Authored by Matthew Piepenburg via VonGreyerz.gold,

How To Hedge Anti-Heroes?

How does one hedge against open stupidity?

Left, right or center, our policy makers – from parliaments and executive branches to central banks and think tanks – have taken the world closer to war, immigration disasters, infrastructure failures, credit traps, wealth inequality, social unrest and currency destruction than any other time in recent memory.

Like myself, many are asking, privately or publicly: How did we get to this historical economic, social and political inflection point?

Perhaps the answer lies, at least in part, from trusting false idols, false slogans and even false notions of success.

The Philosophy of Success

Aristotle included aspects of the heroic in his definition of Success; one was “successful” who made it a priority to serve something larger than one’s self.

But between Paris, Virginia and Paris, France, I’ve often discovered that many who make political power or dollars an end in itself have missed the bullseye of thinking beyond their own interests…

My grandfather was a pilot in the Second World War. Never, not even once, did he speak of aerial combat or brag of a kill.

By the end of the Battle of Britain, hundreds of RAF pilots had perished, but England remained free. As Winston Churchill famously remarked when referring to these pilots:

“Never in the field of human conflict was so much owed by so many to so few.”

But when I consider the embarrassing, DC/Wall Street history of self-interest at the expense of public interest, many of our modern “success stories” boil down to this:

“Never in the field of human vanity was so little owed by so few, to so many.”

Today’s Mis-Understanding of “Success”

As recent whiz-kids from Mark Zuckerberg and Adam Neuman to Sam Bankman Fried, or ARC to Theranos remind, so many of our former “heroes” are anything but heroic.

Like Wall Street, DC has even less heroes to admire. The historical evidence of this is worth a brief reminder.

Wilson

Unlike Thomas Jefferson, who would have fought to the death to prevent a private central bank from taking over our economy and “coin,” Woodrow Wilson let a private bank raid our nation’s economic destiny in exchange for his own political self-interest when signing the Fed into law in 1913.

Andrew Jackson previously described the very notion of such a private central bank as the “prostitution of our government for the advancement of the few at the expense of the many.”

The unprecedented wealth inequality that exists today in America is proof that Jackson was right.

FDR

It was not a local bank run that caused the markets to tank in 1929; rather it was the now all-too-familiar low-interest rate policy/pattern and debt orgy of the prior and roaring 20’s that caused markets to grow too hot – a theme repeated to this day in market bust, after market bust–from 1929 to 1987, 2000 to 2008 or 2020 to the next disaster looming off our bow.

FDR helped create a subsequent template whereby America solves old debt problems, by well…taking on more debt paid for with debased money.

By removing the dollar from the gold exchange, FDR, like other anti-heroic actors to come, focused on manipulating the US currency rather than addressing US productivity—the veritable “P” in GDP.

FDR’s macro policies interfered with the hard but informative lesson of free markets, namely: Deep recession always follows deep debt. There’s just no such thing as a free ride…

Policy makers, however, like to sell free-rides to get or stay elected.

As I recently argued with math rather than emotion, the net result has been the death of democracy, which has piggy-backed off an equally empirical death of capitalism.

Nixon

In 1971, Nixon was staring down the barrel of an economy on the brink of bad news.

The gold standard, revived by the Post World War II Bretton Woods Accord (and the heroic fiscal restraints of Eisenhower and Martin) meant the dollar was once again tied to a restraining asset upon which global markets and trade partners relied.

But in a move similar to FDR in the 30’s, Nixon jettisoned the gold standard and once again welched on US dollar holders and currency-honest trade partners overseas in order to retain power for himself via unlimited dollar liquidity.

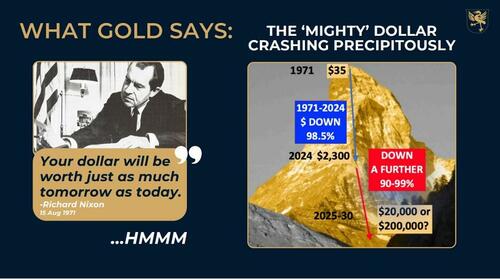

He promised the USD would remain as strong as ever. He lied. It has lost 98% of its purchasing power vs. gold since 1971.

