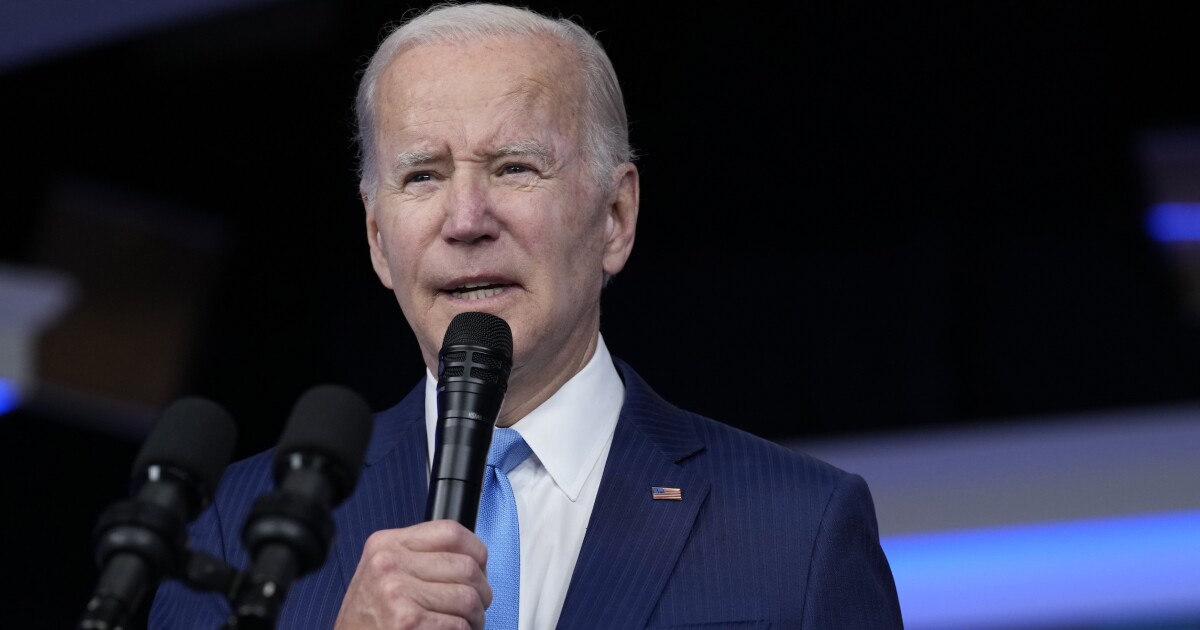

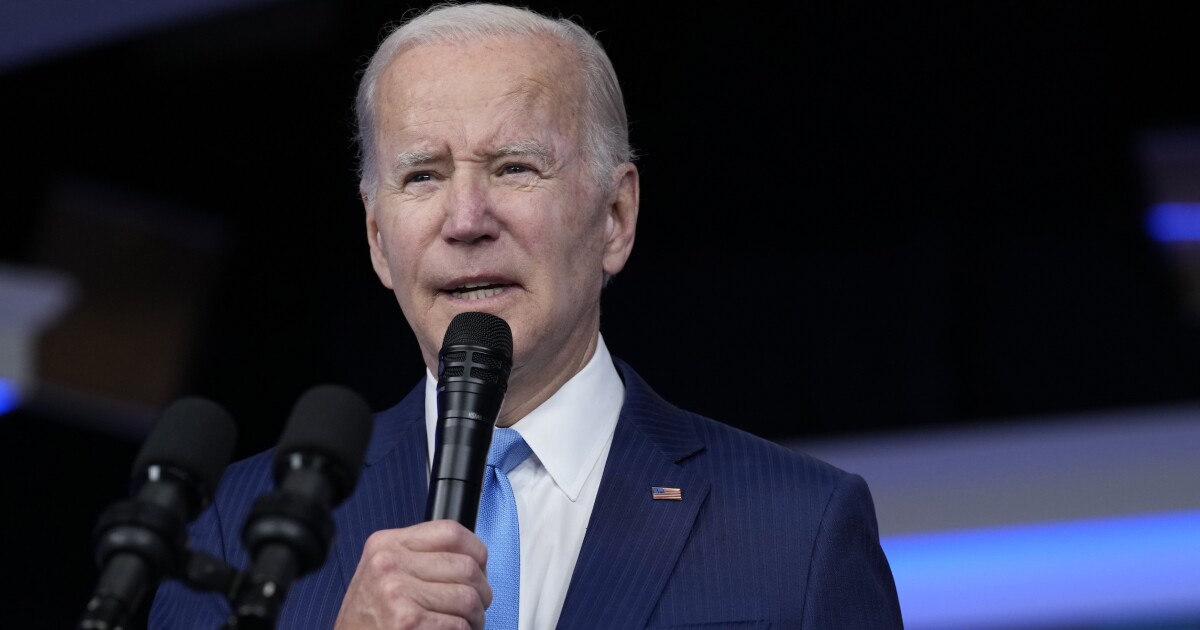

President Joe Biden may get an early test of bipartisan deal-making skills as Congress debates bringing back an expanded child tax credit during the lame-duck session.

Biden will face a GOP-led House of Representatives for the next two years starting in January, meaning he’ll need to get at least a few Republican votes in order to pass legislation for the remainder of his term. But the White House is reportedly getting an early start by backing a compromise in mid-December.

‘TWITTER FILES’ LEAD TO PUSHBACK ON BIDEN’S COVID-19 SOCIAL MEDIA EFFORTS

According to reports

, the White House has told Democrats it will support a deal to bring back the expanded child tax credit, which expired a year ago, with a work requirement and potentially corporate tax breaks that could secure GOP votes.

While the deal is considered a long shot, it could be a signal of things to come as Biden looks to work across the aisle going forward.

The child tax credit, like many other government programs, expanded greatly during the pandemic, with some families receiving up to $3,600 per year even if they had no income. The expansion died at the hands of Sen. Joe Manchin (D-WV), who scuttled it over concerns about inflation.

Manchin still backs a work requirement and means-testing for the program, which presumably some of his Republican colleagues will want as well. But the White House would prefer for eligibility to be decoupled from earnings.

Democratic strategist Brad Bannon backs the reported deal and says it could be a valuable talking point in his party’s favor.

“It’s unconscionable that the Republicans are holding hungry kids hostage to get corporate tax breaks at a time when corporations are making record profits,” he said. “If that’s the contrast the Republicans want to draw between the needs of hungry children and big corporate profits, I’ll take that fight any day.”

