By Michael Msika, Bloomberg Markets Live reporter and strategist

Falling volumes, crushed volatilities and record highs, equity markets seem to price nothing but a rosy outlook. While much has gone right for investors this year, some risks can’t be ignored and deserve attention.

It seems no one wants to be short in this market. Bears are falling like dominoes and positioning is increasing, leaving the market very much one-sided ahead of the Fed minutes and European PMI data, along with the results of the world’s most important stock Nvidia.

Goldman Sachs’ proprietary risk appetite indicator hit its highest level since 2021, which is indicative of lower returns in the medium term, according to strategists including Andrea Ferrario. Volatility structure suggests markets are pricing less risk of a sustained drawdown from here but are worried about temporary spikes in volatility - with high market concentration, idiosyncratic events can also matter, such as Nvidia’s results, they add.

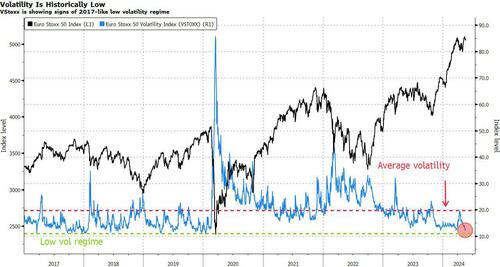

Looking at the volatility curve, very short dated implied volatilities are now trading at the sub-10 point level, a significant decline at the front end. This suggests market is pricing nothing but calm over the coming days.

“As equity vol approaches post-Covid lows, investors may be wondering how far we are from a return to 2017‘s record low vol regime,” say Bank of America derivatives strategists including Vittoria Volta. “Structurally higher idiosyncratic risk today vs 2017, a market arguably at risk of disappointment by the pace of ECB cuts anticipated for the second half of the year, coupled with spillover from US megacap tech fragility, could keep EU stock vol supported through the summer.”

The strategists note that Euro Stoxx 50 skew is flat versus post-Covid history but not quite at 2017 extremes, term structure is steep but not ‘2017 steep’. Meanwhile, 3-month realized index correlation is at 2017 record-low but single stock realized vol is still relatively far. Finally, volatility tends to be supported into the fall during low vol years, they say.

Index future positioning ahead of these events has continued to increase, especially on US equities, as exposure to Europe was already hovering at extreme levels and was slightly trimmed, according to Citigroup data. Separately, Goldman’s derivatives desk points out that single stock put/call skew suggests positioning is 9.5 out of 10, while Deutsche Bank strategists estimate CTAs’ exposure to global stocks are in the 91st percentile. CTA, also known as trend followers, are future funds chasing momentum and can flip positions fast, which can spur volatility episodes.

“Bullish positioning levels continue to rise for the S&P and Nasdaq,” say Citi quantitative strategists including Chris Montagu. “Last week’s activity was led by increased new risk flows. This leaves the S&P extended and almost exclusively one-sided.”

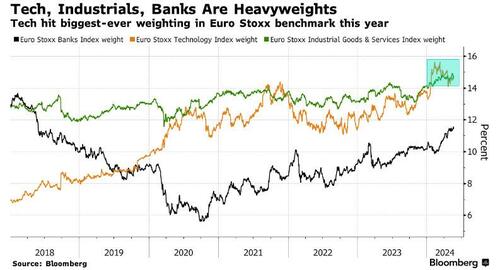

Nvidia’s results are going to be interesting and likely have an impact on the overall market. Expectations are high after a nearly 550% surge in share price and earnings forecasts since the start of 2023. The stock has accounted for about a quarter of the S&P 500’s 11% returns this year and boosted sentiment for tech globally. Tech is the second best performing sector in Europe and has the largest weight in the euro-area benchmark Euro Stoxx index at 15%.

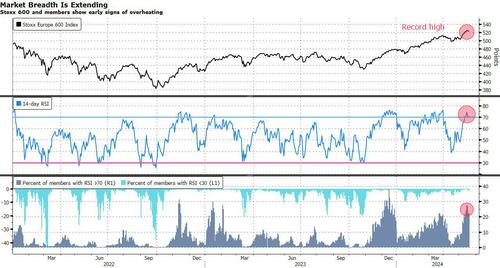

“We note the Stoxx 600 has been flirting around short-term overbought territory of late with five sectors — banks, telecoms, personal care, staples and energy — currently screening that way,” says Carl Dooley, head of EMEA trading at TD Rowen. “That, combined with a lighter volume tape to start the week contributing to what feels like a buyer’s pause.”

By Michael Msika, Bloomberg Markets Live reporter and strategist

Falling volumes, crushed volatilities and record highs, equity markets seem to price nothing but a rosy outlook. While much has gone right for investors this year, some risks can’t be ignored and deserve attention.

It seems no one wants to be short in this market. Bears are falling like dominoes and positioning is increasing, leaving the market very much one-sided ahead of the Fed minutes and European PMI data, along with the results of the world’s most important stock Nvidia.

Goldman Sachs’ proprietary risk appetite indicator hit its highest level since 2021, which is indicative of lower returns in the medium term, according to strategists including Andrea Ferrario. Volatility structure suggests markets are pricing less risk of a sustained drawdown from here but are worried about temporary spikes in volatility – with high market concentration, idiosyncratic events can also matter, such as Nvidia’s results, they add.

Looking at the volatility curve, very short dated implied volatilities are now trading at the sub-10 point level, a significant decline at the front end. This suggests market is pricing nothing but calm over the coming days.

“As equity vol approaches post-Covid lows, investors may be wondering how far we are from a return to 2017‘s record low vol regime,” say Bank of America derivatives strategists including Vittoria Volta. “Structurally higher idiosyncratic risk today vs 2017, a market arguably at risk of disappointment by the pace of ECB cuts anticipated for the second half of the year, coupled with spillover from US megacap tech fragility, could keep EU stock vol supported through the summer.”

The strategists note that Euro Stoxx 50 skew is flat versus post-Covid history but not quite at 2017 extremes, term structure is steep but not ‘2017 steep’. Meanwhile, 3-month realized index correlation is at 2017 record-low but single stock realized vol is still relatively far. Finally, volatility tends to be supported into the fall during low vol years, they say.

Index future positioning ahead of these events has continued to increase, especially on US equities, as exposure to Europe was already hovering at extreme levels and was slightly trimmed, according to Citigroup data. Separately, Goldman’s derivatives desk points out that single stock put/call skew suggests positioning is 9.5 out of 10, while Deutsche Bank strategists estimate CTAs’ exposure to global stocks are in the 91st percentile. CTA, also known as trend followers, are future funds chasing momentum and can flip positions fast, which can spur volatility episodes.

“Bullish positioning levels continue to rise for the S&P and Nasdaq,” say Citi quantitative strategists including Chris Montagu. “Last week’s activity was led by increased new risk flows. This leaves the S&P extended and almost exclusively one-sided.”

Nvidia’s results are going to be interesting and likely have an impact on the overall market. Expectations are high after a nearly 550% surge in share price and earnings forecasts since the start of 2023. The stock has accounted for about a quarter of the S&P 500’s 11% returns this year and boosted sentiment for tech globally. Tech is the second best performing sector in Europe and has the largest weight in the euro-area benchmark Euro Stoxx index at 15%.

“We note the Stoxx 600 has been flirting around short-term overbought territory of late with five sectors — banks, telecoms, personal care, staples and energy — currently screening that way,” says Carl Dooley, head of EMEA trading at TD Rowen. “That, combined with a lighter volume tape to start the week contributing to what feels like a buyer’s pause.”

Loading…