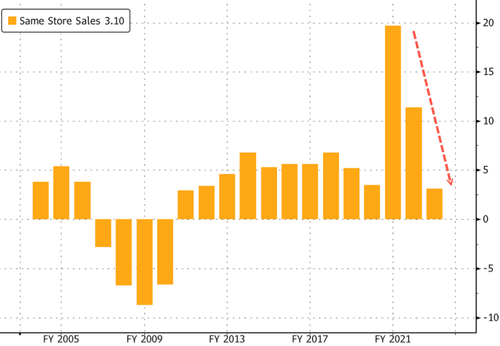

Home Depot's sales fell for the fifth straight quarter as the country's largest home improvement retailer felt the impacts of higher mortgage rates that have put a big freeze on the housing market.

Fourth-quarter revenue came in at $34.79 billion, down from $35.83 in the prior-year period. The figure still beat $34.61 billion that analysts surveyed by Bloomberg expected.

Comparable sales, a key indicator of a retailer's health, fell 3.5%. The retailer predicted a 1% decline in comparable revenue for this year. Analysts have been expecting a rise of .2%.

Here's a snapshot of fourth-quarter earnings (courtesy of Bloomberg):

- Comparable sales -3.5% vs. -0.3% y/y, estimate -3.63% (Bloomberg Consensus)

- US comparable sales -4% vs. -0.3% y/y, estimate -3.78%

- Net sales $34.79 billion, -2.9% y/y, estimate $34.61 billion

- EPS $2.82 vs. $3.30 y/y

- Customer transactions -1.7%, estimate -3.6%

- Average ticket sales $88.87, -1.3% y/y

- Average ticket -1.3%, estimate -0.35%

- Sales per square foot -3.6%

- Merchandise inventories $20.98 billion, estimate $23.31 billion

- Total location count 2,335, +0.6% y/y, estimate 2,335

- SG&A expense $6.68 billion, +2% y/y, estimate $6.7 billion

And the fiscal 2024 forecast (courtesy of Bloomberg):

- Sees comparable sales about -1%, estimate +0.18%

- Sees sales about +1%

- Sees operating margin about 14.1%, estimate 14.2%

- Sees 53-week diluted EPS growth of about 1.0%

Shares of Home Depot are down 2% in premarket trading in New York.

CEO Ted Decker wrote in a statement: "After three years of exceptional growth for our business, 2023 was a year of moderation."

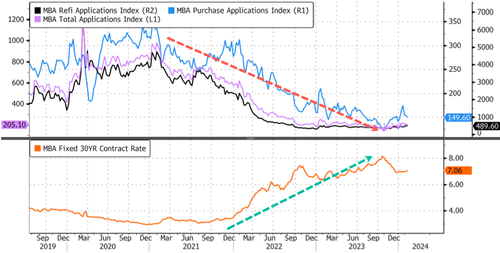

Elevated mortgage rates have pushed mortgage applications to a multi-decade low.

Even with the ongoing slowdown in the housing market, Wall Street analysts maintain optimism about the retailer's long-term prospects.

Just weeks ago, analysts at Wedbush Securities upgraded Home Depot from "neutral" to "outperform," pointing to a "rebounding industry environment with healthy Pro and general employment, solid wage growth and homeowner spending power from continued home-price appreciation."

Home Depot’s sales fell for the fifth straight quarter as the country’s largest home improvement retailer felt the impacts of higher mortgage rates that have put a big freeze on the housing market.

Fourth-quarter revenue came in at $34.79 billion, down from $35.83 in the prior-year period. The figure still beat $34.61 billion that analysts surveyed by Bloomberg expected.

Comparable sales, a key indicator of a retailer’s health, fell 3.5%. The retailer predicted a 1% decline in comparable revenue for this year. Analysts have been expecting a rise of .2%.

Here’s a snapshot of fourth-quarter earnings (courtesy of Bloomberg):

- Comparable sales -3.5% vs. -0.3% y/y, estimate -3.63% (Bloomberg Consensus)

- US comparable sales -4% vs. -0.3% y/y, estimate -3.78%

- Net sales $34.79 billion, -2.9% y/y, estimate $34.61 billion

- EPS $2.82 vs. $3.30 y/y

- Customer transactions -1.7%, estimate -3.6%

- Average ticket sales $88.87, -1.3% y/y

- Average ticket -1.3%, estimate -0.35%

- Sales per square foot -3.6%

- Merchandise inventories $20.98 billion, estimate $23.31 billion

- Total location count 2,335, +0.6% y/y, estimate 2,335

- SG&A expense $6.68 billion, +2% y/y, estimate $6.7 billion

And the fiscal 2024 forecast (courtesy of Bloomberg):

- Sees comparable sales about -1%, estimate +0.18%

- Sees sales about +1%

- Sees operating margin about 14.1%, estimate 14.2%

- Sees 53-week diluted EPS growth of about 1.0%

Shares of Home Depot are down 2% in premarket trading in New York.

CEO Ted Decker wrote in a statement: “After three years of exceptional growth for our business, 2023 was a year of moderation.”

Elevated mortgage rates have pushed mortgage applications to a multi-decade low.

Even with the ongoing slowdown in the housing market, Wall Street analysts maintain optimism about the retailer’s long-term prospects.

Just weeks ago, analysts at Wedbush Securities upgraded Home Depot from “neutral” to “outperform,” pointing to a “rebounding industry environment with healthy Pro and general employment, solid wage growth and homeowner spending power from continued home-price appreciation.”

Loading…