It is a relatively quiet week, and the biggest highlight for investors following the growth concerns that have roiled markets of late will be the global preliminary PMIs for May tomorrow. Central banks will also remain in focus as we will get the latest FOMC meeting minutes (Wednesday) and the US April PCE, the Fed's preferred inflation proxy, on Friday. An array of global industrial activity data will be another theme to watch.

Consumer sentiment will be in focus too, with a number of confidence measures from Europe and personal income and spending data from the US (Friday). Corporates reporting results will include spending bellwethers Macy's and Costco. After last week’s retail earnings bloodbath (e.g. Walmart and Target) these will get added attention.

On the Fed, the minutes may be a bit stale now but it’ll still be interesting to see the insight around the biases of 50bps vs 25/75bps hikes after the next couple of meetings. Thoughts on QT will also be devoured.

Staying with the US, for the personal income and spending numbers on Friday, our US economists expect the two indicators to slow to +0.2% and +0.6% in April, respectively. The Fed’s preferred inflation gauge, the PCE, will be another important metric released the same day and DB’s economics team expects the April core reading to stay at +0.3%. Other US data will include April new home sales tomorrow and April durable goods orders on Wednesday.

A number of manufacturing and business activity indicators are in store, too. Regional Fed indicators throughout the week will include an April gauge of national activity from the Chicago Fed (today) and May manufacturing indices from the Richmond Fed (tomorrow) and the Kansas City Fed (Thursday). In Europe, the May IFO business climate indicator for Germany will be out today, followed by a manufacturing confidence gauge for France (tomorrow) and Italy (Thursday). China's industrial profits are due on Friday.

This week will also feature a number of important summits. Among them will be the World Economic Forum’s annual meeting in Davos that has now started and will run until next Thursday. It'll be the first in-person meeting since the pandemic began and geopolitics will likely be in focus. Meanwhile, President Biden will travel to Asia for the first time as US president and attend a Quad summit in Tokyo tomorrow. Details on the Indo-Pacific Economic Framework are expected. Finally, NATO Parliamentary Assembly’s 2022 Spring Session will be held in Vilnius from next Friday to May 30th.

In corporate earnings, investors will be closely watching Macy's, Costco and Dollar General after this week's slump in Walmart and Target. Amid the carnage in tech, several companies that were propelled by the pandemic will be in focus too, with reporters including NVIDIA, Snowflake (Wednesday) and Zoom (today). Other notable corporates releasing earnings will be Lenovo, Alibaba, Baidu (Thursday) and XPeng (Monday).

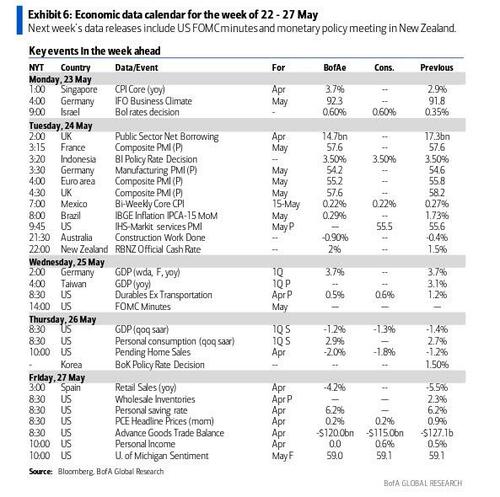

Courtesy of DB, here is a day-by-day calendar of events

Monday May 23

- Data: US April Chicago Fed national activity index, Germany May IFO business climate

- Central banks: Fed's Bostic speaks, ECB's Holzmann, Nagel and Villeroy speak, BoE's Bailey speaks

- Earnings: XPeng, Zoom

Tuesday May 24

- Data: May PMIs for the US, Japan, UK, France, Germany and the Eurozone, US May Richmond Fed manufacturing index, April new home sales, Japan April nationwide, Tokyo department sales, UK April public finances, France May manufacturing confidence