Gold, however, is far more honest in its actions than politicians are with words:

In short, and as always, the currency was sacrificed to “save” a broke system and buy political time.

He won by a landslide.

Nixon’s policies strengthened the template for a now trend-setting perversion of free market price discovery via a familiar pattern of:

1) removing the dollar from a gold standard,

2) lowering rates to encourage short-term speculation which

3) ends in unnaturally large market bubbles and corrections.

Look familiar?

The Greenspan Monster

The spark which set off the crash of 87′ was the ironic fear/rumor that the new Fed Sheriff in town (Alan Greenspan) might put an end to the Wall Street binge party by raising rates in a “Volcker-like” scenario.

And so, in a single day, the stock index suddenly dropped 23% – double the 13% declines on the worst day of the 29 Crash.

But even more astounding than this Black Monday was the Lazarus-like resurrection of the market recovery on the White Tuesday to follow. By 12:30 PM the next day, the market saw massive buy orders which, in a miraculous swoop, stopped the panic.

The Greenspan Fed was clearly no “Volcker 2.0” (or Bill Martin either), but instead, this patient-zero of the current bubble cycle came to the rescue of wayward markets and an over-valued Wall Street.

That is, rather than allow painful corrections (i.e. natural market hangovers or what the Austrians call “constructive destruction”) to teach investors a lesson about derivatives, leverage and other land mines dotting the S&P futures pits (which dropped by 29% in a single day), the Fed came in with buckets of cheap money and thus destroyed any chance for the cleansing, tough-love of naturally correcting markets.

Modern Wall Street – Almost Nothing but Anti-Heroes

Self-seeking, career-preserving policy makers who create environments where the dollar is unrestrained, credit is cheap and regulation is lax (or favors “creativity”) stay popular, get rich and keep their jobs.

The mantra everyone knows in Wall Street is simple: “Bears get fired and bulls get hired,”

Such thinking has set a stage where clever market players are free to scheme their ways into ever-increasing bubbles which enrich insider whales and crush the middle-class/retail plankton.

The Exchange Pits and the Modern Derivatives Cancer

Irrational credit expansion creates a cancer to form in every asset class, including within the once humble mercantile exchange.

It was in this former cob-web-modest Chicago-based exchange where another anti-hero, Leo Melamed, applied the notion of using futures contracts (originally and modestly created to help humble farmers and suppliers adjust for price volatility) to global currencies.

Shortly thereafter, Melamed, having conferred with well-paid “advisors” like Greenspan and other easy-money, self-interested minds (including Milton Friedman), got the green light to open currencies to an entirely new level of speculative alchemy via addictive leverage.

Four decades later, the volume of currency (and risk) traded in 1 hour on the bankers-only commodities exchange exceeded the annual volume of funds traded on the original, farmers-only MERC.

Now, like all post-71 markets, the exchange pits have morphed into a casino with an astonishing 50,000X growth based on derivative time bombs that set up 100:1 ratios of hedging volume to the underlying activity rate.

These “modern derivative pits” (now surpassing the quadrillion levels in notional risk) are nothing more than levered and cancerous hot potatoes whose degree of risk and intentional confusion will be a party to the next liquidity crisis.

In short, this is not our grandfather’s MERC…

Long-Term Capital Management

In yet another example of the non-heroic, we saw the 1998 collapse of LTCM—aka, Long Term Capital Management —a hedge fund leveraging over $125B at the height of its drunken splendor.

This Greenwich, CT-based creation of the not-so-heroic John Meriwether, with a staff of the best and brightest Wall Street algorithm writers and Nobel Laureate advisors, stands out as a telling reminder of three repeated observations regarding Wall Street:

1) The smart guys really aren’t that smart,

2) wherever there is exaggerated leverage, a day of reckoning awaits, and

3) the Fed will once again come to the aid of Wall Street (its real shadow mandate) whenever its misbehaving “elites” get caught in yet another market DUI—that is trading under the influence of easy credit and hence easy leverage.

Of course, the pattern (and lesson) after LTCM was not headed, it simply continued…

The Dot.Com Anti-Heroes…

Just as the smoke was rising from the Connecticut rubble of LTCM, another classic asset bubble misconstrued as free-market prosperity was playing itself out in the form of a dot.com tech hysteria.

