By Ven Ram, Bloomberg markets live reporter and analyst

Bill Gross famously remarked in 2015 that bunds represented the short of a lifetime. He was seven years too early.

To watch German bonds this year has been like witnessing a horror show. Yet, we are only nearing intermission -- meaning there is far worse to emerge in the months ahead.

The European Central Bank raised rates by an emphatic 75 basis points last week and flagged that there was more to come, spurring traders to factor in about 170 basis points of additional tightening. Markets expect the euro-area deposit rate to top out at around 2.35% in the current cycle.

Even so, that may be underestimating the work required of the ECB to curb inflation.

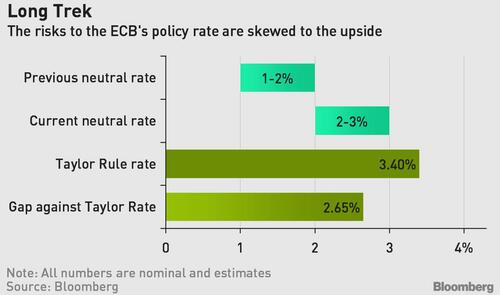

A crucial piece of calculus will be to work out where the elusive, unobservable neutral rate is for the ECB. Given a lack of inflation before the pandemic, the euro area’s r* was widely estimated to be between 1% and 2%.

However, in the post-pandemic world that has completely upended the region’s inflation outlook, a nominal neutral rate would perforce be higher than its 2% target assuming that the ECB targets a neutral real rate of at least zero. In fact, given that HICP is currently running at almost 9%, it may be argued that the short-term neutral nominal rate is somewhere between 2.50% and 3%.

In other words, it is possible that the ECB may raise rates all the way to around 3% should inflation prove to be stubbornly high in the coming quarters, with President Christine Lagarde having commented in May that “a progressive further normalization of interest rates toward the neutral rate will be appropriate.” According to the ECB’s own projections, inflation doesn’t converge to its 2% target even in 2024.

The benchmark policy rate for the euro area implied by the well-known Taylor Rule is, in fact, around 3.40%. While it may seem unlikely that the ECB will raise rates that high in the current cycle, the rule highlights the scale of the challenge the monetary authority faces. More importantly perhaps, it shows that risks are skewed to the upside.

All the above mean that two-year German bonds, whose yields have already surged almost 200 basis points this year, are not done with the phenomenal selloff. In fact, the yield may ascend to 2.50% and beyond by the middle of next year should the ECB continue with its tightening as priced by the markets.

In turn, yields on German 10-year bunds -- now around 1.70% after soaring more than 180 basis points this year, may approach around 2.30%, with the lower peak for the longer maturity predicated on an inversion of the yield curve in sympathy with expected weakness in the euro-area economy.

Given the outlook for the ECB’s rate trajectory, there’s still plenty more downside on German bonds. Bill Gross’s portfolio may be up for it this time around.

By Ven Ram, Bloomberg markets live reporter and analyst

Bill Gross famously remarked in 2015 that bunds represented the short of a lifetime. He was seven years too early.

To watch German bonds this year has been like witnessing a horror show. Yet, we are only nearing intermission — meaning there is far worse to emerge in the months ahead.

The European Central Bank raised rates by an emphatic 75 basis points last week and flagged that there was more to come, spurring traders to factor in about 170 basis points of additional tightening. Markets expect the euro-area deposit rate to top out at around 2.35% in the current cycle.

Even so, that may be underestimating the work required of the ECB to curb inflation.

A crucial piece of calculus will be to work out where the elusive, unobservable neutral rate is for the ECB. Given a lack of inflation before the pandemic, the euro area’s r* was widely estimated to be between 1% and 2%.

However, in the post-pandemic world that has completely upended the region’s inflation outlook, a nominal neutral rate would perforce be higher than its 2% target assuming that the ECB targets a neutral real rate of at least zero. In fact, given that HICP is currently running at almost 9%, it may be argued that the short-term neutral nominal rate is somewhere between 2.50% and 3%.

In other words, it is possible that the ECB may raise rates all the way to around 3% should inflation prove to be stubbornly high in the coming quarters, with President Christine Lagarde having commented in May that “a progressive further normalization of interest rates toward the neutral rate will be appropriate.” According to the ECB’s own projections, inflation doesn’t converge to its 2% target even in 2024.

The benchmark policy rate for the euro area implied by the well-known Taylor Rule is, in fact, around 3.40%. While it may seem unlikely that the ECB will raise rates that high in the current cycle, the rule highlights the scale of the challenge the monetary authority faces. More importantly perhaps, it shows that risks are skewed to the upside.

All the above mean that two-year German bonds, whose yields have already surged almost 200 basis points this year, are not done with the phenomenal selloff. In fact, the yield may ascend to 2.50% and beyond by the middle of next year should the ECB continue with its tightening as priced by the markets.

In turn, yields on German 10-year bunds — now around 1.70% after soaring more than 180 basis points this year, may approach around 2.30%, with the lower peak for the longer maturity predicated on an inversion of the yield curve in sympathy with expected weakness in the euro-area economy.

Given the outlook for the ECB’s rate trajectory, there’s still plenty more downside on German bonds. Bill Gross’s portfolio may be up for it this time around.