- Central banks: Fed's George speaks, ECB's Villeroy speaks

- Earnings: Best Buy, Intuit

- Other: Quad summit in Tokyo

Wednesday May 25

- Data: US April durable, capital goods orders, Germany June GfK consumer confidence, Q1 private consumption, government spending, capital investment, France May consumer confidence

- Central banks: Fed FOMC meeting minutes, ECB's Lagarde, Rehn, Panetta and Holzmann speak, BoJ's Kuroda speaks, ECB's Finance Stability Review

- Earnings: NVIDIA, Snowflake

Thursday May 26

- Data: US May Kansas City Fed manufacturing activity index, April pending home sales, initial jobless claims, Japan April services PPI, Italy May consumer, manufacturing, economic confidence, March industrial sales, Canada May CFIB business barometer, March payroll employment change, retail sales

- Earnings: Royal Bank of Canada, Dollar General, Lenovo, Alibaba, Baidu, Macy's, Dollar Tree, Costco, Marvell, Autodesk

Friday May 27

- Data: US April advance goods trade balance, April wholesale inventories, personal income, personal spending, PCE deflator, China April industrial profits, Japan May Tokyo CPI, Eurozone April M3

- Central banks: ECB's Lane speaks

- Earnings: Pinduoduo

- Other: NATO Parliamentary Assembly begins, until May 30th

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Wednesday, the Q1 GDP release on Thursday, and the core PCE inflation report on Friday. The minutes from the May FOMC meeting will be released on Wednesday. There are several scheduled speaking engagements by Fed officials this week, including remarks by Chair Powell on Tuesday and a speech by Vice Chair Brainard on Wednesday.

Monday, May 23

- There are no major economic data releases scheduled.

- 12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss the economic outlook at an event in Atlanta. Audience and media Q&A are expected. On May 10th, President Bostic argued that a 50bp pace of hiking is “the pace we need to stay at—getting 50bp increases, maybe for the next two or perhaps three meetings, and let’s just keep this moving to make sure that we’re doing all we can to get inflation under control,” while also stressing that he does not think “we need to be moving even more aggressively” than a 50bp pace.

- 07:30 PM Kansas City Fed President George (FOMC non-voter) speaks: Kansas City Fed President Esther George will give a speech at an agricultural symposium hosted by the Kansas City Fed. Audience Q&A is expected. On May 19th, President George noted that she was “very comfortable right now with 50 basis points,” and argued that “what’s more important [than estimates of the neutral rate] is at what point will we see inflation level out and begin to decelerate. That, I think, will tell us something about where we need to go with monetary policy.”

Tuesday, May 24

- 09:45 AM S&P Global US manufacturing PMI, May preliminary (consensus 57.8, last 59.2); S&P Global US services PMI, May preliminary (consensus 55.3, last 55.6)

- 10:00 AM Richmond Fed manufacturing index, May (consensus 10, last 16)

- 10:00 AM New home sales, April (GS -2.0%, consensus -1.7%, last -8.6%): We estimate that new home sales declined 2.0% in April, following an 8.6% decline in March.

- 12:20 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will deliver welcoming remarks to the National Center for American Indian Enterprise Development 2022 Reservation Economic Summit. Text is expected. On May 17th, Chair Powell noted that “during the course of the [May FOMC] meeting it became clear that there was broad support in the committee for having on the table the idea of doing additional [50bp] rate increases … at each of the next two meetings.” Chair Powell noted that the Fed is looking to “have financial conditions tighten to the point where growth will moderate and still be positive, but moderate to the point where supply and demand can get back into alignment and where we can get inflation back down to 2%,” and stressed that “what we need to see is inflation coming down in a clear and convincing way and we're going to keep pushing until we see that.” Chair Powell argued that “there are a number of plausible paths to having a softish landing,” although he warned that “there could be some pain” as the Fed tightens monetary policy.

