With earnings season now mostly over (AI vanguard NVDA reports on Wednesday) and the economic data slate relatively sparse, the debt ceiling negotiations will dominate this week's calendar. As noted earlier, the latest is that President Biden and House Speaker Kevin McCarthy will meet at the White House today to resume negotiations. There was a slightly more positive tone from both sides after a phone call between the two yesterday. This follows the GOP walking out on talks late Friday. Yellen said over the weekend that the chances that the US can pay its bills by mid-June are "quite low".

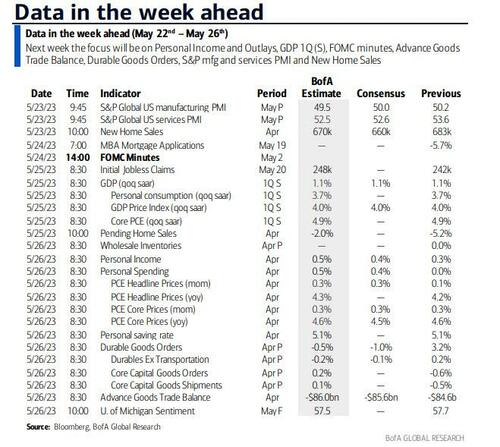

Outside of this story, highlights for the week ahead which include the latest FOMC Minutes on Wednesday, the global flash PMIs tomorrow and the US PCE inflation release on Friday. The details of the University of Michigan Survey the same day are going to be interesting as 5-10yr inflation expectations spiked from 2.9% to 3.2% earlier this month in the prelim reading, a level that hasn't been exceeded since 2007. This often gets revised down in the final print but if not, it could mark a firming of inflation at the consumer level. Watch for any upward revisions to Q1 US GDP on Thursday after recent better than expected data. Also on the data front we have UK inflation on Wednesday (last month shocked to the upside at 10.1% - 8.2% expected this week), various sentiment data in Europe and the Tokyo CPI in Japan on Friday.

As DB's Jim Reid notes, from central banks, as the June FOMC slowly comes into view and with an increasing possibility of a hike that was all but ruled out 1-2 weeks ago, there are lots of Fed speakers, especially early in the week (see in the calendar at the end), and also the release of the FOMC meeting minutes on Wednesday. This might help show how high the bar is for the Fed to add more hikes.

Although earnings season is drawing to a close, Nvidia on Wednesday could be worth watching. Nvidia is up +112% in 2023 and has a market cap of $773bn highlighting why AI is becoming a huge topic and one that also moves macro markets. Nvidia is trading on heroic valuations which time will tell if they are justified.

Asian equity markets have shrugged off Friday’s GOP talks walkout losses on Wall Street following comments by President Biden during the G-7 summit that he sees US-China relations improving “very shortly”. Across the region, the Hang Seng (+1.32%) is leading gains with the KOSPI (+0.83%), the CSI (+0.39%), the Shanghai Composite (+0.11%) and the Nikkei (+0.10%) also up. S&P 500 futures (-0.03%) are trading just below flat with 10yr USTs -2.3bps lower, trading at 3.65%, as we go to press.

Early morning data showed that Japanese core machinery orders unexpectedly dropped -3.9% m/m in March (v/s +0.4% expected, -4.5% in February), contracting for the second month in a row. Elsewhere, the People’s Bank of China (PBOC) kept their benchmark lending rates unchanged for a ninth straight month, keeping the one-year loan prime rate intact at 3.65% while the five-year rate, a reference for mortgages, was also held at 4.3%, as expected.

