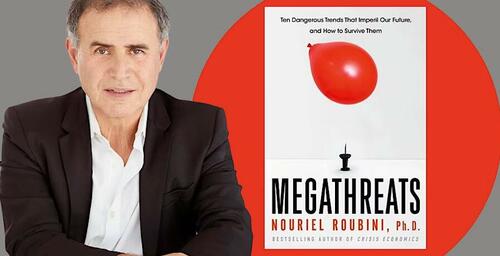

Economist Nouriel Roubini, who's been dubbed 'Dr. Doom' for his gloomy-yet-correct prediction of the 2008 market meltdown, is making headlines again during a series of interviews promoting his new book "Megathreats".

"We have to worry about everything at the same time, as all these megathreats are interconnected..."

When asked if we're "there again" in reference to the 2008 great financial crisis, Roubini replied: "Yes, we’re here again."

"But in addition to the economic, monetary, and financial risks - and there are new ones - now we’re going towards stagflation like we’ve never seen since the 1970s."

Private and public debt levels globally have exploded from 200 percent of GDP in 2000 to around 350 percent of GDP today, he said, blaming ultra-loose central bank policies that made borrowing cheap and encouraged households, businesses, and countries to take on ever greater debt loads even though many were barely solvent.

But now, facing persistently high inflation, central banks led by the Fed have embarked on aggressive rate hiking cycles, with Roubini predicting that highly indebted and operationally fragile “zombie” institutions are going to go bankrupt.

“That’s why we’re not only going to have inflation and stagflation but we’ll have a stagflationary debt crisis,” Roubini predicted.

In the 1970s, debt levels were far lower than today and so advanced economies didn’t suffer debt crises when the Fed jacked up rates to around 20 percent.

“Today we have the worst of the 70s with a massive amount of stagflationary negative supply shock,” he added.

Roubini has called predictions for a brief and mild U.S. recession “delusional.”

He told Bloomberg in an interview at the end of July that he expects the United States to be hit by a “severe recession and a severe debt and financial crisis.”

Roubini said that, in addition to economic, monetary, and financial risks currently in play, the world faces higher geopolitical risks.

During an extensive interview with Der Spiegel, the economist said he preferred "Dr. Realist" as he detailed some of the world's most acute problems.

When speaking about major global threats, Roubini mentioned the ongoing conflict between Russia and Ukraine, adding that Iran and Israel are “on a collision course” as well.

"It is already happening. The U.S. has just passed new regulations banning the export of semiconductors to Chinese companies for AI or quantum computing or military use. Europeans would like to continue doing business with the U.S. and China, but it won't be possible because of national security issues."

"...just this morning, I read that the Biden administration expects China to attack Taiwan sooner rather than later. Honestly, World War III has already effectively begun, certainly in Ukraine and cyberspace."

He believes that a breakup of the globalized world is looming.

“Trade, finance, technology, internet: Everything will split in two,” he predicted.

Finally, Roubini said debt levels are higher than they’ve ever been, adding that all this represents a confluence of “mega trends” that he predicts will combine into a stagflationary storm that will engulf many of the world’s economies.

The economist said that the worst possible outcome would be if all eleven “mega trends” materialize and feed on each other, leading to a “dystopian future.”

“It’s not just the end of the world economy... it could be even global war.”

Recalling a recent event hosted by the IMF, Roubini referred to historian Niall Ferguson who “said in a speech there that we would be lucky if we got an economic crisis like in the 1970s — and not a war like in the 1940s.”

After all that, we think 'Dr. Doom' remains a more appropriate nickname.

* * *

Read the full Der Spiegel interview below:

DER SPIEGEL: Professor Roubini, you don't like your nickname "Dr. Doom." Instead you would like to be called "Dr. Realist." But in your new book, you describe "ten megathreats" that endanger our future. It doesn’t get much gloomier than that.

