Authored by Lance Roberts via RealInvestmentAdvioce.com,

The market’s 8.5% decline during August sent shockwaves through the media and investors. The drop raised concerns about whether this was the start of a larger correction or a temporary pullback. However, a powerful reversal, driven by investor buying and corporate share repurchases, halted the decline, leading many to wonder if the worst is behind us.

However, the picture becomes more nuanced as we examine the technical levels and broader market conditions. While the recent bounce suggests the market decline may be over, risks remain—particularly with the November election looming. Let’s dive into the details.

The August Decline: What Caused It?

August has historically been volatile for markets; this year was no exception. A combination of factors drove the S&P 500’s 8.5% drop:

-

Elevated Interest Rates: The Federal Reserve’s continued commitment to fighting inflation led to increased concerns about economic growth slowing. That spooked investors betting on a soft landing for the economy when recent economic data deteriorated.

-

Weak Economic Data: A string of weaker-than-expected economic reports fueled the fire, including slowing job growth and declining consumer confidence. Concerns about a potential recession started the sell-off in equities.

-

The Yen Carry Trade: A significant rise in the Japanese Yen led to a rapid unwinding of leverage used by institutions to increase portfolio returns. For more information on the carry trade, read the linked article.

-

Technically Overbought: As we discussed repeatedly in June and July, the markets were technically overbought and extended from long-term means. Only an appropriate catalyst was needed for a 5-10% market decline.

The correction, however, was unsurprising and something we repeatedly discussed in June and July.

“Reversals of overbought conditions tend to be shallow in a momentum-driven bullish market. These corrections often find support at the 20 and 50-day moving averages (DMA), but the 100 and 200-DMAs are not outside regular corrective periods.

If you remember, in March, we discussed the potential for a 5 to 10% correction due to many of the same concerns noted above. That correction of 5.5% came in April. We are again at a juncture where a 5-10% is likely. The only issue is it could come anytime between now and October.“ – June 22nd

With that 5-10% correction complete, many investors wonder what caused the rapid reversal last week, given that many factors leading up to the market decline remain.

The Reversal: Investor Buying and Share Repurchases

Despite the sharp decline, the market found support as a wave of investor buying and corporate share repurchases helped stem the losses. Here’s how these factors played out:

-

Investor Buying at Key Support Levels: The S&P 500 found support at the 5153 level, which coincides with the lows of the trading range back in April. Buyers stepped in as the market declined 3% during the “Yen Carry” blowup. From there, buying volume began to accelerate.

-

The chart shows that the S&P 500’s bounce off that support was pivotal. With the markets oversold, the reversal of the decline began. As the market low held, it provided the confidence needed for investors to step back into the market.

-

Corporate Share Repurchases: August also saw a significant increase in corporate share buybacks. With stock prices down, many companies took the opportunity to repurchase shares at a lower cost as the “blackout window” reopened, providing additional support to the market. This corporate activity helped absorb some of the selling pressure and stabilized the market.

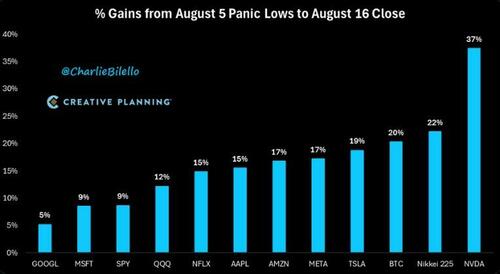

As we noted last week, we expected the “Mega-cap” stocks to lead the way higher, and we were not disappointed.

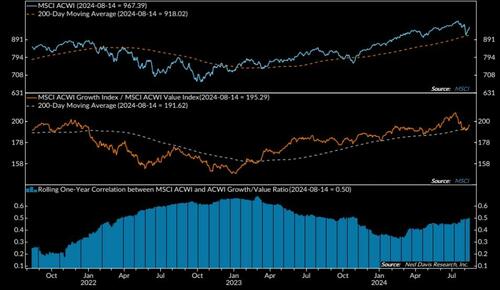

Notably, the market leadership, primarily growth stocks, has regained its footing, suggesting that the recent correction is complete and the bull market has resumed.

However, the recent rally has been very sharp and likely needs a breather before further gains can be made.

Technical Levels to Watch

With the market rebounding, it’s crucial to identify the key technical levels that will determine the following potential entry points to increase equity exposures.

-

Resistance at 5673: The first significant resistance level for the S&P 500 is at 5673, which coincides with the recent all-time highs. If the index can break above this level, it would signal a continuation of the recovery and potentially set the stage for a continuation of the rally. However, if the S&P 500 fails to break through this resistance, it could lead to another market decline to retest current support at the 50-DMA.

-

Support at 5330: On the downside, the 5,330 level remains a critical support zone. That number will continue to adjust higher as that is the 100-DMA. However, if that level fails to hold, there is only minor support at the recent lows before a test of the 200-DMA near 5100. Investors should watch the 100-DMA level closely, as a failure to hold here could signal that the market’s recent bounce was just a temporary relief rally.