A day-by-day calendar of events, courtesy of DB:

Monday May 22

- Data: Japan March core machine orders, Eurozone May consumer confidence, March construction output

- Central banks: Fed's Bullard, Bostic and Barkin speak, ECB's Vujcic, Guindos, Villeroy, Holzmann and Lane speak

- Earnings: Zoom, Ryanair

Tuesday May 23

- Data: US, UK, Japan, Germany, France and Eurozone May preliminary PMIs, US May Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, April new home sales, UK April public finances, Japan April nationwide department store sales, Italy March current account balance, Eurozone March ECB current account, Canada April raw materials and industrial product price

- Central banks: Fed's Logan speaks, ECB's Guindos, Muller, Nagel and Villeroy speak, BoE's Haskel speaks

- Earnings: Lowe's, Palo Alto Networks, Intuit, Agilent Technologies

Wednesday May 24

- Data: UK April CPI, RPI, PPI, March house price index, Germany May ifo survey

- Central banks: Fed's FOMC minutes, ECB's non-policy meeting, BoE's Bailey speaks

- Earnings: NVIDIA, Analog Devices, Snowflake, Kohl's

Thursday May 25

- Data: US Q1 GDP second reading, May Kansas City Fed manufacturing activity, April pending home sales, Chicago Fed national activity index, initial jobless claims, Germany Q1 private consumption,government spending, capital investment, June GfK consumer confidence, France May manufacturing and business confidence

- Central banks: ECB's Guindos, Nagel, Villeroy, Centeno and de Cos speak, BoE's Haskel speaks

- Earnings: Costco, Dollar Tree, Autodesk, GAP, Marvell, Workday, Royal Bank of Canada

Friday May 26

- Data: US April personal spending, personal income, PCE, durable goods orders, advance goods trade balance, wholesale and retail inventories, May Kansas City Fed services activity, UK April retail sales, Japan May Tokyo CPI, April PPI services, Italy May manufacturing confidence, economic sentiment, consumer confidence index,

- France May consumer confidence

- Central banks: ECB's Vujcic speaks

* * *

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the core PCE, durable goods, and University of Michigan reports on Friday. The minutes from the May FOMC meeting will be released on Wednesday and there are several speaking engagements from Fed officials, including governor Waller and presidents Bullard, Bostic, Daly, Logan, and Collins.

Monday, May 22

- 08:30 AM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will participate in a fireside chat at an event hosted by the American Gas Association. Media availability and a press release are not expected. On May 18, Bullard said, “I do expect disinflation, but it’s been slower than I would have liked, and it may warrant taking out some insurance by raising rates somewhat more to make sure that we really do get inflation under control…Our main risk is that inflation doesn’t go down or even turns around and goes higher, as it did in the 1970s.”

- 11:05 AM Atlanta Fed President Bostic (FOMC non-voter) and Richmond Fed President Barkin (FOMC non-voter) speak: Atlanta Fed President Raphael Bostic and Richmond Fed President Thomas Barkin will discuss technology-enabled disruption at an event hosted by the Richmond Fed. On May 15, Bostic said, “If I had a bias between going up and going down as our next action, I would say we might have to go up. What we’ve seen is that inflation has been persistently high. Consumers have been really resilient in terms of their spending and labor markets remain extremely tight. All of those suggest that there’s still going be upward pressure on prices. That is not my base case either.” On May 15, Barkin said, “If inflation persists, or God forbid accelerates, there’s no barrier in my mind to further increases in rates…It is not obvious to me that there is a financial stability challenge of having a higher rate path…I don’t see the urgency of making a different decision because of financial stability risks.”

- 11:05 AM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will participate in a fireside chat at the National Association of Business Economics/Banque de France International Economic Symposium. A moderated Q&A with the audience is expected. On April 12, Daly said, “While the full impact of this policy tightening is still making its way through the system, the strength of the economy and the elevated readings on inflation suggest that there is more work to do. But how much more time and how much additional slowing is coming is unclear…We will need to carefully monitor the situation as we assess what it means for policy.”

Tuesday, May 23

- 09:00 AM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will deliver welcoming remarks at a conference on technology-enabled disruption hosted by the Richmond Fed. On May 18, Logan said, “The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet.” On May 16, she said, “Gradual policy adjustments can be helpful…financial conditions can sometimes deteriorate nonlinearly, doing damage to the broader economy, but the risk of a nonlinear reaction can be mitigated by raising interest rates in smaller, less frequent steps.”

