Having been convinced that we were at 'peak inflation', traders puked as CPI ran hotter than expected this morning (Core doubled expectations) sparking chaos across every asset class.

Stocks puked hard with Nasdaq down 2.5%...

The S&P 500 fell to the lows of Powell's Jackson Hole day plunge...

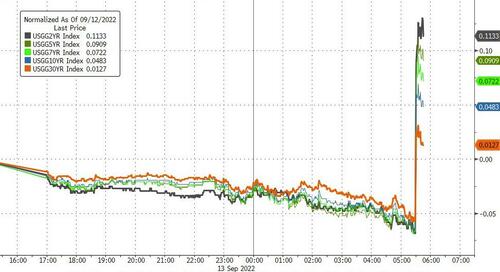

Treasury yields exploded higher with the short-end underperforming (2Y +11bps)...

The dollar spiked back higher after recent 'dovish' hope...

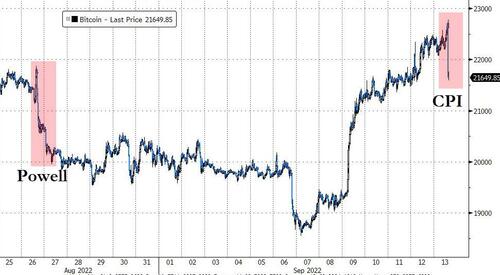

Bitcoin also tumbled, back below $22,000...

Gold is also getting clubbed like a baby seal after the hot CPI print...

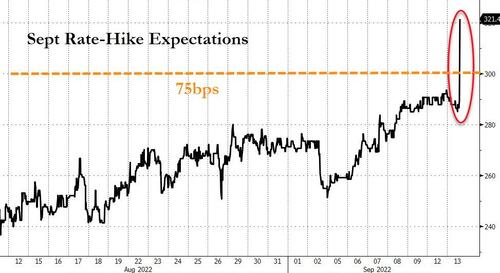

And finally, we note that STIRs are now pricing in a 20% chance of 100bps Fed Hike next week!

November is now pricing a 50% chance of 75bps hike and December is pricing a 25% chance of a 50bps hike...

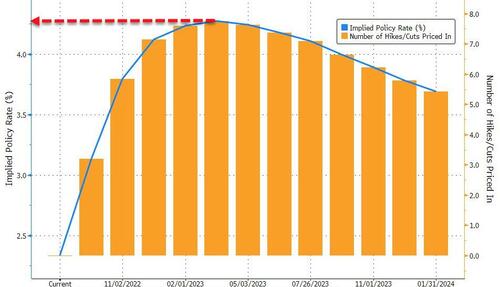

Overall, that has pushed expectations for year-end Fed rates above 4%... which the market seems to now believe will plunge the economy into recession (and has pushed rate-cut expectations up significantly)...

Powell will be pleased as financial conditions tighten and erase the recent squeeze-driven fiasco.

Having been convinced that we were at ‘peak inflation’, traders puked as CPI ran hotter than expected this morning (Core doubled expectations) sparking chaos across every asset class.

Stocks puked hard with Nasdaq down 2.5%…

The S&P 500 fell to the lows of Powell’s Jackson Hole day plunge…

Treasury yields exploded higher with the short-end underperforming (2Y +11bps)…

The dollar spiked back higher after recent ‘dovish’ hope…

Bitcoin also tumbled, back below $22,000…

Gold is also getting clubbed like a baby seal after the hot CPI print…

And finally, we note that STIRs are now pricing in a 20% chance of 100bps Fed Hike next week!

November is now pricing a 50% chance of 75bps hike and December is pricing a 25% chance of a 50bps hike…

Overall, that has pushed expectations for year-end Fed rates above 4%… which the market seems to now believe will plunge the economy into recession (and has pushed rate-cut expectations up significantly)…

The terminal rate for this Fed cycle is now at 4.28% in April 2023…

Powell will be pleased as financial conditions tighten and erase the recent squeeze-driven fiasco.