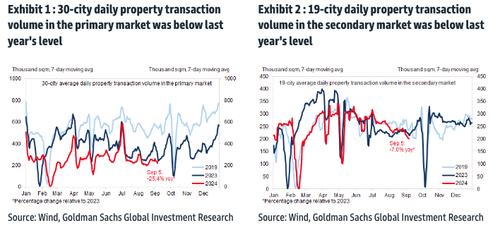

A deepening property crisis and sluggish consumer spending derailed China's economic recovery by late summer. Last week, Bloomberg Market Live reporters noted that soft corporate earnings signaled the world's second-largest economy is "nowhere close to bottoming out."

Goldman analysts led by Yuting Yang and Lisheng Wang recently published a client note highlighting that high-frequency economic indicators, including consumption and mobility; production and investment; other macro activity, and markets and policy, reveal continued souring conditions in China.

The big takeaway from the high-frequency economic indicators is that the property sector has yet to stabilize to end the vicious spiral of consumption, employment, and housing. Even more apparent is that relying on manufacturing and exports to boost growth is not working. Also, Beijing might not have a clear policy roadmap until after the US elections in early November.

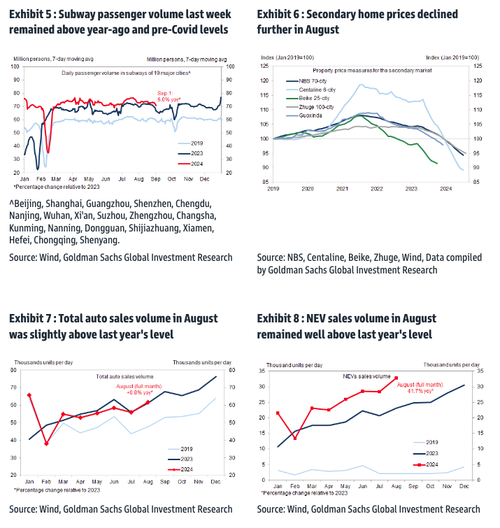

1) Consumption and mobility

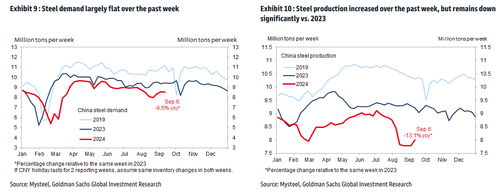

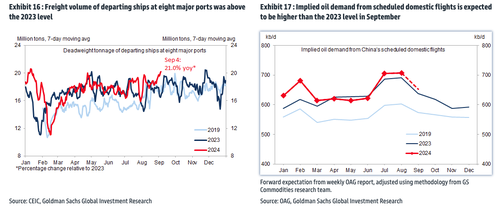

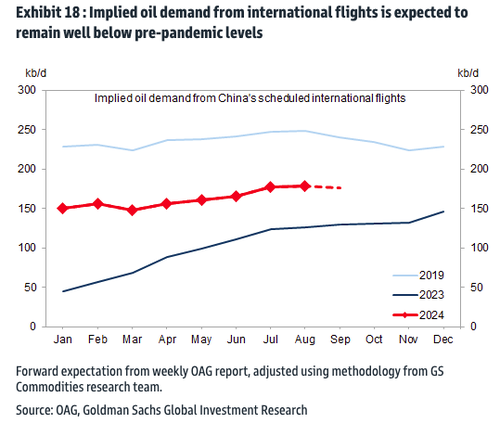

2) Production and investment

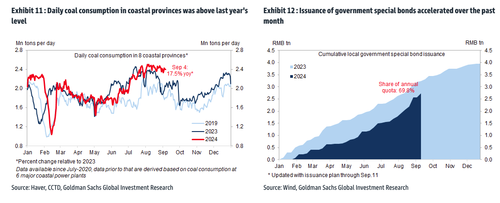

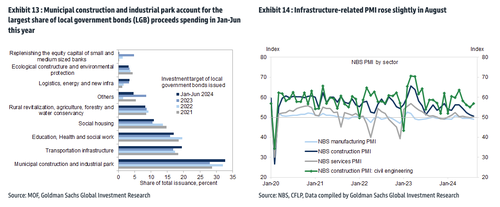

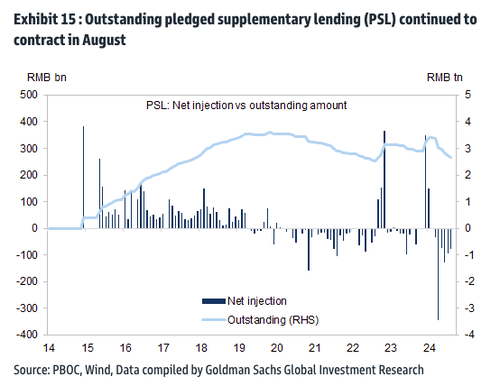

3) Other macro activity

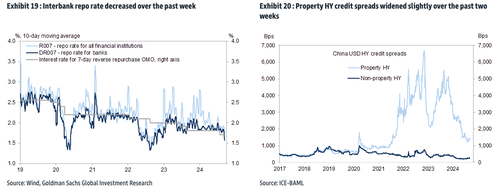

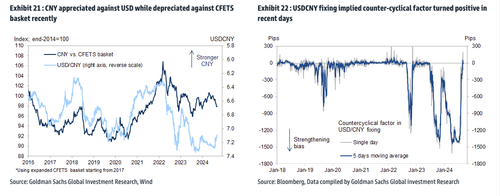

4) Markets and policy

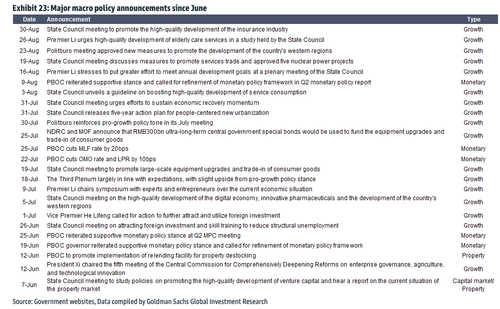

Here are the latest policy announcements since June...

An uninspiring economic recovery in China has led to a tumble in the country's main equity index, the CSI 300 Index... The most important trend line of the last two decades is failing as prices return to 2019 lows.

Tracking high-frequency economic indicators, particularly from China, gives investors a clearer view of global economic cycles. With momentum in both China and the US heading in the wrong direction, the case for a slowing global economy mounts.

A deepening property crisis and sluggish consumer spending derailed China’s economic recovery by late summer. Last week, Bloomberg Market Live reporters noted that soft corporate earnings signaled the world’s second-largest economy is “nowhere close to bottoming out.”

Goldman analysts led by Yuting Yang and Lisheng Wang recently published a client note highlighting that high-frequency economic indicators, including consumption and mobility; production and investment; other macro activity, and markets and policy, reveal continued souring conditions in China.

The big takeaway from the high-frequency economic indicators is that the property sector has yet to stabilize to end the vicious spiral of consumption, employment, and housing. Even more apparent is that relying on manufacturing and exports to boost growth is not working. Also, Beijing might not have a clear policy roadmap until after the US elections in early November.

1) Consumption and mobility

2) Production and investment

3) Other macro activity

4) Markets and policy

Here are the latest policy announcements since June…

An uninspiring economic recovery in China has led to a tumble in the country’s main equity index, the CSI 300 Index… The most important trend line of the last two decades is failing as prices return to 2019 lows.

Tracking high-frequency economic indicators, particularly from China, gives investors a clearer view of global economic cycles. With momentum in both China and the US heading in the wrong direction, the case for a slowing global economy mounts.

Loading…