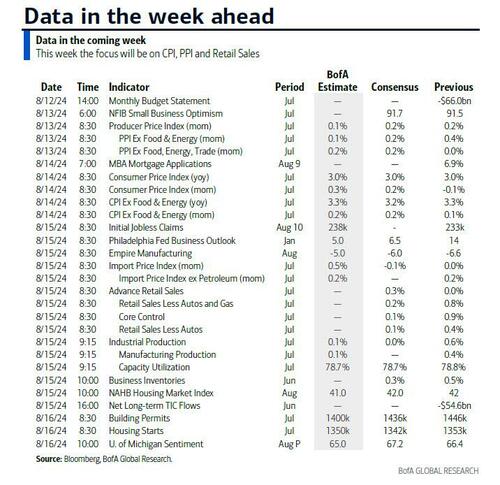

It is a macro-heavy week, and the market's key focus will be on US inflation data, with the July CPI print on Wednesday preceded by the PPI data on Tuesday, followed by Retail Sales on Thursday.

The median economist forecast is for both headline and core CPI to rise +0.20% on the month, which would leave annual headline CPI steady at 3.0%, with core ticking down a tenth to 3.2%. On a monthly basis, this would be an acceleration from the +0.1% core CPI print in June, but with both the three- and six-month annualized rates falling by 40bps to 1.7% and 2.9%, respectively.

In terms of the CPI details, there will be focus on whether the June slowing in rental inflation is sustained. For the PPI on Tuesday, economists see headline PPI gains staying at +0.2% MoM, though PPI components that feed into the Fed’s preferred core PCE measure may leave it running ahead of core CPI for the second month in a row.

The upcoming inflation data will be key for whether the Fed gains confidence to signal more clearly a cut at the September meeting. Over the weekend we heard from Fed Governor Bowman, who commented that “she “will remain cautious in my approach to considering adjustments to the current stance of policy” as "inflation is still uncomfortably above the committee’s 2% goal". So one of the most hawkish FOMC voices sounding not yet convinced on the immediacy of rate cuts.

Speaking of Fed talking heads, several regional Fed presidents are due to speak this week, including Bostic on Tuesday, Musalem and Harker on Thursday and Goolsbee on Friday, so we’ll see if there are any changes in tone in response to the inflation data. We may have to wait until next week’s Jackson Hole symposium for an in depth take on how the Fed is thinking about the expected easing cycle.

Other notable US releases this week will include July retail sales and industrial production on Thursday, which economists expect to grow by +0.4% and shrink -0.3% on the month respectively. These will present some of the first pieces of hard activity data for Q3. We will also have the University of Michigan consumer survey on Friday.

Finally, with earnings season winding down, we will get some more evidence on the health of the US consumer with earnings reports from Home Depot (Tuesday) and Walmart (Thursday) as the earnings season winds down.

A bit of a detour here courtesy of DB's Peter Sidorov who writes that as we start the week, Fed funds futures are pricing 101bps of cuts by year-end, so favoring at least one 50bps cut across the remaining three FOMC meetings. This is down from 138bps at the peak of the market stress last Monday but still well above the 87bps seen prior to the July payrolls print and it is hard to see how such easing would transpire without a material slowing of the economy. While fears of a US recession ticked up in recent weeks amid softer labor market data, activity surveys have largely held up and the Atlanta Fed’s GDPNow currently signals solid 2.9% growth for Q3. Compared to Europe, the US continues to benefit from stronger productivity growth, higher wealth effects and deeper capital markets.

Courtesy of Rabobank and DB, here is a day by day snapshot of what to expect.

Monday: A light day for data. RBA Deputy Governor Andrew Hauser is speaking, China money supply figures will be released, and we will also see building permits for Canada and the New York Fed’s 1-year inflation expectations index.

- Data: US July NY Fed 1-yr inflation expectations, monthly budget statement, Germany June current account balance, July wholesale price index, Canada June building permits, Denmark July CPI

- Earnings: Barrick Gold

Tuesday: Japan PPI and New Zealand net migration are first up, followed by Australia’s wage price index (an important one for RBA watchers) and both business and consumer confidence figures. At the start of the European session we have UK labour market data, followed by the ZEW survey in Germany and then it’s over to the USA for PPI and comments from the Fed’s Raphael Bostic.