- 09:45 AM S&P Global US manufacturing PMI, May preliminary (consensus 50.0, last 50.2): S&P Global US services PMI, May preliminary (consensus 52.5, last 53.6)

- 10:00 AM New home sales, April (GS -2.0%, consensus -2.9%, last +9.6%)

- 10:00 AM Richmond Fed manufacturing index, May (consensus -8, last -10)

Wednesday, May 24

- 12:10 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will discuss the economic outlook at an event hosted by the University of California Santa Barbara. Speech text and a moderated Q&A are expected. On April 14, Waller said, “Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further. How much further will depend on incoming data on inflation, the real economy, and the extent of tightening credit conditions.”

- 02:00 PM FOMC meeting minutes, May 2-3 meeting: The FOMC increased the federal funds rate target range by 25bp to 5-5.25% at its May meeting. We saw the May FOMC meeting as supportive of our call for a pause in June. The FOMC removed from its statement the earlier guidance that some additional policy firming may be appropriate, and while the nod toward a June pause was not quite as strong as we had expected, Chair Powell emphasized twice that this is a “meaningful change.”

Thursday, May 25

- 08:30 AM Initial jobless claims, week ended May 20 (GS 235k, consensus 248k, last 242k); Continuing jobless claims, week ended May 13 (consensus 1,800k, last 1,799k): We estimate that initial jobless claims declined to 235k in the week ended May 20. While the number of initial claims from Massachusetts declined meaningfully last week, the level still appears elevated—likely reflecting continued issues with fraudulent filings. Our forecast assumes that some of those fraudulent filings—which we estimate could be boosting the level of nationwide initial claims by roughly 20k—are further curtailed.

- While the annual seasonal factor revisions that took place last month appear to have resolved most of the seasonal distortions in initial claims, we believe the revisions may have intensified the distortions in continuing claims. Those distortions have likely contributed to the net decline over the last month, and we estimate they could exert a cumulative drag on the level of continuing claims of up to 400k between April and September.

- 08:30 AM GDP, Q1 second release (GS +1.4%, consensus +1.1%, last +1.1%); Personal consumption, Q1 second release (GS +4.0%, consensus +3.7%, last +3.7%): We estimate a 0.3pp upward revision to Q1 GDP growth to +1.4% (qoq ar), reflecting upward revisions to consumer spending and inventories.

- 10:00 AM Pending home sales, April (GS +1.5%, consensus +1.0%, last -5.2%)

- 10:30 AM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will participate in a fireside chat at the Community College of Rhode Island. Speech text and a moderated Q&A with audience are expected. On March 30, Collins said, “Similar to the SEP median, I currently anticipate some modest additional policy tightening, and then holding through the end of this year. Of course, I’ll be carefully watching a range of indicators including data on inflation, spending, labor markets, and financial conditions.”

11:00 AM Kansas City Fed manufacturing activity, May (consensus -12, last -10)

Friday, May 26

- 08:30 AM Personal income, April (GS +0.6%, consensus +0.4%, last +0.3%); Personal spending, April (GS +0.6%, consensus +0.4%, last flat); PCE price index, April (GS +0.27%, consensus +0.3%, last +0.1%); Core PCE price index, April (GS +0.28%, consensus +0.3%, last +0.3%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.28% month-over-month in April, corresponding to a 4.56% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.27% in April, corresponding to a 4.24% increase from a year earlier. We expect that both personal income and personal spending increased by 0.6% in April.

- 08:30 AM Wholesale inventories, April preliminary (consensus +0.1%, last flat)

- 08:30 AM Advance goods trade balance, April (GS -$85.1bn, consensus -$85.7bn, last -$84.6bn)

- 08:30 AM Durable goods orders, April preliminary (GS +0.2%, consensus -1.0%, last +3.2%); Durable goods orders ex-transportation, April preliminary (GS +0.5%, consensus -0.2%, last +0.2%); Core capital goods orders, April preliminary (GS +0.5%, consensus +0.2%, last -0.6%); Core capital goods shipments, April preliminary (GS +0.2%, consensus -0.1%, last -0.5%): We estimate that durable goods orders rose 0.2% in the preliminary April report, reflecting mixed commercial aircraft orders. We forecast a rebound in core capital goods orders (+0.5%) and shipments (+0.2%), reflecting a pickup in global industrial activity but a continued a drag from tighter credit.

