Iranian-backed Houthi attacks in the Red Sea and Gulf of Aden continue ramping up, with two more incident reports in under 12 hours (as of 0800 ET) on Sunday morning. In oil markets, traders ignore broader conflict risks in the Middle East as the Gaza war may soon spill over into Lebanon. If further escalation is realized, then expect increased drone and missile attacks on commercial vessels sailing through critical maritime chokepoints in the Middle East, where trillions of dollars in global trade flows each year.

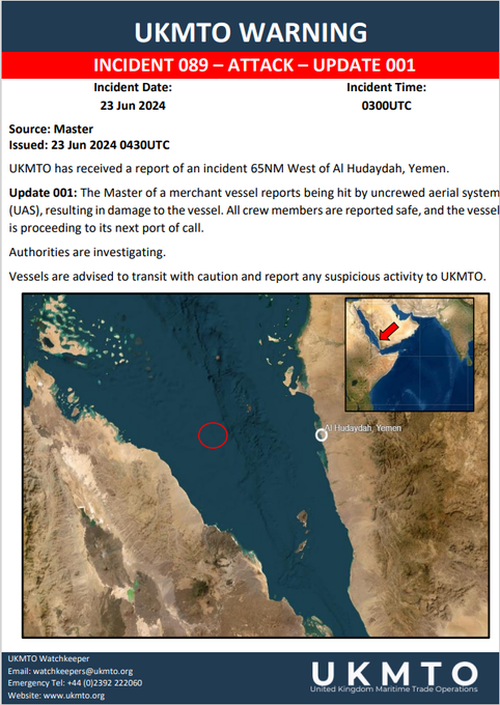

Let's begin with the first incident reported by the United Kingdom Maritime Trade Operations (UKMTO) on X. Just after midnight, they detailed in a report that an "uncrewed aerial system" hit a commercial vessel about 65 nautical miles west of Yemen's Hodeidah in the southern Red Sea, resulting in "damage."

"All crew members are reported safe, and the vessel is proceeding to its next port of call," UKMTO said.

Separately, Reuters quoted British security firm Ambrey as saying the damaged vessel is a "Liberia-flagged fully cellular container ship." The firm did not provide the vessel's name.

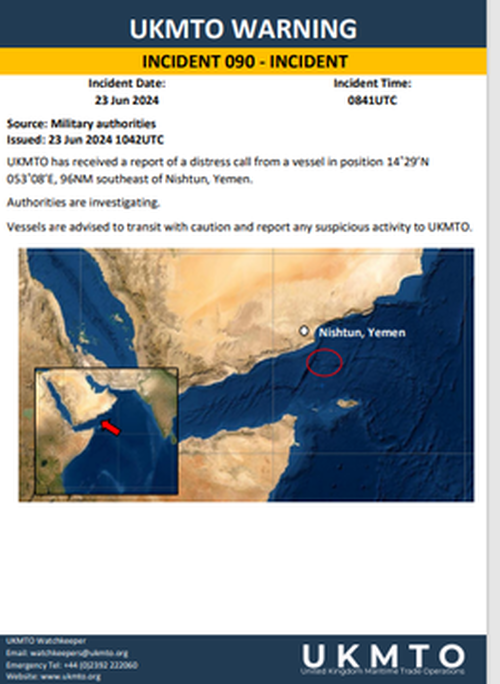

According to UKMTO, the second incident occurred just hours ago with a "distress call from a vessel" located 96 nautical miles southeast of Nishtun, Yemen, in the Gulf of Aden.

UKMTO is currently investigating, and details are limited.

The suspected Houthi attacks come after the sinking of the commodity-hauling bulk carrier "Tutor" last week. The use of a kamikaze drone boat marked what appeared to be a new escalation in attacks on the critical shipping lane.

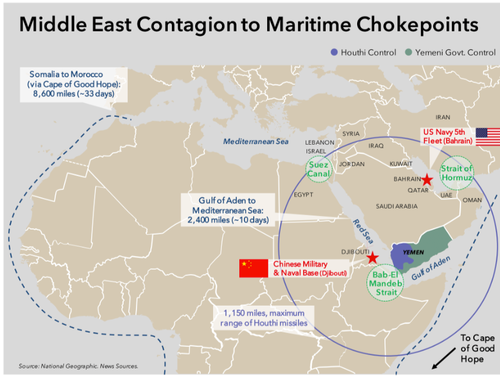

The rebel group has been launching drone and missile strikes on Western-linked commercial vessels sailing through or near the Bab-el-Mandeb Strait since November. Rebels say it's in solidarity with Palestinians in Israel's war with Hamas militants in Gaza.