- Data: US July PPI, NFIB small business optimism, UK June average weekly earnings, unemployment rate, July jobless claims change, Japan July PPI, machine tool orders, Germany and Eurozone August Zew survey

- Central banks: Fed's Bostic speaks

- Earnings: Home Depot, Asics

Wednesday: The RBNZ policy rate decision is main point of interest early in the day. We think the bank will err on the side of unchanged, but it really is a knife’s edge decision, and the futures see strong odds of a cut. Following that its over to the UK for July CPI (-0.1% m-o-m expected) and then we will get the second read of Q2 GDP for the Eurozone. The key release of the day (and the week) is the US CPI report, where prices are expected to have risen by 0.2% m-o-m on both headline and core readings.

- Data: US July CPI, UK July CPI, RPI, PPI, June house price index, Eurozone Q2 GDP, employment, June industrial production, Sweden July CPI

- Central banks: RBNZ decision

- Earnings: Cisco, Tencent, RWE, Vestas

Thursday: RBNZ Governor Orr will appear before the Kiwi parliament, and we will also see July card spending and food price data for New Zealand in the early morning. Following that is Japan Q2 GDP, the PBOC’s 1-year MLF decision, Aussie labour market figures for July (+20k employment and an unchanged unemployment rate of 4% being the consensus) and July industrial production and retail sales data for China. Later in the day we get UK Q2 GDP, the results of the Empire manufacturing survey and the US retail sales report, where growth of 0.1% m-o-m is expected for the control group. We will also see the US weekly jobless claims data, which might be important this time around. The Fed’s Patrick Harker and Alberto Musalem will be speaking.

- Data: US July retail sales, industrial production, import and export price indices, capacity utilisation, August Empire manufacturing index, Philadelphia Fed business outlook, NAHB housing market index, June business inventories, total net TIC flows, initial jobless claims, China July retail sales, industrial production, new home prices, property investment, UK June monthly GDP, Japan Q2 GDP, June capacity utilisation, Canada July existing home sales, June wholesale sales ex. petroleum

- Central banks: Fed's Musalem and Harker speak, Norges decision, China 1-yr MLF rate

- Earnings: Walmart, Alibaba, JD.com, Deere, Applied Materials, Orsted

Friday: New Zealand’s manufacturing PMI and Q2 PPI is out. We will also see more remarks from RBNZ Governor Orr and then it’s over to the UK for July retail sales (+0.6% m-o-m incl fuel expected). Following that we have Canadian housing starts and manufacturing sales for June, and then US housing starts for July, the New York Fed’s Service Business Activity Survey and the University of Michigan’s Consumer Sentiment report where a modest improvement is expected. The Fed’s Austan Goolsbee will also be speaking in a ‘fireside chat’.

- Data: US August University of Michigan consumer survey, New York Fed services business activity, July building permits, housing starts, UK July retail sales, Japan June Tertiary industry index, Italy June general government debt, Eurozone June trade balance, Canada July housing starts, June manufacturing sales, international securities transactions

- Central banks: Fed's Goolsbee speaks

Finally, focusing on just the US, Goldman notes that the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Thursday. There are several speaking engagements from Fed officials this week.

Monday, August 12

- There are no major economic data releases scheduled.

Tuesday, August 13

- 06:00 AM NFIB small business optimism, July (consensus 91.5, last 91.5)

- 08:30 AM PPI final demand, July (GS +0.2%, consensus +0.2%, last +0.2%); PPI ex-food and energy, July (GS +0.2%, consensus +0.2%, last +0.4%); PPI ex-food, energy, and trade, July (GS +0.2%, consensus +0.2%, last flat)

- 01:15 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will speak on the economic outlook in a moderated conversation at the Conference of African American Financial Professionals. A Q&A is expected.

