By Peter Tchir of Academy Securities

Smooth Sailing Ahead?

The market started off rough and looked incredibly shaky on Wednesday. However, a great performance by MSFT was one of the main things that held the broad markets together and they ended the week incredibly strong.

There were some interesting reactions last week. FRC dropped from $14.24 to $3.50, but KRE (a regional bank ETF) finished virtually unchanged and seemed to be able to shrug off the issues dragging FRC stock down. That sort of resilience is encouraging as it seems like the market is in the process of sorting out the banks that have been affected (from the rest). Yes, there are still issues with what banks may have to pay on deposits to retain customers, but this was very encouraging. I’m finding myself re-reading I Like Mid Banks, I Cannot Lie because we have learned a lot since that was published. I’m more encouraged than I have been in weeks in large part due to how we traded this week.

Inventories

GDP was weaker than expected, but much of that can be attributed to inventories declining. Since the inventory overhang (or even glut) has been a major concern (Moving Beyond Banks), this was encouraging news. Seeing GDP shrink because we are draining inventories is actually a positive because it sets the stage for future growth.

Having said that, two questions still need to be answered:

- Have inventories been reduced enough to start creating demand for increased production or are they still far too high? I’m leaning towards the latter.

- Were companies really able to sell a lot more (close to full price) or were they just reducing shipments so fast that even “mediocre” sales helped? There is some evidence that it was the former, which would be good, but the evidence is mixed at best.

While the inventory news was encouraging, the bar has been set quite low on that front, so I wouldn’t expect smooth sailing from here.

The Consumer

Consumption data looked decent. If we look at new home sales, durable goods, and personal consumption data, all of this points to a consumer that is still spending.

This is in contrast to increasing (but still manageable) delinquency rates on auto loans and credit cards. Yes, they are higher, but they are still below pre-Covid historical levels (at least for the data series that I’ve been tracking). However, credit card debt has been building, but not to alarming levels.

We have all become used to never betting against the American consumer’s willingness to consume, and maybe we have another round of high spending to look forward to, but I struggle to see that.

I don’t believe that the consumer will be a big tailwind for markets or the economy and I expect to see weaker data as layoffs start to take effect.

Inflation

Inflation seems to be stabilizing around levels that are “too high” but not “alarmingly too high”. Right around 4% is higher than the Fed (and incumbent politicians) would like, but it is in the realm of “manageable” and heading in the right direction.

As someone who expected deflation concerns to mount in the first half of this year, I am not worried about inflation rising. Yes, we had an uptick in reported data after “disinflation” gained some traction in January. However, we will learn that we are still headed down a path to lower inflation, because we were set on that path months ago when hikes were started (see

Mistaking Hard for Soft Landing).

Not a Short Squeeze

While markets did very well on Thursday (and even on Friday), there was less of a “squeezy” feel than in some prior rallies. I’ve seen some charts indicating that in some sectors, the “most shorted” names underperformed significantly (not what you would expect in a “short squeeze”). We already discussed FRC versus KRE, but ARKK (another crowd favorite) was down while QQQ (Nasdaq 100) powered higher and beat the Dow and S&P 500 on the week. If you told me that the Nasdaq 100 was going to be up more than other indices, I’d have guessed that ARKK would outperform (it didn’t). Similarly, the Russell 2000 was down on the week, pointing to some selectivity.

This price action is encouraging to me, because it isn’t just a bunch of bears getting stopped out. It is indicative of “new risks” being added with a degree of thoughtfulness that we didn’t see in many of last year’s “ripfests”.

M2

While not something that I pay close attention to, as Tom Keene exposed on Bloomberg TV (at the 1 hour 38 minute mark), the recent decline has been noticed by many people.

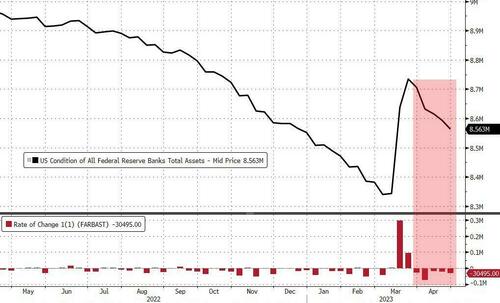

The Fed balance sheet, which I do watch, has resumed its decline as banks are using less of the emergency lending facilities and quantitative tightening is taking its toll.

This will continue to be a headwind.

The Fed

We get the FOMC on Wednesday, which all seems to boil down to the messaging that will be provided during the press conference.

Consensus is for a 25 basis point hike with talk of a pause. Since I don’t think that they should have hiked at the last meeting (or at the last couple of meetings), I can’t see why they won’t raise rates 25 bps (so let’s price this in). I also think that the “pause” is so long overdue that I’d be shocked if we don’t get some indication of this.

