By Jane Foley, Senior FX Strategist at Rabobank

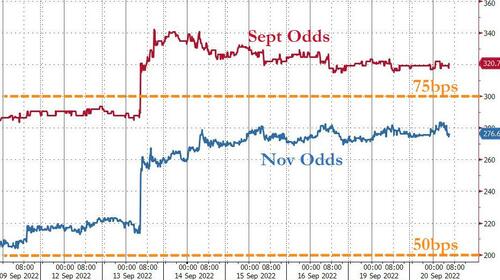

A late rally on Wall Street last night allowed for a largely positive tone in risk appetite to prevail overnight. That said, trading activity was fairly quiet yesterday in view of the UK bank holiday and ahead of this week’s slew of activity from various central banks including the Federal Reserve. Many market participants are of the view that a 75 bps rate hike from the Fed on Wednesday is all-but-done.

That said, there is still a lot of uncertainty over potential revisions to the dot plot estimates from the FOMC members and the terminal level of the Fed funds rate. These unknowns saw the front end of the US curve underperforming yesterday with the 2 year yield reportedly hitting its highest level since 2007. The favoured view in the market is that central bankers are determined to quash inflationary pressures even if that means a downturn becomes unavoidable. Reflecting this view, crude oil has lost around one third of its value since June, with the strong USD also acting as a headwind. Yesterday, however, crude prices stabilised in tune with the better tone in stock markets, though the overall tone remains cautious. More multi-national corporates have added their voices to the warnings regarding the headwinds to growth. Ford Motor Co. said that inflation has resulted in costs of around USD1 bln higher than expected in the current quarter. General Electric has warned that supply chain issues are dragging on its earnings. Last week, Fed Ex warned about a slowdown in global demand, a factor which contributed to the decline in equity market indices.

This morning the PBoC left its 1 year prime loan rate unchanged at 3.65%, in line with expectations. The 5 year rate, a reference for mortgages, was also left on hold. Both rates were cut last month, and further reductions are expected in the months ahead as the Chinese authorities take action to support the economy. Last week, USD/CNY broke through the 7.00 level, which was likely a contributing factor behind the PBoC’s decision to pause its rate cutting cycle this month. In view of the likelihood of another substantial Fed move this week, another Chinese rate cut may have resulted in a surge of pressure on the exchange rate. In line with the Fed’s current policy of large incremental rate hikes, most of the policy moves from other major central banks this week are also expected to be large. For some of the smaller central banks, however, recent actions have illustrated that large rate hikes may only be sufficient to stop their respective currencies from falling. A potential solution for this is to raise the ante even further.

Day ahead

Our US strategist acknowledges that there are risks that the FOMC could go for 100bp to signal their resolve to fight inflation and to keep expectations in check. Nonetheless, he believes that the FOMC will stick to a 75 bp this month. We expect the FOMC to follow this up by a fourth 75bp hike in November, which has us estimating the terminal rate at 5% by early 2023. What’s more, we don’t see how the Fed can reverse any of these hikes before 2024. Although the exogenous shocks of supply chain disruptions may fade soon enough, the wage-price spiral may keep core inflation elevated – which would make the path down for inflation a slow grind. Insofar as the US has experienced a greater post-pandemic uptick in demand and an earlier increase in wage pressures then elsewhere, other central banks may struggle to match the pace of the Fed into year-end and beyond with may also translate into a stronger for longer USD.

The precarious position of the GBP/USD exchange rate will not have escaped the attention of the BoE ahead of its delayed policy meeting this week. Cable last week touched its lowest levels since the mid-1980s, and the pound has also been on the back foot vs. the EUR. Following the end of the UK’s national period of mourning today, UK politics will be back in action. Truss is on her way to the US to make her first speech to the UN General Assembly as PM. She has confirmed to journalists that no negotiations are taking place with respect to a trade deal between the US and the UK. Although this may be an embarrassment to Brexiteers who had appeared confident in their ability to strike trade deals once the UK left the EU, President Biden has made it clear that the UK government’s threat to walk away from the Northern Ireland protocol and the resultant uncertainty over the impact on the region’s peace settlement made it impossible for a trade deal between the two nations at the present time.

Stronger than expected Japanese August CPI inflation data this morning as 3.0% y/y is unlikely to move BoJ policy makers away from their dovish policy position this week. In contrast to its G10 peers, the BoJ is attempting to nurture rather than supress inflation pressures. German August PPI inflation has ratcheted up a shocking 45.8% y/y, underpinning the likelihood of a further strong policy moves from the ECB going forward. Comments from ECB President Lagarde in addition to US housing starts and Canadian CPI inflation data are slated for later in the day.