Wednesday, August 14

- 08:30 AM CPI (MoM), July (GS +0.17%, consensus +0.2%, last -0.1%); Core CPI (MoM), July (GS +0.16%, consensus +0.2%, last +0.1%); CPI (YoY), July (GS +2.93%, consensus +3.0%, last +3.0%); Core CPI (YoY), July (GS +3.20%, consensus +3.2%, last +3.3%): We estimate a 0.16% increase in July core CPI (month-over-month SA). Our forecast reflects further declines in used car prices (-1.5%) and airfares (-2.5%), as well as a modest decline in new car prices (-0.1%) after a rebound in incentives following last month’s disruptions to dealer software systems. We expect another firm increase in the car insurance category (+0.7%) based on continued—albeit decelerating—increases in premiums in our online dataset. We expect modest boosts from tobacco prices related to new taxes in Colorado and Maryland and from the partial-month impact of a postage price hike on July 14th. After last month’s step lower, we assume another moderate increase in OER (+0.29%) and a partial rebound in primary rent (+0.33%), reflecting payback for the January spike in OER and drop in rent. We estimate a 0.17% rise in headline CPI, reflecting higher food (+0.15%) and energy (+0.4%) prices.

Thursday, August 15

- 08:30 AM Empire State manufacturing survey, August (consensus -5.5, last -6.6); 08:30 AM Retail sales, July (GS +0.1%, consensus +0.4%, last flat); Retail sales ex-auto, July (GS flat, consensus +0.1%, last +0.4%); Retail sales ex-auto & gas, July (GS flat, consensus +0.2%, last +0.8%); Core retail sales, July (GS -0.2%, consensus +0.1%, last +0.9%): We estimate core retail sales declined 0.2% in July (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects a boost from another record Amazon Prime Day but sequentially slower credit card spending growth and a potential headwind from seasonality. We estimate a 0.1% rebound in headline retail sales, reflecting flattish gasoline prices but sharply higher auto sales following disruptions from cyberattacks in the prior month.

- 08:30 AM Philadelphia Fed manufacturing index, August (GS 3.9, consensus 5.0, last 13.9): We estimate that the Philadelphia Fed manufacturing index pulled back 10pt to 3.9 in August, reflecting downward convergence toward other surveys.

- 08:30 AM Initial jobless claims, week ended August 10 (GS 230k, consensus 236k, last 233k): Continuing jobless claims, week ended August 3 (consensus 1,870k, last 1,875k)

- 08:30 AM Import price index, July (consensus -0.1%, last flat): Export price index, July (consensus flat, last -0.5%)

- 09:10 AM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will speak on the US economy and monetary policy at Greater Louisville Inc.'s Regional Economic Development Update. A Q&A is expected. On July 11, Musalem said “I will be looking for more evidence that inflation can be expected to return to 2% going forward.”

- 09:15 AM Industrial production, July (GS -0.1%, consensus -0.3%, last +0.6%); Manufacturing production, July (GS -0.1%, consensus -0.3%, last +0.4%); Capacity utilization, July (GS 78.6%, consensus 78.5%, last 78.8%); We estimate industrial production decreased 0.1%, as weak electricity production likely outweighed strong oil and gas and mining production. We estimate capacity utilization decreased to 78.6%.

- 10:00 AM Business inventories, June (consensus +0.3%, last +0.5%)

- 10:00 AM NAHB housing market index, August (consensus 42, last 42)

- 01:10 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will give a speech on the Federal Reserve Bank of Philadelphia’s Center for the Restoration of Economic Data (CREED). Speech text is expected. On July 17, Harker said that he expects “economic growth to slow but remain above trend and the unemployment rate to increase modestly” this year.

Friday, August 16

- 08:30 AM Housing starts, July (GS -1.5%, consensus -1.3%, last +3.0%); Building permits, July (consensus -1.5%, last +3.9%)

- 10:00 AM University of Michigan consumer sentiment, August preliminary (GS 65.9, consensus 66.9, last 66.4); University of Michigan 5-10-year inflation expectations, August preliminary (GS 2.9%, consensus 2.9%, last 3.0%)

- 01:25 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will participate in a fireside chat at the Angeles Investors’ Q3 Summit & Awards Event. A Q&A is expected. On August 6, Goolsbee said “I’ve been saying for a long time that we’ve been in a restrictive posture… the real fed funds rate is as high as it’s been in a long time and we’re at the peak even in this cycle as inflation comes down. And you only want to be that restrictive if you think there’s fear of overheating. These data, to me, do not look like overheating.”

