By Jean-Laurent Cadorel of Exante Data

-

Monetary policy matters in the short-run through its impact on asset prices, demand, and activity;

-

Yet in the long run the economy is assumed to gravitate towards some “natural” rate of activity independent of such monetary actions;

-

A growing number of researchers are asking, however, whether monetary policy can have hysteresis effects and impact the natural rate through innovation activity.

THIS YEAR’S Jackson Hole gathering was themed “structural shifts in the global economy.” Policymaker speeches garnered the most attention, of course. But there were also the usual academic contributions. And of these perhaps the most talked about was Monetary Policy and Innovation by Yueran Ma of the University of Chicago and Kaspar Zimmermann of the Leibniz Institute for Financial Research.

Ma and Zimmerman argue monetary policy can have hysteresis effects on the economy through the financing of innovation; lower innovation can lead to lower growth and less desirable macroeconomic outcomes. The authors show this empirically using monetary shocks constructed à la Christina Romer and David Romer and a variety of measures of innovation in the United States. They find statistically significant and economically large effects using local projections.

This result matters because it changes central bank calculus. For example, Taylor Rules implicitly assume the natural rate of interest is independent of the rate of interest set by the central bank—the natural rate being that “ground out” by frictionless markets, per Milton Friedman’s analogue in unemployment. And it is assumed the central bank anchors the money rate of interest to the natural rate of interest (per Woodford). So if economists now show monetary policy impacts the natural rate, Taylor Rules may need some rethinking: how can we target a natural rate of interest using a money rate if the latter impacts the former?

Motivation

Over the second half of the last century, macroeconomics has come to a compromise between the extreme (Keynesian) view than monetary policy is ineffective (in a liquidity trap) and monetary policy is all that matters (the extreme monetarist view). Today, it is generally understood that monetary policy has short-run effects but is neutral in the long run—Patinkin’s classical dichotomy prevails.

Discussions about monetary policy have therefore focused on its short-run impact while natural forces are expected to do their work on the supply side of the economy.

The paper by Ma and Zimmerman is part of a small but growing body of work interested in possible longer-term consequences of monetary policy which may operate through innovation and technological progress. They adopt a New Keynesian perspective with endogenous total factor productivity (TFP). Monetary policy influences firms’ incentives to develop and implement innovations.

For example, following monetary policy contractions, reductions in aggregate demand can decrease profitability and incentives for innovation. Tighter financial conditions and lower risk appetite can decrease funding for innovation. A slower pace of innovation may then have lasting effects.

This paper tests the effects of monetary policy on innovation activities, using a variety of metrics of innovation: aggregate investment in intellectual property (including R&D) from national accounts, the R&D spending of public companies, and measures based on VC investment and patent filing.

Results

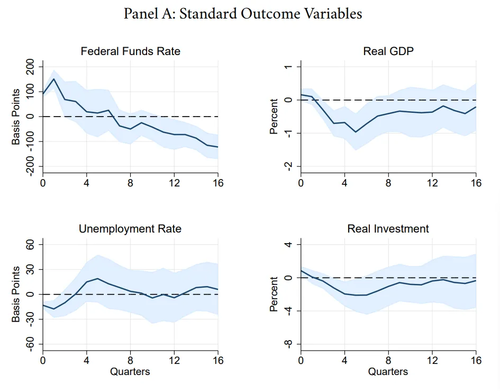

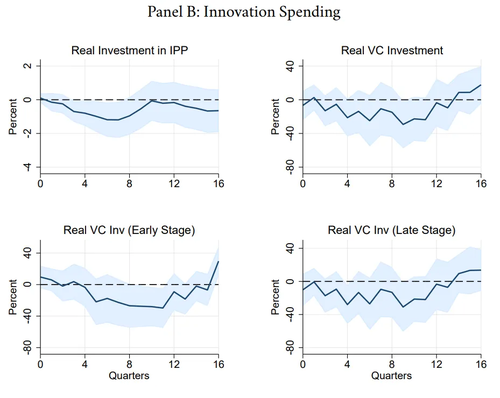

The authors observe meaningful changes in innovation activity in the years following monetary policy shocks. First, investment in intellectual property products (IPP) in the national accounts (NIPA) declines by about 1 percent. The magnitude is comparable to the decline in traditional investment in physical assets. R&D spending in Compustat data for public firms declines by about 3 percent.

