After a hope-filled rebound in August, analysts expect UMich Sentiment in preliminary August data to show further improvements with inflation expectations flat. They were right in their prediction as the headline sentiment beat expectations (69.0 vs 68.5 exp), as did the current conditions and expectations sub-indices.

Source: Bloomberg

The gain was led by an improvement in buying conditions for durables, driven by more favorable prices as perceived by consumers.

Year-ahead expectations for personal finances and the economy both improved as well, despite a modest weakening in views of labor markets.

However, more notably, medium-term inflation expectations picked up (while short-dated expectations - which largely reflect oil prices - fell to their lowest since Dec 2020)...

Source: Bloomberg

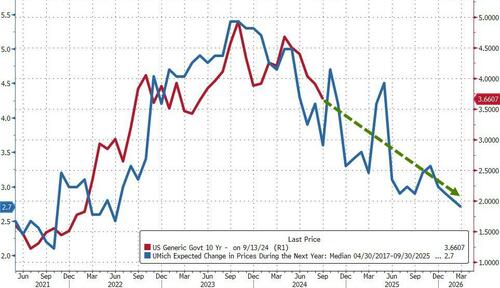

...which suggests (on a lagged basis) that 10Y yields are going a lot lower...

Source: Bloomberg

Finally, we note that confidence continued to rise for Democrats, was flat for Independents, and slid further among Republicans...

Source: Bloomberg

Consistent with their divergent views of the implications of a Harris presidency for the economy, partisan gaps in sentiment inched up.

Note that interviews for this release concluded prior to Tuesday’s debate; a more comprehensive look at election expectations will be released next week.

After a hope-filled rebound in August, analysts expect UMich Sentiment in preliminary August data to show further improvements with inflation expectations flat. They were right in their prediction as the headline sentiment beat expectations (69.0 vs 68.5 exp), as did the current conditions and expectations sub-indices.

Source: Bloomberg

The gain was led by an improvement in buying conditions for durables, driven by more favorable prices as perceived by consumers.

Year-ahead expectations for personal finances and the economy both improved as well, despite a modest weakening in views of labor markets.

However, more notably, medium-term inflation expectations picked up (while short-dated expectations – which largely reflect oil prices – fell to their lowest since Dec 2020)…

Source: Bloomberg

…which suggests (on a lagged basis) that 10Y yields are going a lot lower…

Source: Bloomberg

Finally, we note that confidence continued to rise for Democrats, was flat for Independents, and slid further among Republicans…

Source: Bloomberg

Consistent with their divergent views of the implications of a Harris presidency for the economy, partisan gaps in sentiment inched up.

Note that interviews for this release concluded prior to Tuesday’s debate; a more comprehensive look at election expectations will be released next week.

Loading…