Authored by Emel Akan via The Epoch Times (emphasis ours),

President Joe Biden, who has typically refrained from discussing the stock market, finally broached the subject in mid-December, celebrating a record high for the Dow Jones. It was an apparent attempt to appeal to voters who are still pessimistic about inflation and the economy.

The president recently trolled former President Donald Trump in a campaign video posted on social media; mocking his predecessor's 2020 warning of a stock market crash if Mr. Biden were elected.

“Good one, Donald,” President Biden wrote in a Dec. 15 post on X, formerly Twitter.

During the 2020 presidential campaign, President Trump said, “If Biden wins, you’re going to have a stock market collapse the likes of which you’ve never had.”

The recent rally shows three major U.S. indexes notching gains for seven consecutive weeks thanks to the Federal Reserve’s “dovish” stance. Since Oct. 27, the Dow Jones Industrial Average and S&P 500 surged by 15 percent, and the Nasdaq jumped by 17 percent.

On Dec. 13, the central bank concluded its final policy meeting of the year, signaling that its anti-inflation campaign is making progress and that monetary policy tightening has likely come to an end.

The Fed's policymakers are now predicting three rate cuts in 2024, more than previously projected, offering a ray of hope to investors who have been gloomy for the past two years.

President Biden, who's running for reelection, has struggled to win over Americans with his economic agenda, which he calls "Bidenomics." The 46th president may now want to capitalize on the recent stock market gains with the hope of making his economic message appealing to voters.

According to a new CBS News poll, Americans perceive the current economic challenges as the most severe they've faced in generations, surpassing the 2008–09 financial crisis and even the inflation rates and gas shortages experienced in the 1970s.

Despite positive job reports and discussions of a "soft landing" in the economy, people still focus on their personal experiences rather than broader economic data. An overwhelming number of respondents say their incomes aren't keeping up with the rising cost of living.

According to a recent poll by Bankrate, 59 percent of Americans believe the United States is in a recession, with many referring to it as a "silent recession."

‘Wealth Effect’

Individual struggles have a tremendous influence on people's perceptions, exposing the disconnect between macroeconomic facts and personal financial conditions, according to Merrill Matthews, a resident scholar at the Institute for Policy Innovation, a public policy think tank.

"Within the economy, there's reality and there's perception, and perception always trumps reality,” he told The Epoch Times.

The main reason Americans are still struggling, according to Mr. Matthews, is that Bidenomics has erased the so-called wealth effect.

The wealth effect is a behavioral economic theory that suggests people feel more financially secure and confident about their wealth when the values of their homes or investment portfolios rise. When consumers feel wealthy, they tend to spend more, which benefits the economy as a whole.

Economic factors such as the stock market, inflation, home values, and consumer confidence contribute to the wealth effect.

For example, when Americans witness their retirement savings plateau or decline, it has a significant influence on their sense of financial well-being. This is especially important given that the majority of Americans are investors in the stock market.

According to a Gallup survey, 61 percent of Americans own stock, whether through direct investments or a retirement savings account such as a 401(k).

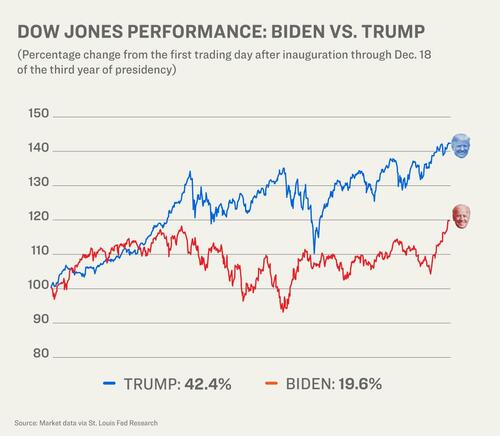

Mr. Matthews, in a recent op-ed in The Hill, stated that Americans of all income levels experienced the wealth effect during the Trump years. Bidenomics, on the other hand, has brought the wealth effect to a standstill, which is one of the main reasons President Biden's polling numbers are so poor, he said.