When I pull up WIRP it shows a high of 5.09%, so basically one and done, but isn’t that priced in?

Even as someone who thinks that a recession is well on its way, I struggle to see how the market is pricing in a better than 50% chance of a cut by September.

Expect messaging to be “higher for longer”, which I’m not sure the market is on board with.

Jobs

This week will be all about jobs, starting with JOLTS on Monday. Can they continue to surprise? Can we start to trust ADP (which was revised) more than the NFP data (where response rates are abysmally low)? Will some of the headlines about layoffs translate into weaker published data

Finally, and maybe most importantly, will we start to focus on jobs at a granular level and see a disturbing trend (from an economic standpoint) that low-paying jobs are abundant, but middle to high-end jobs are being cut?

We continue to be in the camp that the negative economic impact won’t be a function of job losses, it will be a function of which jobs are lost (i.e., # of jobs multiplied by pay for those jobs will be the real metric to identify and react to).

Debt Ceiling

Will the Republicans’ successful vote bring Biden to the table for serious negotiations or will both sides dig in their heels because they are confident that they have the support of the voters? Or at least can they get the voters to blame the other side for any failure to pay?

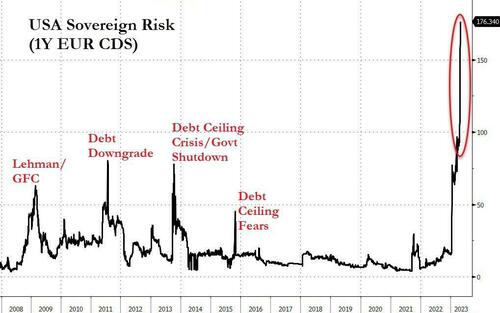

When I look at 1-year U.S. government CDS (which I rarely look at), I see that it indicates a small (but increasing) probability of some sort of a “failure to pay” credit event.

As discussed in recent reports, I take a very simplistic view that given where some longer-dated Treasuries trade (70 cents on the dollar), a failure to pay event will create a 30 point gain for holders of CDS. With a price of 1.75 points, that implies slightly less than a 6% chance of a failure to pay. The CDS is much more complex than that, but I think that this sums up the basic logistics here. No one is buying U.S. CDS because they think that the holders of any debt (that isn’t paid) won’t get paid in full with interest. They are buying it in hopes of a credit event occurring that opens up the “cheapest to deliver” bonds.

So, it is wonky, but important.

I expect rough seas on the debt ceiling front!

It is possible that one (or more) of the NRSRO (Nationally Recognized Statistical Ratings Organizations) will decide to put the U.S. credit rating on credit watch for a potential downgrade. However, since most mandates that I see treat U.S. Treasury risk as its own asset class (i.e., not dependent on rating, unlike what we see in mandates for credit and structured products investors), I don’t think that any potential downgrade would move markets. Any Treasury sell-off linked to a downgrade headline should be bought. However, I would be in no rush to buy any corresponding equity sell-off.

From Made in China to Made by China

We wrote about this in Locking in Some Themes and discussed it in the aforementioned Bloomberg TV interview.

On Tuesday May 2nd, at 1:00 pm ET, Academy will be hosting a webinar on China’s Recent Geopolitical Successes and Influence (please use this link to register). Rachel Washburn will lead a conversation with General Marks, General Walsh, and myself on China’s recent ventures into the global political arena. We will examine what it means for our relationship with not just China, but also other countries and regions. China is certainly improving how it wields its influence on the global stage.

I’d be shocked if questions surrounding “reserve currency” don’t come up!

Bottom Line

A bit of a broken record.

Remaining at -4 on equities on a scale of -10 to 10. Based on price action on Thursday and Friday, I’d move myself closer to neutral or even bullish, but Wednesday felt so awful that I cannot bring myself to make the change to neutral so quickly. However, I certainly cannot get more “beared up” after the past couple of days. I am concerned that I am fighting the “one last hike and done” rally, but so much of that seems to be priced in that I’m willing to take that risk.

On rates, I expect that Powell and the Fed will try to push the “higher for longer” pitch. That will be bad for the front-end (say out to 3-years), so I’d expect yields to increase there. With the 10-year already at a measly 3.4%, it is difficult to imagine it going much lower (back to the hawkish Fed being bad for the front-end, but good for the long-end). But given how much everyone seems to hate the bond market here (apparently record short positions amongst speculators), I won’t bet on much higher longer-dated yields.

I think that the 2s vs 10s yield curve will become more inverted (again).

On the credit side of things, I still like to err on the side of caution. IG over high yield and high yield over leveraged loans (viewing it as big cap vs secured, but not necessarily well secured). In addition, I favor higher credit quality versus lower credit quality tranches on the structured products side of things.

