As we end the week, the question - according to JPMorgan's trading desk - is whether the bear market current rally has ended and what that means for stocks moving forward.

While the Banks painted a picture of strength in Consumer and Corporate sectors, bears will point to (lack of) hiring (and outright firing) in Tech and headlines from companies such as AT&T that consumers are behind on payments on their phone bills! Recall AT&T’s management said “we're seeing an increase in bad debt to slightly higher than pre-pandemic levels, as well as extended cash collection cycles. However, it's important to note that customers are making their accounts today consistent with historical patterns and previous economic cycles.”

Here, JPM flow trader Andrew Tyler notes that his conclusion is that the economy is clearly slowing but it is not falling off a cliff, and "while recession risk (within 12 months) is elevated it may take a bit more time to eat through Consumer (~$2T remains in excess cash relative to 2019 level) and Corporate cash piles (SPX had record high cash levels coming into 2022 with near record interest coverage ratios)." Here, we find it amusing how everything still keeps harping about this "excess cash savings" (which have been spent long ago) some two years after the fact, yet nobody talks about the "excess savings" in the form of stock market investments and which are $10 trillion lower in the past 6 months. Or is the psychology of cash savings somehow different from those of short-term speculative market holdings.

Goldman trader Rich Privorotsky concludes the week with a far more downbeat take: it's been a long week, he writes, and the "market has absorbed lots of bad news very well and I think little doubt how one side positioning has been." Privorotsky is amazed that despite negative ytd performance equites have still seen little to no outflows. He thinks that this means "the asset management community cashed up waiting for redemptions that haven’t come."

And echoing what we have been saying for days, the Goldman trader says that in his view, positioning (including the fact that this is the "most hated rally" and certainly including the tens of billions in buying by systematic funds) is largely to blame here, as the "market is pricing all of the upside from rate compression but ignoring the cause (what would drive commodities to go down this much when supply is so constrained...negative growth revisions) and the rally is meant to be sold."

Perhaps, but the question on every trader's mind is how long with the rally last? After all, just one violent bear market rally can make one's entire year in days.

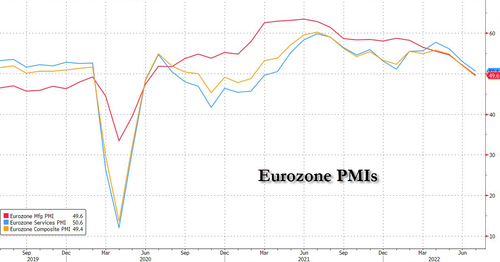

For one answer, we turn again to Nomura's Charlie McElligott who first points to the dramatic action in bonds, where following this morning's contractionary PMI prints out of Europe which confirm a recession has arrived...

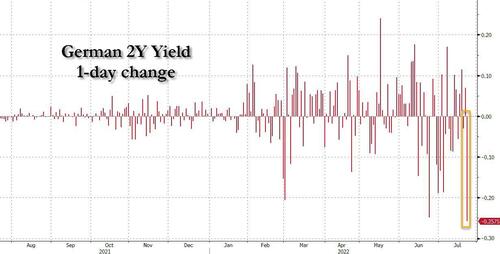

... Bonds have gone full tilt VaR event spasm - with the German 2Y yield plunging -25bps, the largest move since 2008..

... as the short-squeeze panic - having now turned into new “long” risk being added - turns violently unstable.

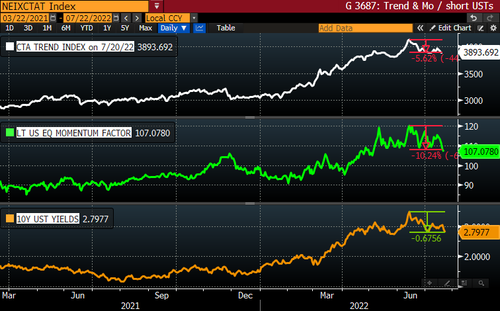

According to Charlie, in a world where all performance dynamics over the past 1-2Y period have been about having a “short” view on Duration (vs “Long” on Inflation / Cyclicality), the sudden and violent return of “Bonds as Hedge” spells further looming pain and reversal for all things “Trend / Momentum”, where positive performance has almost entirely been dictated by “Bond / Duration” Shorts and “Cyclical Inflation” Longs.

