With the Fed now on their blackout period ahead of next week's FOMC and with the ECB quiet before their meeting on Thursday, DB's Jim Reid writes that we'll have a few days break from what has been relatively hawkish central bank rhetoric over the past week. Even the BoJ meeting tomorrow is now likely to be a non-event, just as we said in December when everyone was buying the yen in anticipation of an "imminent" rate hike by the BOJ (in fact shorting the USDJPY was a top consensus trade for 2024, well good luck with those huge losses).

Risk was briefly shaken by central bankers pushing back on the market in the first half of last week as rate expectations and yields moved higher. Although yields continued to move higher in the second half, risk fought back and we saw a decoupling between rates and equities that is potentially the biggest test of the very tight relationship the two have seen since August (both bearish and bullish). So although 1 0yr yields are now up +23bps in 2024, the S&P 500 closed at an all-time high on Friday, the first since January 2022, and largely on the back of chip optimism sparked by Taiwan Semi, when the whole story was just China scrambling to buy chips ahead of a new round of sanctions.

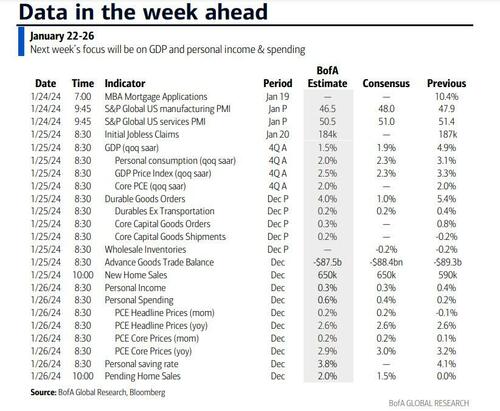

Looking at the key events this week, we’ll get two bites at US core PCE trends this week, first within the first estimate for Q4 GDP (Thursday) and then in the personal income and spending report (Friday). Although CPI disappointed higher in December the components of this and PPI suggest a more benign core PCE reading. So this will be very important. Last week’s retail sales beat, and especially the control group, meant DB's economists upped their Q4 GDP forecast from 2.0% to 2.3%. Durable goods and trade data on the same day as GDP could add a bit of uncertainty to the print though.

Staying with the US, today’s leading indicators will likely still be at levels only really seen in recessions, but the direction of travel may well be moving in a more positive direction if consensus is correct. Elsewhere, tomorrow brings the second state to vote in the Republican nomination process with the New Hampshire primary. Last night DeSantis pulled out of the race and endorsed Trump. The latest polling in the state before the news had Trump on 49.8%, Haley with some momentum on 36.1%, and DeSantis slipping in recent weeks to 5.8%. So it's now effectively a two-horse race and a winner could materialise in the next few weeks. In 2016 Trump became the presumptive nominee on May 3rd.

Earnings season will be busy with the highlights being Tesla, Netflix, Intel and ASML on Wednesday. We note the other main companies reporting in the calendar at the end.

Outside of the US we have the flash PMIs for key countries due on Wednesday. It’s worth noting that both manufacturing and services indicators remain below 50 in both France and Germany.

In terms of those central bank meetings, DB expects the BoJ to stick with its current policy stance tomorrow but further out sees the BoJ abandoning its negative interest rate policy in April (until that is pushed out again some time in 2025, then 2026 and so on). Tokyo CPI is out on Thursday as an aside.

For the ECB, most economists expect the ECB to stay cautious on the inflation front and continue pushing back against a rate cut in Q1. DB's team sees the first rate cut in April (50bps back to back in April-June and 150bps in total in 2024) amid weak growth and inflation ahead. Note that the ECB bank lending survey is out tomorrow. This will show whether banks are starting to be less cautious about extending lending to the economy from tight levels and will be an interesting preview to the US equivalent (SLOOS) in a couple of weeks.

Staying with Europe, a number of sentiment gauges will be out this week including consumer confidence metrics for the UK, Germany and France on Friday as well as the Ifo survey for Germany on Thursday.