- 10:00 AM University of Michigan consumer sentiment, May final (GS 57.7, consensus 58.0, last 57.7): University of Michigan 5–10-year inflation expectations, May final (GS +3.1%, consensus +3.1%, last +3.2%)

Source: DB, Goldman, BofA

With earnings season now mostly over (AI vanguard NVDA reports on Wednesday) and the economic data slate relatively sparse, the debt ceiling negotiations will dominate this week’s calendar. As noted earlier, the latest is that President Biden and House Speaker Kevin McCarthy will meet at the White House today to resume negotiations. There was a slightly more positive tone from both sides after a phone call between the two yesterday. This follows the GOP walking out on talks late Friday. Yellen said over the weekend that the chances that the US can pay its bills by mid-June are “quite low”.

Outside of this story, highlights for the week ahead which include the latest FOMC Minutes on Wednesday, the global flash PMIs tomorrow and the US PCE inflation release on Friday. The details of the University of Michigan Survey the same day are going to be interesting as 5-10yr inflation expectations spiked from 2.9% to 3.2% earlier this month in the prelim reading, a level that hasn’t been exceeded since 2007. This often gets revised down in the final print but if not, it could mark a firming of inflation at the consumer level. Watch for any upward revisions to Q1 US GDP on Thursday after recent better than expected data. Also on the data front we have UK inflation on Wednesday (last month shocked to the upside at 10.1% – 8.2% expected this week), various sentiment data in Europe and the Tokyo CPI in Japan on Friday.

As DB’s Jim Reid notes, from central banks, as the June FOMC slowly comes into view and with an increasing possibility of a hike that was all but ruled out 1-2 weeks ago, there are lots of Fed speakers, especially early in the week (see in the calendar at the end), and also the release of the FOMC meeting minutes on Wednesday. This might help show how high the bar is for the Fed to add more hikes.

Although earnings season is drawing to a close, Nvidia on Wednesday could be worth watching. Nvidia is up +112% in 2023 and has a market cap of $773bn highlighting why AI is becoming a huge topic and one that also moves macro markets. Nvidia is trading on heroic valuations which time will tell if they are justified.

Asian equity markets have shrugged off Friday’s GOP talks walkout losses on Wall Street following comments by President Biden during the G-7 summit that he sees US-China relations improving “very shortly”. Across the region, the Hang Seng (+1.32%) is leading gains with the KOSPI (+0.83%), the CSI (+0.39%), the Shanghai Composite (+0.11%) and the Nikkei (+0.10%) also up. S&P 500 futures (-0.03%) are trading just below flat with 10yr USTs -2.3bps lower, trading at 3.65%, as we go to press.

Early morning data showed that Japanese core machinery orders unexpectedly dropped -3.9% m/m in March (v/s +0.4% expected, -4.5% in February), contracting for the second month in a row. Elsewhere, the People’s Bank of China (PBOC) kept their benchmark lending rates unchanged for a ninth straight month, keeping the one-year loan prime rate intact at 3.65% while the five-year rate, a reference for mortgages, was also held at 4.3%, as expected.

A day-by-day calendar of events, courtesy of DB:

Monday May 22

- Data: Japan March core machine orders, Eurozone May consumer confidence, March construction output

- Central banks: Fed’s Bullard, Bostic and Barkin speak, ECB’s Vujcic, Guindos, Villeroy, Holzmann and Lane speak

- Earnings: Zoom, Ryanair

Tuesday May 23

- Data: US, UK, Japan, Germany, France and Eurozone May preliminary PMIs, US May Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, April new home sales, UK April public finances, Japan April nationwide department store sales, Italy March current account balance, Eurozone March ECB current account, Canada April raw materials and industrial product price

- Central banks: Fed’s Logan speaks, ECB’s Guindos, Muller, Nagel and Villeroy speak, BoE’s Haskel speaks

- Earnings: Lowe’s, Palo Alto Networks, Intuit, Agilent Technologies

Wednesday May 24

- Data: UK April CPI, RPI, PPI, March house price index, Germany May ifo survey

- Central banks: Fed’s FOMC minutes, ECB’s non-policy meeting, BoE’s Bailey speaks