Wednesday, May 25

- 08:30 AM Durable goods orders, April preliminary (GS -0.4%, consensus +0.6%, last +1.1%); Durable goods orders ex-transportation, April preliminary (GS +0.4%, consensus +0.6%, last +1.4%); Core capital goods orders, April preliminary (GS +0.3%, consensus +0.5%, last +1.3%); Core capital goods shipments, April preliminary (GS +0.5%, consensus +0.5%, last +0.4%): We estimate that durable goods orders declined 0.4% in the preliminary April report, following a 1.1% increase in March. Our forecast reflects lower commercial aircraft orders and a possible slowdown in new orders of core capex equipment.

- 12:15 PM Fed Vice Chair Brainard (FOMC voter) speaks: Fed Vice Chair Lael Brainard will deliver remarks at the Johns Hopkins University School of Advance International Studies 2022 commencement ceremony in Washington. Text is expected. On April 12th, Vice Chair Brainard said that she expects “the combined effect of moving the policy rate to a more neutral level and commencing balance sheet reduction to have the effect of bringing inflation down, seeing some moderation in demand while the supply side catches up.” Vice Chair Brainard also noted that “core goods, which has been the source of an outsized amount of core inflationary pressure, moderated more than I had anticipated. It’s very welcome to see the moderation in this category. And I will be looking to see whether we continue to see moderation in the months ahead.”

- 02:00 PM FOMC meeting minutes, May 3-4 meeting: The FOMC increased the federal funds rate by 50bp at its May meeting. Chair Powell said that further 50bp increases in the funds rate should be on the table at the next couple of meetings, but that a “75bp increase is not something the committee is actively considering.” We expect the FOMC to deliver two additional 50bp hikes in June and July, and to hike by 25bp at its remaining meetings this year.

- The FOMC also announced the start of balance sheet runoff at the May meeting, with peak caps of $60bn for Treasury securities and $35bn for mortgage-backed securities. We expect that UST runoff will always hit its cap until the balance sheet reaches its terminal size, but MBS runoff will never hit its cap, especially following the very sharp recent rise in mortgage rates.

Thursday, May 26

- 08:30 AM GDP, Q1 second (GS -1.7%, consensus -1.3%, last -1.4%); Personal consumption, Q1 second (GS +2.0%, consensus +2.9%, last +2.7%): We estimate a three-tenths downward revision to Q1 GDP growth to -1.7% (qoq ar) following Friday’s weaker-than-expected Quarterly Services Survey (QSS). Our forecast assumes downward revisions to consumption related to Omicron, partially offset by upward revisions to intellectual property investment and inventories.

- 08:30 AM Initial jobless claims, week ended May 21 (GS 218k, consensus 210k, last 218k); Continuing jobless claims, week ended May 14 (consensus 1,310k, last 1,317k): We estimate initial jobless claims were unchanged at 218k in the week ended May 21.

- 10:00 AM Pending home sales, April (GS -2.3%, consensus -2.0%, last -1.2%): We estimate that pending home sales declined 2.3% in April, following a 1.2% decline in March.

- 11:00 AM Kansas City Fed manufacturing index, May (consensus 18, last 25)

Friday, May 27

- 08:30 AM Personal income, April (GS +0.6%, consensus +0.5%, last +0.5%); Personal spending, April (GS +1.1%, consensus +0.7%, last +1.1%); PCE price index, April (GS +0.14%, consensus +0.2%, last +0.87%); PCE price index (yoy), April (GS +6.13%, consensus +6.2%, last +6.59%); Core PCE price index, April (GS +0.21%, consensus +0.3%, last +0.29%); Core PCE price index (yoy), April (GS +4.75%, consensus +4.9%, last +5.18%): Based on details in the PPI, CPI, and import prices reports, we estimate that the core PCE price index rose by 0.20% month-over-month in April, corresponding to a 4.75% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.14% in April, corresponding to a +6.13% increase from a year earlier. We expect that personal income increased by 0.6% and personal spending increased by 1.1% in April.

- 08:30 AM Advance goods trade balance, April (GS -$114.0, consensus -$114.7bn, last -$127.1bn): We estimate that the goods trade deficit decreased by $13.1 to $114.0 in April compared to the final March report, reflecting a decrease in imports.