While a pullback to support levels to increase equity exposure is likely, are there more substantial risks that investors should be aware of?

The Risks Ahead: November Election and Economic Uncertainty

While the market’s recent recovery is encouraging, several risks could derail the rally over the next few months.

-

November Election: The upcoming election adds another layer of uncertainty to the market. Historically, elections tend to increase volatility as investors react to potential policy changes. We could see sharp moves in sectors like healthcare, energy, and technology depending on the outcome. That uncertainty may lead to increased selling pressure, particularly if the election results are contested or lead to a significant shift in policy.

-

Economic Data: The market will remain highly sensitive to economic data releases. Any signs of further economic weakness could reignite fears of a recession, leading to another wave of selling. In particular, investors will watch for updates on inflation, employment, and consumer spending. If weakening economic data impairs earnings estimates, the risk of market revaluation increases.

-

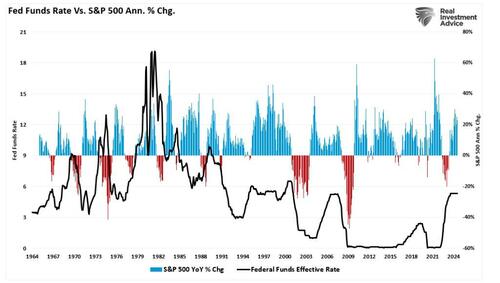

Federal Reserve Policy: The Fed’s decisions will also shape market sentiment. If the Fed is willing to start cutting rates, the market may temporarily see that optimistically. However, historically, a Fed rate-cutting cycle has not benefited higher asset prices, as rate cuts tend to coincide with slower economic growth.

Risk management is always crucial when managing portfolios, as “no one” knows with certainty what markets will do over the next week, much less over the next month or quarter.

Conclusion: Is the Decline Over?

The market decline in August and subsequent reversal highlight the market’s volatility and the importance of critical technical levels. While the bounce off minor support and the surge in corporate buybacks suggest that the worst may be over, significant risks remain.

With the polls now very tight between Trump and Harris, the potential for managers to “de-risk” portfolios remains elevated, given the uncertainty of outcomes. Furthermore, that potential “de-risking” process will coincide with the October blackout period for share repurchases, removing another supportive buyer of equities. That combination could set up a likely “flash point” for volatility before the November election.

We remain underweight equities and overweight cash in the near term with our core Treasury bond holdings intact to hedge against a sharp increase in volatility. That positioning is unlikely to change over the next two months, and we are willing to sacrifice some performance in exchange for control over risk.

While we have discussed these simplistic rules over the last several weeks, we continue to reiterate the need to rebalance risk if you have an allocation to equities.

-

Tighten up stop-loss levels to current support levels for each position.

-

Hedge portfolios against significant market declines.

-

Take profits in positions that have been big winners

-

Sell laggards and losers

-

Raise cash and rebalance portfolios to target weightings.

If a further correction occurs, the preparation allows you to survive the impact. Protecting capital will mean less time spent getting back to breakeven afterward. Alternatively, it is relatively easy to reallocate funds to equity risk if the market reverses and resumes its bullish trend.

Investing during periods of market uncertainty can be difficult. However, you can take steps to ensure that increased volatility is survivable.

Authored by Lance Roberts via RealInvestmentAdvioce.com,

The market’s 8.5% decline during August sent shockwaves through the media and investors. The drop raised concerns about whether this was the start of a larger correction or a temporary pullback. However, a powerful reversal, driven by investor buying and corporate share repurchases, halted the decline, leading many to wonder if the worst is behind us.

However, the picture becomes more nuanced as we examine the technical levels and broader market conditions. While the recent bounce suggests the market decline may be over, risks remain—particularly with the November election looming. Let’s dive into the details.

The August Decline: What Caused It?

August has historically been volatile for markets; this year was no exception. A combination of factors drove the S&P 500’s 8.5% drop:

-

Elevated Interest Rates: The Federal Reserve’s continued commitment to fighting inflation led to increased concerns about economic growth slowing. That spooked investors betting on a soft landing for the economy when recent economic data deteriorated.

-

Weak Economic Data: A string of weaker-than-expected economic reports fueled the fire, including slowing job growth and declining consumer confidence. Concerns about a potential recession started the sell-off in equities.

-

The Yen Carry Trade: A significant rise in the Japanese Yen led to a rapid unwinding of leverage used by institutions to increase portfolio returns. For more information on the carry trade, read the linked article.

-

Technically Overbought: As we discussed repeatedly in June and July, the markets were technically overbought and extended from long-term means. Only an appropriate catalyst was needed for a 5-10% market decline.

The correction, however, was unsurprising and something we repeatedly discussed in June and July.

“Reversals of overbought conditions tend to be shallow in a momentum-driven bullish market. These corrections often find support at the 20 and 50-day moving averages (DMA), but the 100 and 200-DMAs are not outside regular corrective periods.