- Earnings: NVIDIA, Analog Devices, Snowflake, Kohl’s

Thursday May 25

- Data: US Q1 GDP second reading, May Kansas City Fed manufacturing activity, April pending home sales, Chicago Fed national activity index, initial jobless claims, Germany Q1 private consumption,government spending, capital investment, June GfK consumer confidence, France May manufacturing and business confidence

- Central banks: ECB’s Guindos, Nagel, Villeroy, Centeno and de Cos speak, BoE’s Haskel speaks

- Earnings: Costco, Dollar Tree, Autodesk, GAP, Marvell, Workday, Royal Bank of Canada

Friday May 26

- Data: US April personal spending, personal income, PCE, durable goods orders, advance goods trade balance, wholesale and retail inventories, May Kansas City Fed services activity, UK April retail sales, Japan May Tokyo CPI, April PPI services, Italy May manufacturing confidence, economic sentiment, consumer confidence index,

- France May consumer confidence

- Central banks: ECB’s Vujcic speaks

* * *

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the core PCE, durable goods, and University of Michigan reports on Friday. The minutes from the May FOMC meeting will be released on Wednesday and there are several speaking engagements from Fed officials, including governor Waller and presidents Bullard, Bostic, Daly, Logan, and Collins.

Monday, May 22

- 08:30 AM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will participate in a fireside chat at an event hosted by the American Gas Association. Media availability and a press release are not expected. On May 18, Bullard said, “I do expect disinflation, but it’s been slower than I would have liked, and it may warrant taking out some insurance by raising rates somewhat more to make sure that we really do get inflation under control…Our main risk is that inflation doesn’t go down or even turns around and goes higher, as it did in the 1970s.”

- 11:05 AM Atlanta Fed President Bostic (FOMC non-voter) and Richmond Fed President Barkin (FOMC non-voter) speak: Atlanta Fed President Raphael Bostic and Richmond Fed President Thomas Barkin will discuss technology-enabled disruption at an event hosted by the Richmond Fed. On May 15, Bostic said, “If I had a bias between going up and going down as our next action, I would say we might have to go up. What we’ve seen is that inflation has been persistently high. Consumers have been really resilient in terms of their spending and labor markets remain extremely tight. All of those suggest that there’s still going be upward pressure on prices. That is not my base case either.” On May 15, Barkin said, “If inflation persists, or God forbid accelerates, there’s no barrier in my mind to further increases in rates…It is not obvious to me that there is a financial stability challenge of having a higher rate path…I don’t see the urgency of making a different decision because of financial stability risks.”

- 11:05 AM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will participate in a fireside chat at the National Association of Business Economics/Banque de France International Economic Symposium. A moderated Q&A with the audience is expected. On April 12, Daly said, “While the full impact of this policy tightening is still making its way through the system, the strength of the economy and the elevated readings on inflation suggest that there is more work to do. But how much more time and how much additional slowing is coming is unclear…We will need to carefully monitor the situation as we assess what it means for policy.”

Tuesday, May 23

- 09:00 AM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will deliver welcoming remarks at a conference on technology-enabled disruption hosted by the Richmond Fed. On May 18, Logan said, “The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet.” On May 16, she said, “Gradual policy adjustments can be helpful…financial conditions can sometimes deteriorate nonlinearly, doing damage to the broader economy, but the risk of a nonlinear reaction can be mitigated by raising interest rates in smaller, less frequent steps.”

- 09:45 AM S&P Global US manufacturing PMI, May preliminary (consensus 50.0, last 50.2): S&P Global US services PMI, May preliminary (consensus 52.5, last 53.6)

- 10:00 AM New home sales, April (GS -2.0%, consensus -2.9%, last +9.6%)

- 10:00 AM Richmond Fed manufacturing index, May (consensus -8, last -10)

Wednesday, May 24

- 12:10 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will discuss the economic outlook at an event hosted by the University of California Santa Barbara. Speech text and a moderated Q&A are expected. On April 14, Waller said, “Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further. How much further will depend on incoming data on inflation, the real economy, and the extent of tightening credit conditions.”

