Making money in the markets over the past few months has really come down to four simple steps:

Step 1: Put on pants.

Step 2: Identify buzzy stock-du-jour.

Step 3: Buy metric fuckton of deep OTM, extremely short-dated calls.

Step 4: Sit back, sip coffee, take profits after gamma squeeze complete.

Sounds to simple to be true, right?

Here's Goldman Sachs' flows guru reflecting on the situation:

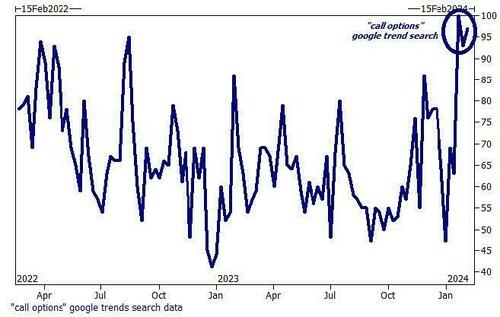

And, everyone's searching for "call options"...

At first it appeared to be SoftBank up to its old tricks...

Holy shit, that sociopath really did it again. https://t.co/OsWXOxOl5e pic.twitter.com/uHC6X8If5Y

— zerohedge (@zerohedge) February 13, 2024

But then, day after day, a different name was picked and gamma-squeeze-algo unleashed on poor unsuspecting dealers...

Of course, the 'buzz' recently has been 'AI' stocks...

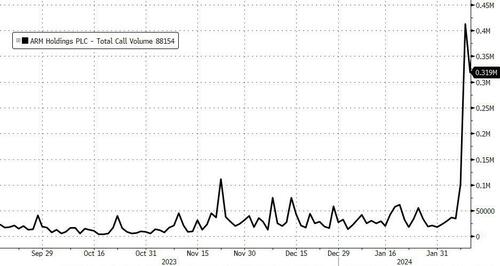

ARM Holdings call volume exploding as the stock ramped over 100% in 4 days...

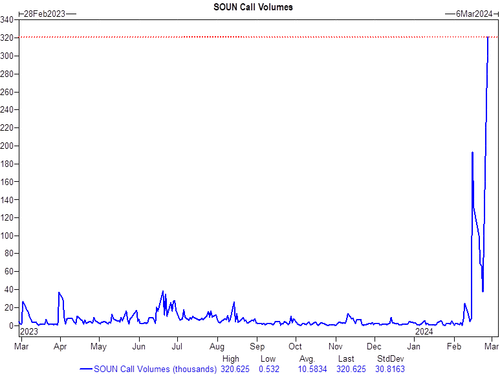

SoundHound AI stocks soared a stunning 330% in the last two weeks as call volumes literally went to the moon...

Even boring old DELL is in on the act with gamma-squeezers buying calls with both hands and feet, sending the stock up 36% in 3 days...

Careful though - it doesn't always work.

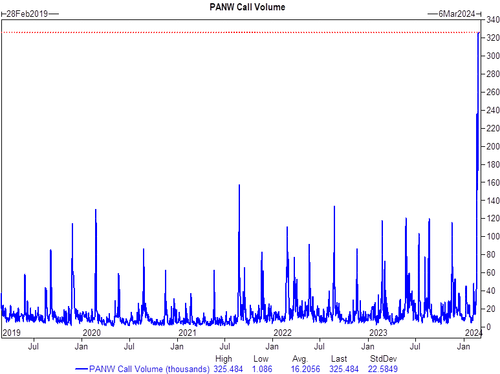

Palo Alto Networks disappointed after the call-buying-brigade has gone wild into earnings and that shitshow left the stock (critical to AI) down 28% in a day (but we do note that since that decline, the gamma-guys didn't give up, pumping the stock up 20% in the last few days on the back even more call-buying)...

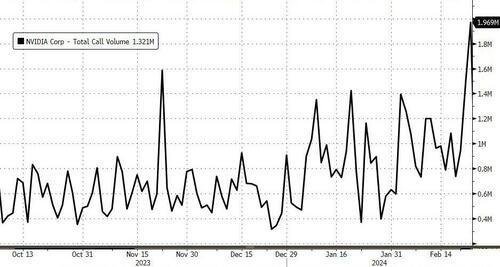

And then there's the big boy - NVDA - where we see call-volume spike into earnings every time, but this time was special as the put-denying-pumpers pushed the giant AI chip maker up 17% in 2 days after this massive call-buying-gasm...