Below, courtesy of DB, is a day-by-day calendar of events

Monday January 22

- Data: US December leading index, China 1-yr and 5-yr loan prime rates, France December retail sales

- Earnings: United Airlines

Tuesday January 23

- Data: US January Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, UK December public finances, Japan December trade balance, Eurozone January consumer confidence

- Central banks: BoJ decision, Outlook Report, ECB's bank lending survey

- Earnings: Johnson & Johnson, Procter & Gamble, Netflix, Verizon, Texas Instruments, General Electric, RTX, Lockheed Martin, Halliburton

- Auctions: US 2-yr Notes ($60bn)

Wednesday January 24

- Data: US, UK, Japan, Germany, France and the Eurozone January PMIs

- Central banks: BoC decision

- Earnings: Tesla, ASML, Abbott Laboratories, SAP, IBM, ServiceNow, AT&T, Lam Research, CSX, Freeport-McMoRan, Crown Castle

- Auctions: US 2-yr FRNs ($28bn), 5-yr Notes ($61bn)

Thursday January 25

- Data: US Q4 GDP advance reading, core PCE, January Kansas City Fed manufacturing activity, December durable goods orders, advance goods trade balance, new home sales, retail inventories, Chicago Fed national activity index, initial jobless claims, Japan January Tokyo CPI, December PPI services, Germany January Ifo survey, France Q4 total jobseekers, January business and manufacturing confidence

- Central banks: ECB decision, BoJ minutes of the December meeting

- Earnings: Visa, LVMH, Intel, T-Mobile US, Comcast, Union Pacific, Blackstone, NextEra Energy, KLA, Northrop Grumman, SK Hynix, Valero Energy, STMicroelectronics, Nokia

- Auctions: US 7-yr Notes ($41bn)

Friday January 26

- Data: US December personal spending and income, PCE deflator, pending home sales, January Kansas City Fed services activity, UK January GfK consumer confidence, Germany February GfK consumer confidence, France January consumer confidence, Eurozone December M3

- Central banks: ECB's survey of professional forecasters, ECB's Panetta, Kazaks and Vujcic speak

- Earnings: American Express, Volvo, Lonza Group

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the Q4 GDP advance release and durable goods report on Thursday, and the core PCE inflation report on Friday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period in advance of the FOMC meeting January 30-31.

Monday, January 22

- No major data releases.

Tuesday, January 23

- 10:00 AM Richmond Fed manufacturing index, January (consensus -6, last -11)

Wednesday, January 24

- 09:45 AM S&P Global US manufacturing PMI, January preliminary (consensus 47.5, last 47.9); S&P Global US services PMI, January preliminary (consensus 51.0, last 51.4)

Thursday, January 25

- 08:30 AM GDP, Q4 advance (GS +2.1%, consensus +2.0%, last +4.9%); Personal consumption, Q4 advance (GS +2.9%, consensus +2.5%, last +3.1%): We estimate that GDP rose 2.1% annualized in the advance reading for Q4, following +4.9% annualized in Q3. Our forecast reflects strength in consumption (+2.9% qoq ar) and government spending (+3.5%) but a pullback in housing (-6.3%) and a -0.7pp GDP growth contribution from inventories (qoq ar).

- 08:30 AM Durable goods orders, December preliminary (GS +4.0%, consensus +1.1%, last +5.4%); Durable goods orders ex-transportation, December preliminary (GS +0.1%, consensus +0.2%, last +0.4%); Core capital goods orders, December preliminary (GS -0.1%, consensus +0.2%, last +0.8%); Core capital goods shipments, December preliminary (GS -0.1%, consensus +0.2%, last -0.2%): We estimate that durable goods orders rose 4.0% in the preliminary December report (mom sa), reflecting a jump in commercial aircraft orders. We forecast weaker details however, including a 0.1% decline in both core capital goods orders and core capital goods shipments. The latter forecast reflects an end-of-year lull in global manufacturing activity and the related pullback in industrial production of business equipment in December.

- 08:30 AM Advance goods trade balance, December (GS -$87.5bn, consensus -$88.5bn, last -$89.3bn)

- 08:30 AM Wholesale inventories, December preliminary (consensus -0.2%, last -0.2%)

- 08:30 AM Initial jobless claims, week ending January 20 (GS 195k, consensus 200k, last 187k): Continuing claims, week ending January 13 (GS 1,830k, consensus 1,840k, last 1,806k)

- 10:00 AM New home sales, December (GS +10.5%, consensus +10.0%, last -12.2%)

- 11:00 AM Kansas City Fed manufacturing index, January (last -1)

Friday, January 26

- 08:30 AM Personal spending, December (GS 0.3%, consensus 0.4%, last 0.2%); Personal income, December (GS 0.3%, consensus 0.3%, last 0.4%); PCE price index, December (GS +0.18%, consensus +0.2%, last -0.1%); Core PCE price index, December (GS +0.18%, consensus +0.2%, last +0.1%): We estimate personal spending increased 0.3% and personal income increased 0.3% in December. We estimate that the core PCE price index rose +0.18%, corresponding to a year-over-year rate of 2.94%. Additionally, we expect that the headline PCE price index increased by 0.18% from the prior month, corresponding to a year-over-year rate of 2.63%. Our forecast is consistent with a 0.19% increase in our trimmed core PCE measure (vs. 0.12% in November and 0.17% in October).