Case in point, the SG Trend (CTA) Index is now -5.6% over the past one month (through 7/20/22, and that will update much worse later today), while the Nomura-Wolfe Long Term Momentum Factor is -10.2% over that same 1m period, as UST 10Y has explosively rallied off the lows and seen yields collapse from 3.47% high mid June to this morning’s 2.79%

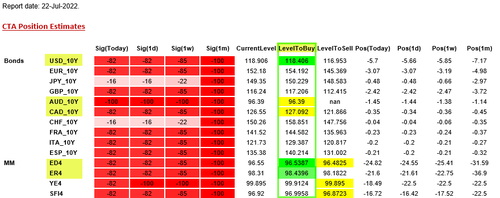

Nomura then notes that even before this morning's freakish rally, we were already in the strike-zone for more forced short-covering from CTA Trend space in Bonds (USD, AUD, CAD) and MMs (ED$ and ER):

As McElligott puts it "we all get the joke: the post COVID response of unprecedented fiscal and mon policy from global CBs, the pent-up demand release post vaccine, the start-stop lockdowns thereafter, the already broken supply-chain getting broken-er off the back of that, the “bull-whip” effect on demand / inventories, the under-capitalization of traditional Energy / Oil / Gas in the ESG era, the Russia / Ukraine war….has conspired to create this synthetic and steroidally-charged business cycle, where phase shifts are turning faster-and-faster, with break-neck speed."

It's also why we disagreed with McElligott's view presented yesterday that the Fed will take a loooooooong time to pivot, and won't do it in 2023 - not only will the Fed pivot, but it will do it so fast once the economy trapdoors into recession at a record speed, heads will spin.

In any case, amid this liftathon in rates, Nomura here echoes Goldman above and writes that "equities futures refuse to crack lower under the barage of what feels like “perpetual pessimism” and “bad news” and not just recent European “goings-ons,” but also US, where we witnessed SNAP, STX, SIVB, COF, CRSR, SAM etc earnings / guide disasters yesterday on “macro headwinds” stories... but Spooz “no cares.”

Such “trading firm despite calamity” matters, as it relates to Charlie's recent observation that this Equities rally is acting VERY differently from the prior bear market bounces during this now 9 month long sell-off, as it indicates a mismatch between extremely negative sentiment & positioning from dour views about economic growth due to the surge of FCI tightening…versus seemingly what might have already been “priced-into” the market.

This goes back to the belief that Markets and the Economy are not synonymous, as Equities/Rates/Credit all have very well captured a large part of this anticipated turn in the business cycle, and well-ahead of the actual “realization” (and Fed pivot).

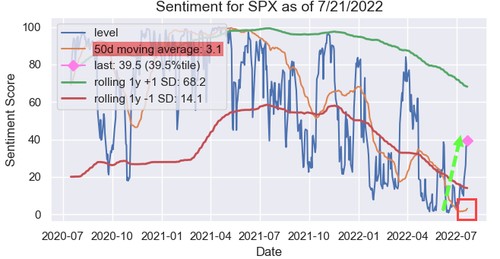

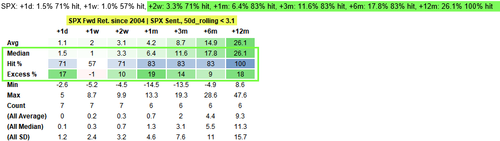

Indeed, a re-fresh on Nomura's “SPX Sentiment Index” shows “live” sentiment scrambling to “catch up” to the market, versus the legacy “doldrums” we have been immersed in as per the the 50d rolling avg, and currently 3.1% since 2004.