"The call volume is very extreme," said Piper Sandler head of options, Daniel Kirsch, referencing interest in Nvidia.

"People seem to just — every day — have no problem continuing to add."

Finally, just so you get the point, here's SMCI - probably the ultimate poster-boy for gamma-squeezers in the last month as the stock rallied 222% practically without a dip as day-after-day, the deep OTM, short-dated cal-buying worked to squeeze dealers to chase the stock higher and higher...

But, with all this upside call buying - and no downside protection buying - skews have collapsed to a point that some are anxious of another systemic crisis in equity-vol land...

Last time skew was this low was on Feb 5, 2018, a few hours before Volmageddon sent the VIX from 14 to 40 pic.twitter.com/gQEn8zpXny

— zerohedge (@zerohedge) February 11, 2024

So, maybe, just maybe, the 'squeezers' got out of bed this last week, put on their pants, and noticed that the buzzy-stock-du-jour was actually bitcoin ETFs (and bitcoin itself).

Which is where we find ourselves now.

UNless you lived under a rock - or are marooned, powerless in Lake Tahoe - right now, you will have likely read/watched news about crypto's impressive gains in the last two weeks...

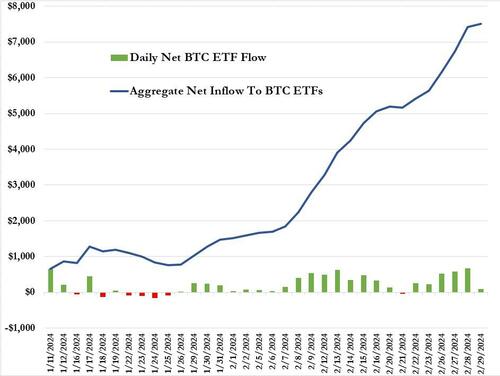

...as the newly-launched Spot Bitcoin ETFs has seen unprecedented net inflows...

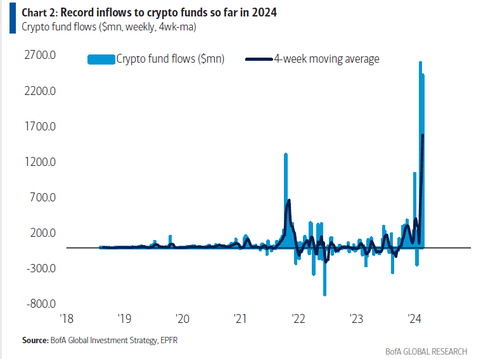

Putting this sudden 'demand' in context...

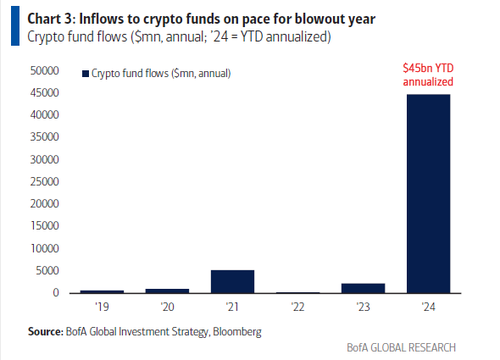

Heading for a blowout year...

And this is ahead of the Halving, which implicitly hampers supply.

“All things are pointing towards if momentum keeps us going up, then we could see another violent move upwards,” said Luke Nolan, a research associate at digital-asset manager CoinShares.

So applying the four-step logic from above - what do you think would be the most likely next target for the gamma-squeezers?

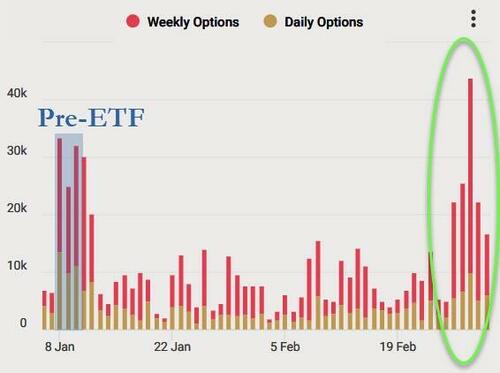

Bitcoin options volumes are exploding higher...