In retrospect, the dot.com implosion seems obvious. But even at the time it was happening, that market (precisely like today’s) felt, well: Immortal, meme-driven and surreal.

Consider Dell Inc. It started at $0.05 per share and grew to $54.00/share (a 1,100X multiple), only to slide back to 10.00/share.

Today, similar unicorns abound and the magnificent 7, which comprise 30% of the S&P’s market cap (while violating every principal of the anti-trust laws I studied in law school) continue to act as sirens seducing FOMO sailors to the fatal rocks.

The dot.com champagne party of the 1990’s, like its predecessor in the dapper 1920’s, ended in ruins, with the S&P down 45% and the wild-child NASDAQ off its prior highs by 80% in 2003.

Today’s tech, real estate and bond bubbles, by the way, will be no different in their eventual fall from grace…

Playing with Rates Rather than Reality

In the rubble of the dot.com bubble, the market-enamored policy makers at the Fed began the greatest rate reduction yet seen, resulting in a wide-open spigot for more easy credit, leverage and hence debt-induced market deformations.

That is, they solved one tech bubble crisis by creating a new real estate bubble.

A wide and embarrassing swath of wasteful M&A, stock-by-backs and LBO deals also took place.

Highlights of this low point in “American deal making” include GE’s dive from $50 to $10 share prices. Net result? Did GE’s Mr. Jeffrey Immelt take his lumps heroically? Did the company learn the necessary lessons of reckless speculation in the fall from its 40X valuation peaks?

No. Instead, GE’s CEO took a bailout…

Larry Summers

And then there’s the endless Larry Summers, the veritable patient-zero of the derivatives cancer…

Larry Summers was the president of Harvard. He worked for Clinton; served as a Treasury Secretary. He made lots of opinionated (and well paid) speaking appearances. Even Ray Dalio hangs with him.

But let’s not let credentials get in the way of facts. As La Rouchefoucauld noted centuries ago, the highest offices are not always – or even often – held by the highest minds.

Opinions, of course, differ, but it’s hard not to list Larry Summers among the key architects behind the 2008 financial debacle “Where Larry Summers Went Wrong.“

Most veterans of recent market cycles pre and post 08, concede that OTC derivatives were the heart of the 2008 darkness.

Bullied Hero

During this period, Brooksley Born, then head of the CFTC (Commodity Futures Trading Commission)- openly warned of the derivative dangers of, well…derivatives.

But in 1998, then Deputy Treasury Secretary Larry Summers telephoned her desk and openly bullied her: “I have 13 bankers in my office,” he shouted, “who tell me you’re going to cause the worst financial crisis since World War II” if she continued moving forward in bringing much needed transparency and reporting requirements to the OTC market.

Larry then went on to attack Born publicly, condescendingly assuring Congress that her concerns about the potential unwieldiness of these instruments were exaggerated. As he promised:

“The parties to these kind of contracts are largely sophisticated financial institutions that would appear to be eminently capable of protecting themselves from fraud and counter-party insolvencies.”

But fast-forward less than a decade later (and an OTC derivatives market which Summers helped take from $95 Trillion to $670 Trillion), and we all learned how those “eminently capable” and “largely sophisticated financial institutions” (Bear, Lehman, Goldman, AIG et al…) created the worst financial crisis (and bailout) since World War II.

More Bad Ideas, More Anti-Heroes

It’s worth remembering that neither Greenspan in 01 nor Bernanke in 08 ever saw these market crashes coming. Of course, neither did any of the “heroes” running the private banks or the US Treasury.

Powell will be no different. The Fed’s record for calling a recession or market implosion in 0 in 10.

Revisiting “Success”

A man, Walt Whitman reminds, is many things. Most would agree that we are philosophically, economically, morally and historically designed to screw up – over and over again.

What is less forgivable is not a lack of perfection, but rather a lack of accountability, even humility.

We can’t all be brave RAF pilots.

But sometimes, just being honest is heroic enough.

Unfortunately, the anti-heroes touched upon above, and the countless other Wall Street “supermen” (whose executive to worker salary ratios are at 333:1) do not represent anything close to serving a cause greater than one’s own income or position.