Second, VC investment is more volatile, and declines by as much as 25 percent at a horizon of 1 to 3 years after the monetary policy shock. Third, patenting in important technologies measured by Bloom et al. (2023) declines by up to 9 percent 2 to 4 years after the shock. Patenting in other technologies declines by less than patenting in important technologies according to the importance classification in Bloom et al. (2023).

An aggregate innovation index constructed by Kogan et al. (2017) using estimates of the economic value of patents also declines by up to 9 percent. Based on this paper’s output and total factor productivity (TFP) sensitivity to the aggregate innovation index, a 9 percent decline in the index can contribute to 1 percent lower real output and 0.5 percent lower TFP 5 years later.

Mechanism

For the transmission mechanism from monetary policy to innovation activities, Ma and Zimmerman find indications that both demand and financial conditions are relevant.

First, by decreasing demand, monetary policy tightening can reduce the profitability of developing new products and the incentives to innovate (Shleifer, 1986; Fatas, 2000; Comin and Gertler, 2006; Benigno and Fornaro, 2018). In the data, they observe a stronger decline in both R&D and patenting in more cyclical industries. They also observe that patenting declines after monetary policy tightening among both public and private companies, and among both large and small public companies. To the extent that large public firms have abundant financial resources, the slowdown of innovation activities among these firms is likely driven by reduced demand.

Second, monetary policy tightening can affect financial conditions and reduce the appetite for risk-taking (Bauer, Bernanke, and Milstein, 2023; Kashyap and Stein, 2023). In the data, they observe that VC investment for both early-stage and late-stage startups declines after monetary policy tightening. To the extent that early-stage startups are still in the product development phase and may not have products coming to the market immediately, reduced funding could reflect less appetite for investing in risky endeavors.

Conclusion

The Ma and Zimmerman contribution is an important empirical counterpart to recent papers exploring the possible longer-term consequences of monetary policy, which may operate through the influence of monetary policy on innovation and technological progress (Stadler, 1990; Moran and Queralto, 2018; Modery et al., 2021; Grimm, Laeven, and Popov, 2022; Amador, 2022; Fornaro and Wolf, 2023; Jordà, Singh, and Taylor, 2023).

The authors document the response of innovation to monetary policy using a collection of measures.

The results suggest that monetary policy could have a persistent influence on the productive capacity of the economy, in addition to the well-recognized near-term effects on economic outcomes. Rising interest rates since 2022 and a substantial decline in venture capital investment highlight how relevant these issues are. Recent breakthroughs in AI raise the hope that another technological revolution could be on the horizon.

What does this mean for policy? The authors argue their contribution does not imply monetary policy should be more dovish. A number of economic observers have highlighted the misallocation of capital (excessive housing construction) or the emergence of asset bubbles (in debt markets, housing, and cryptocurrencies) due to the low level of interest rates.

Striking the right balance between these two sides requires evidence and the authors contribute a persuasive set of results to the debate. But as they also point out. it is possible that the effects of monetary policy on innovation cancel out over the complete cycle. So, for now, the policy conclusions are not clear.

By Jean-Laurent Cadorel of Exante Data

-

Monetary policy matters in the short-run through its impact on asset prices, demand, and activity;

-

Yet in the long run the economy is assumed to gravitate towards some “natural” rate of activity independent of such monetary actions;

-

A growing number of researchers are asking, however, whether monetary policy can have hysteresis effects and impact the natural rate through innovation activity.

THIS YEAR’S Jackson Hole gathering was themed “structural shifts in the global economy.” Policymaker speeches garnered the most attention, of course. But there were also the usual academic contributions. And of these perhaps the most talked about was Monetary Policy and Innovation by Yueran Ma of the University of Chicago and Kaspar Zimmermann of the Leibniz Institute for Financial Research.

Ma and Zimmerman argue monetary policy can have hysteresis effects on the economy through the financing of innovation; lower innovation can lead to lower growth and less desirable macroeconomic outcomes. The authors show this empirically using monetary shocks constructed à la Christina Romer and David Romer and a variety of measures of innovation in the United States. They find statistically significant and economically large effects using local projections.

This result matters because it changes central bank calculus. For example, Taylor Rules implicitly assume the natural rate of interest is independent of the rate of interest set by the central bank—the natural rate being that “ground out” by frictionless markets, per Milton Friedman’s analogue in unemployment. And it is assumed the central bank anchors the money rate of interest to the natural rate of interest (per Woodford). So if economists now show monetary policy impacts the natural rate, Taylor Rules may need some rethinking: how can we target a natural rate of interest using a money rate if the latter impacts the former?