On Sunday, Israeli Defence Minister Yoav Gallant said in a statement ahead of his Washington trip that the next phase of the Gaza conflict could broaden into Lebanon.

"We are prepared for any action that may be required in Gaza, Lebanon, and in more areas," Gallant said in a statement, who was quoted by Reuters.

Meanwhile, AP News said that thousands of fighters from Iran-backed groups in the Middle East are preparing to flood Lebanon to join Hezbollah if further conflict breaks out.

An expanding conflict in the Gaza war will almost guarantee Houthis or other Iran-backed groups will ramp up attacks on commercial vessels across critical maritime chokepoints, including Bab-El Mandeb Strait and the Strait of Hormuz. Analysts from MUFG Bank pointed out these risks earlier this year.

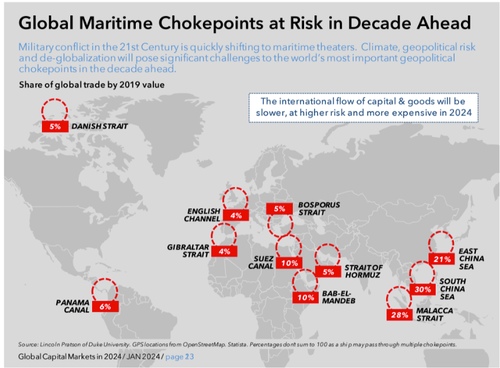

MUFG analysts showed that 25% of global trade flows through three chokepoints: the Suez Canal, the Bab-El Mandeb Strait, and the Strait of Hormuz. This means the global economy is at serious risk of a supply shock if wider conflict breaks out.

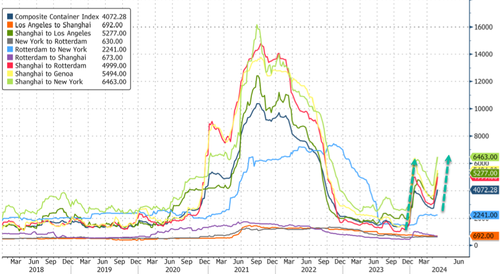

Already, global shipping companies have rerouted vessels around the Cape of Good Hope, straining containerized shipping capacity, which has, in turn, catapulted shipping costs higher.

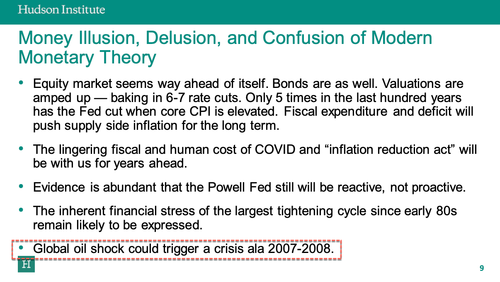

One fear that David Asher, a senior fellow at Hudson Institute, has is Iran weaponizing crude against the US economy if conflict broadens in the Middle East. He recently wrote in a note, "Iran is Preparing For Oil War: Markets Ignore Growing Risk," and a "Global oil shock could trigger a crisis ala 2007-2008."

Asher's note was prepared earlier this year.

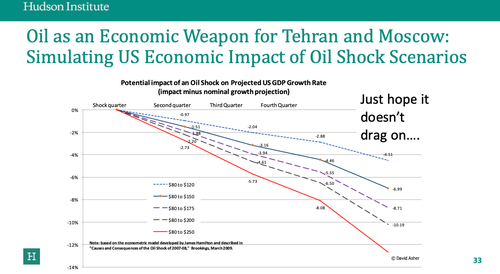

Asher pointed out in this slide that Tehran could use oil as an economic weapon against the West.

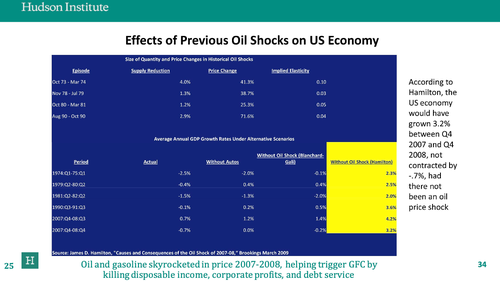

Consider the economic impacts of previous oil shocks...