It is a macro-heavy week, and the market’s key focus will be on US inflation data, with the July CPI print on Wednesday preceded by the PPI data on Tuesday, followed by Retail Sales on Thursday.

The median economist forecast is for both headline and core CPI to rise +0.20% on the month, which would leave annual headline CPI steady at 3.0%, with core ticking down a tenth to 3.2%. On a monthly basis, this would be an acceleration from the +0.1% core CPI print in June, but with both the three- and six-month annualized rates falling by 40bps to 1.7% and 2.9%, respectively.

In terms of the CPI details, there will be focus on whether the June slowing in rental inflation is sustained. For the PPI on Tuesday, economists see headline PPI gains staying at +0.2% MoM, though PPI components that feed into the Fed’s preferred core PCE measure may leave it running ahead of core CPI for the second month in a row.

The upcoming inflation data will be key for whether the Fed gains confidence to signal more clearly a cut at the September meeting. Over the weekend we heard from Fed Governor Bowman, who commented that “she “will remain cautious in my approach to considering adjustments to the current stance of policy” as “inflation is still uncomfortably above the committee’s 2% goal”. So one of the most hawkish FOMC voices sounding not yet convinced on the immediacy of rate cuts.

Speaking of Fed talking heads, several regional Fed presidents are due to speak this week, including Bostic on Tuesday, Musalem and Harker on Thursday and Goolsbee on Friday, so we’ll see if there are any changes in tone in response to the inflation data. We may have to wait until next week’s Jackson Hole symposium for an in depth take on how the Fed is thinking about the expected easing cycle.

Other notable US releases this week will include July retail sales and industrial production on Thursday, which economists expect to grow by +0.4% and shrink -0.3% on the month respectively. These will present some of the first pieces of hard activity data for Q3. We will also have the University of Michigan consumer survey on Friday.

Finally, with earnings season winding down, we will get some more evidence on the health of the US consumer with earnings reports from Home Depot (Tuesday) and Walmart (Thursday) as the earnings season winds down.

A bit of a detour here courtesy of DB’s Peter Sidorov who writes that as we start the week, Fed funds futures are pricing 101bps of cuts by year-end, so favoring at least one 50bps cut across the remaining three FOMC meetings. This is down from 138bps at the peak of the market stress last Monday but still well above the 87bps seen prior to the July payrolls print and it is hard to see how such easing would transpire without a material slowing of the economy. While fears of a US recession ticked up in recent weeks amid softer labor market data, activity surveys have largely held up and the Atlanta Fed’s GDPNow currently signals solid 2.9% growth for Q3. Compared to Europe, the US continues to benefit from stronger productivity growth, higher wealth effects and deeper capital markets.

Courtesy of Rabobank and DB, here is a day by day snapshot of what to expect.

Monday: A light day for data. RBA Deputy Governor Andrew Hauser is speaking, China money supply figures will be released, and we will also see building permits for Canada and the New York Fed’s 1-year inflation expectations index.

- Data: US July NY Fed 1-yr inflation expectations, monthly budget statement, Germany June current account balance, July wholesale price index, Canada June building permits, Denmark July CPI

- Earnings: Barrick Gold

Tuesday: Japan PPI and New Zealand net migration are first up, followed by Australia’s wage price index (an important one for RBA watchers) and both business and consumer confidence figures. At the start of the European session we have UK labour market data, followed by the ZEW survey in Germany and then it’s over to the USA for PPI and comments from the Fed’s Raphael Bostic.

