By Ven Ram, Bloomberg Markets Live commentator and reporter

The Federal Reserve may have to go further than what the markets are factoring in to quell inflation in the current cycle.

Treasuries and stocks rallied after the Fed suggested last week that the monetary authority had reached the neutral rate, signaling that increases down the line may be more measured.

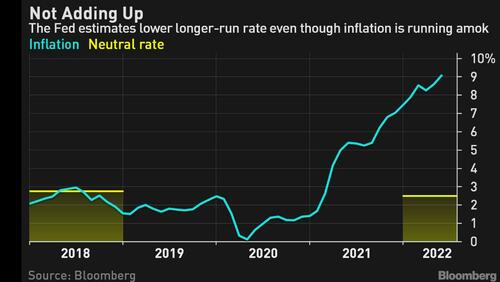

However, the Fed’s suggestion about the neutral rate -- when the policy benchmark is neither contractionary nor expansionary -- is likely flawed.

In its latest summary of economic projections made in June, the median of the longer-run Fed funds rate was 2.50%, alongside an inflation projection of 2%. In other words, the Fed is willing to set its benchmark at a real rate of 50 basis points.

However, with headline inflation running at 9.1%, it can scarcely be argued that the neutral rate would be less than where it was back in December 2018, when the Fed ended its hiking campaign in the previous cycle. It then projected a neutral rate of 2.75%, while inflation was comfortably around 2%.

While a precise estimate of the neutral rate isn’t possible given that it is an unobservable variable, it doesn’t require a massive leap of judgment to infer that slowing a car running at more than four times the usual speed requires far more vigorous braking action than just taking your foot off the accelerator.

Former Pimco Chief Executive Officer Mohamed El-Erian reckons the neutral rate is “at least half a percentage point” above the Fed’s 2.50% long-run projection.

But given how far above target inflation is running, the Fed may have to get its rate into restrictive territory. The top end of Fed members’ projection range for the funds rate next year was as high as 4.1% back in June, suggesting some members thought the central bank would need to raise rates far more than is currently factored in by the markets.

Overnight indexed swaps are pricing about 100 basis points of tightening by the end of the year -- give or take a few basis points depending on when you are reading this -- before the rate starts unwinding in 2023. Much of that outlook stems directly from Powell’s remarks that we are now around the neutral rate, providing almost a replay of what happened in November 2018. Back then, his comment that interest rates were just below the neutral range sparked a massive rally in stocks.

While the markets then took the Fed’s hiking cycle as nearing the end (and they were right then), this time around the situation is a lot trickier. Economic momentum is slowing, and the adverse feedback loop stemming from the technical recession of the first two quarters will only make matters worse. Yet, given the uncertainty around inflation, the Fed may have no choice but to keep going

Powell himself suggested that the Fed’s median projection of a rate of 3.8% for 2023 is still the best guide, which should puncture the markets’ arithmetic.

In re-calibrating the Fed’s calculus, the markets have unduly latched onto his comment on the neutral rate and are assuming that its play book this time around will be no different to 2018. They may be in for a rude shock in the coming months.

By Ven Ram, Bloomberg Markets Live commentator and reporter

The Federal Reserve may have to go further than what the markets are factoring in to quell inflation in the current cycle.

Treasuries and stocks rallied after the Fed suggested last week that the monetary authority had reached the neutral rate, signaling that increases down the line may be more measured.

However, the Fed’s suggestion about the neutral rate — when the policy benchmark is neither contractionary nor expansionary — is likely flawed.

In its latest summary of economic projections made in June, the median of the longer-run Fed funds rate was 2.50%, alongside an inflation projection of 2%. In other words, the Fed is willing to set its benchmark at a real rate of 50 basis points.

However, with headline inflation running at 9.1%, it can scarcely be argued that the neutral rate would be less than where it was back in December 2018, when the Fed ended its hiking campaign in the previous cycle. It then projected a neutral rate of 2.75%, while inflation was comfortably around 2%.

While a precise estimate of the neutral rate isn’t possible given that it is an unobservable variable, it doesn’t require a massive leap of judgment to infer that slowing a car running at more than four times the usual speed requires far more vigorous braking action than just taking your foot off the accelerator.

Former Pimco Chief Executive Officer Mohamed El-Erian reckons the neutral rate is “at least half a percentage point” above the Fed’s 2.50% long-run projection.

But given how far above target inflation is running, the Fed may have to get its rate into restrictive territory. The top end of Fed members’ projection range for the funds rate next year was as high as 4.1% back in June, suggesting some members thought the central bank would need to raise rates far more than is currently factored in by the markets.

Overnight indexed swaps are pricing about 100 basis points of tightening by the end of the year — give or take a few basis points depending on when you are reading this — before the rate starts unwinding in 2023. Much of that outlook stems directly from Powell’s remarks that we are now around the neutral rate, providing almost a replay of what happened in November 2018. Back then, his comment that interest rates were just below the neutral range sparked a massive rally in stocks.

While the markets then took the Fed’s hiking cycle as nearing the end (and they were right then), this time around the situation is a lot trickier. Economic momentum is slowing, and the adverse feedback loop stemming from the technical recession of the first two quarters will only make matters worse. Yet, given the uncertainty around inflation, the Fed may have no choice but to keep going

Powell himself suggested that the Fed’s median projection of a rate of 3.8% for 2023 is still the best guide, which should puncture the markets’ arithmetic.

In re-calibrating the Fed’s calculus, the markets have unduly latched onto his comment on the neutral rate and are assuming that its play book this time around will be no different to 2018. They may be in for a rude shock in the coming months.