The downturn in the European auto market is accelerating.

Volkswagen, Mercedes, Aston Martin, and BMW have all cut their financial forecasts in response to the deteriorating conditions. A recently leaked memo from a senior Stellantis executive highlighted increasing concerns over the deepening auto slump. Bloomberg's latest data shows the downturn continues to worsen.

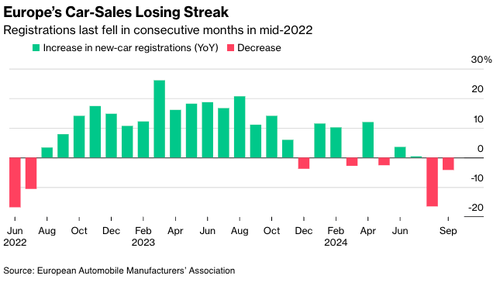

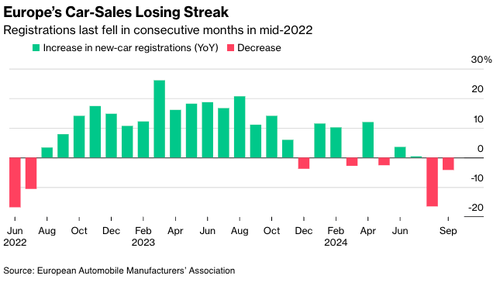

New figures from the European Automobile Manufacturers' Association show that new car registrations across Europe in September declined 4.2% compared with the same month one year ago, to 1.12 million units. This was the second consecutive month of declines since mid-summer 2022. Data showed that gains in electric vehicles could not offset the weakness in combustion-engine models.

Constantin Gall, the managing partner at EY for Western European markets, wrote in a note to clients that the European auto market "remains in crisis mode," adding, "There is no positive impetus towards the end of the year — the economy is weakening, the considerable geopolitical tensions are not easing and are causing uncertainty among both private and commercial customers."

European consumers balked at expensive EVs in September. Instead, they gravitated towards affordable ones.

Sales of EVs bounced back in September, a welcome sign for the industry that's seen demand for fully electric cars decline after governments pulled subsidies last year. EV deliveries jumped 24% in the UK, where carmakers are heavily discounting to try to comply with the government's zero-emissions vehicle sales mandate. In Germany, where the government is discussing the potential of new incentives, EV sales increased 8.7%. -BBG

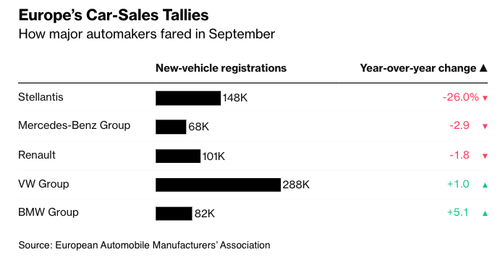

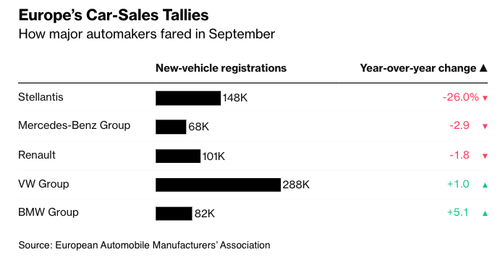

Regarding each automaker's performance in September, Stellantis nosedived, recording the steepest decline in new car sales, about 26%.

We have extensively covered the automaker downturn:

-

Volkswagen Considers First-Ever Germany Factory Closures As Economic Troubles Mount

-

Aston Martin Crashes, Stellantis Slides As Auto Slowdown Worsens For European Carmakers

-

"Doghouse Is Back!": Stellantis CFO Instructs Staff To Take "Drastic Measures" To Conserve Cash

In markets, the MSCI Europe Automobiles and Components Index has made four attempts at new all-time highs in the last decade, the first in March 2015, and has since failed three other times, with the latest in April. On the year, the index is down about 10%.

The MSCI World Automobiles Index is another index that shows, more broadly, global automakers are under pressure.

Heading into 2025, auto companies will continue to face many challenges. Interest rates remain high, and vehicle prices are elevated, driving some of the worst affordability for consumers in a generation. This problem also persists in the US.

The downturn in the European auto market is accelerating.

Volkswagen, Mercedes, Aston Martin, and BMW have all cut their financial forecasts in response to the deteriorating conditions. A recently leaked memo from a senior Stellantis executive highlighted increasing concerns over the deepening auto slump. Bloomberg’s latest data shows the downturn continues to worsen.

New figures from the European Automobile Manufacturers’ Association show that new car registrations across Europe in September declined 4.2% compared with the same month one year ago, to 1.12 million units. This was the second consecutive month of declines since mid-summer 2022. Data showed that gains in electric vehicles could not offset the weakness in combustion-engine models.

Constantin Gall, the managing partner at EY for Western European markets, wrote in a note to clients that the European auto market “remains in crisis mode,” adding, “There is no positive impetus towards the end of the year — the economy is weakening, the considerable geopolitical tensions are not easing and are causing uncertainty among both private and commercial customers.”

European consumers balked at expensive EVs in September. Instead, they gravitated towards affordable ones.

Sales of EVs bounced back in September, a welcome sign for the industry that’s seen demand for fully electric cars decline after governments pulled subsidies last year. EV deliveries jumped 24% in the UK, where carmakers are heavily discounting to try to comply with the government’s zero-emissions vehicle sales mandate. In Germany, where the government is discussing the potential of new incentives, EV sales increased 8.7%. -BBG

Regarding each automaker’s performance in September, Stellantis nosedived, recording the steepest decline in new car sales, about 26%.

We have extensively covered the automaker downturn:

In markets, the MSCI Europe Automobiles and Components Index has made four attempts at new all-time highs in the last decade, the first in March 2015, and has since failed three other times, with the latest in April. On the year, the index is down about 10%.

The MSCI World Automobiles Index is another index that shows, more broadly, global automakers are under pressure.

Heading into 2025, auto companies will continue to face many challenges. Interest rates remain high, and vehicle prices are elevated, driving some of the worst affordability for consumers in a generation. This problem also persists in the US.

Loading…