By Marcel Kasumovich, Head of Research for One River Asset Management

It’s normal, sort of. Digital asset markets are following a commodity boom, bust, recovery cycle. Investors are focused on the bust. The decline in inflation, bond yields, and the US dollar makes the downturn shallower. And inflation assets are leading the recovery. That’s not normal.

Inflation Assets Leading the Not-Normal

“If you want two cups of coffee, save money and order both at the same time,” a student at the University of Freiburg famously quipped during Germany’s hyperinflation. That’s the inflation we worry about – pernicious, invisible tax. The recent surge in inflation is an inconvenience by historical standards. Periods of inflation lead people to shed currency for almost any real asset – even pianos were a hedge for Germans in the 1920s. That’s not now. But it’s also not never.

The pandemic brought a warning shot, a reminder that the saying “too much money chasing too few goods” still applies. Global inflation surged to 9% last year as bottlenecks emerged in all supply chains. Assets believed to hedge inflation performed dismally. Real assets – bitcoin, gold, lumber, land – crashed as inflation rose. Those assets didn’t “fail” in their roles. Real interest rates shot higher. And that’s the real driving force behind inflation assets.

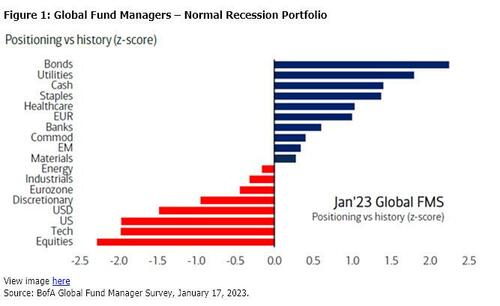

The evidence is obvious in investor behavior. There was a dash for cash as inflation rose, not real assets. Last quarter, Global Fund Managers reported the highest cash holding since 2001! The inflation tax was an afterthought. All other assets were rapidly deflating in response to the surge in rates. That is not an inflationary mindset. It’s conviction that policy will kill inflation, leaving real rates higher for a stretch of time. And it’s self-reinforcing.

Market expectations call for a cratering of inflation this year, to 2.33%. It’s also expected to stay there for a very long time, 2.19% in 2024 and an average of 2.29% in the next ten years. The consensus is centered on the idea that a recession will bring everything back to “normal.” And it is exactly how investors are positioned – long bonds, short equities, and long US dollar (Figure 1). Our own Macro Pulse confirms the consensus – it’s in recessionary territory.

But change is afoot. Downturns don’t last long, even brutal ones. They are usually fast, severe fractures. This one is slow and shallow. Our Macro Pulse has been in recessionary territory three of the past four months; the longest recessionary signal was nine months in the Great Financial Crisis. Market stabilizers are also emerging. Declines in inflation, bond yields and the US dollar are cushioning the downturn with mortgage and business surveys bottoming.

Commodity markets provide the simplest connection to the cyclicality of digital assets. Doug Wilson, One River Digital PM, likens the downturn in digital infrastructure to a boom, bust, recovery cycle of energy markets. It’s a terrific benchmark. Bitcoin is a unit of energy. The boom saw Bitcoin trade miles above its marginal cost of production. That boom led to excess investment. The bust that followed is like an over-supplied commodity cycle.

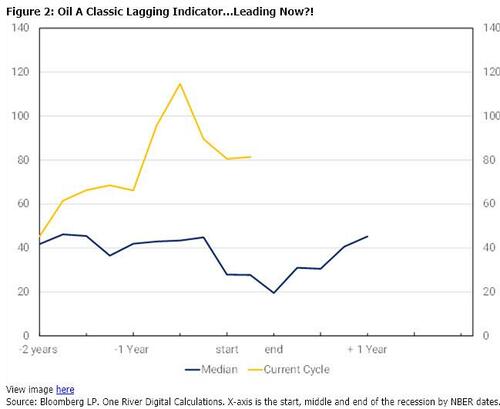

What does the recovery look like? Let’s benchmark the boom-bust-recovery cycle through the macro lens of recessions. Figure 2 shows median oil prices in the past 4 economic cycles. The most interesting observation – oil prices aren’t anywhere close to the downturns of the past. This is the “too few goods” side of the inflation equation. A long period of commodity underinvestment means that inflation assets don’t decline to the same degree in recession.

It also means inflationary assets can lead in the recovery, counter to the consensus of a return to “normal.” But inflation assets are supposed to lag, not lead. It takes an extended period of strong demand to absorb excess capacity built in this expansion. Those are the assets soonest to bump up against capacity constraints and be demonstrated as short in supply. Cyclical forces are pulling down inflation, structural pressures may be less benign.