Bannon said he’d accept the work requirement if it meant securing the tax credit expansion but that there should be requirements placed on corporations looking to get tax breaks, too.

Still, with inflation nearing 40-year highs, concerns about cost should not be ignored, argued the Committee for a Responsible Federal Budget’s Maya MacGuineas.

“This policy is expensive, and it comes at a time where any policies that aren’t paid for are both going to push up the debt and push inflation in the wrong direction,” said MacGuineas, the group’s president. “Somewhat more concerning is the fact that some of the talk involves trading some type of expansion for other tax cuts.”

She called such a scenario a “double whammy of debt” unless it’s paid for by raising taxes elsewhere or reducing spending.

“One can make a case for the policy, but it should abide by the general principle that if something is worth doing, it’s worth paying for,” said MacGuineas.

Republicans have slammed Biden over what they describe as runaway spending, led by the Democrat-only American Rescue Plan, which cost nearly $2 trillion. But other bills that attracted more GOP votes, such as the $1.2 trillion Infrastructure Investment and Jobs Act, also included significant new spending.

GOPers emphasized a need to rein in Biden’s big-spending ways on the campaign trail and will get a chance to follow through with that promise beginning in January.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

White House press secretary Karine Jean-Pierre was asked about the expanded child tax credit Monday, saying Biden supports the idea.

“Our position is simple,” Jean-Pierre said. “If Congress is going to extend tax cuts and tax breaks for businesses in the lame duck, they must include tax relief for working families. That’s the way we see this process moving forward. Some sort of tax credit for children is the most direct way to do that.”