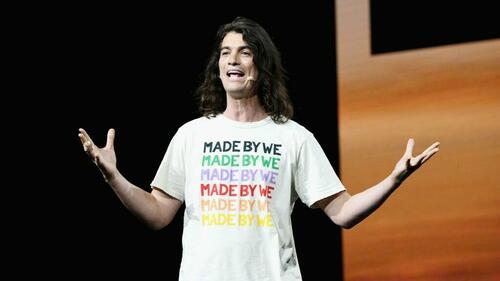

In case you're wondering if the bubble has finally "burst" enough to remove detritus like Adam Neumann from the investing atmosphere, the answer appears to be a resounding "no".

That's because Neumann - famous for taking hundreds of millions in compensation, a botched IPO and overseeing more than $10 billion in WeWork valuation disappear into thin air - is now once again being enabled invested in by Andreessen Horowitz.

And guess what? Neumann's latest venture just happens to be in residential real estate.

The company, called Flow, comes in the wake of WeWork's IPO attempt nearly marking the market top prior to Covid. Andreessen Horowitz stood up for Neumann in a blog post this week, calling his efforts at WeWork "often under appreciated". It said it loves “seeing repeat-founders build on past successes by growing from lessons learned,” according to CNBC.

The details on the company are few and far between, other than it is supposed to launch in 2023. The New York Times described the company as “effectively a service that landlords can team up with for their properties, somewhat similar to the way an owner of a hotel might contract with a branded hotel chain to operate the property.”

"Exact details of the business plan could not be learned," the New York Times wrote. What could go wrong?

Andreessen Horowitz co-founder and general partner Marc Andreessen wrote on a blog post this week: “In a world where limited access to home ownership continues to be a driving force behind inequality and anxiety, giving renters a sense of security, community, and genuine ownership has transformative power for our society.”

He continued: “We think it is natural that for his first venture since WeWork, Adam returns to the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes.”

“We are thrilled by the scope and aspiration of this project,” Andreessen said. “It is not lacking in vision or ambition, but only projects with such lofty goals have a chance at changing the world.”

Sure, that sounds nice. So did the idea of shared office space. We can't wait to see the financial reality of this project, not to mention in 2023, when rates will have been their highest in nearly a decade.

Here's a preview of the pitch deck...

— Nate Geraci (@NateGeraci) August 16, 2022

In case you’re wondering if the bubble has finally “burst” enough to remove detritus like Adam Neumann from the investing atmosphere, the answer appears to be a resounding “no”.

That’s because Neumann – famous for taking hundreds of millions in compensation, a botched IPO and overseeing more than $10 billion in WeWork valuation disappear into thin air – is now once again being enabled invested in by Andreessen Horowitz.

And guess what? Neumann’s latest venture just happens to be in residential real estate.

The company, called Flow, comes in the wake of WeWork’s IPO attempt nearly marking the market top prior to Covid. Andreessen Horowitz stood up for Neumann in a blog post this week, calling his efforts at WeWork “often under appreciated”. It said it loves “seeing repeat-founders build on past successes by growing from lessons learned,” according to CNBC.

The details on the company are few and far between, other than it is supposed to launch in 2023. The New York Times described the company as “effectively a service that landlords can team up with for their properties, somewhat similar to the way an owner of a hotel might contract with a branded hotel chain to operate the property.”

“Exact details of the business plan could not be learned,” the New York Times wrote. What could go wrong?

Andreessen Horowitz co-founder and general partner Marc Andreessen wrote on a blog post this week: “In a world where limited access to home ownership continues to be a driving force behind inequality and anxiety, giving renters a sense of security, community, and genuine ownership has transformative power for our society.”

He continued: “We think it is natural that for his first venture since WeWork, Adam returns to the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes.”

“We are thrilled by the scope and aspiration of this project,” Andreessen said. “It is not lacking in vision or ambition, but only projects with such lofty goals have a chance at changing the world.”

Sure, that sounds nice. So did the idea of shared office space. We can’t wait to see the financial reality of this project, not to mention in 2023, when rates will have been their highest in nearly a decade.

Here’s a preview of the pitch deck…

— Nate Geraci (@NateGeraci) August 16, 2022