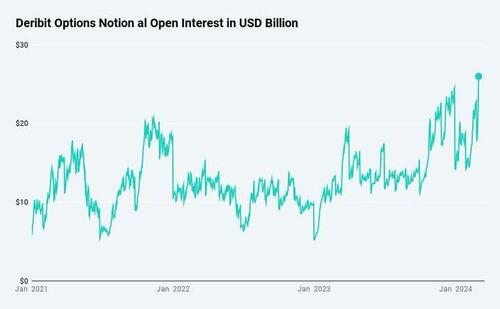

And notional options open interest has hit a new high...

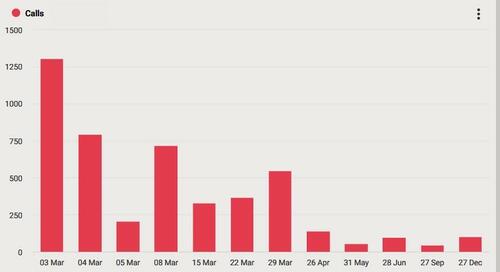

As Yahoo Finance reports, an influx of buyers for short-dated options has increased Bitcoin volatility to the highest since last year’s collapse of crypto-friendly Silvergate and Signature banks. The notional value of the March 29 call and put options contracts has climbed to around $7 billion, far above the amount of any other contracts on a specific expiration date, according to data from Amberdata (and call volumes are dominating puts in the shortest-dated maturities)...

“We can see still a huge amount of OTM (out of money) calls,” Nolan said.

“If Bitcoin pushes to levels near that, then in my opinion we could certainly get a squeeze.”

To put it simply, if a large amount of call options are bought, the sellers of the options, usually dealers or market makers, need to hedge their exposure. The usual way to hedge is to buy the underlying instrument so that they are not exposed to directional risk, Nolan said. If Bitcoin starts going up, the dealers will have to hedge further, thus buying more of the underlying token.

“This self-perpetuating loop can lead to a rapid price increase as dealers push the price up, causing them to have to buy more,” Nolan said.

But, Nolan warns, even a small change in ETF flows could cause people to quickly deleverage.

"It works both ways,” he said.

But, there are three good reasons to believe the ammunition for a gamma-squeeze is still there - Technicals (short positioning), Supply (Halving) and Demand (ETF flows and institutional adoption).

For one, funding rates are through the roof (implying a large demand for shorting bitcoin)... which implicitly provides support for the gamma-squeezers to the upside if it morphs into a short-squeeze...

We've had to (possibly temporarily) add a new color to the funding rate heatmap for >100% APR: pic.twitter.com/8GIn1C5SHY

— Velo (@VeloData) February 29, 2024

In fact we've already seen very heavy short-liquidation driving this move...

Another factor supporting bitcoin from here is the upcoming Halving, and as the stock-to-flow model shows, we have reverted back to fair-value just as the supply-shrink is about to occur....

As @PlanB explains below, we are entering a 'bull market' with "face-melting FOMO and extreme price pumps"... hyperbole?

And then there is demand as institutional interest accelerates and retail adoption improves.

“I think there’s an even bigger wave coming in a few months as we start to see the major wirehouses turn on,” Bitwise’s CIO Matt Hougan explained in a Feb. 29 interview with CNBC, adding that the first wave of Bitcoin ETF interest has primarily come from retail, hedge funds and independent financial advisors.

“So we’re going to see the next wave of institutional capital coming,” said Hougan, who referred to the ETFs as Bitcoin’s “IPO moment.”

"With #Bitcoin right now ... there is too much demand and not enough supply." - Matt Hougan, CIO Bitwise pic.twitter.com/1B0joUQ1Pp

— Michael Saylor⚡️ (@saylor) February 29, 2024

The supply-demand dynamic is just “off the hook,” Hougan said of the amount of Bitcoin ETFs purchased relative to Bitcoin mined day-to-day and the upcoming halving event.

“There’s too much demand and not enough supply.”

When asked how high, Hougan said Bitcoin could blow Bitwise’s initial 2024 prediction of $80,000 out of the park and reach anywhere between $100,000 to $200,000 or even higher.

While many have welcomed Bitcoin ETFs, some major U.S. players like Merrill Lynch are still blocking clients from being able to access the investment products. Vanguard, the world’s second-largest largest asset manager, also blocks access to Bitcoin ETFs through its platform due to the firm’s “philosophy” around investing.

“I'm sure pressure is mounting for them,” tweeted Bloomberg ETF analyst Eric Balchunas on Thursday, noting that recent ETF flows are likely “natural demand” for BTC rather than algorithmic buying.

