Authored by Simon White, Bloomberg macro strategist,

The next US downturn is primed to wrong-foot investors as stocks, bonds and commodities trade markedly differently than in a regular, non-inflationary recession.

Stocks and commodities lower, bonds higher.

That’s probably what most people would expect to happen in a slump.

But historically in inflationary recessions, nominal returns of stocks mask the true damage done to equity portfolios; bonds rise in nominal terms, but in real terms they start selling off long before the recession begins; and commodities don’t fall in price, they rally.

Life without heuristics would be ferociously complicated. Trying to figure out each situation from scratch without reference to previous experience would slow us down to the point of paralysis. That’s why heuristics – mental shortcuts – are essential.

But when they are not tweaked to sufficiently suit the current situation they can become counter-productive, or worse when it comes to investing: highly detrimental to your (or your clients’) wealth.

-

First of all, the market continues to underestimate the likelihood of a recession. Manufacturing, GDI, slumping services, weak leading economic indicators, and jobs data subject to significant downwards revisions are either already recessionary or looking more so.

-

Secondly, there are several indications that inflation will soon begin rising again. Thus not only is there a much better-than-even chance of a near-term recession, it is likely to be the first one for decades accompanied by elevated and rising inflation. Unfortunately, recency bias is liable to lead many to reach the conclusion the next recession will not be that much different to the downturns of recent years (ex the very singular pandemic recession).

But in inflationary recessions, money illusion obscures what is really happening.

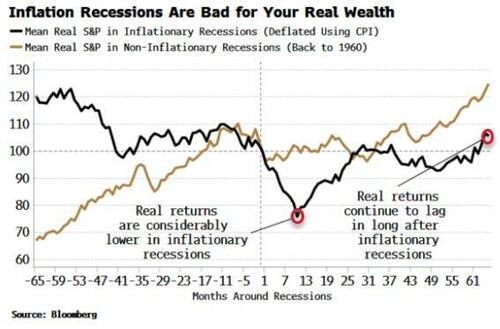

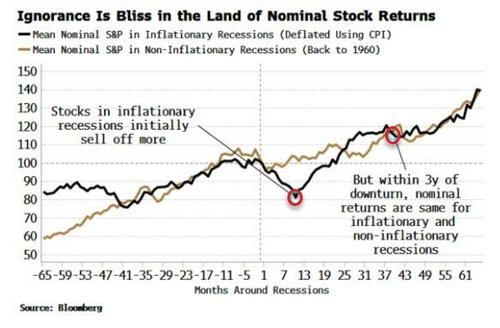

For stocks, in nominal terms they typically sell off more through an inflationary recession. Yet within a few years, nominal returns in inflationary and non-inflationary recessions become indistinguishable.

In real terms, though, when inflation is elevated stocks sell off more before the recession and after it. Further, real returns continue to lag the real returns in non-inflationary recessions several years after the downturn’s onset. You’re poorer for longer.

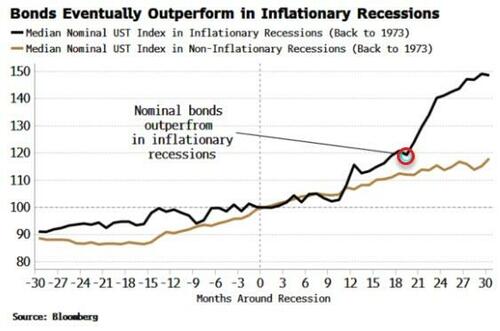

Bonds typically rally in a recession. But again, differentiating between nominal and real returns is crucial. In nominal terms, bonds perform the same over the first 9-12 months after either type of recession begins, but thereafter rise by more in inflationary recessions.

Why? When inflation is elevated, bonds start to become more attractive relative to equities, as the coupon on a bond can be re-negotiated on the maturity date, unlike a stock which is de facto of infinite duration. In other words, when inflation is high investors start to prize greater certainty, which a bond has increasingly more of the closer you approach the repayment day.

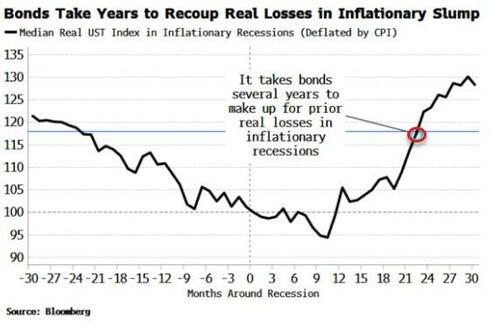

Nonetheless, money illusion once again makes returns look better than they really are. In real terms, bonds typically sell off before the inflationary recession begins, and continue to sell off after it. It takes several years before an investor recovers their real losses, even though nominally they have had made money.

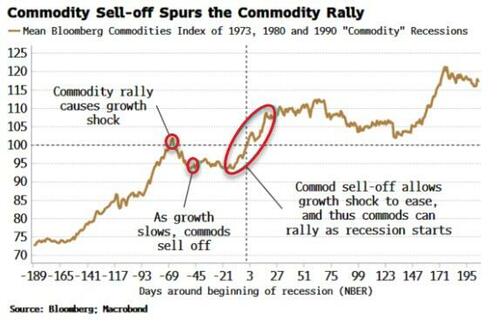

Commodities, too, are unlikely to behave the same way in the next recession. Typically in downturns caused by a commodity shock, the shock to growth causes commodities to sell off before the recession, easing the ultimate impact on the economy.