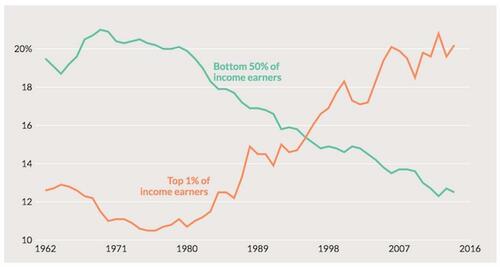

Anti-heroes like those above help explain the graph below and the new Feudalism that has replaced American capitalism:

More Candor—Less Anti-Heroes

We stand today at the edge of a market, social and political cliff built upon unprecedented levels of post-08 debt and money supply expansion.

The current public debt of $35T and a government debt-to-GDP ratio of 125-30% is mathematically unsustainable and makes real (rather than debt-driven) growth objectively impossible.

Today, we and our children’s generation are the inheritors of the sins of such anti-heroes.

If easy money leads to market bubbles, drunk investing and sobering crashes, then we can all see what’s coming as Powell inches predictably from rate hikes, to a rate pause to rate cuts.

Next, will come a deflationary recession and/or market correction followed by Super QE to absorb Uncle Sam’s unwanted IOUs, $20 trillion of which are projected in the next 10 years by our Congressional Budget Office.

The anti-heroes, of course, won’t say this, and they certainly won’t take accountability.

Instead, they will lie – blaming the troubles now and to come on Putin, COVID, global warming and their opposing party.

Gold, however, will be more honest. Gold is not a debate against paper or crypto money, but a voice of yesterday, today and tomorrow.

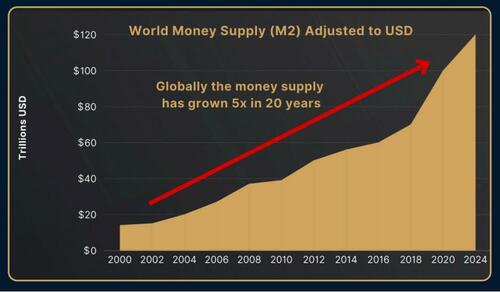

When money is expanded by 5X in just 20 years, it dilutes its value…

…which explains why gold, even at all-time-highs, is still under-valued when measured against the broad money supply:

As in every liquidity, market and political crisis throughout history, gold will store value far better than any debased currency engineered to inflate away national debt disasters with debased money.

This explains gold’s deliberately ignored tier-one asset status, its greater favor (and performance) over USTs and USDs and its historically-confirmed answer to every currency crisis since time was recorded.

It also explains why none of our Anti-heroes – from DC to Brussels – will talk about gold out loud. They are literally allergic to blunt truth, historical lessons or simple math.

For an informed minority, however, sophisticated investors will forever hedge against the golden tongues of anti-heroes with the golden bars of time and nature.

Authored by Matthew Piepenburg via VonGreyerz.gold,

How To Hedge Anti-Heroes?

How does one hedge against open stupidity?

Left, right or center, our policy makers – from parliaments and executive branches to central banks and think tanks – have taken the world closer to war, immigration disasters, infrastructure failures, credit traps, wealth inequality, social unrest and currency destruction than any other time in recent memory.

Like myself, many are asking, privately or publicly: How did we get to this historical economic, social and political inflection point?

Perhaps the answer lies, at least in part, from trusting false idols, false slogans and even false notions of success.

The Philosophy of Success

Aristotle included aspects of the heroic in his definition of Success; one was “successful” who made it a priority to serve something larger than one’s self.

But between Paris, Virginia and Paris, France, I’ve often discovered that many who make political power or dollars an end in itself have missed the bullseye of thinking beyond their own interests…

My grandfather was a pilot in the Second World War. Never, not even once, did he speak of aerial combat or brag of a kill.

By the end of the Battle of Britain, hundreds of RAF pilots had perished, but England remained free. As Winston Churchill famously remarked when referring to these pilots:

“Never in the field of human conflict was so much owed by so many to so few.”

But when I consider the embarrassing, DC/Wall Street history of self-interest at the expense of public interest, many of our modern “success stories” boil down to this:

“Never in the field of human vanity was so little owed by so few, to so many.”

