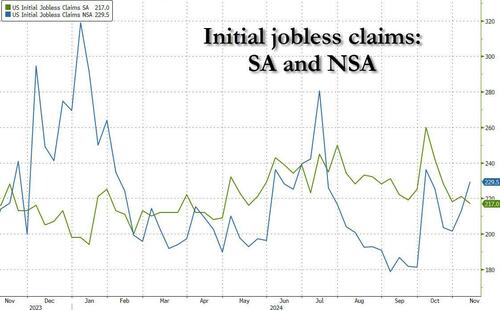

At the exact same time that the latest PPI print came in well hotter than expected, Biden's outgoing Dept of Labor came out revealed even more hawkish data, reporting that as the impacts of the hurricanes has largely worn off, initial jobless claims dropped last week to 217k (from 221k) - below the 220K consensus estimate - and the lowest since May.

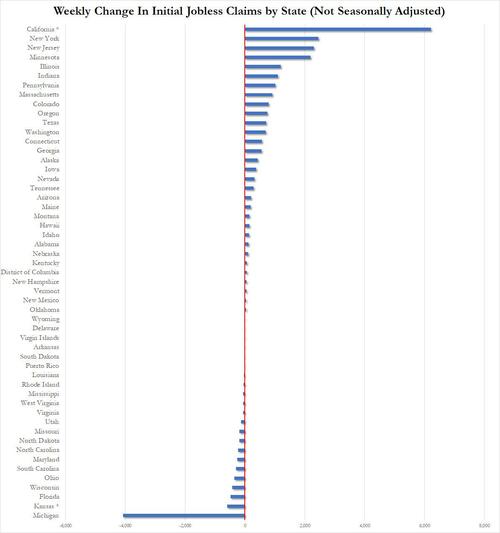

For the second week in a row, the biggest increase in claims was in California which was not only the outlier state this month, but its claims were estimated by the DOL. On the other end, the number of initial claims dropped the most in Florida and Georgia.

In fact, both North Carolina (Helene) and Florida (Milton) have seen claims revert to pre-Hurricane norms...

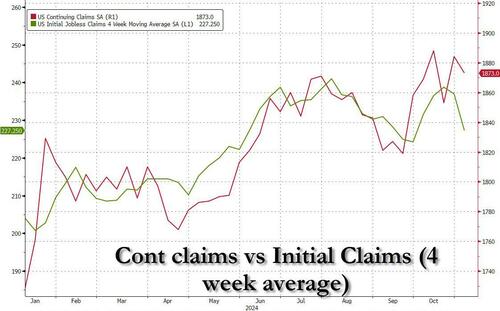

Continuing claims also fell from a downward revised 1884K (vs 1892K pre revision) to 1873K, but still holding near the highest since Dec 2022.

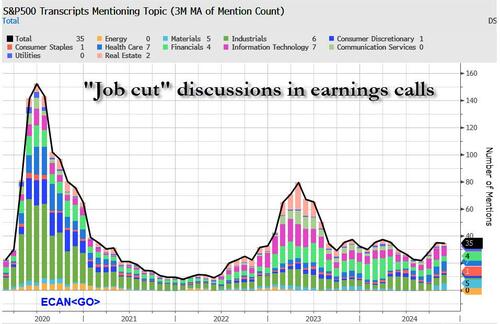

What is also notable is that as BBG's Michael McDonough notes, "job cut" discussions are not meaningfully increasing in S&P earnings calls:

So PPI hot, and jobless claims at a fresh six month low - not the kind of data that The Fed doves want to see to justify another rate-cut... although now that Trump is in the White House, we are confident the Fed will have far fewer scruples about calling it a "Fed Accompli" (sic) and ending its easing cycle after 2 rate cuts.

At the exact same time that the latest PPI print came in well hotter than expected, Biden’s outgoing Dept of Labor came out revealed even more hawkish data, reporting that as the impacts of the hurricanes has largely worn off, initial jobless claims dropped last week to 217k (from 221k) – below the 220K consensus estimate – and the lowest since May.

For the second week in a row, the biggest increase in claims was in California which was not only the outlier state this month, but its claims were estimated by the DOL. On the other end, the number of initial claims dropped the most in Florida and Georgia.

In fact, both North Carolina (Helene) and Florida (Milton) have seen claims revert to pre-Hurricane norms…

Continuing claims also fell from a downward revised 1884K (vs 1892K pre revision) to 1873K, but still holding near the highest since Dec 2022.

What is also notable is that as BBG’s Michael McDonough notes, “job cut” discussions are not meaningfully increasing in S&P earnings calls:

So PPI hot, and jobless claims at a fresh six month low – not the kind of data that The Fed doves want to see to justify another rate-cut… although now that Trump is in the White House, we are confident the Fed will have far fewer scruples about calling it a “Fed Accompli” (sic) and ending its easing cycle after 2 rate cuts.

Loading…