Authored by Adam Taggart via Wealthion.com,

Voices like Elizabeth Warren have been among the loudest when it comes to painting “corporate greed” as the prime suspect behind rising inflation in the US.This isn’t a fringe perspective. On Wednesday, Joe Biden sent a warning letter to top oil executives asking them to bring down prices, implying the administration might intervene if not.

Is this narrative true? Is Exxon responsible for rising gas prices? Is Tyson Foods responsible for rising egg and pork prices?

Macro analyst Stephanie Pomboy doesn’t think so.

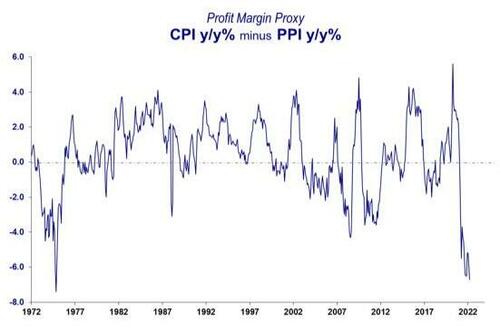

According to Pomboy, we need to look at the difference between the consumer price index (CPI) and the producer price index (PPI). The PPI does not make too many headlines as it’s not of immediate concern to everyday consumers. It tracks the prices of raw commodities and intermediate services like bulk shipping.

In short, PPI reflects prices that small businesses and corporations pay while CPI is analogous for the typical consumer. Taking a look at the difference between the two measures, there is quite a massive gap and not one that favors corporations:

So what does this mean? On net, businesses are bearing the brunt of this inflation. Perhaps many CEOs believed inflation was transitory and were initially reluctant to raise prices.

The implications of this, however, are deeper than the realization that Elizabeth Warren needs to retake Econ 101. It also means businesses, which are already facing soaring costs of capital due to the Federal Reserve’s tightening campaign, are in a worse position financially than most thought.

This could mean layoffs or worse: insolvency and liquidations.

Overall, Pomboy sees the private sector as extremely fragile, especially now that the labor market is no longer the Fed’s primary concern.

She recalls the 2008 financial crisis, when market pundits were having a bit of an inflation scare as well.

At the time, inflation peaked in July ‘08 at 5.6% YoY. Exactly one year later, inflation had morphed into deflation, coming in at -2.1%.

Pomboy warns that with an economy this fragile, we may be facing a brutal deflationary contraction just as inflation fears have reached peak hysteria.

Listen to her full interview here

Authored by Adam Taggart via Wealthion.com,

Voices like Elizabeth Warren have been among the loudest when it comes to painting “corporate greed” as the prime suspect behind rising inflation in the US.This isn’t a fringe perspective. On Wednesday, Joe Biden sent a warning letter to top oil executives asking them to bring down prices, implying the administration might intervene if not.

Is this narrative true? Is Exxon responsible for rising gas prices? Is Tyson Foods responsible for rising egg and pork prices?

Macro analyst Stephanie Pomboy doesn’t think so.

According to Pomboy, we need to look at the difference between the consumer price index (CPI) and the producer price index (PPI). The PPI does not make too many headlines as it’s not of immediate concern to everyday consumers. It tracks the prices of raw commodities and intermediate services like bulk shipping.

In short, PPI reflects prices that small businesses and corporations pay while CPI is analogous for the typical consumer. Taking a look at the difference between the two measures, there is quite a massive gap and not one that favors corporations:

So what does this mean? On net, businesses are bearing the brunt of this inflation. Perhaps many CEOs believed inflation was transitory and were initially reluctant to raise prices.

The implications of this, however, are deeper than the realization that Elizabeth Warren needs to retake Econ 101. It also means businesses, which are already facing soaring costs of capital due to the Federal Reserve’s tightening campaign, are in a worse position financially than most thought.

This could mean layoffs or worse: insolvency and liquidations.

Overall, Pomboy sees the private sector as extremely fragile, especially now that the labor market is no longer the Fed’s primary concern.

She recalls the 2008 financial crisis, when market pundits were having a bit of an inflation scare as well.

At the time, inflation peaked in July ‘08 at 5.6% YoY. Exactly one year later, inflation had morphed into deflation, coming in at -2.1%.

Pomboy warns that with an economy this fragile, we may be facing a brutal deflationary contraction just as inflation fears have reached peak hysteria.

Listen to her full interview here

[embedded content]