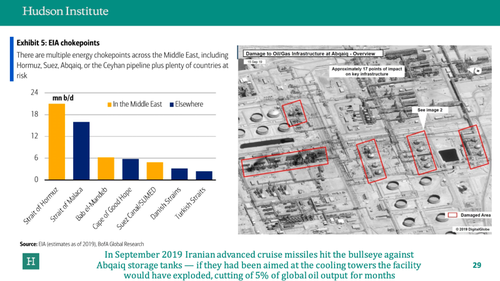

If Houthi rebels start targeting key oil facilities in Saudi Arabia, then expect Brent crude to be well over $100/bbl.

All eyes are on the Middle East.

Iranian-backed Houthi attacks in the Red Sea and Gulf of Aden continue ramping up, with two more incident reports in under 12 hours (as of 0800 ET) on Sunday morning. In oil markets, traders ignore broader conflict risks in the Middle East as the Gaza war may soon spill over into Lebanon. If further escalation is realized, then expect increased drone and missile attacks on commercial vessels sailing through critical maritime chokepoints in the Middle East, where trillions of dollars in global trade flows each year.

Let’s begin with the first incident reported by the United Kingdom Maritime Trade Operations (UKMTO) on X. Just after midnight, they detailed in a report that an “uncrewed aerial system” hit a commercial vessel about 65 nautical miles west of Yemen’s Hodeidah in the southern Red Sea, resulting in “damage.”

“All crew members are reported safe, and the vessel is proceeding to its next port of call,” UKMTO said.

Separately, Reuters quoted British security firm Ambrey as saying the damaged vessel is a “Liberia-flagged fully cellular container ship.” The firm did not provide the vessel’s name.

According to UKMTO, the second incident occurred just hours ago with a “distress call from a vessel” located 96 nautical miles southeast of Nishtun, Yemen, in the Gulf of Aden.

UKMTO is currently investigating, and details are limited.

The suspected Houthi attacks come after the sinking of the commodity-hauling bulk carrier “Tutor” last week. The use of a kamikaze drone boat marked what appeared to be a new escalation in attacks on the critical shipping lane.

The rebel group has been launching drone and missile strikes on Western-linked commercial vessels sailing through or near the Bab-el-Mandeb Strait since November. Rebels say it’s in solidarity with Palestinians in Israel’s war with Hamas militants in Gaza.

On Sunday, Israeli Defence Minister Yoav Gallant said in a statement ahead of his Washington trip that the next phase of the Gaza conflict could broaden into Lebanon.

“We are prepared for any action that may be required in Gaza, Lebanon, and in more areas,” Gallant said in a statement, who was quoted by Reuters.

Meanwhile, AP News said that thousands of fighters from Iran-backed groups in the Middle East are preparing to flood Lebanon to join Hezbollah if further conflict breaks out.

An expanding conflict in the Gaza war will almost guarantee Houthis or other Iran-backed groups will ramp up attacks on commercial vessels across critical maritime chokepoints, including Bab-El Mandeb Strait and the Strait of Hormuz. Analysts from MUFG Bank pointed out these risks earlier this year.

MUFG analysts showed that 25% of global trade flows through three chokepoints: the Suez Canal, the Bab-El Mandeb Strait, and the Strait of Hormuz. This means the global economy is at serious risk of a supply shock if wider conflict breaks out.

Already, global shipping companies have rerouted vessels around the Cape of Good Hope, straining containerized shipping capacity, which has, in turn, catapulted shipping costs higher.

One fear that David Asher, a senior fellow at Hudson Institute, has is Iran weaponizing crude against the US economy if conflict broadens in the Middle East. He recently wrote in a note, “Iran is Preparing For Oil War: Markets Ignore Growing Risk,” and a “Global oil shock could trigger a crisis ala 2007-2008.”

Asher’s note was prepared earlier this year.

Asher pointed out in this slide that Tehran could use oil as an economic weapon against the West.

Consider the economic impacts of previous oil shocks…

If Houthi rebels start targeting key oil facilities in Saudi Arabia, then expect Brent crude to be well over $100/bbl.

All eyes are on the Middle East.

Loading…