A quick glimpse at the the Japanese Yen's price action (against the USD) since the BoJ 's decision to hike rates for the first time in 17 years and one could be forgiven for being confused as the 'hawkish' move has prompted aggressive 'dovish' weakening of the currency, However, as a reminder, this was one of the most dovish rate-hike we've seen with endless promises of support if the SHTF and continued JGB buying (despite ending YCC).

Even more notably, the risk of intervention by Japanese officials in the spot market could cap expectations for any further weakness:

“The current weakening of the yen is not in line with fundamentals and is clearly driven by speculation,” vice finance minister for international affairs Masato Kanda told reporters Monday.

“We will take appropriate action against excessive fluctuations, without ruling out any options.”

“We are always prepared,” Kanda said when asked about a possible direct intervention in the currency market.

USDJPY is testing level that saw significant interventions to support the Yen (green ovals below) in Sept/Oct 2022...

Source: Bloomberg

Kanda’s warnings on the currency were his first since February.

“We have seen a large fluctuation of 4% in just two weeks in the dollar-yen, a move that isn’t reflecting fundamentals and I find this unusual,” Kanda said.

It's always the speculators that get the blame (and in this case there are sizable short spec positions).

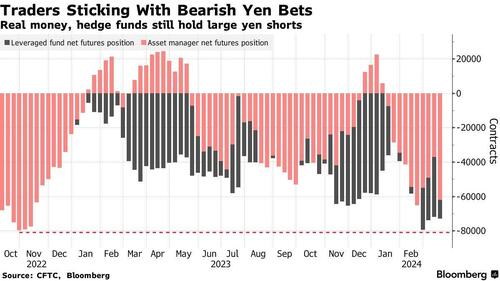

Bloomberg reports that hedge funds ramped up bearish yen wagers in the week stretching through the BOJ’s March meeting. Leveraged speculators in the currency market increased their holdings of contracts tied to bets the yen will fall to 80,805, approaching the six-year high of 83,562 reached last month, according to data through March 19 from the Commodity Futures Trading Commission.

Source: Bloomberg

The irony here, of course, is that quietly behind the scenes, Japanese officials wouldn't mind a weaker Yen, to juice the economy somewhat, although the more the yen drops, the higher the imported inflation, the more the BOJ will have to hike to contain it, and so on.

“The tone of verbal intervention is intensifying and the yen may draw short-term support amid growing risk of real action,” said Takeshi Ishida, a strategist at Resona Holdings Inc. in Tokyo.

“Kanda acknowledges the move is speculative and seems to pay close attention to the 152 line for the currency pair.”

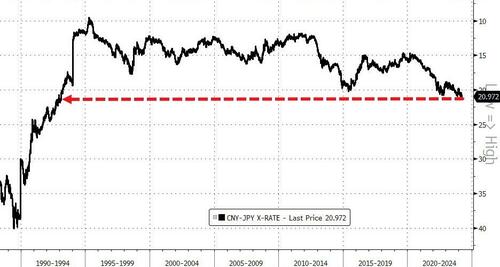

But this is not a unilateral game and the weakness in the Japanese yen appears to have worried Chinese authorities given the two countries’ “competitive export business,” according to Saxo Markets.

The yen is at a 30-year low against the renminbi...

Source: Bloomberg

“I do think JPY has been the biggest concern for Chinese authorities for now,” says Charu Chanana, head of FX strategy in Singapore.

“If the USD/JPY broke above 152, we could likely see the PBOC letting the onshore yuan weaken further towards 7.25.”

PBOC does not have a steady weakening bias for the yuan for now; market’s reaction to Friday’s weak fix likely “alerted authorities against playing this game”

“Too must bearishness isn’t good for a currency that has goals to be the reserve currency.”

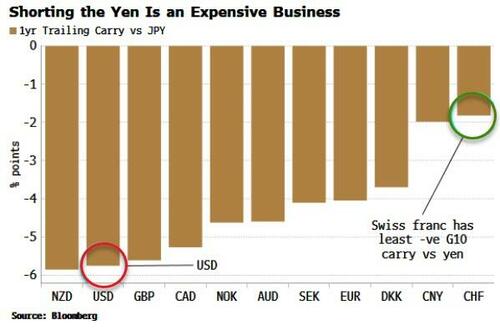

Of course, much of the recent movement in USDJPY has been driven by the lass-dovish sentiment from The Fed (stronger dollar, rather than weaker yen) and we also note that despite the rate-hike by The BoJ, the yen-carry trade (which implicitly weighs on the yen versus the dollar) continues to offer solid returns (among the highest among the majors)...