Today’s Mis-Understanding of “Success”

As recent whiz-kids from Mark Zuckerberg and Adam Neuman to Sam Bankman Fried, or ARC to Theranos remind, so many of our former “heroes” are anything but heroic.

Like Wall Street, DC has even less heroes to admire. The historical evidence of this is worth a brief reminder.

Wilson

Unlike Thomas Jefferson, who would have fought to the death to prevent a private central bank from taking over our economy and “coin,” Woodrow Wilson let a private bank raid our nation’s economic destiny in exchange for his own political self-interest when signing the Fed into law in 1913.

Andrew Jackson previously described the very notion of such a private central bank as the “prostitution of our government for the advancement of the few at the expense of the many.”

The unprecedented wealth inequality that exists today in America is proof that Jackson was right.

FDR

It was not a local bank run that caused the markets to tank in 1929; rather it was the now all-too-familiar low-interest rate policy/pattern and debt orgy of the prior and roaring 20’s that caused markets to grow too hot – a theme repeated to this day in market bust, after market bust–from 1929 to 1987, 2000 to 2008 or 2020 to the next disaster looming off our bow.

FDR helped create a subsequent template whereby America solves old debt problems, by well…taking on more debt paid for with debased money.

By removing the dollar from the gold exchange, FDR, like other anti-heroic actors to come, focused on manipulating the US currency rather than addressing US productivity—the veritable “P” in GDP.

FDR’s macro policies interfered with the hard but informative lesson of free markets, namely: Deep recession always follows deep debt. There’s just no such thing as a free ride…

Policy makers, however, like to sell free-rides to get or stay elected.

As I recently argued with math rather than emotion, the net result has been the death of democracy, which has piggy-backed off an equally empirical death of capitalism.

Nixon

In 1971, Nixon was staring down the barrel of an economy on the brink of bad news.

The gold standard, revived by the Post World War II Bretton Woods Accord (and the heroic fiscal restraints of Eisenhower and Martin) meant the dollar was once again tied to a restraining asset upon which global markets and trade partners relied.

But in a move similar to FDR in the 30’s, Nixon jettisoned the gold standard and once again welched on US dollar holders and currency-honest trade partners overseas in order to retain power for himself via unlimited dollar liquidity.

He promised the USD would remain as strong as ever. He lied. It has lost 98% of its purchasing power vs. gold since 1971.

Gold, however, is far more honest in its actions than politicians are with words:

In short, and as always, the currency was sacrificed to “save” a broke system and buy political time.

He won by a landslide.

Nixon’s policies strengthened the template for a now trend-setting perversion of free market price discovery via a familiar pattern of:

1) removing the dollar from a gold standard,

2) lowering rates to encourage short-term speculation which

3) ends in unnaturally large market bubbles and corrections.

Look familiar?

The Greenspan Monster

The spark which set off the crash of 87′ was the ironic fear/rumor that the new Fed Sheriff in town (Alan Greenspan) might put an end to the Wall Street binge party by raising rates in a “Volcker-like” scenario.

And so, in a single day, the stock index suddenly dropped 23% – double the 13% declines on the worst day of the 29 Crash.

But even more astounding than this Black Monday was the Lazarus-like resurrection of the market recovery on the White Tuesday to follow. By 12:30 PM the next day, the market saw massive buy orders which, in a miraculous swoop, stopped the panic.

The Greenspan Fed was clearly no “Volcker 2.0” (or Bill Martin either), but instead, this patient-zero of the current bubble cycle came to the rescue of wayward markets and an over-valued Wall Street.

That is, rather than allow painful corrections (i.e. natural market hangovers or what the Austrians call “constructive destruction”) to teach investors a lesson about derivatives, leverage and other land mines dotting the S&P futures pits (which dropped by 29% in a single day), the Fed came in with buckets of cheap money and thus destroyed any chance for the cleansing, tough-love of naturally correcting markets.

Modern Wall Street – Almost Nothing but Anti-Heroes

Self-seeking, career-preserving policy makers who create environments where the dollar is unrestrained, credit is cheap and regulation is lax (or favors “creativity”) stay popular, get rich and keep their jobs.

