What’s going on with US banks?

After the rash of big bank failures in March, the Fed rolled out something called the Bank Term Funding Program (BTFP) to fill the void of FDIC’s coverage limitations.

What you need to know about the BTFP is that it’s code for socializing losses.

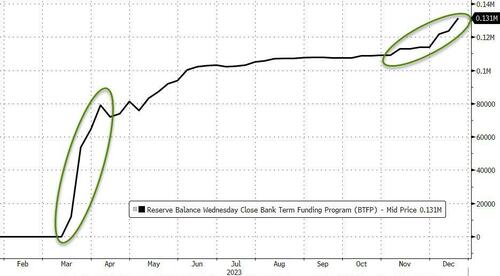

Over the last month, loans outstanding in the Federal Reserve bank bailout program increased by around $17.5BN. It was the second month we’ve seen borrowing from the Bank Term Funding Program (BTFP) surge. And the pace of borrowing is increasing.

Between December 13 and December 20, the balance in the BTFP grew by $7.6BN

As of Dec. 20, the balance in the BTFP stood at just over $131BN. It’s the largest balance since the program was created in March.

As SchiffGold's Michael Maharrey notes, the increase in banks tapping into the BTFP started to re-accelerate in November. As you can see from the chart, borrowing had leveled off in August before the sudden spike in November. Keep in mind that banks were still tapping into the bailout even as the total balance in the program plateaued. Some banks were paying off loans as others borrowed.

This surge in bank bailout borrowing would seem to indicate more banks are struggling in this high interest rate environment, and the financial crisis that kicked off in March continues to boil under the surface.

But thanks to the Fed bailout, the crisis remains “out of sight, out of mind.”

But there's more to this recent re-acceleration - which has occurred as rates have actually declined, inferring that losses on bank's bond positions would have actually shrank.

As MN Gordon writes at EconomicPrism.com, like any ‘heads I win, tails you lose’ government program for the big banks, it is ripe for exploitation.

How Bankers are Exploiting the Fed’s BTFP at Your Expense

The BTFP offers loans up to one year to banks that pledge U.S. Treasuries and agency debt as collateral valued at par. The rate for these loans is the one-year overnight index swap rate plus 10 basis points.

To be clear, the BTFP has nothing to do with free market capitalism. It is an instrument of central planning, instituted by the Fed, to bail out the reckless decisions of its cohorts in the banking sector.

Yet rather than graciously accepting their gift, and the gift of forthcoming rate cuts, bankers are now exploiting the spread between the Fed’s overnight rate and the BTFP rate to line their pockets.

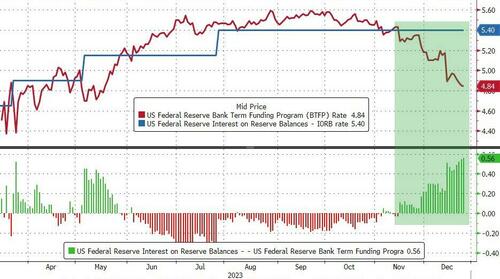

Expectations of a Powell pivot, and the recent decline in Treasury yields, have inadvertently delivered a unique arbitrage opportunity. Lou Crandall, of Wrightson ICAP, recently detailed the scam in a note to clients:

“At first glance, that 10 basis point markup might appear to qualify as the kind of penalty rate typically associated with ‘lender of last resort’ facilities. In practice, however, the BTFP pricing formula turns it into a subsidy rate when the yield curve is downward sloping.

“The drop in BTFP borrowing costs means that there’s a larger arbitrage for banks to take advantage of, where institutions borrow from the facility [BTFP] and then park the proceeds in their account at the Fed to earn interest on reserve balances - currently 5.40 percent. That spread is currently 44 basis points after jumping to 51 basis points on Dec. 14.”

This rate-arbitrage subsidy for banks, made possible by playing Fed policy and Fed programs off of each other, is free money for bankers.

The current arb is at its highest at 56bps as The Fed's jawboning pulls OIS lower.