Roubini: The threats I write about are real – no one would deny that. I grew up in Italy in the 1960s and 1970s. Back then, I never worried about a war between great powers or a nuclear winter, as we had détente between the Soviet Union and the West. I never heard the words climate change or global pandemic. And no one worried about robots taking over most jobs. We had freer trade and globalization, we lived in stable democracies, even if they were not perfect. Debt was very low, the population wasn’t over-aged, there were no unfunded liabilities from the pension and health care systems. That's the world I grew up in. And now I have to worry about all these things – and so does everyone else.

DER SPIEGEL: But do they? Or do you feel like a voice crying in the wilderness?

Roubini: I was in Washington at the IMF meeting. The economic historian Niall Ferguson said in a speech there that we would be lucky if we got an economic crisis like in the 1970s – and not a war like in the 1940s. National security advisers were worried about NATO getting involved in the war between Russia and Ukraine and Iran and Israel being on a collision course. And just this morning, I read that the Biden administration expects China to attack Taiwan sooner rather than later. Honestly, World War III has already effectively begun, certainly in Ukraine and cyberspace.

DER SPIEGEL: Politicians seem overwhelmed by the simultaneity of many major crises. What priorities should they set?

Roubini: Of course, they must take care of Russia and Ukraine before they take care of Iran and Israel or China. But policymakers should also think about inflation and recessions, i.e. stagflation. The eurozone is already in a recession, and I think it will be long and ugly. The United Kingdom is even worse. The pandemic seems contained, but new COVID variants could emerge soon. And climate change is a slow-motion disaster that is accelerating. For each of the 10 threats I describe in my book, I can give you 10 examples that are happening as we speak today, not in the distant future. Do you want one on climate change?

DER SPIEGEL: If you must.

Roubini: This summer, there have been droughts all over the world, including in the United States. Near Las Vegas, the drought is so bad that bodies of mobsters from the 1950s have surfaced in the dried-up lakes. In California, farmers are now selling their water rights because it's more profitable than growing anything. And in Florida, you can't get insurance for houses on the coast anymore. Half of Americans will have to eventually move to the Midwest or Canada. That's science, not speculation.

DER SPIEGEL: Another threat you describe is that the U.S. could pressure Europe to limit its business relations with China in order to not endanger the U.S. military presence on the continent. How far are we from that scenario?

Roubini: It is already happening. The U.S. has just passed new regulations banning the export of semiconductors to Chinese companies for AI or quantum computing or military use. Europeans would like to continue doing business with the U.S. and China, but it won't be possible because of national security issues. Trade, finance, technology, internet: Everything will split in two.

DER SPIEGEL: In Germany, there is a dispute right now about whether parts of the Port of Hamburg should be sold to the Chinese state-owned company Cosco. What would your advice be?

Roubini: You have to think about what the purpose of such a deal is. Germany has already made a big mistake by relying on energy from Russia. China, of course, is not going to take over German ports militarily, as it could in Asia and Africa. But the only economic argument for this kind of agreement would be that we could strike back once European factories are seized in China. Otherwise, it's not a very smart idea.

DER SPIEGEL: You warn that Russia and China are trying to build an alternative to the dollar and the SWIFT system. But the two countries have failed so far.

Roubini: It's not just about payment systems. China is going around the world selling subsidized 5G technologies that can be used for spying. I asked the president of an African country why he gets 5G technology from China and not from the West. He told me, we are a small country, so someone will spy on us anyway. Then, I might as well take the Chinese technology, it's cheaper. China is growing its economic, financial and trading power in many parts of the world.

DER SPIEGEL: But will the Chinese renminbi really replace the dollar in the long run?

Roubini: It will take time, but the Chinese are good at thinking long term. They have suggested to the Saudis that they price and charge for the oil they sell them in renminbi. And they have more sophisticated payment systems than anyone else in the world. Alipay and WeChat pay are used by a billion Chinese every day for billions of transactions. In Paris, you can already shop at Louis Vuitton with WeChat pay.