But commodities are sensitive to the level of demand, not its rate of growth, therefore they can rally if the recession is less bad than feared. We can see from the chart below this is historically what has happened.

The commodity shock in 2020-22 will be the ultimate cause of the next downturn. We may have already experienced the pre-recessionary selloff in the 23% fall in commodity prices we have seen since last summer.

Either way, commodities have been rallying, boosted by supportive conditions in excess liquidity. A recession – if the past is a guide – won’t be enough to stop them from continuing to do so.

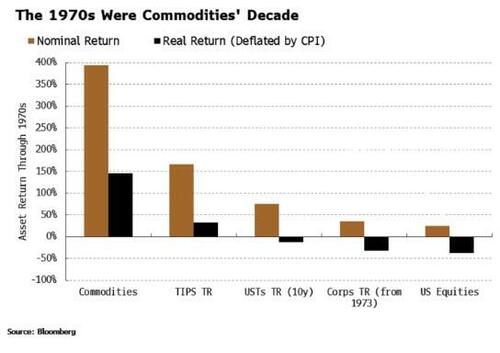

This is not just a nominal phenomenon; commodities typically are the best-performing asset class in real terms when inflation is elevated. Through the 1970s – a decade pock-marked with high inflation, stagnant growth and a deep recession – commodities were the only major asset class to deliver a significantly positive real return.

As someone once quipped, the past is a foreign country, they do things differently there. One of which is not treating real and nominal returns as synonymous.

If present-day investors wish to preserve the (real value) of their wealth, they need to do likewise, and jettison heuristics that will likely prove to be outmoded in the next recession.

Authored by Simon White, Bloomberg macro strategist,

The next US downturn is primed to wrong-foot investors as stocks, bonds and commodities trade markedly differently than in a regular, non-inflationary recession.

Stocks and commodities lower, bonds higher.

That’s probably what most people would expect to happen in a slump.

But historically in inflationary recessions, nominal returns of stocks mask the true damage done to equity portfolios; bonds rise in nominal terms, but in real terms they start selling off long before the recession begins; and commodities don’t fall in price, they rally.

Life without heuristics would be ferociously complicated. Trying to figure out each situation from scratch without reference to previous experience would slow us down to the point of paralysis. That’s why heuristics – mental shortcuts – are essential.

But when they are not tweaked to sufficiently suit the current situation they can become counter-productive, or worse when it comes to investing: highly detrimental to your (or your clients’) wealth.

-

First of all, the market continues to underestimate the likelihood of a recession. Manufacturing, GDI, slumping services, weak leading economic indicators, and jobs data subject to significant downwards revisions are either already recessionary or looking more so.

-

Secondly, there are several indications that inflation will soon begin rising again. Thus not only is there a much better-than-even chance of a near-term recession, it is likely to be the first one for decades accompanied by elevated and rising inflation. Unfortunately, recency bias is liable to lead many to reach the conclusion the next recession will not be that much different to the downturns of recent years (ex the very singular pandemic recession).

But in inflationary recessions, money illusion obscures what is really happening.

For stocks, in nominal terms they typically sell off more through an inflationary recession. Yet within a few years, nominal returns in inflationary and non-inflationary recessions become indistinguishable.

In real terms, though, when inflation is elevated stocks sell off more before the recession and after it. Further, real returns continue to lag the real returns in non-inflationary recessions several years after the downturn’s onset. You’re poorer for longer.

Bonds typically rally in a recession. But again, differentiating between nominal and real returns is crucial. In nominal terms, bonds perform the same over the first 9-12 months after either type of recession begins, but thereafter rise by more in inflationary recessions.

Why? When inflation is elevated, bonds start to become more attractive relative to equities, as the coupon on a bond can be re-negotiated on the maturity date, unlike a stock which is de facto of infinite duration. In other words, when inflation is high investors start to prize greater certainty, which a bond has increasingly more of the closer you approach the repayment day.

Nonetheless, money illusion once again makes returns look better than they really are. In real terms, bonds typically sell off before the inflationary recession begins, and continue to sell off after it. It takes several years before an investor recovers their real losses, even though nominally they have had made money.

Commodities, too, are unlikely to behave the same way in the next recession. Typically in downturns caused by a commodity shock, the shock to growth causes commodities to sell off before the recession, easing the ultimate impact on the economy.

But commodities are sensitive to the level of demand, not its rate of growth, therefore they can rally if the recession is less bad than feared. We can see from the chart below this is historically what has happened.

The commodity shock in 2020-22 will be the ultimate cause of the next downturn. We may have already experienced the pre-recessionary selloff in the 23% fall in commodity prices we have seen since last summer.

Either way, commodities have been rallying, boosted by supportive conditions in excess liquidity. A recession – if the past is a guide – won’t be enough to stop them from continuing to do so.

This is not just a nominal phenomenon; commodities typically are the best-performing asset class in real terms when inflation is elevated. Through the 1970s – a decade pock-marked with high inflation, stagnant growth and a deep recession – commodities were the only major asset class to deliver a significantly positive real return.

As someone once quipped, the past is a foreign country, they do things differently there. One of which is not treating real and nominal returns as synonymous.

If present-day investors wish to preserve the (real value) of their wealth, they need to do likewise, and jettison heuristics that will likely prove to be outmoded in the next recession.

Loading…