- Data: US July PPI, NFIB small business optimism, UK June average weekly earnings, unemployment rate, July jobless claims change, Japan July PPI, machine tool orders, Germany and Eurozone August Zew survey

- Central banks: Fed’s Bostic speaks

- Earnings: Home Depot, Asics

Wednesday: The RBNZ policy rate decision is main point of interest early in the day. We think the bank will err on the side of unchanged, but it really is a knife’s edge decision, and the futures see strong odds of a cut. Following that its over to the UK for July CPI (-0.1% m-o-m expected) and then we will get the second read of Q2 GDP for the Eurozone. The key release of the day (and the week) is the US CPI report, where prices are expected to have risen by 0.2% m-o-m on both headline and core readings.

- Data: US July CPI, UK July CPI, RPI, PPI, June house price index, Eurozone Q2 GDP, employment, June industrial production, Sweden July CPI

- Central banks: RBNZ decision

- Earnings: Cisco, Tencent, RWE, Vestas

Thursday: RBNZ Governor Orr will appear before the Kiwi parliament, and we will also see July card spending and food price data for New Zealand in the early morning. Following that is Japan Q2 GDP, the PBOC’s 1-year MLF decision, Aussie labour market figures for July (+20k employment and an unchanged unemployment rate of 4% being the consensus) and July industrial production and retail sales data for China. Later in the day we get UK Q2 GDP, the results of the Empire manufacturing survey and the US retail sales report, where growth of 0.1% m-o-m is expected for the control group. We will also see the US weekly jobless claims data, which might be important this time around. The Fed’s Patrick Harker and Alberto Musalem will be speaking.

- Data: US July retail sales, industrial production, import and export price indices, capacity utilisation, August Empire manufacturing index, Philadelphia Fed business outlook, NAHB housing market index, June business inventories, total net TIC flows, initial jobless claims, China July retail sales, industrial production, new home prices, property investment, UK June monthly GDP, Japan Q2 GDP, June capacity utilisation, Canada July existing home sales, June wholesale sales ex. petroleum

- Central banks: Fed’s Musalem and Harker speak, Norges decision, China 1-yr MLF rate

- Earnings: Walmart, Alibaba, JD.com, Deere, Applied Materials, Orsted

Friday: New Zealand’s manufacturing PMI and Q2 PPI is out. We will also see more remarks from RBNZ Governor Orr and then it’s over to the UK for July retail sales (+0.6% m-o-m incl fuel expected). Following that we have Canadian housing starts and manufacturing sales for June, and then US housing starts for July, the New York Fed’s Service Business Activity Survey and the University of Michigan’s Consumer Sentiment report where a modest improvement is expected. The Fed’s Austan Goolsbee will also be speaking in a ‘fireside chat’.

- Data: US August University of Michigan consumer survey, New York Fed services business activity, July building permits, housing starts, UK July retail sales, Japan June Tertiary industry index, Italy June general government debt, Eurozone June trade balance, Canada July housing starts, June manufacturing sales, international securities transactions

- Central banks: Fed’s Goolsbee speaks

Finally, focusing on just the US, Goldman notes that the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Thursday. There are several speaking engagements from Fed officials this week.

Monday, August 12

- There are no major economic data releases scheduled.

Tuesday, August 13

- 06:00 AM NFIB small business optimism, July (consensus 91.5, last 91.5)

- 08:30 AM PPI final demand, July (GS +0.2%, consensus +0.2%, last +0.2%); PPI ex-food and energy, July (GS +0.2%, consensus +0.2%, last +0.4%); PPI ex-food, energy, and trade, July (GS +0.2%, consensus +0.2%, last flat)

- 01:15 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will speak on the economic outlook in a moderated conversation at the Conference of African American Financial Professionals. A Q&A is expected.