- 08:30 AM Wholesale inventories, April preliminary (consensus +1.9%, last +2.3%): Retail inventories, April (consensus +2.0%, last +2.0%)

- 10:00 AM University of Michigan consumer sentiment, April final (GS 58.1, consensus 59.1, last 59.1): We expect the University of Michigan consumer sentiment index decreased by 1.0pt to 58.1 in the final May reading.

d

It is a relatively quiet week, and the biggest highlight for investors following the growth concerns that have roiled markets of late will be the global preliminary PMIs for May tomorrow. Central banks will also remain in focus as we will get the latest FOMC meeting minutes (Wednesday) and the US April PCE, the Fed’s preferred inflation proxy, on Friday. An array of global industrial activity data will be another theme to watch.

Consumer sentiment will be in focus too, with a number of confidence measures from Europe and personal income and spending data from the US (Friday). Corporates reporting results will include spending bellwethers Macy’s and Costco. After last week’s retail earnings bloodbath (e.g. Walmart and Target) these will get added attention.

On the Fed, the minutes may be a bit stale now but it’ll still be interesting to see the insight around the biases of 50bps vs 25/75bps hikes after the next couple of meetings. Thoughts on QT will also be devoured.

Staying with the US, for the personal income and spending numbers on Friday, our US economists expect the two indicators to slow to +0.2% and +0.6% in April, respectively. The Fed’s preferred inflation gauge, the PCE, will be another important metric released the same day and DB’s economics team expects the April core reading to stay at +0.3%. Other US data will include April new home sales tomorrow and April durable goods orders on Wednesday.

A number of manufacturing and business activity indicators are in store, too. Regional Fed indicators throughout the week will include an April gauge of national activity from the Chicago Fed (today) and May manufacturing indices from the Richmond Fed (tomorrow) and the Kansas City Fed (Thursday). In Europe, the May IFO business climate indicator for Germany will be out today, followed by a manufacturing confidence gauge for France (tomorrow) and Italy (Thursday). China’s industrial profits are due on Friday.

This week will also feature a number of important summits. Among them will be the World Economic Forum’s annual meeting in Davos that has now started and will run until next Thursday. It’ll be the first in-person meeting since the pandemic began and geopolitics will likely be in focus. Meanwhile, President Biden will travel to Asia for the first time as US president and attend a Quad summit in Tokyo tomorrow. Details on the Indo-Pacific Economic Framework are expected. Finally, NATO Parliamentary Assembly’s 2022 Spring Session will be held in Vilnius from next Friday to May 30th.

In corporate earnings, investors will be closely watching Macy’s, Costco and Dollar General after this week’s slump in Walmart and Target. Amid the carnage in tech, several companies that were propelled by the pandemic will be in focus too, with reporters including NVIDIA, Snowflake (Wednesday) and Zoom (today). Other notable corporates releasing earnings will be Lenovo, Alibaba, Baidu (Thursday) and XPeng (Monday).

Courtesy of DB, here is a day-by-day calendar of events

Monday May 23

- Data: US April Chicago Fed national activity index, Germany May IFO business climate

- Central banks: Fed’s Bostic speaks, ECB’s Holzmann, Nagel and Villeroy speak, BoE’s Bailey speaks

- Earnings: XPeng, Zoom

Tuesday May 24

- Data: May PMIs for the US, Japan, UK, France, Germany and the Eurozone, US May Richmond Fed manufacturing index, April new home sales, Japan April nationwide, Tokyo department sales, UK April public finances, France May manufacturing confidence

- Central banks: Fed’s George speaks, ECB’s Villeroy speaks

- Earnings: Best Buy, Intuit

- Other: Quad summit in Tokyo

Wednesday May 25

- Data: US April durable, capital goods orders, Germany June GfK consumer confidence, Q1 private consumption, government spending, capital investment, France May consumer confidence

- Central banks: Fed FOMC meeting minutes, ECB’s Lagarde, Rehn, Panetta and Holzmann speak, BoJ’s Kuroda speaks, ECB’s Finance Stability Review