The Dow Jones index was slightly below 20,000 when Donald Trump took office in January 2017. It reached above 30,000 when he left office, a roughly 50 percent increase in four years. That was despite a huge drop in spring 2020 due to the government shutdowns over the COVID-19 pandemic.

During President Biden's first year in office, the Dow rose to 36,000, a roughly 20 percent increase. While there have been some ups and downs since then, the Dow has largely moved sideways over the past two years, essentially remaining stagnant inside a tight range and producing mediocre returns. This has put yet another negative light on Bidenomics.

To combat excessive inflation, the Fed began hiking interest rates in March 2022. As a result, Treasury yields have begun to look more attractive compared to stocks. This is one of the reasons investors have started to pull out of the stock market.

Even though economic data is improving and the stock market has risen in recent weeks, President Biden may face additional economic challenges in 2024.

“As always, the economy will play a big part in next year's election and could constitute a major headwind for the Biden campaign,” Desmond Lachman, senior fellow at the American Enterprise Institute, told The Epoch Times.

“While so far economic growth has held up well and inflation has been coming down, there is a high risk that we will experience an economic recession before the election.”

Mr. Lachman said that the economy has yet to witness the full effects of the Fed's monetary policy tightening.

Inflation Erodes Wealth

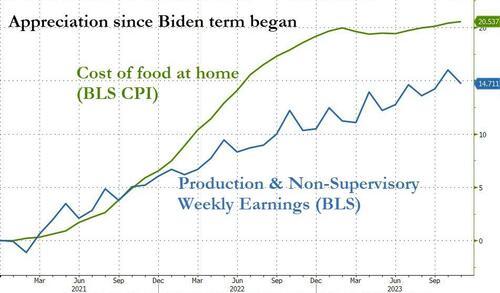

Inflation has played a larger role than the stock market in erasing the wealth effect.

Americans haven't witnessed inflation of this magnitude since the early 1980s. The real value of household wealth has been declining over the past two years, at the fastest rate in more than four decades, according to the Financial Times.

Price increases reduce the purchasing power of consumers, devalue people's wages and savings, and increase the cost of living. As a result, people feel poorer and cut back on their consumption and spending.

Lower-income households with already tight budgets have felt the effects of inflation the most.

Although the annual inflation rate has significantly dropped from its peak of 9.1 percent in June 2022 to 3.1 percent in November 2023, it's important to note that prices remain elevated when compared to the time President Biden took office.

Overall, prices have surged by more than 17 percent since January 2021—nearly 20 percent for food, more than 43 percent for gasoline, and 18 percent for housing, according to data from the U.S. Bureau of Labor Statistics.

Read the rest here...

Authored by Emel Akan via The Epoch Times (emphasis ours),

President Joe Biden, who has typically refrained from discussing the stock market, finally broached the subject in mid-December, celebrating a record high for the Dow Jones. It was an apparent attempt to appeal to voters who are still pessimistic about inflation and the economy.

The president recently trolled former President Donald Trump in a campaign video posted on social media; mocking his predecessor’s 2020 warning of a stock market crash if Mr. Biden were elected.

“Good one, Donald,” President Biden wrote in a Dec. 15 post on X, formerly Twitter.

During the 2020 presidential campaign, President Trump said, “If Biden wins, you’re going to have a stock market collapse the likes of which you’ve never had.”

The recent rally shows three major U.S. indexes notching gains for seven consecutive weeks thanks to the Federal Reserve’s “dovish” stance. Since Oct. 27, the Dow Jones Industrial Average and S&P 500 surged by 15 percent, and the Nasdaq jumped by 17 percent.

On Dec. 13, the central bank concluded its final policy meeting of the year, signaling that its anti-inflation campaign is making progress and that monetary policy tightening has likely come to an end.

The Fed’s policymakers are now predicting three rate cuts in 2024, more than previously projected, offering a ray of hope to investors who have been gloomy for the past two years.

President Biden, who’s running for reelection, has struggled to win over Americans with his economic agenda, which he calls “Bidenomics.” The 46th president may now want to capitalize on the recent stock market gains with the hope of making his economic message appealing to voters.