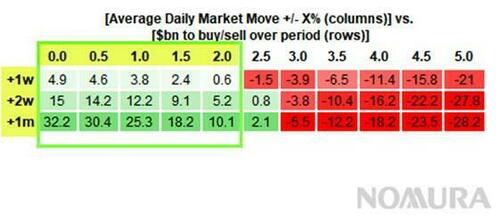

If one plugs this 3.1% 50-day avg trigger in an SPX forward returns test/signal”, it further illuminates what this “mismatch” dynamic has tended to mean moving-forward for US Equities: i.e. a standard “extreme negative sentiment = bullish forwards” signal, with significant SPX excess returns and high “hit rates” on nearly all time series! Or said otherwise, extremely bearishness is extremely bullish!

Here’s the rub: one can argue, of course, those all the prior trigger “hits” with this test do not necessarily occur against a “Stagflationary” backdrop of unmoored inflation into a growth slowdown, that, for at least an additional window of time here, will not allow the “urgent and immediate” Central Bank rescue which we’ve grown accustomed to, versus the past decade’s conditioning to the standard “Cut Rates / Buy Bonds” drill at the first sign of crisis or growth slowdown, which is the point Charlie has been been making this week regarding the inability for CB’s to “pivot” as soon as market’s currently expect (once again, we completely disagree, and we are confident the Nomura x-asset strategist will soon change his mind too once we get a -200K print in an upcoming payrolls report).

As an aside, Charlie is nice enough to observe that the topic of the “Fed Pivot” has illicited an enormous amount on emotion from clients to this week’s notes, and from both sides of the aisle.

- Some are saying that US is already deep recession, that July will be the Fed’s last hike, and that the first Fed cuts will come as early as Dec ’22 or Feb ’23 meetings…

- Others believe that due to inflation staying sticky higher and with lagging inputs (like Rent), that the only Fed “easing” next year will come in the form of a premature end to QT in 2H23, and that the currently anticipated “weak” recession will not be enough to slow Labor enough to put any dent into Inflation…hence, the Fed will be forced to stay “tighter for longer”

But going back to equities, and the ongoing short-term rally (as a reminder, we are all trying to figure out how long it will last), the signs of angst from the “earnings shoe to drop” shorts or those simply “underweight” continue to mount, where the negative earnings shoe is dropping real-time (names as noted earlier above), and yet the market isn’t going lower - instead, it continues to grind higher in what Goldman dubbed the "most hated rally" since everyone is positioned bearishly!

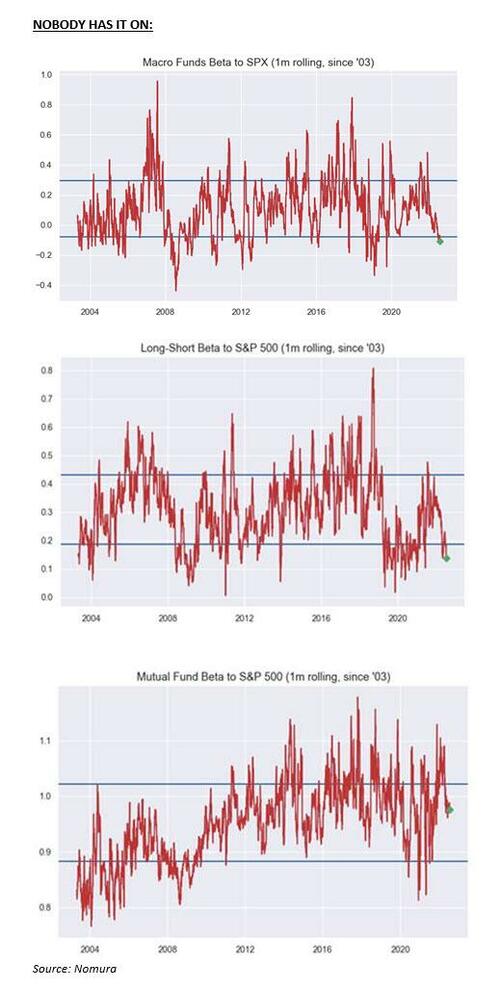

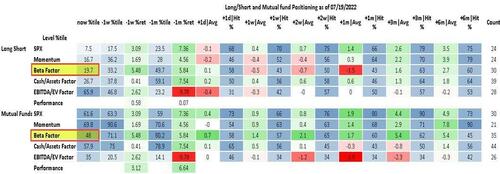

The lack of upside positioning is also in single-names too, as everybody's "low risk" tilt has them with no portfolio "beta to beta" on the move higher, especially long-short hedge funds!