- Earnings: NVIDIA, Snowflake

Thursday May 26

- Data: US May Kansas City Fed manufacturing activity index, April pending home sales, initial jobless claims, Japan April services PPI, Italy May consumer, manufacturing, economic confidence, March industrial sales, Canada May CFIB business barometer, March payroll employment change, retail sales

- Earnings: Royal Bank of Canada, Dollar General, Lenovo, Alibaba, Baidu, Macy’s, Dollar Tree, Costco, Marvell, Autodesk

Friday May 27

- Data: US April advance goods trade balance, April wholesale inventories, personal income, personal spending, PCE deflator, China April industrial profits, Japan May Tokyo CPI, Eurozone April M3

- Central banks: ECB’s Lane speaks

- Earnings: Pinduoduo

- Other: NATO Parliamentary Assembly begins, until May 30th

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Wednesday, the Q1 GDP release on Thursday, and the core PCE inflation report on Friday. The minutes from the May FOMC meeting will be released on Wednesday. There are several scheduled speaking engagements by Fed officials this week, including remarks by Chair Powell on Tuesday and a speech by Vice Chair Brainard on Wednesday.

Monday, May 23

- There are no major economic data releases scheduled.

- 12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss the economic outlook at an event in Atlanta. Audience and media Q&A are expected. On May 10th, President Bostic argued that a 50bp pace of hiking is “the pace we need to stay at—getting 50bp increases, maybe for the next two or perhaps three meetings, and let’s just keep this moving to make sure that we’re doing all we can to get inflation under control,” while also stressing that he does not think “we need to be moving even more aggressively” than a 50bp pace.

- 07:30 PM Kansas City Fed President George (FOMC non-voter) speaks: Kansas City Fed President Esther George will give a speech at an agricultural symposium hosted by the Kansas City Fed. Audience Q&A is expected. On May 19th, President George noted that she was “very comfortable right now with 50 basis points,” and argued that “what’s more important [than estimates of the neutral rate] is at what point will we see inflation level out and begin to decelerate. That, I think, will tell us something about where we need to go with monetary policy.”

Tuesday, May 24

- 09:45 AM S&P Global US manufacturing PMI, May preliminary (consensus 57.8, last 59.2); S&P Global US services PMI, May preliminary (consensus 55.3, last 55.6)

- 10:00 AM Richmond Fed manufacturing index, May (consensus 10, last 16)

- 10:00 AM New home sales, April (GS -2.0%, consensus -1.7%, last -8.6%): We estimate that new home sales declined 2.0% in April, following an 8.6% decline in March.

- 12:20 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will deliver welcoming remarks to the National Center for American Indian Enterprise Development 2022 Reservation Economic Summit. Text is expected. On May 17th, Chair Powell noted that “during the course of the [May FOMC] meeting it became clear that there was broad support in the committee for having on the table the idea of doing additional [50bp] rate increases … at each of the next two meetings.” Chair Powell noted that the Fed is looking to “have financial conditions tighten to the point where growth will moderate and still be positive, but moderate to the point where supply and demand can get back into alignment and where we can get inflation back down to 2%,” and stressed that “what we need to see is inflation coming down in a clear and convincing way and we’re going to keep pushing until we see that.” Chair Powell argued that “there are a number of plausible paths to having a softish landing,” although he warned that “there could be some pain” as the Fed tightens monetary policy.

Wednesday, May 25

- 08:30 AM Durable goods orders, April preliminary (GS -0.4%, consensus +0.6%, last +1.1%); Durable goods orders ex-transportation, April preliminary (GS +0.4%, consensus +0.6%, last +1.4%); Core capital goods orders, April preliminary (GS +0.3%, consensus +0.5%, last +1.3%); Core capital goods shipments, April preliminary (GS +0.5%, consensus +0.5%, last +0.4%): We estimate that durable goods orders declined 0.4% in the preliminary April report, following a 1.1% increase in March. Our forecast reflects lower commercial aircraft orders and a possible slowdown in new orders of core capex equipment.