By Jane Foley, Senior FX Strategist at Rabobank

A late rally on Wall Street last night allowed for a largely positive tone in risk appetite to prevail overnight. That said, trading activity was fairly quiet yesterday in view of the UK bank holiday and ahead of this week’s slew of activity from various central banks including the Federal Reserve. Many market participants are of the view that a 75 bps rate hike from the Fed on Wednesday is all-but-done.

That said, there is still a lot of uncertainty over potential revisions to the dot plot estimates from the FOMC members and the terminal level of the Fed funds rate. These unknowns saw the front end of the US curve underperforming yesterday with the 2 year yield reportedly hitting its highest level since 2007. The favoured view in the market is that central bankers are determined to quash inflationary pressures even if that means a downturn becomes unavoidable. Reflecting this view, crude oil has lost around one third of its value since June, with the strong USD also acting as a headwind. Yesterday, however, crude prices stabilised in tune with the better tone in stock markets, though the overall tone remains cautious. More multi-national corporates have added their voices to the warnings regarding the headwinds to growth. Ford Motor Co. said that inflation has resulted in costs of around USD1 bln higher than expected in the current quarter. General Electric has warned that supply chain issues are dragging on its earnings. Last week, Fed Ex warned about a slowdown in global demand, a factor which contributed to the decline in equity market indices.

This morning the PBoC left its 1 year prime loan rate unchanged at 3.65%, in line with expectations. The 5 year rate, a reference for mortgages, was also left on hold. Both rates were cut last month, and further reductions are expected in the months ahead as the Chinese authorities take action to support the economy. Last week, USD/CNY broke through the 7.00 level, which was likely a contributing factor behind the PBoC’s decision to pause its rate cutting cycle this month. In view of the likelihood of another substantial Fed move this week, another Chinese rate cut may have resulted in a surge of pressure on the exchange rate. In line with the Fed’s current policy of large incremental rate hikes, most of the policy moves from other major central banks this week are also expected to be large. For some of the smaller central banks, however, recent actions have illustrated that large rate hikes may only be sufficient to stop their respective currencies from falling. A potential solution for this is to raise the ante even further.

Day ahead

Our US strategist acknowledges that there are risks that the FOMC could go for 100bp to signal their resolve to fight inflation and to keep expectations in check. Nonetheless, he believes that the FOMC will stick to a 75 bp this month. We expect the FOMC to follow this up by a fourth 75bp hike in November, which has us estimating the terminal rate at 5% by early 2023. What’s more, we don’t see how the Fed can reverse any of these hikes before 2024. Although the exogenous shocks of supply chain disruptions may fade soon enough, the wage-price spiral may keep core inflation elevated – which would make the path down for inflation a slow grind. Insofar as the US has experienced a greater post-pandemic uptick in demand and an earlier increase in wage pressures then elsewhere, other central banks may struggle to match the pace of the Fed into year-end and beyond with may also translate into a stronger for longer USD.

The precarious position of the GBP/USD exchange rate will not have escaped the attention of the BoE ahead of its delayed policy meeting this week. Cable last week touched its lowest levels since the mid-1980s, and the pound has also been on the back foot vs. the EUR. Following the end of the UK’s national period of mourning today, UK politics will be back in action. Truss is on her way to the US to make her first speech to the UN General Assembly as PM. She has confirmed to journalists that no negotiations are taking place with respect to a trade deal between the US and the UK. Although this may be an embarrassment to Brexiteers who had appeared confident in their ability to strike trade deals once the UK left the EU, President Biden has made it clear that the UK government’s threat to walk away from the Northern Ireland protocol and the resultant uncertainty over the impact on the region’s peace settlement made it impossible for a trade deal between the two nations at the present time.

Stronger than expected Japanese August CPI inflation data this morning as 3.0% y/y is unlikely to move BoJ policy makers away from their dovish policy position this week. In contrast to its G10 peers, the BoJ is attempting to nurture rather than supress inflation pressures. German August PPI inflation has ratcheted up a shocking 45.8% y/y, underpinning the likelihood of a further strong policy moves from the ECB going forward. Comments from ECB President Lagarde in addition to US housing starts and Canadian CPI inflation data are slated for later in the day.