The mantra everyone knows in Wall Street is simple: “Bears get fired and bulls get hired,”

Such thinking has set a stage where clever market players are free to scheme their ways into ever-increasing bubbles which enrich insider whales and crush the middle-class/retail plankton.

The Exchange Pits and the Modern Derivatives Cancer

Irrational credit expansion creates a cancer to form in every asset class, including within the once humble mercantile exchange.

It was in this former cob-web-modest Chicago-based exchange where another anti-hero, Leo Melamed, applied the notion of using futures contracts (originally and modestly created to help humble farmers and suppliers adjust for price volatility) to global currencies.

Shortly thereafter, Melamed, having conferred with well-paid “advisors” like Greenspan and other easy-money, self-interested minds (including Milton Friedman), got the green light to open currencies to an entirely new level of speculative alchemy via addictive leverage.

Four decades later, the volume of currency (and risk) traded in 1 hour on the bankers-only commodities exchange exceeded the annual volume of funds traded on the original, farmers-only MERC.

Now, like all post-71 markets, the exchange pits have morphed into a casino with an astonishing 50,000X growth based on derivative time bombs that set up 100:1 ratios of hedging volume to the underlying activity rate.

These “modern derivative pits” (now surpassing the quadrillion levels in notional risk) are nothing more than levered and cancerous hot potatoes whose degree of risk and intentional confusion will be a party to the next liquidity crisis.

In short, this is not our grandfather’s MERC…

Long-Term Capital Management

In yet another example of the non-heroic, we saw the 1998 collapse of LTCM—aka, Long Term Capital Management —a hedge fund leveraging over $125B at the height of its drunken splendor.

This Greenwich, CT-based creation of the not-so-heroic John Meriwether, with a staff of the best and brightest Wall Street algorithm writers and Nobel Laureate advisors, stands out as a telling reminder of three repeated observations regarding Wall Street:

1) The smart guys really aren’t that smart,

2) wherever there is exaggerated leverage, a day of reckoning awaits, and

3) the Fed will once again come to the aid of Wall Street (its real shadow mandate) whenever its misbehaving “elites” get caught in yet another market DUI—that is trading under the influence of easy credit and hence easy leverage.

Of course, the pattern (and lesson) after LTCM was not headed, it simply continued…

The Dot.Com Anti-Heroes…

Just as the smoke was rising from the Connecticut rubble of LTCM, another classic asset bubble misconstrued as free-market prosperity was playing itself out in the form of a dot.com tech hysteria.

In retrospect, the dot.com implosion seems obvious. But even at the time it was happening, that market (precisely like today’s) felt, well: Immortal, meme-driven and surreal.

Consider Dell Inc. It started at $0.05 per share and grew to $54.00/share (a 1,100X multiple), only to slide back to 10.00/share.

Today, similar unicorns abound and the magnificent 7, which comprise 30% of the S&P’s market cap (while violating every principal of the anti-trust laws I studied in law school) continue to act as sirens seducing FOMO sailors to the fatal rocks.

The dot.com champagne party of the 1990’s, like its predecessor in the dapper 1920’s, ended in ruins, with the S&P down 45% and the wild-child NASDAQ off its prior highs by 80% in 2003.

Today’s tech, real estate and bond bubbles, by the way, will be no different in their eventual fall from grace…

Playing with Rates Rather than Reality

In the rubble of the dot.com bubble, the market-enamored policy makers at the Fed began the greatest rate reduction yet seen, resulting in a wide-open spigot for more easy credit, leverage and hence debt-induced market deformations.

That is, they solved one tech bubble crisis by creating a new real estate bubble.

A wide and embarrassing swath of wasteful M&A, stock-by-backs and LBO deals also took place.

Highlights of this low point in “American deal making” include GE’s dive from $50 to $10 share prices. Net result? Did GE’s Mr. Jeffrey Immelt take his lumps heroically? Did the company learn the necessary lessons of reckless speculation in the fall from its 40X valuation peaks?

No. Instead, GE’s CEO took a bailout…

Larry Summers

And then there’s the endless Larry Summers, the veritable patient-zero of the derivatives cancer…

Larry Summers was the president of Harvard. He worked for Clinton; served as a Treasury Secretary. He made lots of opinionated (and well paid) speaking appearances. Even Ray Dalio hangs with him.