I’d keep buying banks that trade cheap here, though much (if not all) of that trade has already disappeared.

Basically, on credit, I don’t see much downside to spreads (but very little upside), which is often an okay time to give up some potential returns in hopes of a cheapening event (that would likely occur if I’m correct on stocks).

With summer fast approaching, clear sailing would be nice, but while that’s a possibility, my current forecast is for more of the same choppy (but not dangerous) seas, which we just have to make our way through.

By Peter Tchir of Academy Securities

Smooth Sailing Ahead?

The market started off rough and looked incredibly shaky on Wednesday. However, a great performance by MSFT was one of the main things that held the broad markets together and they ended the week incredibly strong.

There were some interesting reactions last week. FRC dropped from $14.24 to $3.50, but KRE (a regional bank ETF) finished virtually unchanged and seemed to be able to shrug off the issues dragging FRC stock down. That sort of resilience is encouraging as it seems like the market is in the process of sorting out the banks that have been affected (from the rest). Yes, there are still issues with what banks may have to pay on deposits to retain customers, but this was very encouraging. I’m finding myself re-reading I Like Mid Banks, I Cannot Lie because we have learned a lot since that was published. I’m more encouraged than I have been in weeks in large part due to how we traded this week.

Inventories

GDP was weaker than expected, but much of that can be attributed to inventories declining. Since the inventory overhang (or even glut) has been a major concern (Moving Beyond Banks), this was encouraging news. Seeing GDP shrink because we are draining inventories is actually a positive because it sets the stage for future growth.

Having said that, two questions still need to be answered:

- Have inventories been reduced enough to start creating demand for increased production or are they still far too high? I’m leaning towards the latter.

- Were companies really able to sell a lot more (close to full price) or were they just reducing shipments so fast that even “mediocre” sales helped? There is some evidence that it was the former, which would be good, but the evidence is mixed at best.

While the inventory news was encouraging, the bar has been set quite low on that front, so I wouldn’t expect smooth sailing from here.

The Consumer

Consumption data looked decent. If we look at new home sales, durable goods, and personal consumption data, all of this points to a consumer that is still spending.

This is in contrast to increasing (but still manageable) delinquency rates on auto loans and credit cards. Yes, they are higher, but they are still below pre-Covid historical levels (at least for the data series that I’ve been tracking). However, credit card debt has been building, but not to alarming levels.

We have all become used to never betting against the American consumer’s willingness to consume, and maybe we have another round of high spending to look forward to, but I struggle to see that.

I don’t believe that the consumer will be a big tailwind for markets or the economy and I expect to see weaker data as layoffs start to take effect.

Inflation

Inflation seems to be stabilizing around levels that are “too high” but not “alarmingly too high”. Right around 4% is higher than the Fed (and incumbent politicians) would like, but it is in the realm of “manageable” and heading in the right direction.

As someone who expected deflation concerns to mount in the first half of this year, I am not worried about inflation rising. Yes, we had an uptick in reported data after “disinflation” gained some traction in January. However, we will learn that we are still headed down a path to lower inflation, because we were set on that path months ago when hikes were started (see

Mistaking Hard for Soft Landing).

Not a Short Squeeze

While markets did very well on Thursday (and even on Friday), there was less of a “squeezy” feel than in some prior rallies. I’ve seen some charts indicating that in some sectors, the “most shorted” names underperformed significantly (not what you would expect in a “short squeeze”). We already discussed FRC versus KRE, but ARKK (another crowd favorite) was down while QQQ (Nasdaq 100) powered higher and beat the Dow and S&P 500 on the week. If you told me that the Nasdaq 100 was going to be up more than other indices, I’d have guessed that ARKK would outperform (it didn’t). Similarly, the Russell 2000 was down on the week, pointing to some selectivity.

This price action is encouraging to me, because it isn’t just a bunch of bears getting stopped out. It is indicative of “new risks” being added with a degree of thoughtfulness that we didn’t see in many of last year’s “ripfests”.

M2

While not something that I pay close attention to, as Tom Keene exposed on Bloomberg TV (at the 1 hour 38 minute mark), the recent decline has been noticed by many people.

The Fed balance sheet, which I do watch, has resumed its decline as banks are using less of the emergency lending facilities and quantitative tightening is taking its toll.

This will continue to be a headwind.

The Fed

We get the FOMC on Wednesday, which all seems to boil down to the messaging that will be provided during the press conference.

Consensus is for a 25 basis point hike with talk of a pause. Since I don’t think that they should have hiked at the last meeting (or at the last couple of meetings), I can’t see why they won’t raise rates 25 bps (so let’s price this in). I also think that the “pause” is so long overdue that I’d be shocked if we don’t get some indication of this.

