By Russell Clark of the Capital Flows and Asset Markets Substack

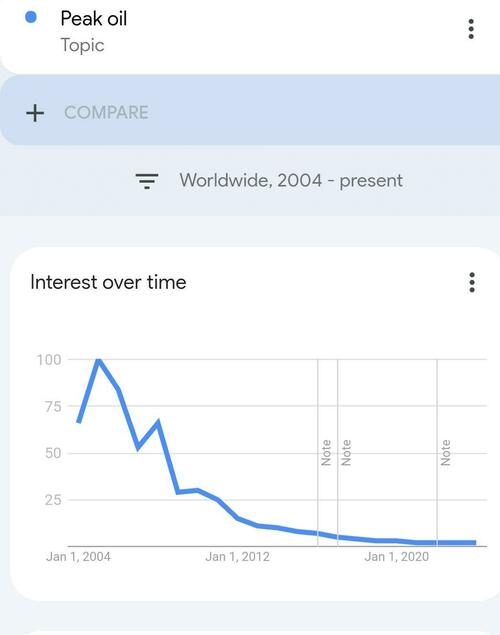

As hard as it may seem now, peak oil was a big thing around 2007 or so, as the oil price surged.

The idea was that all the easy oil had been extracted, and that oil production was headed for a period of decline and high oil prices would be with us forever.

Of course, economics and finance suggests that high prices will attract capital and innovation, and eventually drive supply. This is exactly what happened as the US shale revolution turned the US into an energy exporter and flooded the market.

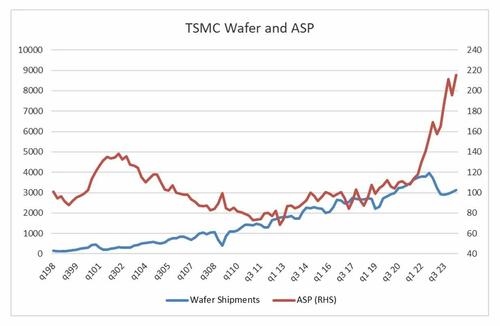

The best shorts are cyclical businesses that people believe in are secular stories. Cyclical businesses just need prices to rise high enough to attract competition. To my mind semiconductors and oil seem to have a lot in common. Essential for economic growth, but just need the occasional period of high prices to incentivise supply and capital investment. For me TSMC with its transparent pricing seemed to be a good place to look for signals. And in recent years, pricing has surged. I thought the surge would then see a period of decline like we saw from 2002 to 2011. Now I am not so sure.

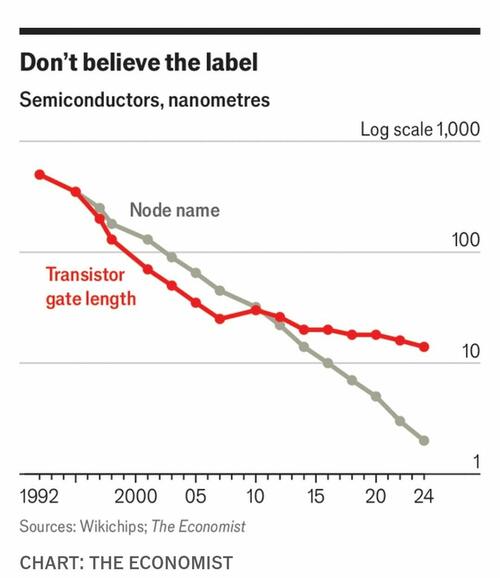

Part of me put the recent surge in semi pricing down to the US effectively kneecapping Chinese semiconductor industry. Surely for an industry as innovative and competitive as semiconductors, surging pricing should soon turn to bust, as it did in 2001. However, reading a recent Economist briefing on semiconductors, I realised I was fooled. As a regular reader of TSMC quarterly reports, and the continual movement to lower and lower telemetry, I thought innovation in the semi industry was moving as it had always done. However as the Economist shows, the node names now longer match up with the actual improvements we are seeing. Unlike oil, there has been no breakthrough technology - we have been operating at peak semi since 2010.

And in contrast to the oil industry, the semiconductor sector has been the place to be.

There has been talk of some technological breakthroughs to drive more improvement- switching from silicone to nano carbon or quantum computing, but nothing so far. If peak semi is real, and it looks that way to me, and AI is real, and my interactions with Chat GPT are leaning that way, then absent a recession, semiconductors will continue to do well. What is similar to peak oil is that semiconductor industry requires a new technology to add capacity. While there is plenty of investment, so far no transformative breakthrough has occurred. Perhaps the most interesting thing about “peak semi” is that AI is driving increasing power usage. The performance of US utilities, and particularly nuclear focused utilities shows that a connection between computing and power prices is beginning to be established.

Can surging investment into AI eventually cause power prices to rise to a degree to force much tighter interest rates policy from central bankers? Maybe, but I don’t know. But what I have learnt is that if the best shorts are cyclical stocks that people believe are secular growth stocks, then the corollary is looking true - cyclical stocks that turn into secular growth stocks are the best longs. Nvidia and semiconductors are fitting that bill - and maybe now utilities too?

By Russell Clark of the Capital Flows and Asset Markets Substack

As hard as it may seem now, peak oil was a big thing around 2007 or so, as the oil price surged.

The idea was that all the easy oil had been extracted, and that oil production was headed for a period of decline and high oil prices would be with us forever.

Of course, economics and finance suggests that high prices will attract capital and innovation, and eventually drive supply. This is exactly what happened as the US shale revolution turned the US into an energy exporter and flooded the market.

The best shorts are cyclical businesses that people believe in are secular stories. Cyclical businesses just need prices to rise high enough to attract competition. To my mind semiconductors and oil seem to have a lot in common. Essential for economic growth, but just need the occasional period of high prices to incentivise supply and capital investment. For me TSMC with its transparent pricing seemed to be a good place to look for signals. And in recent years, pricing has surged. I thought the surge would then see a period of decline like we saw from 2002 to 2011. Now I am not so sure.

Part of me put the recent surge in semi pricing down to the US effectively kneecapping Chinese semiconductor industry. Surely for an industry as innovative and competitive as semiconductors, surging pricing should soon turn to bust, as it did in 2001. However, reading a recent Economist briefing on semiconductors, I realised I was fooled. As a regular reader of TSMC quarterly reports, and the continual movement to lower and lower telemetry, I thought innovation in the semi industry was moving as it had always done. However as the Economist shows, the node names now longer match up with the actual improvements we are seeing. Unlike oil, there has been no breakthrough technology – we have been operating at peak semi since 2010.

And in contrast to the oil industry, the semiconductor sector has been the place to be.

There has been talk of some technological breakthroughs to drive more improvement- switching from silicone to nano carbon or quantum computing, but nothing so far. If peak semi is real, and it looks that way to me, and AI is real, and my interactions with Chat GPT are leaning that way, then absent a recession, semiconductors will continue to do well. What is similar to peak oil is that semiconductor industry requires a new technology to add capacity. While there is plenty of investment, so far no transformative breakthrough has occurred. Perhaps the most interesting thing about “peak semi” is that AI is driving increasing power usage. The performance of US utilities, and particularly nuclear focused utilities shows that a connection between computing and power prices is beginning to be established.

Can surging investment into AI eventually cause power prices to rise to a degree to force much tighter interest rates policy from central bankers? Maybe, but I don’t know. But what I have learnt is that if the best shorts are cyclical stocks that people believe are secular growth stocks, then the corollary is looking true – cyclical stocks that turn into secular growth stocks are the best longs. Nvidia and semiconductors are fitting that bill – and maybe now utilities too?

Loading…