If you remember, in March, we discussed the potential for a 5 to 10% correction due to many of the same concerns noted above. That correction of 5.5% came in April. We are again at a juncture where a 5-10% is likely. The only issue is it could come anytime between now and October.“ – June 22nd

With that 5-10% correction complete, many investors wonder what caused the rapid reversal last week, given that many factors leading up to the market decline remain.

The Reversal: Investor Buying and Share Repurchases

Despite the sharp decline, the market found support as a wave of investor buying and corporate share repurchases helped stem the losses. Here’s how these factors played out:

-

Investor Buying at Key Support Levels: The S&P 500 found support at the 5153 level, which coincides with the lows of the trading range back in April. Buyers stepped in as the market declined 3% during the “Yen Carry” blowup. From there, buying volume began to accelerate.

-

The chart shows that the S&P 500’s bounce off that support was pivotal. With the markets oversold, the reversal of the decline began. As the market low held, it provided the confidence needed for investors to step back into the market.

-

Corporate Share Repurchases: August also saw a significant increase in corporate share buybacks. With stock prices down, many companies took the opportunity to repurchase shares at a lower cost as the “blackout window” reopened, providing additional support to the market. This corporate activity helped absorb some of the selling pressure and stabilized the market.

As we noted last week, we expected the “Mega-cap” stocks to lead the way higher, and we were not disappointed.

Notably, the market leadership, primarily growth stocks, has regained its footing, suggesting that the recent correction is complete and the bull market has resumed.

However, the recent rally has been very sharp and likely needs a breather before further gains can be made.

Technical Levels to Watch

With the market rebounding, it’s crucial to identify the key technical levels that will determine the following potential entry points to increase equity exposures.

-

Resistance at 5673: The first significant resistance level for the S&P 500 is at 5673, which coincides with the recent all-time highs. If the index can break above this level, it would signal a continuation of the recovery and potentially set the stage for a continuation of the rally. However, if the S&P 500 fails to break through this resistance, it could lead to another market decline to retest current support at the 50-DMA.

-

Support at 5330: On the downside, the 5,330 level remains a critical support zone. That number will continue to adjust higher as that is the 100-DMA. However, if that level fails to hold, there is only minor support at the recent lows before a test of the 200-DMA near 5100. Investors should watch the 100-DMA level closely, as a failure to hold here could signal that the market’s recent bounce was just a temporary relief rally.

While a pullback to support levels to increase equity exposure is likely, are there more substantial risks that investors should be aware of?

The Risks Ahead: November Election and Economic Uncertainty

While the market’s recent recovery is encouraging, several risks could derail the rally over the next few months.

-

November Election: The upcoming election adds another layer of uncertainty to the market. Historically, elections tend to increase volatility as investors react to potential policy changes. We could see sharp moves in sectors like healthcare, energy, and technology depending on the outcome. That uncertainty may lead to increased selling pressure, particularly if the election results are contested or lead to a significant shift in policy.

-

Economic Data: The market will remain highly sensitive to economic data releases. Any signs of further economic weakness could reignite fears of a recession, leading to another wave of selling. In particular, investors will watch for updates on inflation, employment, and consumer spending. If weakening economic data impairs earnings estimates, the risk of market revaluation increases.

-

Federal Reserve Policy: The Fed’s decisions will also shape market sentiment. If the Fed is willing to start cutting rates, the market may temporarily see that optimistically. However, historically, a Fed rate-cutting cycle has not benefited higher asset prices, as rate cuts tend to coincide with slower economic growth.

Risk management is always crucial when managing portfolios, as “no one” knows with certainty what markets will do over the next week, much less over the next month or quarter.

Conclusion: Is the Decline Over?

The market decline in August and subsequent reversal highlight the market’s volatility and the importance of critical technical levels. While the bounce off minor support and the surge in corporate buybacks suggest that the worst may be over, significant risks remain.

With the polls now very tight between Trump and Harris, the potential for managers to “de-risk” portfolios remains elevated, given the uncertainty of outcomes. Furthermore, that potential “de-risking” process will coincide with the October blackout period for share repurchases, removing another supportive buyer of equities. That combination could set up a likely “flash point” for volatility before the November election.

We remain underweight equities and overweight cash in the near term with our core Treasury bond holdings intact to hedge against a sharp increase in volatility. That positioning is unlikely to change over the next two months, and we are willing to sacrifice some performance in exchange for control over risk.

While we have discussed these simplistic rules over the last several weeks, we continue to reiterate the need to rebalance risk if you have an allocation to equities.

-

Tighten up stop-loss levels to current support levels for each position.

-

Hedge portfolios against significant market declines.

-

Take profits in positions that have been big winners

-

Sell laggards and losers

-

Raise cash and rebalance portfolios to target weightings.

If a further correction occurs, the preparation allows you to survive the impact. Protecting capital will mean less time spent getting back to breakeven afterward. Alternatively, it is relatively easy to reallocate funds to equity risk if the market reverses and resumes its bullish trend.

Investing during periods of market uncertainty can be difficult. However, you can take steps to ensure that increased volatility is survivable.

Loading…