“They like to see [a] track record and get paid off, but with grassroots demand like this they [are] gonna have to expedite,” he continued.

And Bitcoin is hitting record highs around the world.

Bitcoin has passed all-time highs in 30+ countries, including China and India. pic.twitter.com/63CnC9DE0F

— Balaji (@balajis) February 28, 2024

Japan has been a particularly weak case, with a 24% decline in the yen meaning bitcoin hit a record price in that country well before this week's fireworks that saw bitcoin prices soar.

"Japan’s government has been devaluing the yen, and the flow of liquidity has trickled into bitcoin as their fiat has weakened," March Zheng, Managing partner of Bizantine Capital explained in an interview with CoinDesk.

With The Fed hinting at the next QE on Friday (Reverse Twist), will we see 'record highs' in the USD price for bitcoin soon too?

Making money in the markets over the past few months has really come down to four simple steps:

Step 1: Put on pants.

Step 2: Identify buzzy stock-du-jour.

Step 3: Buy metric fuckton of deep OTM, extremely short-dated calls.

Step 4: Sit back, sip coffee, take profits after gamma squeeze complete.

Sounds to simple to be true, right?

Here’s Goldman Sachs’ flows guru reflecting on the situation:

And, everyone’s searching for “call options”…

At first it appeared to be SoftBank up to its old tricks…

Holy shit, that sociopath really did it again. https://t.co/OsWXOxOl5e pic.twitter.com/uHC6X8If5Y

— zerohedge (@zerohedge) February 13, 2024

But then, day after day, a different name was picked and gamma-squeeze-algo unleashed on poor unsuspecting dealers…

Of course, the ‘buzz’ recently has been ‘AI’ stocks…

ARM Holdings call volume exploding as the stock ramped over 100% in 4 days…

SoundHound AI stocks soared a stunning 330% in the last two weeks as call volumes literally went to the moon…

Even boring old DELL is in on the act with gamma-squeezers buying calls with both hands and feet, sending the stock up 36% in 3 days…

Careful though – it doesn’t always work.

Palo Alto Networks disappointed after the call-buying-brigade has gone wild into earnings and that shitshow left the stock (critical to AI) down 28% in a day (but we do note that since that decline, the gamma-guys didn’t give up, pumping the stock up 20% in the last few days on the back even more call-buying)…

And then there’s the big boy – NVDA – where we see call-volume spike into earnings every time, but this time was special as the put-denying-pumpers pushed the giant AI chip maker up 17% in 2 days after this massive call-buying-gasm…

“The call volume is very extreme,” said Piper Sandler head of options, Daniel Kirsch, referencing interest in Nvidia.

“People seem to just — every day — have no problem continuing to add.”

Finally, just so you get the point, here’s SMCI – probably the ultimate poster-boy for gamma-squeezers in the last month as the stock rallied 222% practically without a dip as day-after-day, the deep OTM, short-dated cal-buying worked to squeeze dealers to chase the stock higher and higher…

But, with all this upside call buying – and no downside protection buying – skews have collapsed to a point that some are anxious of another systemic crisis in equity-vol land…

Last time skew was this low was on Feb 5, 2018, a few hours before Volmageddon sent the VIX from 14 to 40 pic.twitter.com/gQEn8zpXny

— zerohedge (@zerohedge) February 11, 2024

So, maybe, just maybe, the ‘squeezers’ got out of bed this last week, put on their pants, and noticed that the buzzy-stock-du-jour was actually bitcoin ETFs (and bitcoin itself).

Which is where we find ourselves now.

UNless you lived under a rock – or are marooned, powerless in Lake Tahoe – right now, you will have likely read/watched news about crypto’s impressive gains in the last two weeks…

…as the newly-launched Spot Bitcoin ETFs has seen unprecedented net inflows…

Putting this sudden ‘demand’ in context…

Heading for a blowout year…

And this is ahead of the Halving, which implicitly hampers supply.

“All things are pointing towards if momentum keeps us going up, then we could see another violent move upwards,” said Luke Nolan, a research associate at digital-asset manager CoinShares.

So applying the four-step logic from above – what do you think would be the most likely next target for the gamma-squeezers?