The deadline for new BTFP loans expires on March 11, 2024. But, alas, like the advent of quantitative easing in 2008, these programs – and the moral hazards they provoke – never go away.

The Fed’s future playbook has been revealed. When the next liquidity crisis arrives in 2024, perhaps from the impending commercial real estate apocalypse, the Fed will be poised to deliver its next iteration of the BTFP.

And, once again, bankers will line their pockets at your expense.

What’s going on with US banks?

After the rash of big bank failures in March, the Fed rolled out something called the Bank Term Funding Program (BTFP) to fill the void of FDIC’s coverage limitations.

What you need to know about the BTFP is that it’s code for socializing losses.

Over the last month, loans outstanding in the Federal Reserve bank bailout program increased by around $17.5BN. It was the second month we’ve seen borrowing from the Bank Term Funding Program (BTFP) surge. And the pace of borrowing is increasing.

Between December 13 and December 20, the balance in the BTFP grew by $7.6BN

As of Dec. 20, the balance in the BTFP stood at just over $131BN. It’s the largest balance since the program was created in March.

As SchiffGold’s Michael Maharrey notes, the increase in banks tapping into the BTFP started to re-accelerate in November. As you can see from the chart, borrowing had leveled off in August before the sudden spike in November. Keep in mind that banks were still tapping into the bailout even as the total balance in the program plateaued. Some banks were paying off loans as others borrowed.

This surge in bank bailout borrowing would seem to indicate more banks are struggling in this high interest rate environment, and the financial crisis that kicked off in March continues to boil under the surface.

But thanks to the Fed bailout, the crisis remains “out of sight, out of mind.”

But there’s more to this recent re-acceleration – which has occurred as rates have actually declined, inferring that losses on bank’s bond positions would have actually shrank.

As MN Gordon writes at EconomicPrism.com, like any ‘heads I win, tails you lose’ government program for the big banks, it is ripe for exploitation.

How Bankers are Exploiting the Fed’s BTFP at Your Expense

The BTFP offers loans up to one year to banks that pledge U.S. Treasuries and agency debt as collateral valued at par. The rate for these loans is the one-year overnight index swap rate plus 10 basis points.

To be clear, the BTFP has nothing to do with free market capitalism. It is an instrument of central planning, instituted by the Fed, to bail out the reckless decisions of its cohorts in the banking sector.

Yet rather than graciously accepting their gift, and the gift of forthcoming rate cuts, bankers are now exploiting the spread between the Fed’s overnight rate and the BTFP rate to line their pockets.

Expectations of a Powell pivot, and the recent decline in Treasury yields, have inadvertently delivered a unique arbitrage opportunity. Lou Crandall, of Wrightson ICAP, recently detailed the scam in a note to clients:

“At first glance, that 10 basis point markup might appear to qualify as the kind of penalty rate typically associated with ‘lender of last resort’ facilities. In practice, however, the BTFP pricing formula turns it into a subsidy rate when the yield curve is downward sloping.

“The drop in BTFP borrowing costs means that there’s a larger arbitrage for banks to take advantage of, where institutions borrow from the facility [BTFP] and then park the proceeds in their account at the Fed to earn interest on reserve balances – currently 5.40 percent. That spread is currently 44 basis points after jumping to 51 basis points on Dec. 14.”

This rate-arbitrage subsidy for banks, made possible by playing Fed policy and Fed programs off of each other, is free money for bankers.

The current arb is at its highest at 56bps as The Fed’s jawboning pulls OIS lower.

The deadline for new BTFP loans expires on March 11, 2024. But, alas, like the advent of quantitative easing in 2008, these programs – and the moral hazards they provoke – never go away.

The Fed’s future playbook has been revealed. When the next liquidity crisis arrives in 2024, perhaps from the impending commercial real estate apocalypse, the Fed will be poised to deliver its next iteration of the BTFP.

And, once again, bankers will line their pockets at your expense.

Loading…