DER SPIEGEL: In the 1970s, we also had an energy crisis, high inflation and stagnant growth, so-called stagflation. Are we experiencing something similar now?

Roubini: It is worse today. Back then, we didn't have as much public and private debt as we do today. If central banks raise interest rates now to fight inflation, it will lead to the bankruptcy of many »zombie« companies, shadow banks and government institutions. Besides, the oil crisis was caused by a few geopolitical shocks then, there are more today. And just imagine the impact of a Chinese attack on Taiwan, which produces 50 percent of all semiconductors in the world, and 80 percent of the high-end ones. That would be a global shock. We depend more on semiconductors today than on oil.

DER SPIEGEL: You are very critical of central bankers and their lax monetary policy. Is there any central bank that gets it right these days?

Roubini: They are damned either way. Either they fight inflation with high policy rates and cause a hard landing for the real economy and the financial markets. Or they wimp out and blink, don't raise rates and inflation keeps rising. I think the Fed and the ECB will blink – as the Bank of England has already done.

DER SPIEGEL: On the other hand, high inflation rates can also be helpful because they simply inflate the debt away.

Roubini: Yes, but they also make new debt more expensive. Because when inflation rises, lenders charge higher interest rates. One example: If inflation goes from 2 to 6 percent, then U.S. government bond rates will have to go from 4 to 8 percent to keep bringing the same yield; and private borrowing costs for mortgages and business loans will be even higher. This makes it much more expensive for many companies, because they have to offer much higher interest rates than government bonds, which are considered safe. We have so much debt right now that something like this could lead to a total economic, financial and monetary collapse. And we're not even talking about hyperinflation like in the Weimar Republic, just single digit inflation.

DER SPIEGEL: The overriding risk you describe in your book is climate change. Isn't rising debt secondary in light of the possible consequences of a climate catastrophe?

Roubini: We have to worry about everything at the same time, as all these megathreats are interconnected. One example: Right now, there is no way to significantly reduce CO2 emissions without shrinking the economy. And even though 2020 was the worst recession in 60 years, green house gas emissions only fell by 9 percent. But without strong economic growth, we will not be able to solve the debt problem. So, we have to find ways to grow without emissions.

DER SPIEGEL: Given all these parallel crises: How do you assess the chances of democracy surviving against authoritarian systems like in China or Russia

Roubini: I am worried. Democracies are fragile when there are big shocks. There is always some macho man then who says »I will save the country« and who blames everything on the foreigners. That's exactly what Putin did with Ukraine. Erdogan could do the same thing with Greece next year and try to create a crisis because otherwise he might lose the election. If Donald Trump runs again and loses the election, he could openly call on white supremacists to storm the Capitol this time. We could see violence and a real civil war in the U.S. In Germany, things look comparatively good for now. But what happens if things go wrong economically and people vote more for the right-wing opposition?

DER SPIEGEL. You have become known not only as the crash prophet, but also as a party animal. Do you still feel like partying these days?

Roubini: I always hosted art, culture, and book salons, not just social events. And during the pandemic I rediscovered my Jewish roots. Today, I prefer to invite 20 people to a Shabbat dinner with a nice ceremony and live music. Or we do an evening event where I ask a serious question and everyone has to answer. Deep conversations about life and the world at large, not chitchat. We should enjoy life, but also do our bit to save the world.

DER SPIEGEL: What do you mean?

Roubini: All of our carbon footprints are much too big. A significant part of all greenhouse gas emissions alone come from livestock farming. That's why I became a pescatarian and gave up on meat, including chicken.

DER SPIEGEL: You used to be famous for being on the road for three-quarters of the year.

Roubini: I still do travel nonstop. But I will tell you one thing: I love New York. During the pandemic, I didn't flee to the Hamptons or Miami like many others. I stayed here, I saw the Black Lives Matter demonstrations, I volunteered to help the homeless. I saw daily the desperation of many artist friends who lost jobs and incomes and couldn’t afford their rent. And even if there is another hurricane like Sandy in New York that could lead to violence and chaos, I will stay. We have to face the world as it is. Even if there is a nuclear confrontation. Because then the first bomb would fall on New York and the next one on Moscow.

