Authored by Helen Partz via Cointelegraph.com,

Institutional investors have been increasingly betting on the role of artificial intelligence (AI) in the future of trading, according to a new survey by the multinational investment bank JPMorgan.

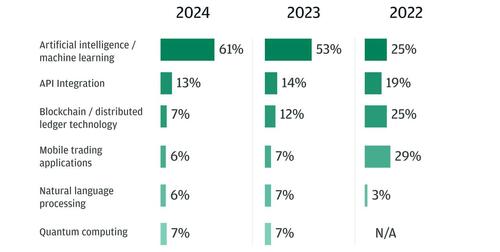

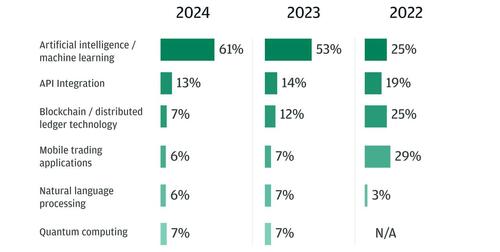

In the most recent edition of JPMorgan’s “e-Trading Edit: Insights from the Inside” survey, 61% of the 4,010 institutional traders surveyed across 65 countries anticipated AI and machine learning (ML) to emerge as the most impactful technologies for trading within the next three years.

According to the survey’s rankings, AI and ML are followed by application programming interface (API) integration, with 13% of respondents choosing it as one of the most important technologies shaping the future of trading.

Blockchain or distributed ledger technology and quantum computing both account for 7% based on the respondent’s preferences. Mobile trading applications and natural language processing secured 6% of respondents.

AI and machine learning have been steadily gaining ground in JPMorgan’s reports in recent years, with the tech accounting for just 25% in ranked importance two years ago.

On the other hand, institutions have been growing increasingly skeptical about the role of other technologies in trading, including mobile trading applications and blockchain, according to JPMorgan’s survey. Since 2022, blockchain and mobile trading applications have lost 18% and 23% of investor choices as promising technologies for trading, respectively.

AI has been reshaping the future of finance over the past few years by offering various features, including trade predictions or identifying real-time threats to market sentiment. According to a 2022 report by Nvidia, investors have been integrating AI and ML, with 30% of respondents reportedly managing to reduce their annual revenue by more than 10%.

While doubling down on the AI role in trading, JPMorgan-surveyed institutions have become less willing to get into cryptocurrency trading.

According to the survey results, 78% of institutional traders have no plans to trade cryptocurrencies like Bitcoin

or digital coins within the next five years. The percentage of investors not planning to trade crypto has increased since last year, as 72% of respondents indicated unwillingness to trade such assets in 2023.

At the same time, the percentage of respondents that have started trading crypto or trade it already has slightly increased from 8% in 2023 to 9% in 2024.

JPMorgan has been controversial in terms of its approach to crypto over the past few years. CEO Jamie Dimon continued to slam cryptocurrencies like Bitcoin even after the company was named an authorized participant in one of the fastest-growing spot Bitcoin exchange-traded funds by BlackRock.

Authored by Helen Partz via Cointelegraph.com,

Institutional investors have been increasingly betting on the role of artificial intelligence (AI) in the future of trading, according to a new survey by the multinational investment bank JPMorgan.

In the most recent edition of JPMorgan’s “e-Trading Edit: Insights from the Inside” survey, 61% of the 4,010 institutional traders surveyed across 65 countries anticipated AI and machine learning (ML) to emerge as the most impactful technologies for trading within the next three years.

According to the survey’s rankings, AI and ML are followed by application programming interface (API) integration, with 13% of respondents choosing it as one of the most important technologies shaping the future of trading.

Blockchain or distributed ledger technology and quantum computing both account for 7% based on the respondent’s preferences. Mobile trading applications and natural language processing secured 6% of respondents.

AI and machine learning have been steadily gaining ground in JPMorgan’s reports in recent years, with the tech accounting for just 25% in ranked importance two years ago.

On the other hand, institutions have been growing increasingly skeptical about the role of other technologies in trading, including mobile trading applications and blockchain, according to JPMorgan’s survey. Since 2022, blockchain and mobile trading applications have lost 18% and 23% of investor choices as promising technologies for trading, respectively.

AI has been reshaping the future of finance over the past few years by offering various features, including trade predictions or identifying real-time threats to market sentiment. According to a 2022 report by Nvidia, investors have been integrating AI and ML, with 30% of respondents reportedly managing to reduce their annual revenue by more than 10%.

While doubling down on the AI role in trading, JPMorgan-surveyed institutions have become less willing to get into cryptocurrency trading.

According to the survey results, 78% of institutional traders have no plans to trade cryptocurrencies like Bitcoin

or digital coins within the next five years. The percentage of investors not planning to trade crypto has increased since last year, as 72% of respondents indicated unwillingness to trade such assets in 2023.

At the same time, the percentage of respondents that have started trading crypto or trade it already has slightly increased from 8% in 2023 to 9% in 2024.

JPMorgan has been controversial in terms of its approach to crypto over the past few years. CEO Jamie Dimon continued to slam cryptocurrencies like Bitcoin even after the company was named an authorized participant in one of the fastest-growing spot Bitcoin exchange-traded funds by BlackRock.

Loading…