Authored by Peter Tchir via Academy Securties,

Monday’s price action and themes seemed to fit in well with this weekend’s Damned If You Do, Damned If You Don’t theme.

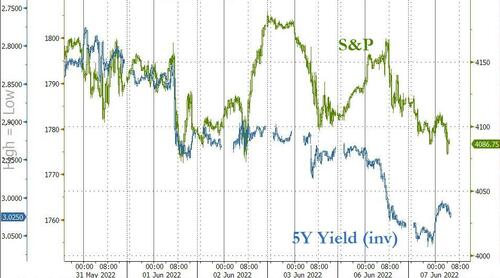

Stocks rallied strongly overnight and into the morning and started to fade as Europe closed and limped home.

Higher rates were allegedly the culprit, but there seemed to be more going on than that.

Not to mention that overnight has a “risk-off” tone with rates doing better while stocks are weak.

The theme that corporate credit was hanging in well seemed to work yesterday as spreads seemed stable in bond land, though leaked, again, in CDS land.

Keep a close eye on credit here!

Both ARKK and TQQQ had more outflows. I want to see some outflows in these “speculative” funds as a sign of more capitulation. Both funds have now seen some steady outflows are near their 2 week lows in terms of shares outstanding. But, and this is a big but, they have taken in significant flows since the beginning of April, so there is more room to fall here. Especially if our Disruptive Portfolio theory is accurate.

Which brings us back to crypto.

Legislation was introduced. Here is a quick summary from Bitcoin Magazine. It seemed to get some heavy circulation within the crypto twitter community and seemed reasonable at first glance (I’m assume a slight bias to the positive given the source, but still seemed like a decent summary).

I strongly believe that crypto needs to go through regulation AND emerge from that regulation to reach new highs. We finally have the semblance of what could be a legislative framework for that regulation. It still needs to be passed and implemented for the first clause of my conditional success story to be met. Then we have the more difficult hurdle of crypto emerging from that regulation.

My quick two cents on this are:

-

Regulation tends to favor the biggest and those with the deepest pockets. They are more likely to influence final rules and to navigate through them.

-

Given the amount of time, money and energy firms across industries spend trying to avoid regulation, it is far from a given that crypto will emerge stronger from this. There is a real risk that as regulators across the globe focus on crypto many of the “benefits” will be curtailed if not eliminated.

More on crypto later this week, but this is an interesting development to watch and I continue to see more downside as the potential impact sinks in. The fact that in addition to the SEC and CFTC we are adding the Federal Energy Regulatory Commission and Government Accountability Office to the mix seems particularly daunting for crypto to makes its way through this new framework quickly and unscathed.

I’m still waiting to buy this dip (i.e. want to be bullish but cannot convince myself that bullish is correct here).

* * *

In the meantime, tune in at 12 pm EST to watch Rachel Washburn and General Walsh (ret.) give the inside scoop on what Top Gun school is really like (registration) and all about. General Walsh served as an instructor at the Top Gun school and has some great stories about “tie-pin cameras and espionage”!

Authored by Peter Tchir via Academy Securties,

Monday’s price action and themes seemed to fit in well with this weekend’s Damned If You Do, Damned If You Don’t theme.

Stocks rallied strongly overnight and into the morning and started to fade as Europe closed and limped home.

Higher rates were allegedly the culprit, but there seemed to be more going on than that.

Not to mention that overnight has a “risk-off” tone with rates doing better while stocks are weak.

The theme that corporate credit was hanging in well seemed to work yesterday as spreads seemed stable in bond land, though leaked, again, in CDS land.

Keep a close eye on credit here!

Both ARKK and TQQQ had more outflows. I want to see some outflows in these “speculative” funds as a sign of more capitulation. Both funds have now seen some steady outflows are near their 2 week lows in terms of shares outstanding. But, and this is a big but, they have taken in significant flows since the beginning of April, so there is more room to fall here. Especially if our Disruptive Portfolio theory is accurate.

Which brings us back to crypto.

Legislation was introduced. Here is a quick summary from Bitcoin Magazine. It seemed to get some heavy circulation within the crypto twitter community and seemed reasonable at first glance (I’m assume a slight bias to the positive given the source, but still seemed like a decent summary).

I strongly believe that crypto needs to go through regulation AND emerge from that regulation to reach new highs. We finally have the semblance of what could be a legislative framework for that regulation. It still needs to be passed and implemented for the first clause of my conditional success story to be met. Then we have the more difficult hurdle of crypto emerging from that regulation.

My quick two cents on this are:

-

Regulation tends to favor the biggest and those with the deepest pockets. They are more likely to influence final rules and to navigate through them.

-

Given the amount of time, money and energy firms across industries spend trying to avoid regulation, it is far from a given that crypto will emerge stronger from this. There is a real risk that as regulators across the globe focus on crypto many of the “benefits” will be curtailed if not eliminated.

More on crypto later this week, but this is an interesting development to watch and I continue to see more downside as the potential impact sinks in. The fact that in addition to the SEC and CFTC we are adding the Federal Energy Regulatory Commission and Government Accountability Office to the mix seems particularly daunting for crypto to makes its way through this new framework quickly and unscathed.

I’m still waiting to buy this dip (i.e. want to be bullish but cannot convince myself that bullish is correct here).

* * *

In the meantime, tune in at 12 pm EST to watch Rachel Washburn and General Walsh (ret.) give the inside scoop on what Top Gun school is really like (registration) and all about. General Walsh served as an instructor at the Top Gun school and has some great stories about “tie-pin cameras and espionage”!