According to a new CBS News poll, Americans perceive the current economic challenges as the most severe they’ve faced in generations, surpassing the 2008–09 financial crisis and even the inflation rates and gas shortages experienced in the 1970s.

Despite positive job reports and discussions of a “soft landing” in the economy, people still focus on their personal experiences rather than broader economic data. An overwhelming number of respondents say their incomes aren’t keeping up with the rising cost of living.

According to a recent poll by Bankrate, 59 percent of Americans believe the United States is in a recession, with many referring to it as a “silent recession.”

‘Wealth Effect’

Individual struggles have a tremendous influence on people’s perceptions, exposing the disconnect between macroeconomic facts and personal financial conditions, according to Merrill Matthews, a resident scholar at the Institute for Policy Innovation, a public policy think tank.

“Within the economy, there’s reality and there’s perception, and perception always trumps reality,” he told The Epoch Times.

The main reason Americans are still struggling, according to Mr. Matthews, is that Bidenomics has erased the so-called wealth effect.

The wealth effect is a behavioral economic theory that suggests people feel more financially secure and confident about their wealth when the values of their homes or investment portfolios rise. When consumers feel wealthy, they tend to spend more, which benefits the economy as a whole.

Economic factors such as the stock market, inflation, home values, and consumer confidence contribute to the wealth effect.

For example, when Americans witness their retirement savings plateau or decline, it has a significant influence on their sense of financial well-being. This is especially important given that the majority of Americans are investors in the stock market.

According to a Gallup survey, 61 percent of Americans own stock, whether through direct investments or a retirement savings account such as a 401(k).

Mr. Matthews, in a recent op-ed in The Hill, stated that Americans of all income levels experienced the wealth effect during the Trump years. Bidenomics, on the other hand, has brought the wealth effect to a standstill, which is one of the main reasons President Biden’s polling numbers are so poor, he said.

The Dow Jones index was slightly below 20,000 when Donald Trump took office in January 2017. It reached above 30,000 when he left office, a roughly 50 percent increase in four years. That was despite a huge drop in spring 2020 due to the government shutdowns over the COVID-19 pandemic.

During President Biden’s first year in office, the Dow rose to 36,000, a roughly 20 percent increase. While there have been some ups and downs since then, the Dow has largely moved sideways over the past two years, essentially remaining stagnant inside a tight range and producing mediocre returns. This has put yet another negative light on Bidenomics.

To combat excessive inflation, the Fed began hiking interest rates in March 2022. As a result, Treasury yields have begun to look more attractive compared to stocks. This is one of the reasons investors have started to pull out of the stock market.

Even though economic data is improving and the stock market has risen in recent weeks, President Biden may face additional economic challenges in 2024.

“As always, the economy will play a big part in next year’s election and could constitute a major headwind for the Biden campaign,” Desmond Lachman, senior fellow at the American Enterprise Institute, told The Epoch Times.

“While so far economic growth has held up well and inflation has been coming down, there is a high risk that we will experience an economic recession before the election.”

Mr. Lachman said that the economy has yet to witness the full effects of the Fed’s monetary policy tightening.

Inflation Erodes Wealth

Inflation has played a larger role than the stock market in erasing the wealth effect.

Americans haven’t witnessed inflation of this magnitude since the early 1980s. The real value of household wealth has been declining over the past two years, at the fastest rate in more than four decades, according to the Financial Times.

Price increases reduce the purchasing power of consumers, devalue people’s wages and savings, and increase the cost of living. As a result, people feel poorer and cut back on their consumption and spending.

Lower-income households with already tight budgets have felt the effects of inflation the most.

Although the annual inflation rate has significantly dropped from its peak of 9.1 percent in June 2022 to 3.1 percent in November 2023, it’s important to note that prices remain elevated when compared to the time President Biden took office.

Overall, prices have surged by more than 17 percent since January 2021—nearly 20 percent for food, more than 43 percent for gasoline, and 18 percent for housing, according to data from the U.S. Bureau of Labor Statistics.

Read the rest here…

Loading…