Economist Nouriel Roubini, who’s been dubbed ‘Dr. Doom’ for his gloomy-yet-correct prediction of the 2008 market meltdown, is making headlines again during a series of interviews promoting his new book “Megathreats”.

“We have to worry about everything at the same time, as all these megathreats are interconnected…”

When asked if we’re “there again” in reference to the 2008 great financial crisis, Roubini replied: “Yes, we’re here again.”

“But in addition to the economic, monetary, and financial risks – and there are new ones – now we’re going towards stagflation like we’ve never seen since the 1970s.”

Private and public debt levels globally have exploded from 200 percent of GDP in 2000 to around 350 percent of GDP today, he said, blaming ultra-loose central bank policies that made borrowing cheap and encouraged households, businesses, and countries to take on ever greater debt loads even though many were barely solvent.

But now, facing persistently high inflation, central banks led by the Fed have embarked on aggressive rate hiking cycles, with Roubini predicting that highly indebted and operationally fragile “zombie” institutions are going to go bankrupt.

“That’s why we’re not only going to have inflation and stagflation but we’ll have a stagflationary debt crisis,” Roubini predicted.

In the 1970s, debt levels were far lower than today and so advanced economies didn’t suffer debt crises when the Fed jacked up rates to around 20 percent.

“Today we have the worst of the 70s with a massive amount of stagflationary negative supply shock,” he added.

Roubini has called predictions for a brief and mild U.S. recession “delusional.”

[embedded content]

He told Bloomberg in an interview at the end of July that he expects the United States to be hit by a “severe recession and a severe debt and financial crisis.”

Roubini said that, in addition to economic, monetary, and financial risks currently in play, the world faces higher geopolitical risks.

During an extensive interview with Der Spiegel, the economist said he preferred “Dr. Realist” as he detailed some of the world’s most acute problems.

When speaking about major global threats, Roubini mentioned the ongoing conflict between Russia and Ukraine, adding that Iran and Israel are “on a collision course” as well.

“It is already happening. The U.S. has just passed new regulations banning the export of semiconductors to Chinese companies for AI or quantum computing or military use. Europeans would like to continue doing business with the U.S. and China, but it won’t be possible because of national security issues.”

“…just this morning, I read that the Biden administration expects China to attack Taiwan sooner rather than later. Honestly, World War III has already effectively begun, certainly in Ukraine and cyberspace.“

He believes that a breakup of the globalized world is looming.

“Trade, finance, technology, internet: Everything will split in two,” he predicted.

Finally, Roubini said debt levels are higher than they’ve ever been, adding that all this represents a confluence of “mega trends” that he predicts will combine into a stagflationary storm that will engulf many of the world’s economies.

The economist said that the worst possible outcome would be if all eleven “mega trends” materialize and feed on each other, leading to a “dystopian future.”

“It’s not just the end of the world economy… it could be even global war.”

Recalling a recent event hosted by the IMF, Roubini referred to historian Niall Ferguson who “said in a speech there that we would be lucky if we got an economic crisis like in the 1970s — and not a war like in the 1940s.”

After all that, we think ‘Dr. Doom’ remains a more appropriate nickname.

* * *

Read the full Der Spiegel interview below:

DER SPIEGEL: Professor Roubini, you don’t like your nickname “Dr. Doom.” Instead you would like to be called “Dr. Realist.” But in your new book, you describe “ten megathreats” that endanger our future. It doesn’t get much gloomier than that.

Roubini: The threats I write about are real – no one would deny that. I grew up in Italy in the 1960s and 1970s. Back then, I never worried about a war between great powers or a nuclear winter, as we had détente between the Soviet Union and the West. I never heard the words climate change or global pandemic. And no one worried about robots taking over most jobs. We had freer trade and globalization, we lived in stable democracies, even if they were not perfect. Debt was very low, the population wasn’t over-aged, there were no unfunded liabilities from the pension and health care systems. That’s the world I grew up in. And now I have to worry about all these things – and so does everyone else.