- 12:15 PM Fed Vice Chair Brainard (FOMC voter) speaks: Fed Vice Chair Lael Brainard will deliver remarks at the Johns Hopkins University School of Advance International Studies 2022 commencement ceremony in Washington. Text is expected. On April 12th, Vice Chair Brainard said that she expects “the combined effect of moving the policy rate to a more neutral level and commencing balance sheet reduction to have the effect of bringing inflation down, seeing some moderation in demand while the supply side catches up.” Vice Chair Brainard also noted that “core goods, which has been the source of an outsized amount of core inflationary pressure, moderated more than I had anticipated. It’s very welcome to see the moderation in this category. And I will be looking to see whether we continue to see moderation in the months ahead.”

- 02:00 PM FOMC meeting minutes, May 3-4 meeting: The FOMC increased the federal funds rate by 50bp at its May meeting. Chair Powell said that further 50bp increases in the funds rate should be on the table at the next couple of meetings, but that a “75bp increase is not something the committee is actively considering.” We expect the FOMC to deliver two additional 50bp hikes in June and July, and to hike by 25bp at its remaining meetings this year.

- The FOMC also announced the start of balance sheet runoff at the May meeting, with peak caps of $60bn for Treasury securities and $35bn for mortgage-backed securities. We expect that UST runoff will always hit its cap until the balance sheet reaches its terminal size, but MBS runoff will never hit its cap, especially following the very sharp recent rise in mortgage rates.

Thursday, May 26

- 08:30 AM GDP, Q1 second (GS -1.7%, consensus -1.3%, last -1.4%); Personal consumption, Q1 second (GS +2.0%, consensus +2.9%, last +2.7%): We estimate a three-tenths downward revision to Q1 GDP growth to -1.7% (qoq ar) following Friday’s weaker-than-expected Quarterly Services Survey (QSS). Our forecast assumes downward revisions to consumption related to Omicron, partially offset by upward revisions to intellectual property investment and inventories.

- 08:30 AM Initial jobless claims, week ended May 21 (GS 218k, consensus 210k, last 218k); Continuing jobless claims, week ended May 14 (consensus 1,310k, last 1,317k): We estimate initial jobless claims were unchanged at 218k in the week ended May 21.

- 10:00 AM Pending home sales, April (GS -2.3%, consensus -2.0%, last -1.2%): We estimate that pending home sales declined 2.3% in April, following a 1.2% decline in March.

- 11:00 AM Kansas City Fed manufacturing index, May (consensus 18, last 25)

Friday, May 27

- 08:30 AM Personal income, April (GS +0.6%, consensus +0.5%, last +0.5%); Personal spending, April (GS +1.1%, consensus +0.7%, last +1.1%); PCE price index, April (GS +0.14%, consensus +0.2%, last +0.87%); PCE price index (yoy), April (GS +6.13%, consensus +6.2%, last +6.59%); Core PCE price index, April (GS +0.21%, consensus +0.3%, last +0.29%); Core PCE price index (yoy), April (GS +4.75%, consensus +4.9%, last +5.18%): Based on details in the PPI, CPI, and import prices reports, we estimate that the core PCE price index rose by 0.20% month-over-month in April, corresponding to a 4.75% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.14% in April, corresponding to a +6.13% increase from a year earlier. We expect that personal income increased by 0.6% and personal spending increased by 1.1% in April.

- 08:30 AM Advance goods trade balance, April (GS -$114.0, consensus -$114.7bn, last -$127.1bn): We estimate that the goods trade deficit decreased by $13.1 to $114.0 in April compared to the final March report, reflecting a decrease in imports.

- 08:30 AM Wholesale inventories, April preliminary (consensus +1.9%, last +2.3%): Retail inventories, April (consensus +2.0%, last +2.0%)

- 10:00 AM University of Michigan consumer sentiment, April final (GS 58.1, consensus 59.1, last 59.1): We expect the University of Michigan consumer sentiment index decreased by 1.0pt to 58.1 in the final May reading.

d