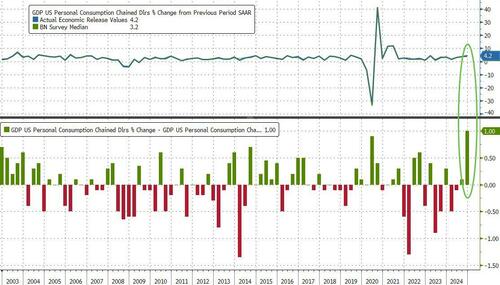

We will have much more to say on the composition of yesterday's first estimate of Q4 GDP which as we highlighted was a very ugly print, and only another quarter of extensive government spending (the 10th quarter in a row) and a record beat of consumer spending relative to expectations, prevented the GDP print from sliding into the 1% range...

... but even if one assumes that there was nothing abnormal about the number itself, the context in which it was derived was astounding. Here's why.

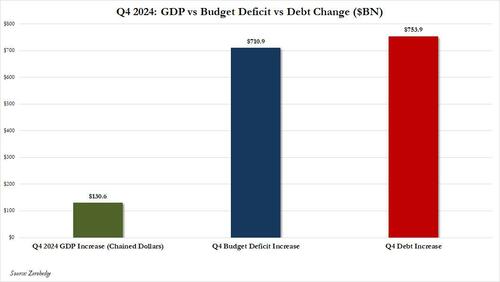

As the BEA reported, in Q4 US GDP grew at a seasonally adjusted rate of 2.3%, below the 2.6% estimate and down from the 3.1% growth pace in Q3. More specifically, the number represented the annualized increase in the 131BN change between what the BEA calculated was chained Q3 GDP ($23.400 trillion) and Q4 GDP ($23.531 trillion). In other words, to keep it simpler, in Q4 the US economy actually grew some $130.6 billion chained dollars.

So far so good. The only problem is what funded this growth, and as regular readers are well aware, in the US the source of all growth is - and for the past 100 years - has been debt, and boy was Q4 a doozy.

As the chart below shows, while the US generated $131bn in chained GDP growth in Q4, this was the result of a $711 billion increase in the US budget deficit, which in turn was funded with a $754 billion increase in debt which, as of Dec 31, 2024, stood at a record 36.218 trillion. The Q4 snapshot is shown below.

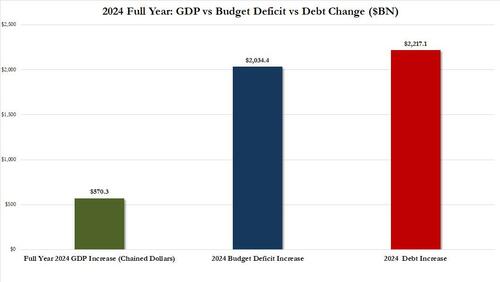

And it's not just Q4. Extending this analysis to all of 2024 we find an almost identical pattern: in the full year 2024, US GDP grew by $570 billion from $22.961 trillion to $23.531 trillion, growth which was made possible by a near record $2.034 trillion increase in the budget deficit, which in turn was funded by a mammoth $2.2 trillion increase in debt.

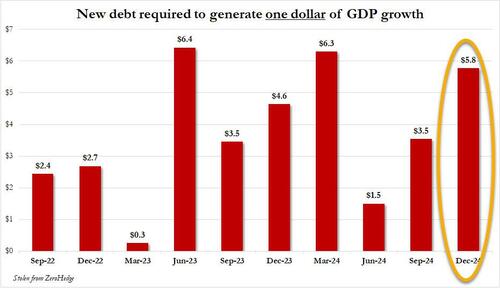

The bottom line: in Q4 it took $5.8 dollars of debt to create $1 dollar of growth, an increase from $3.5 in Q3 and from $1.5 in Q2, which is to be expected: as we revealed in the summer of 2023, US growth was one giant illusion and was entirely the result of the Biden admins' massive debt creation spree. No surprise that with the election in Q4 2024, that's when the bulk of the debt-fueled frenzy would take place.

Taking a bigger picture look, for the full year 2024, it took $3.9 dollar in debt to generate $1 in growth, an increase from the $3.6 in 2023.

What this means is that the only hope the US ever has to grow is to issue debt, or rather issue lots and lots of debt. So good luck to Trump and Elon and DOGE if they hope to slow down the firehose of US debt issuance. They may be successful, but they better have a plan for how to deal with the deep recession that will be immediately triggered as a result.

We will have much more to say on the composition of yesterday’s first estimate of Q4 GDP which as we highlighted was a very ugly print, and only another quarter of extensive government spending (the 10th quarter in a row) and a record beat of consumer spending relative to expectations, prevented the GDP print from sliding into the 1% range…

… but even if one assumes that there was nothing abnormal about the number itself, the context in which it was derived was astounding. Here’s why.

As the BEA reported, in Q4 US GDP grew at a seasonally adjusted rate of 2.3%, below the 2.6% estimate and down from the 3.1% growth pace in Q3. More specifically, the number represented the annualized increase in the 131BN change between what the BEA calculated was chained Q3 GDP ($23.400 trillion) and Q4 GDP ($23.531 trillion). In other words, to keep it simpler, in Q4 the US economy actually grew some $130.6 billion chained dollars.

So far so good. The only problem is what funded this growth, and as regular readers are well aware, in the US the source of all growth is – and for the past 100 years – has been debt, and boy was Q4 a doozy.

As the chart below shows, while the US generated $131bn in chained GDP growth in Q4, this was the result of a $711 billion increase in the US budget deficit, which in turn was funded with a $754 billion increase in debt which, as of Dec 31, 2024, stood at a record 36.218 trillion. The Q4 snapshot is shown below.

And it’s not just Q4. Extending this analysis to all of 2024 we find an almost identical pattern: in the full year 2024, US GDP grew by $570 billion from $22.961 trillion to $23.531 trillion, growth which was made possible by a near record $2.034 trillion increase in the budget deficit, which in turn was funded by a mammoth $2.2 trillion increase in debt.

The bottom line: in Q4 it took $5.8 dollars of debt to create $1 dollar of growth, an increase from $3.5 in Q3 and from $1.5 in Q2, which is to be expected: as we revealed in the summer of 2023, US growth was one giant illusion and was entirely the result of the Biden admins’ massive debt creation spree. No surprise that with the election in Q4 2024, that’s when the bulk of the debt-fueled frenzy would take place.

Taking a bigger picture look, for the full year 2024, it took $3.9 dollar in debt to generate $1 in growth, an increase from the $3.6 in 2023.

What this means is that the only hope the US ever has to grow is to issue debt, or rather issue lots and lots of debt. So good luck to Trump and Elon and DOGE if they hope to slow down the firehose of US debt issuance. They may be successful, but they better have a plan for how to deal with the deep recession that will be immediately triggered as a result.

Loading…