All this goes to the now “pulled-forward” bullish point McElligott has been making about a strong report from MSFT being a real potential catalyst next week to seeing this Equities rally go melt-up, before his bearish point about the Fed being “stuck tighter” than the market currently anticipates can take hold out in the medium-term thereafter

- Everybody in the “top down” macro space has been expecting the “negative earnings revision” in US equities to act as the next risk-off impulse, which then “cleanses” you down to that (arbitrary) 3200-3400 “interesting valuation case” level noted by a handful of prominent Street strategists that many clients said they’d get constructive on market and want to buy on the washout.

- But as we are beginning to realize the negative earnings events, Equities index refuses to go lower, but that “dip that was supposed to be bot” didn’t materialize, and now, that risks a scenario where these folks are forced into being “buyers higher”

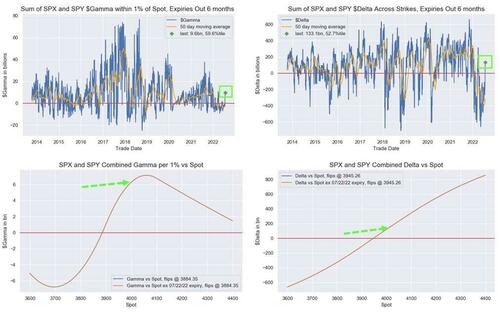

Meanwhile, as discussed yesterday, systematic funds are getting more “signal” on both Price and cratering short-dated trailing realized Vols (SPX 1m rVol from 36 mid-May to now 18), with ongoing CTA covering / long buying now, and Vol Control set to take the baton in weeks ahead, leading to even more circular buying (lower VIX, more buying, leading to lower VIX and even more buying).

CTA trend signals and buy triggers

VOL control setup to "buy" almost all daily change scenarios over the next month!

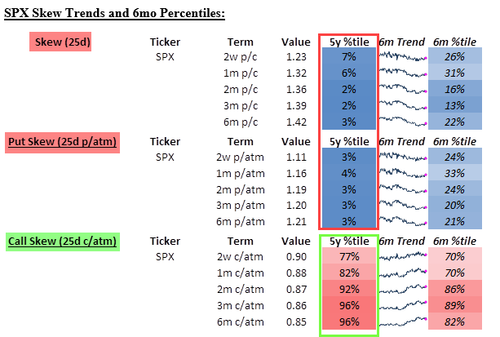

Looking at the Vol space, McElligott notes that this is what we’ve continued to see for months: Skew flattening a lot with demand for Index Calls over Puts, as most just don’t have the exposure on. This is why Index Call Skew remains bid, Put Skew and Skew remain offered—that same theme over the past few months where the real concern became about “missing the Right tail,” since exposure was so slashed for most managers, hence no need for further downside (VVIX at 2 year lows yesterday, no need for “crash” if by-and-large you don’t have the exposure on).

However, the change seen just the past few days this week on the desk, is that we actually now traders are again seeing resumption in downside hedge interest, which paradoxically adds to the “bullish” point: that they are again nibbling back into underlying exposure, hence, they need to again hedge!

What is actionaly, is that this is actually “unstable” type behavior that does often coincide with “Spot Up, Vol Up” periods:

- Scramble to grab upside obvious in the megacap Tech faves of old yesterday: TSLA (1.1mm Calls bot yday), META (295k Calls) and GOOGL (250k Calls)

- Take TSLA alone, which “IS” the US Equites Options market in one singular security, the numbers added-up to an absolutely “un-possible” ~+$1.4B of Net $Delta ADDED yesterday btwn bot Calls / sold Puts alone…blowing out anything we’ve seen over at least the past 1m period

And over the course of the day yday, we saw massive screen buying of over 200k contracts in SPX strikes from 3980 to 4020 in the same day / yesterday Calls, in an attempted “Gamma Squeeze” which was the driver of that move into the close!