Over the second half of the last century, macroeconomics has come to a compromise between the extreme (Keynesian) view than monetary policy is ineffective (in a liquidity trap) and monetary policy is all that matters (the extreme monetarist view). Today, it is generally understood that monetary policy has short-run effects but is neutral in the long run—Patinkin’s classical dichotomy prevails.

Discussions about monetary policy have therefore focused on its short-run impact while natural forces are expected to do their work on the supply side of the economy.

The paper by Ma and Zimmerman is part of a small but growing body of work interested in possible longer-term consequences of monetary policy which may operate through innovation and technological progress. They adopt a New Keynesian perspective with endogenous total factor productivity (TFP). Monetary policy influences firms’ incentives to develop and implement innovations.

For example, following monetary policy contractions, reductions in aggregate demand can decrease profitability and incentives for innovation. Tighter financial conditions and lower risk appetite can decrease funding for innovation. A slower pace of innovation may then have lasting effects.

This paper tests the effects of monetary policy on innovation activities, using a variety of metrics of innovation: aggregate investment in intellectual property (including R&D) from national accounts, the R&D spending of public companies, and measures based on VC investment and patent filing.

The authors observe meaningful changes in innovation activity in the years following monetary policy shocks. First, investment in intellectual property products (IPP) in the national accounts (NIPA) declines by about 1 percent. The magnitude is comparable to the decline in traditional investment in physical assets. R&D spending in Compustat data for public firms declines by about 3 percent.

Second, VC investment is more volatile, and declines by as much as 25 percent at a horizon of 1 to 3 years after the monetary policy shock. Third, patenting in important technologies measured by Bloom et al. (2023) declines by up to 9 percent 2 to 4 years after the shock. Patenting in other technologies declines by less than patenting in important technologies according to the importance classification in Bloom et al. (2023).

An aggregate innovation index constructed by Kogan et al. (2017) using estimates of the economic value of patents also declines by up to 9 percent. Based on this paper’s output and total factor productivity (TFP) sensitivity to the aggregate innovation index, a 9 percent decline in the index can contribute to 1 percent lower real output and 0.5 percent lower TFP 5 years later.

For the transmission mechanism from monetary policy to innovation activities, Ma and Zimmerman find indications that both demand and financial conditions are relevant.

First, by decreasing demand, monetary policy tightening can reduce the profitability of developing new products and the incentives to innovate (Shleifer, 1986; Fatas, 2000; Comin and Gertler, 2006; Benigno and Fornaro, 2018). In the data, they observe a stronger decline in both R&D and patenting in more cyclical industries. They also observe that patenting declines after monetary policy tightening among both public and private companies, and among both large and small public companies. To the extent that large public firms have abundant financial resources, the slowdown of innovation activities among these firms is likely driven by reduced demand.

Second, monetary policy tightening can affect financial conditions and reduce the appetite for risk-taking (Bauer, Bernanke, and Milstein, 2023; Kashyap and Stein, 2023). In the data, they observe that VC investment for both early-stage and late-stage startups declines after monetary policy tightening. To the extent that early-stage startups are still in the product development phase and may not have products coming to the market immediately, reduced funding could reflect less appetite for investing in risky endeavors.

The Ma and Zimmerman contribution is an important empirical counterpart to recent papers exploring the possible longer-term consequences of monetary policy, which may operate through the influence of monetary policy on innovation and technological progress (Stadler, 1990; Moran and Queralto, 2018; Modery et al., 2021; Grimm, Laeven, and Popov, 2022; Amador, 2022; Fornaro and Wolf, 2023; Jordà, Singh, and Taylor, 2023).

The authors document the response of innovation to monetary policy using a collection of measures.

The results suggest that monetary policy could have a persistent influence on the productive capacity of the economy, in addition to the well-recognized near-term effects on economic outcomes. Rising interest rates since 2022 and a substantial decline in venture capital investment highlight how relevant these issues are. Recent breakthroughs in AI raise the hope that another technological revolution could be on the horizon.

What does this mean for policy? The authors argue their contribution does not imply monetary policy should be more dovish. A number of economic observers have highlighted the misallocation of capital (excessive housing construction) or the emergence of asset bubbles (in debt markets, housing, and cryptocurrencies) due to the low level of interest rates.

Striking the right balance between these two sides requires evidence and the authors contribute a persuasive set of results to the debate. But as they also point out. it is possible that the effects of monetary policy on innovation cancel out over the complete cycle. So, for now, the policy conclusions are not clear.

Loading…