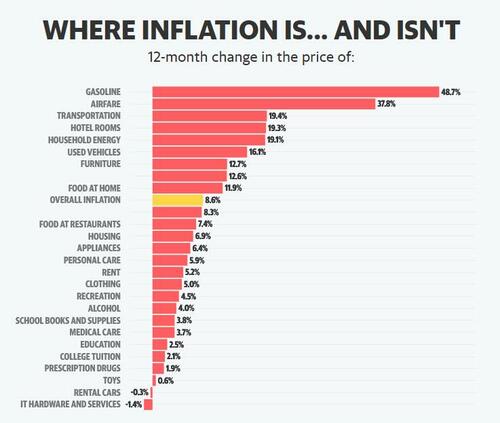

Ahead of tomorrow's nose-bleeding CPI print, which consensus expects to rise 8.8% but many banks forecast will reach 9.0% (or maybe even rise double digits), the White House engaged in preemptive damage control with Biden economic adviser Brian Deese (formerly head of Global Head of Sustainable Investing at BlackRock), saying that he expected energy and food prices to account for more than 40% of the annual increase (which is problematic since people still need to eat and use cars), but added that energy prices had declined since the data for the June CPI index was collected and U.S. gasoline prices could be expected to decline in the weeks ahead.

In other words, it's Putin work when inflation is rising, but a Biden's miracles when it is dropping. Which of course is silly, but dead serious for Biden whose approval rating tracks the inverse of gas prices almost one for one.

“I think it’s a little early to declare that we’re definitively at a peak in terms of energy prices, and gas in particular,” Deese - who we can only assume is not nuts - told reporters, adding that he has not seen the CPI data scheduled to be released on Wednesday at 830am (narrator: he has).

Deese echoed what White House Press Secretary Karine Jean-Pierre said on Monday when she aggressively downplayed expectations for Wednesday’s CPI release, saying it was stale: “June CPI data is already out of date."

Which is fine, we just hope that the Biden admin is as vocal next month when the CPI print is lower yet when commodity prices surge in the second half of July and into August, pushing gasoline prices sharply higher again.

As for the start of the Biden recession, which won't officially begin until the highly political NBER admits it has begun but which most people realize is not only here but may even mutate into a full-blown depression, Deese also said that the United States appears to be shifting to a period of slower job and economic growth, and recent economic data was not consistent with recession in the first or second quarters of this year.

Actually, yes it was.

But it would be worse for Biden if there was no recession because the only reason oil, and gasoline, prices are falling is because expectations a recession if now in the bag. If it isn't, look for new all time highs in gas prices in the coming weeks and months.

Finally, when looking at what the BLS may report tomorrow, and we don't mean that fake report that circulated and spooked some algos to dump stocks in the last hour of trading...

So this "market" now moves off a fake CPI print which algos only noticed 3 hours after it first hit https://t.co/z6lQUe3Gzu

— zerohedge (@zerohedge) July 12, 2022

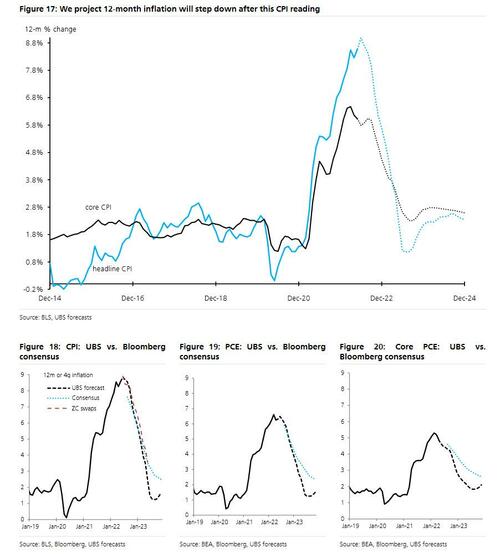

... we remind readers that even the most aggressive forecasts for tomorrow - those that see CPI hitting 9.0% in June - expect inflation to peak and decline after, and not just UBS...

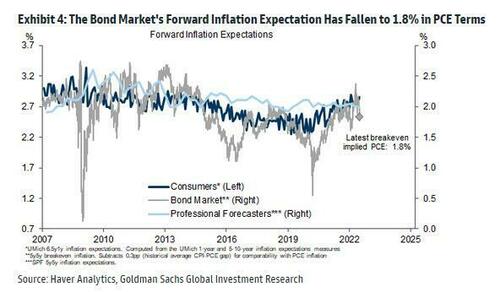

... but also the broader market, which now projects meaningful rate cuts in 2023 and the 5-year 5-year forward breakeven CPI inflation rate has fallen to 2.1%, consistent with PCE inflation of just 1.8%.

We will have a more detailed CPI preview shortly (professional subs can access all of our preview reports in the usual place).

Ahead of tomorrow’s nose-bleeding CPI print, which consensus expects to rise 8.8% but many banks forecast will reach 9.0% (or maybe even rise double digits), the White House engaged in preemptive damage control with Biden economic adviser Brian Deese (formerly head of Global Head of Sustainable Investing at BlackRock), saying that he expected energy and food prices to account for more than 40% of the annual increase (which is problematic since people still need to eat and use cars), but added that energy prices had declined since the data for the June CPI index was collected and U.S. gasoline prices could be expected to decline in the weeks ahead.

In other words, it’s Putin work when inflation is rising, but a Biden’s miracles when it is dropping. Which of course is silly, but dead serious for Biden whose approval rating tracks the inverse of gas prices almost one for one.

“I think it’s a little early to declare that we’re definitively at a peak in terms of energy prices, and gas in particular,” Deese – who we can only assume is not nuts – told reporters, adding that he has not seen the CPI data scheduled to be released on Wednesday at 830am (narrator: he has).

Deese echoed what White House Press Secretary Karine Jean-Pierre said on Monday when she aggressively downplayed expectations for Wednesday’s CPI release, saying it was stale: “June CPI data is already out of date.”

Which is fine, we just hope that the Biden admin is as vocal next month when the CPI print is lower yet when commodity prices surge in the second half of July and into August, pushing gasoline prices sharply higher again.

As for the start of the Biden recession, which won’t officially begin until the highly political NBER admits it has begun but which most people realize is not only here but may even mutate into a full-blown depression, Deese also said that the United States appears to be shifting to a period of slower job and economic growth, and recent economic data was not consistent with recession in the first or second quarters of this year.

Actually, yes it was.

But it would be worse for Biden if there was no recession because the only reason oil, and gasoline, prices are falling is because expectations a recession if now in the bag. If it isn’t, look for new all time highs in gas prices in the coming weeks and months.

Finally, when looking at what the BLS may report tomorrow, and we don’t mean that fake report that circulated and spooked some algos to dump stocks in the last hour of trading…

So this “market” now moves off a fake CPI print which algos only noticed 3 hours after it first hit https://t.co/z6lQUe3Gzu

— zerohedge (@zerohedge) July 12, 2022

… we remind readers that even the most aggressive forecasts for tomorrow – those that see CPI hitting 9.0% in June – expect inflation to peak and decline after, and not just UBS…

… but also the broader market, which now projects meaningful rate cuts in 2023 and the 5-year 5-year forward breakeven CPI inflation rate has fallen to 2.1%, consistent with PCE inflation of just 1.8%.

We will have a more detailed CPI preview shortly (professional subs can access all of our preview reports in the usual place).