- 02:00 PM FOMC meeting minutes, May 2-3 meeting: The FOMC increased the federal funds rate target range by 25bp to 5-5.25% at its May meeting. We saw the May FOMC meeting as supportive of our call for a pause in June. The FOMC removed from its statement the earlier guidance that some additional policy firming may be appropriate, and while the nod toward a June pause was not quite as strong as we had expected, Chair Powell emphasized twice that this is a “meaningful change.”

Thursday, May 25

- 08:30 AM Initial jobless claims, week ended May 20 (GS 235k, consensus 248k, last 242k); Continuing jobless claims, week ended May 13 (consensus 1,800k, last 1,799k): We estimate that initial jobless claims declined to 235k in the week ended May 20. While the number of initial claims from Massachusetts declined meaningfully last week, the level still appears elevated—likely reflecting continued issues with fraudulent filings. Our forecast assumes that some of those fraudulent filings—which we estimate could be boosting the level of nationwide initial claims by roughly 20k—are further curtailed.

- While the annual seasonal factor revisions that took place last month appear to have resolved most of the seasonal distortions in initial claims, we believe the revisions may have intensified the distortions in continuing claims. Those distortions have likely contributed to the net decline over the last month, and we estimate they could exert a cumulative drag on the level of continuing claims of up to 400k between April and September.

- 08:30 AM GDP, Q1 second release (GS +1.4%, consensus +1.1%, last +1.1%); Personal consumption, Q1 second release (GS +4.0%, consensus +3.7%, last +3.7%): We estimate a 0.3pp upward revision to Q1 GDP growth to +1.4% (qoq ar), reflecting upward revisions to consumer spending and inventories.

- 10:00 AM Pending home sales, April (GS +1.5%, consensus +1.0%, last -5.2%)

- 10:30 AM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will participate in a fireside chat at the Community College of Rhode Island. Speech text and a moderated Q&A with audience are expected. On March 30, Collins said, “Similar to the SEP median, I currently anticipate some modest additional policy tightening, and then holding through the end of this year. Of course, I’ll be carefully watching a range of indicators including data on inflation, spending, labor markets, and financial conditions.”

11:00 AM Kansas City Fed manufacturing activity, May (consensus -12, last -10)

Friday, May 26

- 08:30 AM Personal income, April (GS +0.6%, consensus +0.4%, last +0.3%); Personal spending, April (GS +0.6%, consensus +0.4%, last flat); PCE price index, April (GS +0.27%, consensus +0.3%, last +0.1%); Core PCE price index, April (GS +0.28%, consensus +0.3%, last +0.3%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.28% month-over-month in April, corresponding to a 4.56% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.27% in April, corresponding to a 4.24% increase from a year earlier. We expect that both personal income and personal spending increased by 0.6% in April.

- 08:30 AM Wholesale inventories, April preliminary (consensus +0.1%, last flat)

- 08:30 AM Advance goods trade balance, April (GS -$85.1bn, consensus -$85.7bn, last -$84.6bn)

- 08:30 AM Durable goods orders, April preliminary (GS +0.2%, consensus -1.0%, last +3.2%); Durable goods orders ex-transportation, April preliminary (GS +0.5%, consensus -0.2%, last +0.2%); Core capital goods orders, April preliminary (GS +0.5%, consensus +0.2%, last -0.6%); Core capital goods shipments, April preliminary (GS +0.2%, consensus -0.1%, last -0.5%): We estimate that durable goods orders rose 0.2% in the preliminary April report, reflecting mixed commercial aircraft orders. We forecast a rebound in core capital goods orders (+0.5%) and shipments (+0.2%), reflecting a pickup in global industrial activity but a continued a drag from tighter credit.

- 10:00 AM University of Michigan consumer sentiment, May final (GS 57.7, consensus 58.0, last 57.7): University of Michigan 5–10-year inflation expectations, May final (GS +3.1%, consensus +3.1%, last +3.2%)

Source: DB, Goldman, BofA

Loading…