But let’s not let credentials get in the way of facts. As La Rouchefoucauld noted centuries ago, the highest offices are not always – or even often – held by the highest minds.

Opinions, of course, differ, but it’s hard not to list Larry Summers among the key architects behind the 2008 financial debacle “Where Larry Summers Went Wrong.“

Most veterans of recent market cycles pre and post 08, concede that OTC derivatives were the heart of the 2008 darkness.

Bullied Hero

During this period, Brooksley Born, then head of the CFTC (Commodity Futures Trading Commission)- openly warned of the derivative dangers of, well…derivatives.

But in 1998, then Deputy Treasury Secretary Larry Summers telephoned her desk and openly bullied her: “I have 13 bankers in my office,” he shouted, “who tell me you’re going to cause the worst financial crisis since World War II” if she continued moving forward in bringing much needed transparency and reporting requirements to the OTC market.

Larry then went on to attack Born publicly, condescendingly assuring Congress that her concerns about the potential unwieldiness of these instruments were exaggerated. As he promised:

“The parties to these kind of contracts are largely sophisticated financial institutions that would appear to be eminently capable of protecting themselves from fraud and counter-party insolvencies.”

But fast-forward less than a decade later (and an OTC derivatives market which Summers helped take from $95 Trillion to $670 Trillion), and we all learned how those “eminently capable” and “largely sophisticated financial institutions” (Bear, Lehman, Goldman, AIG et al…) created the worst financial crisis (and bailout) since World War II.

More Bad Ideas, More Anti-Heroes

It’s worth remembering that neither Greenspan in 01 nor Bernanke in 08 ever saw these market crashes coming. Of course, neither did any of the “heroes” running the private banks or the US Treasury.

Powell will be no different. The Fed’s record for calling a recession or market implosion in 0 in 10.

Revisiting “Success”

A man, Walt Whitman reminds, is many things. Most would agree that we are philosophically, economically, morally and historically designed to screw up – over and over again.

What is less forgivable is not a lack of perfection, but rather a lack of accountability, even humility.

We can’t all be brave RAF pilots.

But sometimes, just being honest is heroic enough.

Unfortunately, the anti-heroes touched upon above, and the countless other Wall Street “supermen” (whose executive to worker salary ratios are at 333:1) do not represent anything close to serving a cause greater than one’s own income or position.

Anti-heroes like those above help explain the graph below and the new Feudalism that has replaced American capitalism:

More Candor—Less Anti-Heroes

We stand today at the edge of a market, social and political cliff built upon unprecedented levels of post-08 debt and money supply expansion.

The current public debt of $35T and a government debt-to-GDP ratio of 125-30% is mathematically unsustainable and makes real (rather than debt-driven) growth objectively impossible.

Today, we and our children’s generation are the inheritors of the sins of such anti-heroes.

If easy money leads to market bubbles, drunk investing and sobering crashes, then we can all see what’s coming as Powell inches predictably from rate hikes, to a rate pause to rate cuts.

Next, will come a deflationary recession and/or market correction followed by Super QE to absorb Uncle Sam’s unwanted IOUs, $20 trillion of which are projected in the next 10 years by our Congressional Budget Office.

The anti-heroes, of course, won’t say this, and they certainly won’t take accountability.

Instead, they will lie – blaming the troubles now and to come on Putin, COVID, global warming and their opposing party.

Gold, however, will be more honest. Gold is not a debate against paper or crypto money, but a voice of yesterday, today and tomorrow.

When money is expanded by 5X in just 20 years, it dilutes its value…

…which explains why gold, even at all-time-highs, is still under-valued when measured against the broad money supply:

As in every liquidity, market and political crisis throughout history, gold will store value far better than any debased currency engineered to inflate away national debt disasters with debased money.

This explains gold’s deliberately ignored tier-one asset status, its greater favor (and performance) over USTs and USDs and its historically-confirmed answer to every currency crisis since time was recorded.

It also explains why none of our Anti-heroes – from DC to Brussels – will talk about gold out loud. They are literally allergic to blunt truth, historical lessons or simple math.

For an informed minority, however, sophisticated investors will forever hedge against the golden tongues of anti-heroes with the golden bars of time and nature.

Loading…