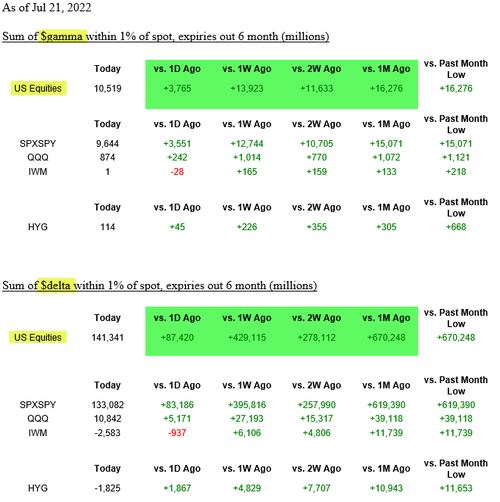

And lo-and-behold, the S&P rally has seen us scramble back into stabilizing “Long Gamma” territory for Dealers across risky-asset Options, on just ridiculous “Net $Delta” added in recent days and off the lows last month—US Equities (SPX, SPY, QQQ, IWM combined) at +$670B vs 1m ago and +$429B versus 1 week ago:

As McElligott concludes, "between the moves in Bonds and Equities, it all adds up to one word: PAIN", which will likely be the prevailing condition at least until Powell gives the all clear in either direction.

As we end the week, the question – according to JPMorgan’s trading desk – is whether the bear market current rally has ended and what that means for stocks moving forward.

While the Banks painted a picture of strength in Consumer and Corporate sectors, bears will point to (lack of) hiring (and outright firing) in Tech and headlines from companies such as AT&T that consumers are behind on payments on their phone bills! Recall AT&T’s management said “we’re seeing an increase in bad debt to slightly higher than pre-pandemic levels, as well as extended cash collection cycles. However, it’s important to note that customers are making their accounts today consistent with historical patterns and previous economic cycles.”

Here, JPM flow trader Andrew Tyler notes that his conclusion is that the economy is clearly slowing but it is not falling off a cliff, and “while recession risk (within 12 months) is elevated it may take a bit more time to eat through Consumer (~$2T remains in excess cash relative to 2019 level) and Corporate cash piles (SPX had record high cash levels coming into 2022 with near record interest coverage ratios).” Here, we find it amusing how everything still keeps harping about this “excess cash savings” (which have been spent long ago) some two years after the fact, yet nobody talks about the “excess savings” in the form of stock market investments and which are $10 trillion lower in the past 6 months. Or is the psychology of cash savings somehow different from those of short-term speculative market holdings.

Goldman trader Rich Privorotsky concludes the week with a far more downbeat take: it’s been a long week, he writes, and the “market has absorbed lots of bad news very well and I think little doubt how one side positioning has been.” Privorotsky is amazed that despite negative ytd performance equites have still seen little to no outflows. He thinks that this means “the asset management community cashed up waiting for redemptions that haven’t come.”

And echoing what we have been saying for days, the Goldman trader says that in his view, positioning (including the fact that this is the “most hated rally” and certainly including the tens of billions in buying by systematic funds) is largely to blame here, as the “market is pricing all of the upside from rate compression but ignoring the cause (what would drive commodities to go down this much when supply is so constrained…negative growth revisions) and the rally is meant to be sold.”

Perhaps, but the question on every trader’s mind is how long with the rally last? After all, just one violent bear market rally can make one’s entire year in days.

For one answer, we turn again to Nomura’s Charlie McElligott who first points to the dramatic action in bonds, where following this morning’s contractionary PMI prints out of Europe which confirm a recession has arrived…

… Bonds have gone full tilt VaR event spasm – with the German 2Y yield plunging -25bps, the largest move since 2008..

… as the short-squeeze panic – having now turned into new “long” risk being added – turns violently unstable.

According to Charlie, in a world where all performance dynamics over the past 1-2Y period have been about having a “short” view on Duration (vs “Long” on Inflation / Cyclicality), the sudden and violent return of “Bonds as Hedge” spells further looming pain and reversal for all things “Trend / Momentum”, where positive performance has almost entirely been dictated by “Bond / Duration” Shorts and “Cyclical Inflation” Longs.