When I pull up WIRP it shows a high of 5.09%, so basically one and done, but isn’t that priced in?

Even as someone who thinks that a recession is well on its way, I struggle to see how the market is pricing in a better than 50% chance of a cut by September.

Expect messaging to be “higher for longer”, which I’m not sure the market is on board with.

Jobs

This week will be all about jobs, starting with JOLTS on Monday. Can they continue to surprise? Can we start to trust ADP (which was revised) more than the NFP data (where response rates are abysmally low)? Will some of the headlines about layoffs translate into weaker published data?

Finally, and maybe most importantly, will we start to focus on jobs at a granular level and see a disturbing trend (from an economic standpoint) that low-paying jobs are abundant, but middle to high-end jobs are being cut?

We continue to be in the camp that the negative economic impact won’t be a function of job losses, it will be a function of which jobs are lost (i.e., # of jobs multiplied by pay for those jobs will be the real metric to identify and react to).

Debt Ceiling

Will the Republicans’ successful vote bring Biden to the table for serious negotiations or will both sides dig in their heels because they are confident that they have the support of the voters? Or at least can they get the voters to blame the other side for any failure to pay?

When I look at 1-year U.S. government CDS (which I rarely look at), I see that it indicates a small (but increasing) probability of some sort of a “failure to pay” credit event.

As discussed in recent reports, I take a very simplistic view that given where some longer-dated Treasuries trade (70 cents on the dollar), a failure to pay event will create a 30 point gain for holders of CDS. With a price of 1.75 points, that implies slightly less than a 6% chance of a failure to pay. The CDS is much more complex than that, but I think that this sums up the basic logistics here. No one is buying U.S. CDS because they think that the holders of any debt (that isn’t paid) won’t get paid in full with interest. They are buying it in hopes of a credit event occurring that opens up the “cheapest to deliver” bonds.

So, it is wonky, but important.

I expect rough seas on the debt ceiling front!

It is possible that one (or more) of the NRSRO (Nationally Recognized Statistical Ratings Organizations) will decide to put the U.S. credit rating on credit watch for a potential downgrade. However, since most mandates that I see treat U.S. Treasury risk as its own asset class (i.e., not dependent on rating, unlike what we see in mandates for credit and structured products investors), I don’t think that any potential downgrade would move markets. Any Treasury sell-off linked to a downgrade headline should be bought. However, I would be in no rush to buy any corresponding equity sell-off.

From Made in China to Made by China

We wrote about this in Locking in Some Themes and discussed it in the aforementioned Bloomberg TV interview.

On Tuesday May 2nd, at 1:00 pm ET, Academy will be hosting a webinar on China’s Recent Geopolitical Successes and Influence (please use this link to register). Rachel Washburn will lead a conversation with General Marks, General Walsh, and myself on China’s recent ventures into the global political arena. We will examine what it means for our relationship with not just China, but also other countries and regions. China is certainly improving how it wields its influence on the global stage.

I’d be shocked if questions surrounding “reserve currency” don’t come up!

Bottom Line

A bit of a broken record.

Remaining at -4 on equities on a scale of -10 to 10. Based on price action on Thursday and Friday, I’d move myself closer to neutral or even bullish, but Wednesday felt so awful that I cannot bring myself to make the change to neutral so quickly. However, I certainly cannot get more “beared up” after the past couple of days. I am concerned that I am fighting the “one last hike and done” rally, but so much of that seems to be priced in that I’m willing to take that risk.

On rates, I expect that Powell and the Fed will try to push the “higher for longer” pitch. That will be bad for the front-end (say out to 3-years), so I’d expect yields to increase there. With the 10-year already at a measly 3.4%, it is difficult to imagine it going much lower (back to the hawkish Fed being bad for the front-end, but good for the long-end). But given how much everyone seems to hate the bond market here (apparently record short positions amongst speculators), I won’t bet on much higher longer-dated yields.

I think that the 2s vs 10s yield curve will become more inverted (again).

On the credit side of things, I still like to err on the side of caution. IG over high yield and high yield over leveraged loans (viewing it as big cap vs secured, but not necessarily well secured). In addition, I favor higher credit quality versus lower credit quality tranches on the structured products side of things.

I’d keep buying banks that trade cheap here, though much (if not all) of that trade has already disappeared.

Basically, on credit, I don’t see much downside to spreads (but very little upside), which is often an okay time to give up some potential returns in hopes of a cheapening event (that would likely occur if I’m correct on stocks).

With summer fast approaching, clear sailing would be nice, but while that’s a possibility, my current forecast is for more of the same choppy (but not dangerous) seas, which we just have to make our way through.

Loading…