DER SPIEGEL: But do they? Or do you feel like a voice crying in the wilderness?

Roubini: I was in Washington at the IMF meeting. The economic historian Niall Ferguson said in a speech there that we would be lucky if we got an economic crisis like in the 1970s – and not a war like in the 1940s. National security advisers were worried about NATO getting involved in the war between Russia and Ukraine and Iran and Israel being on a collision course. And just this morning, I read that the Biden administration expects China to attack Taiwan sooner rather than later. Honestly, World War III has already effectively begun, certainly in Ukraine and cyberspace.

DER SPIEGEL: Politicians seem overwhelmed by the simultaneity of many major crises. What priorities should they set?

Roubini: Of course, they must take care of Russia and Ukraine before they take care of Iran and Israel or China. But policymakers should also think about inflation and recessions, i.e. stagflation. The eurozone is already in a recession, and I think it will be long and ugly. The United Kingdom is even worse. The pandemic seems contained, but new COVID variants could emerge soon. And climate change is a slow-motion disaster that is accelerating. For each of the 10 threats I describe in my book, I can give you 10 examples that are happening as we speak today, not in the distant future. Do you want one on climate change?

DER SPIEGEL: If you must.

Roubini: This summer, there have been droughts all over the world, including in the United States. Near Las Vegas, the drought is so bad that bodies of mobsters from the 1950s have surfaced in the dried-up lakes. In California, farmers are now selling their water rights because it’s more profitable than growing anything. And in Florida, you can’t get insurance for houses on the coast anymore. Half of Americans will have to eventually move to the Midwest or Canada. That’s science, not speculation.

DER SPIEGEL: Another threat you describe is that the U.S. could pressure Europe to limit its business relations with China in order to not endanger the U.S. military presence on the continent. How far are we from that scenario?

Roubini: It is already happening. The U.S. has just passed new regulations banning the export of semiconductors to Chinese companies for AI or quantum computing or military use. Europeans would like to continue doing business with the U.S. and China, but it won’t be possible because of national security issues. Trade, finance, technology, internet: Everything will split in two.

DER SPIEGEL: In Germany, there is a dispute right now about whether parts of the Port of Hamburg should be sold to the Chinese state-owned company Cosco. What would your advice be?

Roubini: You have to think about what the purpose of such a deal is. Germany has already made a big mistake by relying on energy from Russia. China, of course, is not going to take over German ports militarily, as it could in Asia and Africa. But the only economic argument for this kind of agreement would be that we could strike back once European factories are seized in China. Otherwise, it’s not a very smart idea.

DER SPIEGEL: You warn that Russia and China are trying to build an alternative to the dollar and the SWIFT system. But the two countries have failed so far.

Roubini: It’s not just about payment systems. China is going around the world selling subsidized 5G technologies that can be used for spying. I asked the president of an African country why he gets 5G technology from China and not from the West. He told me, we are a small country, so someone will spy on us anyway. Then, I might as well take the Chinese technology, it’s cheaper. China is growing its economic, financial and trading power in many parts of the world.

DER SPIEGEL: But will the Chinese renminbi really replace the dollar in the long run?

Roubini: It will take time, but the Chinese are good at thinking long term. They have suggested to the Saudis that they price and charge for the oil they sell them in renminbi. And they have more sophisticated payment systems than anyone else in the world. Alipay and WeChat pay are used by a billion Chinese every day for billions of transactions. In Paris, you can already shop at Louis Vuitton with WeChat pay.

DER SPIEGEL: In the 1970s, we also had an energy crisis, high inflation and stagnant growth, so-called stagflation. Are we experiencing something similar now?