Bitcoin options volumes are exploding higher…

And notional options open interest has hit a new high…

As Yahoo Finance reports, an influx of buyers for short-dated options has increased Bitcoin volatility to the highest since last year’s collapse of crypto-friendly Silvergate and Signature banks. The notional value of the March 29 call and put options contracts has climbed to around $7 billion, far above the amount of any other contracts on a specific expiration date, according to data from Amberdata (and call volumes are dominating puts in the shortest-dated maturities)…

“We can see still a huge amount of OTM (out of money) calls,” Nolan said.

“If Bitcoin pushes to levels near that, then in my opinion we could certainly get a squeeze.”

To put it simply, if a large amount of call options are bought, the sellers of the options, usually dealers or market makers, need to hedge their exposure. The usual way to hedge is to buy the underlying instrument so that they are not exposed to directional risk, Nolan said. If Bitcoin starts going up, the dealers will have to hedge further, thus buying more of the underlying token.

“This self-perpetuating loop can lead to a rapid price increase as dealers push the price up, causing them to have to buy more,” Nolan said.

But, Nolan warns, even a small change in ETF flows could cause people to quickly deleverage.

“It works both ways,” he said.

But, there are three good reasons to believe the ammunition for a gamma-squeeze is still there – Technicals (short positioning), Supply (Halving) and Demand (ETF flows and institutional adoption).

For one, funding rates are through the roof (implying a large demand for shorting bitcoin)… which implicitly provides support for the gamma-squeezers to the upside if it morphs into a short-squeeze…

We’ve had to (possibly temporarily) add a new color to the funding rate heatmap for >100% APR: pic.twitter.com/8GIn1C5SHY

— Velo (@VeloData) February 29, 2024

In fact we’ve already seen very heavy short-liquidation driving this move…

Another factor supporting bitcoin from here is the upcoming Halving, and as the stock-to-flow model shows, we have reverted back to fair-value just as the supply-shrink is about to occur….

As @PlanB explains below, we are entering a ‘bull market’ with “face-melting FOMO and extreme price pumps”... hyperbole?

[embedded content]

And then there is demand as institutional interest accelerates and retail adoption improves.

“I think there’s an even bigger wave coming in a few months as we start to see the major wirehouses turn on,” Bitwise’s CIO Matt Hougan explained in a Feb. 29 interview with CNBC, adding that the first wave of Bitcoin ETF interest has primarily come from retail, hedge funds and independent financial advisors.

“So we’re going to see the next wave of institutional capital coming,” said Hougan, who referred to the ETFs as Bitcoin’s “IPO moment.”

“With #Bitcoin right now … there is too much demand and not enough supply.” – Matt Hougan, CIO Bitwise pic.twitter.com/1B0joUQ1Pp

— Michael Saylor⚡️ (@saylor) February 29, 2024

The supply-demand dynamic is just “off the hook,” Hougan said of the amount of Bitcoin ETFs purchased relative to Bitcoin mined day-to-day and the upcoming halving event.

“There’s too much demand and not enough supply.”

When asked how high, Hougan said Bitcoin could blow Bitwise’s initial 2024 prediction of $80,000 out of the park and reach anywhere between $100,000 to $200,000 or even higher.

While many have welcomed Bitcoin ETFs, some major U.S. players like Merrill Lynch are still blocking clients from being able to access the investment products. Vanguard, the world’s second-largest largest asset manager, also blocks access to Bitcoin ETFs through its platform due to the firm’s “philosophy” around investing.

“I’m sure pressure is mounting for them,” tweeted Bloomberg ETF analyst Eric Balchunas on Thursday, noting that recent ETF flows are likely “natural demand” for BTC rather than algorithmic buying.

“They like to see [a] track record and get paid off, but with grassroots demand like this they [are] gonna have to expedite,” he continued.

And Bitcoin is hitting record highs around the world.

Bitcoin has passed all-time highs in 30+ countries, including China and India. pic.twitter.com/63CnC9DE0F

— Balaji (@balajis) February 28, 2024

Japan has been a particularly weak case, with a 24% decline in the yen meaning bitcoin hit a record price in that country well before this week’s fireworks that saw bitcoin prices soar.

“Japan’s government has been devaluing the yen, and the flow of liquidity has trickled into bitcoin as their fiat has weakened,” March Zheng, Managing partner of Bizantine Capital explained in an interview with CoinDesk.

With The Fed hinting at the next QE on Friday (Reverse Twist), will we see ‘record highs’ in the USD price for bitcoin soon too?

Loading…