Wednesday, August 14

- 08:30 AM CPI (MoM), July (GS +0.17%, consensus +0.2%, last -0.1%); Core CPI (MoM), July (GS +0.16%, consensus +0.2%, last +0.1%); CPI (YoY), July (GS +2.93%, consensus +3.0%, last +3.0%); Core CPI (YoY), July (GS +3.20%, consensus +3.2%, last +3.3%): We estimate a 0.16% increase in July core CPI (month-over-month SA). Our forecast reflects further declines in used car prices (-1.5%) and airfares (-2.5%), as well as a modest decline in new car prices (-0.1%) after a rebound in incentives following last month’s disruptions to dealer software systems. We expect another firm increase in the car insurance category (+0.7%) based on continued—albeit decelerating—increases in premiums in our online dataset. We expect modest boosts from tobacco prices related to new taxes in Colorado and Maryland and from the partial-month impact of a postage price hike on July 14th. After last month’s step lower, we assume another moderate increase in OER (+0.29%) and a partial rebound in primary rent (+0.33%), reflecting payback for the January spike in OER and drop in rent. We estimate a 0.17% rise in headline CPI, reflecting higher food (+0.15%) and energy (+0.4%) prices.

Thursday, August 15

- 08:30 AM Empire State manufacturing survey, August (consensus -5.5, last -6.6); 08:30 AM Retail sales, July (GS +0.1%, consensus +0.4%, last flat); Retail sales ex-auto, July (GS flat, consensus +0.1%, last +0.4%); Retail sales ex-auto & gas, July (GS flat, consensus +0.2%, last +0.8%); Core retail sales, July (GS -0.2%, consensus +0.1%, last +0.9%): We estimate core retail sales declined 0.2% in July (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects a boost from another record Amazon Prime Day but sequentially slower credit card spending growth and a potential headwind from seasonality. We estimate a 0.1% rebound in headline retail sales, reflecting flattish gasoline prices but sharply higher auto sales following disruptions from cyberattacks in the prior month.

- 08:30 AM Philadelphia Fed manufacturing index, August (GS 3.9, consensus 5.0, last 13.9): We estimate that the Philadelphia Fed manufacturing index pulled back 10pt to 3.9 in August, reflecting downward convergence toward other surveys.

- 08:30 AM Initial jobless claims, week ended August 10 (GS 230k, consensus 236k, last 233k): Continuing jobless claims, week ended August 3 (consensus 1,870k, last 1,875k)

- 08:30 AM Import price index, July (consensus -0.1%, last flat): Export price index, July (consensus flat, last -0.5%)

- 09:10 AM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will speak on the US economy and monetary policy at Greater Louisville Inc.’s Regional Economic Development Update. A Q&A is expected. On July 11, Musalem said “I will be looking for more evidence that inflation can be expected to return to 2% going forward.”

- 09:15 AM Industrial production, July (GS -0.1%, consensus -0.3%, last +0.6%); Manufacturing production, July (GS -0.1%, consensus -0.3%, last +0.4%); Capacity utilization, July (GS 78.6%, consensus 78.5%, last 78.8%); We estimate industrial production decreased 0.1%, as weak electricity production likely outweighed strong oil and gas and mining production. We estimate capacity utilization decreased to 78.6%.

- 10:00 AM Business inventories, June (consensus +0.3%, last +0.5%)

- 10:00 AM NAHB housing market index, August (consensus 42, last 42)

- 01:10 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will give a speech on the Federal Reserve Bank of Philadelphia’s Center for the Restoration of Economic Data (CREED). Speech text is expected. On July 17, Harker said that he expects “economic growth to slow but remain above trend and the unemployment rate to increase modestly” this year.

Friday, August 16

- 08:30 AM Housing starts, July (GS -1.5%, consensus -1.3%, last +3.0%); Building permits, July (consensus -1.5%, last +3.9%)

- 10:00 AM University of Michigan consumer sentiment, August preliminary (GS 65.9, consensus 66.9, last 66.4); University of Michigan 5-10-year inflation expectations, August preliminary (GS 2.9%, consensus 2.9%, last 3.0%)

- 01:25 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will participate in a fireside chat at the Angeles Investors’ Q3 Summit & Awards Event. A Q&A is expected. On August 6, Goolsbee said “I’ve been saying for a long time that we’ve been in a restrictive posture… the real fed funds rate is as high as it’s been in a long time and we’re at the peak even in this cycle as inflation comes down. And you only want to be that restrictive if you think there’s fear of overheating. These data, to me, do not look like overheating.”

Loading…