- 10:00 AM Pending home sales, December (GS +4.5%, consensus +2.0%, last flat)

Source: DB, Goldman, BofA

With the Fed now on their blackout period ahead of next week’s FOMC and with the ECB quiet before their meeting on Thursday, DB’s Jim Reid writes that we’ll have a few days break from what has been relatively hawkish central bank rhetoric over the past week. Even the BoJ meeting tomorrow is now likely to be a non-event, just as we said in December when everyone was buying the yen in anticipation of an “imminent” rate hike by the BOJ (in fact shorting the USDJPY was a top consensus trade for 2024, well good luck with those huge losses).

Risk was briefly shaken by central bankers pushing back on the market in the first half of last week as rate expectations and yields moved higher. Although yields continued to move higher in the second half, risk fought back and we saw a decoupling between rates and equities that is potentially the biggest test of the very tight relationship the two have seen since August (both bearish and bullish). So although 1 0yr yields are now up +23bps in 2024, the S&P 500 closed at an all-time high on Friday, the first since January 2022, and largely on the back of chip optimism sparked by Taiwan Semi, when the whole story was just China scrambling to buy chips ahead of a new round of sanctions.

Looking at the key events this week, we’ll get two bites at US core PCE trends this week, first within the first estimate for Q4 GDP (Thursday) and then in the personal income and spending report (Friday). Although CPI disappointed higher in December the components of this and PPI suggest a more benign core PCE reading. So this will be very important. Last week’s retail sales beat, and especially the control group, meant DB’s economists upped their Q4 GDP forecast from 2.0% to 2.3%. Durable goods and trade data on the same day as GDP could add a bit of uncertainty to the print though.

Staying with the US, today’s leading indicators will likely still be at levels only really seen in recessions, but the direction of travel may well be moving in a more positive direction if consensus is correct. Elsewhere, tomorrow brings the second state to vote in the Republican nomination process with the New Hampshire primary. Last night DeSantis pulled out of the race and endorsed Trump. The latest polling in the state before the news had Trump on 49.8%, Haley with some momentum on 36.1%, and DeSantis slipping in recent weeks to 5.8%. So it’s now effectively a two-horse race and a winner could materialise in the next few weeks. In 2016 Trump became the presumptive nominee on May 3rd.

Earnings season will be busy with the highlights being Tesla, Netflix, Intel and ASML on Wednesday. We note the other main companies reporting in the calendar at the end.

Outside of the US we have the flash PMIs for key countries due on Wednesday. It’s worth noting that both manufacturing and services indicators remain below 50 in both France and Germany.

In terms of those central bank meetings, DB expects the BoJ to stick with its current policy stance tomorrow but further out sees the BoJ abandoning its negative interest rate policy in April (until that is pushed out again some time in 2025, then 2026 and so on). Tokyo CPI is out on Thursday as an aside.

For the ECB, most economists expect the ECB to stay cautious on the inflation front and continue pushing back against a rate cut in Q1. DB’s team sees the first rate cut in April (50bps back to back in April-June and 150bps in total in 2024) amid weak growth and inflation ahead. Note that the ECB bank lending survey is out tomorrow. This will show whether banks are starting to be less cautious about extending lending to the economy from tight levels and will be an interesting preview to the US equivalent (SLOOS) in a couple of weeks.

Staying with Europe, a number of sentiment gauges will be out this week including consumer confidence metrics for the UK, Germany and France on Friday as well as the Ifo survey for Germany on Thursday.

Below, courtesy of DB, is a day-by-day calendar of events

Monday January 22

- Data: US December leading index, China 1-yr and 5-yr loan prime rates, France December retail sales

- Earnings: United Airlines

Tuesday January 23

- Data: US January Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, UK December public finances, Japan December trade balance, Eurozone January consumer confidence

- Central banks: BoJ decision, Outlook Report, ECB’s bank lending survey

- Earnings: Johnson & Johnson, Procter & Gamble, Netflix, Verizon, Texas Instruments, General Electric, RTX, Lockheed Martin, Halliburton

- Auctions: US 2-yr Notes ($60bn)

Wednesday January 24

- Data: US, UK, Japan, Germany, France and the Eurozone January PMIs

- Central banks: BoC decision

- Earnings: Tesla, ASML, Abbott Laboratories, SAP, IBM, ServiceNow, AT&T, Lam Research, CSX, Freeport-McMoRan, Crown Castle