Roubini: It is worse today. Back then, we didn’t have as much public and private debt as we do today. If central banks raise interest rates now to fight inflation, it will lead to the bankruptcy of many »zombie« companies, shadow banks and government institutions. Besides, the oil crisis was caused by a few geopolitical shocks then, there are more today. And just imagine the impact of a Chinese attack on Taiwan, which produces 50 percent of all semiconductors in the world, and 80 percent of the high-end ones. That would be a global shock. We depend more on semiconductors today than on oil.

DER SPIEGEL: You are very critical of central bankers and their lax monetary policy. Is there any central bank that gets it right these days?

Roubini: They are damned either way. Either they fight inflation with high policy rates and cause a hard landing for the real economy and the financial markets. Or they wimp out and blink, don’t raise rates and inflation keeps rising. I think the Fed and the ECB will blink – as the Bank of England has already done.

DER SPIEGEL: On the other hand, high inflation rates can also be helpful because they simply inflate the debt away.

Roubini: Yes, but they also make new debt more expensive. Because when inflation rises, lenders charge higher interest rates. One example: If inflation goes from 2 to 6 percent, then U.S. government bond rates will have to go from 4 to 8 percent to keep bringing the same yield; and private borrowing costs for mortgages and business loans will be even higher. This makes it much more expensive for many companies, because they have to offer much higher interest rates than government bonds, which are considered safe. We have so much debt right now that something like this could lead to a total economic, financial and monetary collapse. And we’re not even talking about hyperinflation like in the Weimar Republic, just single digit inflation.

DER SPIEGEL: The overriding risk you describe in your book is climate change. Isn’t rising debt secondary in light of the possible consequences of a climate catastrophe?

Roubini: We have to worry about everything at the same time, as all these megathreats are interconnected. One example: Right now, there is no way to significantly reduce CO2 emissions without shrinking the economy. And even though 2020 was the worst recession in 60 years, green house gas emissions only fell by 9 percent. But without strong economic growth, we will not be able to solve the debt problem. So, we have to find ways to grow without emissions.

DER SPIEGEL: Given all these parallel crises: How do you assess the chances of democracy surviving against authoritarian systems like in China or Russia?

Roubini: I am worried. Democracies are fragile when there are big shocks. There is always some macho man then who says »I will save the country« and who blames everything on the foreigners. That’s exactly what Putin did with Ukraine. Erdogan could do the same thing with Greece next year and try to create a crisis because otherwise he might lose the election. If Donald Trump runs again and loses the election, he could openly call on white supremacists to storm the Capitol this time. We could see violence and a real civil war in the U.S. In Germany, things look comparatively good for now. But what happens if things go wrong economically and people vote more for the right-wing opposition?

DER SPIEGEL. You have become known not only as the crash prophet, but also as a party animal. Do you still feel like partying these days?

Roubini: I always hosted art, culture, and book salons, not just social events. And during the pandemic I rediscovered my Jewish roots. Today, I prefer to invite 20 people to a Shabbat dinner with a nice ceremony and live music. Or we do an evening event where I ask a serious question and everyone has to answer. Deep conversations about life and the world at large, not chitchat. We should enjoy life, but also do our bit to save the world.

DER SPIEGEL: What do you mean?

Roubini: All of our carbon footprints are much too big. A significant part of all greenhouse gas emissions alone come from livestock farming. That’s why I became a pescatarian and gave up on meat, including chicken.

DER SPIEGEL: You used to be famous for being on the road for three-quarters of the year.

Roubini: I still do travel nonstop. But I will tell you one thing: I love New York. During the pandemic, I didn’t flee to the Hamptons or Miami like many others. I stayed here, I saw the Black Lives Matter demonstrations, I volunteered to help the homeless. I saw daily the desperation of many artist friends who lost jobs and incomes and couldn’t afford their rent. And even if there is another hurricane like Sandy in New York that could lead to violence and chaos, I will stay. We have to face the world as it is. Even if there is a nuclear confrontation. Because then the first bomb would fall on New York and the next one on Moscow.