Digital asset markets are recoupling to macro forces. Inflation assets are leading this year and digital assets are rising with that tide. The differentiation within the digital ecosystem is telling. Base layers and scaling solutions are leading – Bitcoin and Ethereum are back to pre-FTX levels, Optimism scaling protocol has risen well above pre-FTX highs. DeFi protocols are lagging, most notably MakerDAO, as it wrestles with its strategic future pathway.

Market leadership is in the boring basics. We should pay attention. Bitcoin, Ethereum, Lightning, Optimism – base layers with scaling solutions for usable applications. We know that digital asset valuations are all about network effects. But investing in railways is pointless with no demand to ride them. Tokenization has been wildly successful in bridging traditional and digital worlds. That’s one trajectory of turning the boring into beautiful.

By Marcel Kasumovich, Head of Research for One River Asset Management

It’s normal, sort of. Digital asset markets are following a commodity boom, bust, recovery cycle. Investors are focused on the bust. The decline in inflation, bond yields, and the US dollar makes the downturn shallower. And inflation assets are leading the recovery. That’s not normal.

Inflation Assets Leading the Not-Normal

“If you want two cups of coffee, save money and order both at the same time,” a student at the University of Freiburg famously quipped during Germany’s hyperinflation. That’s the inflation we worry about – pernicious, invisible tax. The recent surge in inflation is an inconvenience by historical standards. Periods of inflation lead people to shed currency for almost any real asset – even pianos were a hedge for Germans in the 1920s. That’s not now. But it’s also not never.

The pandemic brought a warning shot, a reminder that the saying “too much money chasing too few goods” still applies. Global inflation surged to 9% last year as bottlenecks emerged in all supply chains. Assets believed to hedge inflation performed dismally. Real assets – bitcoin, gold, lumber, land – crashed as inflation rose. Those assets didn’t “fail” in their roles. Real interest rates shot higher. And that’s the real driving force behind inflation assets.

The evidence is obvious in investor behavior. There was a dash for cash as inflation rose, not real assets. Last quarter, Global Fund Managers reported the highest cash holding since 2001! The inflation tax was an afterthought. All other assets were rapidly deflating in response to the surge in rates. That is not an inflationary mindset. It’s conviction that policy will kill inflation, leaving real rates higher for a stretch of time. And it’s self-reinforcing.

Market expectations call for a cratering of inflation this year, to 2.33%. It’s also expected to stay there for a very long time, 2.19% in 2024 and an average of 2.29% in the next ten years. The consensus is centered on the idea that a recession will bring everything back to “normal.” And it is exactly how investors are positioned – long bonds, short equities, and long US dollar (Figure 1). Our own Macro Pulse confirms the consensus – it’s in recessionary territory.

But change is afoot. Downturns don’t last long, even brutal ones. They are usually fast, severe fractures. This one is slow and shallow. Our Macro Pulse has been in recessionary territory three of the past four months; the longest recessionary signal was nine months in the Great Financial Crisis. Market stabilizers are also emerging. Declines in inflation, bond yields and the US dollar are cushioning the downturn with mortgage and business surveys bottoming.

Commodity markets provide the simplest connection to the cyclicality of digital assets. Doug Wilson, One River Digital PM, likens the downturn in digital infrastructure to a boom, bust, recovery cycle of energy markets. It’s a terrific benchmark. Bitcoin is a unit of energy. The boom saw Bitcoin trade miles above its marginal cost of production. That boom led to excess investment. The bust that followed is like an over-supplied commodity cycle.

What does the recovery look like? Let’s benchmark the boom-bust-recovery cycle through the macro lens of recessions. Figure 2 shows median oil prices in the past 4 economic cycles. The most interesting observation – oil prices aren’t anywhere close to the downturns of the past. This is the “too few goods” side of the inflation equation. A long period of commodity underinvestment means that inflation assets don’t decline to the same degree in recession.

It also means inflationary assets can lead in the recovery, counter to the consensus of a return to “normal.” But inflation assets are supposed to lag, not lead. It takes an extended period of strong demand to absorb excess capacity built in this expansion. Those are the assets soonest to bump up against capacity constraints and be demonstrated as short in supply. Cyclical forces are pulling down inflation, structural pressures may be less benign.

Digital asset markets are recoupling to macro forces. Inflation assets are leading this year and digital assets are rising with that tide. The differentiation within the digital ecosystem is telling. Base layers and scaling solutions are leading – Bitcoin and Ethereum are back to pre-FTX levels, Optimism scaling protocol has risen well above pre-FTX highs. DeFi protocols are lagging, most notably MakerDAO, as it wrestles with its strategic future pathway.

Market leadership is in the boring basics. We should pay attention. Bitcoin, Ethereum, Lightning, Optimism – base layers with scaling solutions for usable applications. We know that digital asset valuations are all about network effects. But investing in railways is pointless with no demand to ride them. Tokenization has been wildly successful in bridging traditional and digital worlds. That’s one trajectory of turning the boring into beautiful.

Loading…