- Auctions: US 2-yr FRNs ($28bn), 5-yr Notes ($61bn)

Thursday January 25

- Data: US Q4 GDP advance reading, core PCE, January Kansas City Fed manufacturing activity, December durable goods orders, advance goods trade balance, new home sales, retail inventories, Chicago Fed national activity index, initial jobless claims, Japan January Tokyo CPI, December PPI services, Germany January Ifo survey, France Q4 total jobseekers, January business and manufacturing confidence

- Central banks: ECB decision, BoJ minutes of the December meeting

- Earnings: Visa, LVMH, Intel, T-Mobile US, Comcast, Union Pacific, Blackstone, NextEra Energy, KLA, Northrop Grumman, SK Hynix, Valero Energy, STMicroelectronics, Nokia

- Auctions: US 7-yr Notes ($41bn)

Friday January 26

- Data: US December personal spending and income, PCE deflator, pending home sales, January Kansas City Fed services activity, UK January GfK consumer confidence, Germany February GfK consumer confidence, France January consumer confidence, Eurozone December M3

- Central banks: ECB’s survey of professional forecasters, ECB’s Panetta, Kazaks and Vujcic speak

- Earnings: American Express, Volvo, Lonza Group

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the Q4 GDP advance release and durable goods report on Thursday, and the core PCE inflation report on Friday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period in advance of the FOMC meeting January 30-31.

Monday, January 22

- No major data releases.

Tuesday, January 23

- 10:00 AM Richmond Fed manufacturing index, January (consensus -6, last -11)

Wednesday, January 24

- 09:45 AM S&P Global US manufacturing PMI, January preliminary (consensus 47.5, last 47.9); S&P Global US services PMI, January preliminary (consensus 51.0, last 51.4)

Thursday, January 25

- 08:30 AM GDP, Q4 advance (GS +2.1%, consensus +2.0%, last +4.9%); Personal consumption, Q4 advance (GS +2.9%, consensus +2.5%, last +3.1%): We estimate that GDP rose 2.1% annualized in the advance reading for Q4, following +4.9% annualized in Q3. Our forecast reflects strength in consumption (+2.9% qoq ar) and government spending (+3.5%) but a pullback in housing (-6.3%) and a -0.7pp GDP growth contribution from inventories (qoq ar).

- 08:30 AM Durable goods orders, December preliminary (GS +4.0%, consensus +1.1%, last +5.4%); Durable goods orders ex-transportation, December preliminary (GS +0.1%, consensus +0.2%, last +0.4%); Core capital goods orders, December preliminary (GS -0.1%, consensus +0.2%, last +0.8%); Core capital goods shipments, December preliminary (GS -0.1%, consensus +0.2%, last -0.2%): We estimate that durable goods orders rose 4.0% in the preliminary December report (mom sa), reflecting a jump in commercial aircraft orders. We forecast weaker details however, including a 0.1% decline in both core capital goods orders and core capital goods shipments. The latter forecast reflects an end-of-year lull in global manufacturing activity and the related pullback in industrial production of business equipment in December.

- 08:30 AM Advance goods trade balance, December (GS -$87.5bn, consensus -$88.5bn, last -$89.3bn)

- 08:30 AM Wholesale inventories, December preliminary (consensus -0.2%, last -0.2%)

- 08:30 AM Initial jobless claims, week ending January 20 (GS 195k, consensus 200k, last 187k): Continuing claims, week ending January 13 (GS 1,830k, consensus 1,840k, last 1,806k)

- 10:00 AM New home sales, December (GS +10.5%, consensus +10.0%, last -12.2%)

- 11:00 AM Kansas City Fed manufacturing index, January (last -1)

Friday, January 26

- 08:30 AM Personal spending, December (GS 0.3%, consensus 0.4%, last 0.2%); Personal income, December (GS 0.3%, consensus 0.3%, last 0.4%); PCE price index, December (GS +0.18%, consensus +0.2%, last -0.1%); Core PCE price index, December (GS +0.18%, consensus +0.2%, last +0.1%): We estimate personal spending increased 0.3% and personal income increased 0.3% in December. We estimate that the core PCE price index rose +0.18%, corresponding to a year-over-year rate of 2.94%. Additionally, we expect that the headline PCE price index increased by 0.18% from the prior month, corresponding to a year-over-year rate of 2.63%. Our forecast is consistent with a 0.19% increase in our trimmed core PCE measure (vs. 0.12% in November and 0.17% in October).

- 10:00 AM Pending home sales, December (GS +4.5%, consensus +2.0%, last flat)

Source: DB, Goldman, BofA

Loading…