As spring approaches, there could be an uptick in capital market activity, hinting at the thawing of the prolonged stagnation in the initial public offering space. This resurgence is fueled by optimistic market narratives, including predictions of a 'no landing' economic scenario, the Federal Reserve winning the inflation fight, and the excitement around artificial intelligence, all of which have driven animal spirits.

The latest evidence of an issuance window possibly opening up is a report from Bloomberg that specifies Reddit, the community-focused message board site with tens of millions of daily users, is preparing for an IPO with a $6.5 billion valuation.

People familiar with the upcoming IPO say insiders target a price range of $31 to $34 a share. They noted that Reddit would have a diluted value of about $6 billion to $6.5 billion at that price range.

Morgan Stanley, Goldman Sachs Group Inc., and JPMorgan Chase & Co. are leading the IPO and plan to market shares to potential investors on March 11. Reddit has already disclosed that it will set a bunch of shares aside in the IPO for moderators on the platform.

Meanwhile, several institutional desks are closely monitoring the IPO market for signs of potential "green shoots."

Jason Draho, head of asset allocation Americas for UBS Global Wealth Management, told clients in a recent note that "falling rates, rising confidence in the economy, and record dry powder" could be the catalysts to revive not just merger and acquisition deals but also the IPO market.

Morgan Stanley's Katy Huberty told clients last week that capital markets activity is on the rise:

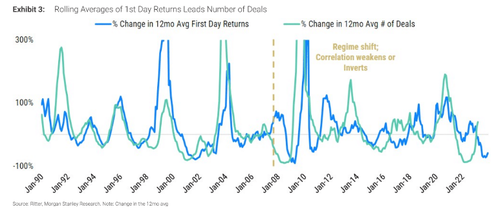

With capital markets activity on the rise, our Thematics Research team is publishing a series of brief analyses of past IPO cycles to try to gain insight on the potential scale of the incipient recovery in deal activity. Their most recent work looks at first-day returns, which are viewed as emblematic of "successful" IPOs. Data going back to the 1990s indicate that average first-day returns demonstrate a positive relationship with IPO deal activity — both 6 months and 12 months thereafter. However, this relationship has become less close since 2008. Our team believes the change in the correlation could be attributable to the market becoming more reactive (i.e. a shortening time lag between rising first-day pops and a rise in volume of activity)

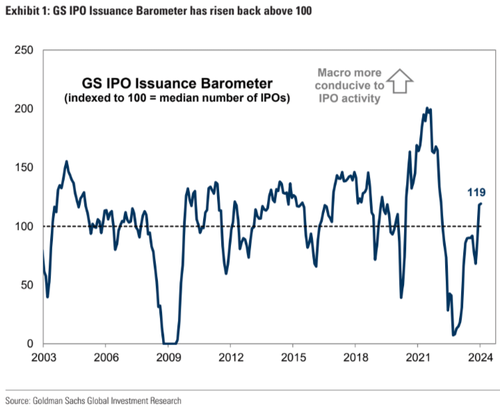

And Goldman's Issuance Barometer increased to 119 in January, the highest level since February 2022. This index shows clients how conducive the macro environment is for IPOs.

So what could burst this bubble? Well, hotter inflation prints, along with the Fed not cutting interest rates in the first half of the year.

As spring approaches, there could be an uptick in capital market activity, hinting at the thawing of the prolonged stagnation in the initial public offering space. This resurgence is fueled by optimistic market narratives, including predictions of a ‘no landing’ economic scenario, the Federal Reserve winning the inflation fight, and the excitement around artificial intelligence, all of which have driven animal spirits.

The latest evidence of an issuance window possibly opening up is a report from Bloomberg that specifies Reddit, the community-focused message board site with tens of millions of daily users, is preparing for an IPO with a $6.5 billion valuation.

People familiar with the upcoming IPO say insiders target a price range of $31 to $34 a share. They noted that Reddit would have a diluted value of about $6 billion to $6.5 billion at that price range.

Morgan Stanley, Goldman Sachs Group Inc., and JPMorgan Chase & Co. are leading the IPO and plan to market shares to potential investors on March 11. Reddit has already disclosed that it will set a bunch of shares aside in the IPO for moderators on the platform.

Meanwhile, several institutional desks are closely monitoring the IPO market for signs of potential “green shoots.”

Jason Draho, head of asset allocation Americas for UBS Global Wealth Management, told clients in a recent note that “falling rates, rising confidence in the economy, and record dry powder” could be the catalysts to revive not just merger and acquisition deals but also the IPO market.

Morgan Stanley’s Katy Huberty told clients last week that capital markets activity is on the rise:

With capital markets activity on the rise, our Thematics Research team is publishing a series of brief analyses of past IPO cycles to try to gain insight on the potential scale of the incipient recovery in deal activity. Their most recent work looks at first-day returns, which are viewed as emblematic of “successful” IPOs. Data going back to the 1990s indicate that average first-day returns demonstrate a positive relationship with IPO deal activity — both 6 months and 12 months thereafter. However, this relationship has become less close since 2008. Our team believes the change in the correlation could be attributable to the market becoming more reactive (i.e. a shortening time lag between rising first-day pops and a rise in volume of activity)

And Goldman’s Issuance Barometer increased to 119 in January, the highest level since February 2022. This index shows clients how conducive the macro environment is for IPOs.

So what could burst this bubble? Well, hotter inflation prints, along with the Fed not cutting interest rates in the first half of the year.

Loading…