Case in point, the SG Trend (CTA) Index is now -5.6% over the past one month (through 7/20/22, and that will update much worse later today), while the Nomura-Wolfe Long Term Momentum Factor is -10.2% over that same 1m period, as UST 10Y has explosively rallied off the lows and seen yields collapse from 3.47% high mid June to this morning’s 2.79%

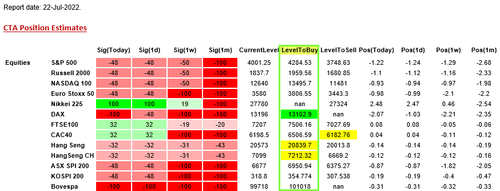

Nomura then notes that even before this morning’s freakish rally, we were already in the strike-zone for more forced short-covering from CTA Trend space in Bonds (USD, AUD, CAD) and MMs (ED$ and ER):

As McElligott puts it “we all get the joke: the post COVID response of unprecedented fiscal and mon policy from global CBs, the pent-up demand release post vaccine, the start-stop lockdowns thereafter, the already broken supply-chain getting broken-er off the back of that, the “bull-whip” effect on demand / inventories, the under-capitalization of traditional Energy / Oil / Gas in the ESG era, the Russia / Ukraine war….has conspired to create this synthetic and steroidally-charged business cycle, where phase shifts are turning faster-and-faster, with break-neck speed.“

It’s also why we disagreed with McElligott’s view presented yesterday that the Fed will take a loooooooong time to pivot, and won’t do it in 2023 – not only will the Fed pivot, but it will do it so fast once the economy trapdoors into recession at a record speed, heads will spin.

In any case, amid this liftathon in rates, Nomura here echoes Goldman above and writes that “equities futures refuse to crack lower under the barage of what feels like “perpetual pessimism” and “bad news” and not just recent European “goings-ons,” but also US, where we witnessed SNAP, STX, SIVB, COF, CRSR, SAM etc earnings / guide disasters yesterday on “macro headwinds” stories… but Spooz “no cares.”

Such “trading firm despite calamity” matters, as it relates to Charlie’s recent observation that this Equities rally is acting VERY differently from the prior bear market bounces during this now 9 month long sell-off, as it indicates a mismatch between extremely negative sentiment & positioning from dour views about economic growth due to the surge of FCI tightening…versus seemingly what might have already been “priced-into” the market.

This goes back to the belief that Markets and the Economy are not synonymous, as Equities/Rates/Credit all have very well captured a large part of this anticipated turn in the business cycle, and well-ahead of the actual “realization” (and Fed pivot).

Indeed, a re-fresh on Nomura’s “SPX Sentiment Index” shows “live” sentiment scrambling to “catch up” to the market, versus the legacy “doldrums” we have been immersed in as per the the 50d rolling avg, and currently 3.1% since 2004.

If one plugs this 3.1% 50-day avg trigger in an SPX forward returns test/signal”, it further illuminates what this “mismatch” dynamic has tended to mean moving-forward for US Equities: i.e. a standard “extreme negative sentiment = bullish forwards” signal, with significant SPX excess returns and high “hit rates” on nearly all time series! Or said otherwise, extremely bearishness is extremely bullish!

Here’s the rub: one can argue, of course, those all the prior trigger “hits” with this test do not necessarily occur against a “Stagflationary” backdrop of unmoored inflation into a growth slowdown, that, for at least an additional window of time here, will not allow the “urgent and immediate” Central Bank rescue which we’ve grown accustomed to, versus the past decade’s conditioning to the standard “Cut Rates / Buy Bonds” drill at the first sign of crisis or growth slowdown, which is the point Charlie has been been making this week regarding the inability for CB’s to “pivot” as soon as market’s currently expect (once again, we completely disagree, and we are confident the Nomura x-asset strategist will soon change his mind too once we get a -200K print in an upcoming payrolls report).

As an aside, Charlie is nice enough to observe that the topic of the “Fed Pivot” has illicited an enormous amount on emotion from clients to this week’s notes, and from both sides of the aisle.

