Authored by Simon White, Bloomberg macro strategist,

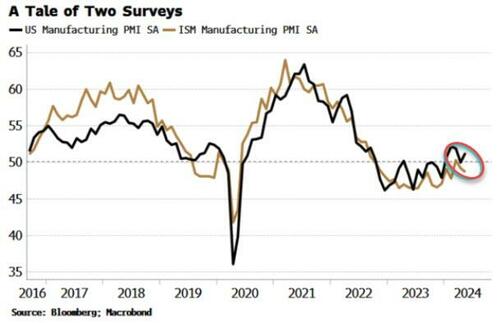

The manufacturing ISM slipped lower again in May, and came in below expectations. Yields have decided to ignore the more upbeat message from the earlier PMI reading - which beat the consensus and remains above 50 – and are lower across the curve.

The ISM has only once been above 50 since November 2022 (in March this year).

The PMI has been more upbeat of late, spending all of this year at 50 or above.

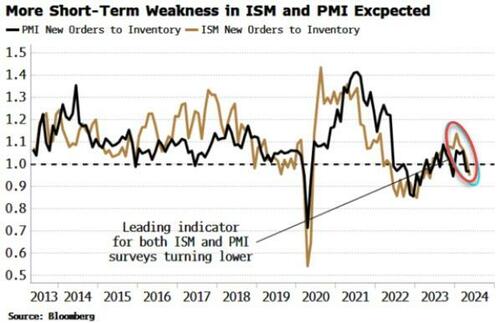

But that may be quite short-lived. The new orders-to-inventory ratio for the PMI, which leads the headline index by about three months, has been weakening (although it steadied in May).

The same ratio is also weakening for the ISM, and for that survey this has so far proven correct. The ratio is also under one for both surveys.

This may be a blip, and indeed global liquidity conditions suggest the ISM should start turning up again later in the year. But as both surveys show surface and underlying weakness, it makes sense to ready for an economy that could start to look more recessionary in the coming months, even if an actual downturn (assuming there is one) is avoided until late in the year.

Authored by Simon White, Bloomberg macro strategist,

The manufacturing ISM slipped lower again in May, and came in below expectations. Yields have decided to ignore the more upbeat message from the earlier PMI reading – which beat the consensus and remains above 50 – and are lower across the curve.

The ISM has only once been above 50 since November 2022 (in March this year).

The PMI has been more upbeat of late, spending all of this year at 50 or above.

But that may be quite short-lived. The new orders-to-inventory ratio for the PMI, which leads the headline index by about three months, has been weakening (although it steadied in May).

The same ratio is also weakening for the ISM, and for that survey this has so far proven correct. The ratio is also under one for both surveys.

This may be a blip, and indeed global liquidity conditions suggest the ISM should start turning up again later in the year. But as both surveys show surface and underlying weakness, it makes sense to ready for an economy that could start to look more recessionary in the coming months, even if an actual downturn (assuming there is one) is avoided until late in the year.

Loading…