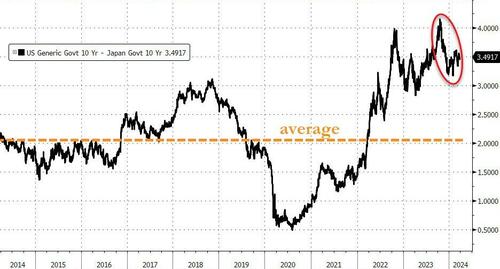

And while the 10Y TSY yield is 50bps or so off its highs relative to 10Y JGBs, it remains extremely high relative to the last decade...

However, the cost of 100% hedging the FX risk makes the switch still unpalatable...

For now, Japanese investors may refrain from repatriating capital until the central bank becomes more hawkish, or the Fed gets closer to cutting rates.

So while USDJPY may be all about trading familiar ranges for the foreseeable future, in the longer run it is going much lower.

A quick glimpse at the the Japanese Yen’s price action (against the USD) since the BoJ ‘s decision to hike rates for the first time in 17 years and one could be forgiven for being confused as the ‘hawkish’ move has prompted aggressive ‘dovish’ weakening of the currency, However, as a reminder, this was one of the most dovish rate-hike we’ve seen with endless promises of support if the SHTF and continued JGB buying (despite ending YCC).

Even more notably, the risk of intervention by Japanese officials in the spot market could cap expectations for any further weakness:

“The current weakening of the yen is not in line with fundamentals and is clearly driven by speculation,” vice finance minister for international affairs Masato Kanda told reporters Monday.

“We will take appropriate action against excessive fluctuations, without ruling out any options.”

“We are always prepared,” Kanda said when asked about a possible direct intervention in the currency market.

USDJPY is testing level that saw significant interventions to support the Yen (green ovals below) in Sept/Oct 2022…

Source: Bloomberg

Kanda’s warnings on the currency were his first since February.

“We have seen a large fluctuation of 4% in just two weeks in the dollar-yen, a move that isn’t reflecting fundamentals and I find this unusual,” Kanda said.

It’s always the speculators that get the blame (and in this case there are sizable short spec positions).

Bloomberg reports that hedge funds ramped up bearish yen wagers in the week stretching through the BOJ’s March meeting. Leveraged speculators in the currency market increased their holdings of contracts tied to bets the yen will fall to 80,805, approaching the six-year high of 83,562 reached last month, according to data through March 19 from the Commodity Futures Trading Commission.

Source: Bloomberg

The irony here, of course, is that quietly behind the scenes, Japanese officials wouldn’t mind a weaker Yen, to juice the economy somewhat, although the more the yen drops, the higher the imported inflation, the more the BOJ will have to hike to contain it, and so on.

“The tone of verbal intervention is intensifying and the yen may draw short-term support amid growing risk of real action,” said Takeshi Ishida, a strategist at Resona Holdings Inc. in Tokyo.

“Kanda acknowledges the move is speculative and seems to pay close attention to the 152 line for the currency pair.”

But this is not a unilateral game and the weakness in the Japanese yen appears to have worried Chinese authorities given the two countries’ “competitive export business,” according to Saxo Markets.

The yen is at a 30-year low against the renminbi…

Source: Bloomberg

“I do think JPY has been the biggest concern for Chinese authorities for now,” says Charu Chanana, head of FX strategy in Singapore.

“If the USD/JPY broke above 152, we could likely see the PBOC letting the onshore yuan weaken further towards 7.25.”

PBOC does not have a steady weakening bias for the yuan for now; market’s reaction to Friday’s weak fix likely “alerted authorities against playing this game”

“Too must bearishness isn’t good for a currency that has goals to be the reserve currency.”

Of course, much of the recent movement in USDJPY has been driven by the lass-dovish sentiment from The Fed (stronger dollar, rather than weaker yen) and we also note that despite the rate-hike by The BoJ, the yen-carry trade (which implicitly weighs on the yen versus the dollar) continues to offer solid returns (among the highest among the majors)…

And while the 10Y TSY yield is 50bps or so off its highs relative to 10Y JGBs, it remains extremely high relative to the last decade…

However, the cost of 100% hedging the FX risk makes the switch still unpalatable…

For now, Japanese investors may refrain from repatriating capital until the central bank becomes more hawkish, or the Fed gets closer to cutting rates.

So while USDJPY may be all about trading familiar ranges for the foreseeable future, in the longer run it is going much lower.

Loading…