- Some are saying that US is already deep recession, that July will be the Fed’s last hike, and that the first Fed cuts will come as early as Dec ’22 or Feb ’23 meetings…

- Others believe that due to inflation staying sticky higher and with lagging inputs (like Rent), that the only Fed “easing” next year will come in the form of a premature end to QT in 2H23, and that the currently anticipated “weak” recession will not be enough to slow Labor enough to put any dent into Inflation…hence, the Fed will be forced to stay “tighter for longer”

But going back to equities, and the ongoing short-term rally (as a reminder, we are all trying to figure out how long it will last), the signs of angst from the “earnings shoe to drop” shorts or those simply “underweight” continue to mount, where the negative earnings shoe is dropping real-time (names as noted earlier above), and yet the market isn’t going lower – instead, it continues to grind higher in what Goldman dubbed the “most hated rally” since everyone is positioned bearishly!

The lack of upside positioning is also in single-names too, as everybody’s “low risk” tilt has them with no portfolio “beta to beta” on the move higher, especially long-short hedge funds!

All this goes to the now “pulled-forward” bullish point McElligott has been making about a strong report from MSFT being a real potential catalyst next week to seeing this Equities rally go melt-up, before his bearish point about the Fed being “stuck tighter” than the market currently anticipates can take hold out in the medium-term thereafter

- Everybody in the “top down” macro space has been expecting the “negative earnings revision” in US equities to act as the next risk-off impulse, which then “cleanses” you down to that (arbitrary) 3200-3400 “interesting valuation case” level noted by a handful of prominent Street strategists that many clients said they’d get constructive on market and want to buy on the washout.

- But as we are beginning to realize the negative earnings events, Equities index refuses to go lower, but that “dip that was supposed to be bot” didn’t materialize, and now, that risks a scenario where these folks are forced into being “buyers higher”

Meanwhile, as discussed yesterday, systematic funds are getting more “signal” on both Price and cratering short-dated trailing realized Vols (SPX 1m rVol from 36 mid-May to now 18), with ongoing CTA covering / long buying now, and Vol Control set to take the baton in weeks ahead, leading to even more circular buying (lower VIX, more buying, leading to lower VIX and even more buying).

CTA trend signals and buy triggers

VOL control setup to “buy” almost all daily change scenarios over the next month!

Looking at the Vol space, McElligott notes that this is what we’ve continued to see for months: Skew flattening a lot with demand for Index Calls over Puts, as most just don’t have the exposure on. This is why Index Call Skew remains bid, Put Skew and Skew remain offered—that same theme over the past few months where the real concern became about “missing the Right tail,” since exposure was so slashed for most managers, hence no need for further downside (VVIX at 2 year lows yesterday, no need for “crash” if by-and-large you don’t have the exposure on).

However, the change seen just the past few days this week on the desk, is that we actually now traders are again seeing resumption in downside hedge interest, which paradoxically adds to the “bullish” point: that they are again nibbling back into underlying exposure, hence, they need to again hedge!

What is actionaly, is that this is actually “unstable” type behavior that does often coincide with “Spot Up, Vol Up” periods:

- Scramble to grab upside obvious in the megacap Tech faves of old yesterday: TSLA (1.1mm Calls bot yday), META (295k Calls) and GOOGL (250k Calls)

- Take TSLA alone, which “IS” the US Equites Options market in one singular security, the numbers added-up to an absolutely “un-possible” ~+$1.4B of Net $Delta ADDED yesterday btwn bot Calls / sold Puts alone…blowing out anything we’ve seen over at least the past 1m period

And over the course of the day yday, we saw massive screen buying of over 200k contracts in SPX strikes from 3980 to 4020 in the same day / yesterday Calls, in an attempted “Gamma Squeeze” which was the driver of that move into the close!

And lo-and-behold, the S&P rally has seen us scramble back into stabilizing “Long Gamma” territory for Dealers across risky-asset Options, on just ridiculous “Net $Delta” added in recent days and off the lows last month—US Equities (SPX, SPY, QQQ, IWM combined) at +$670B vs 1m ago and +$429B versus 1 week ago:

As McElligott concludes, “between the moves in Bonds and Equities, it all adds up to one word: PAIN“, which will likely be the prevailing condition at least until Powell gives the all clear in either direction.