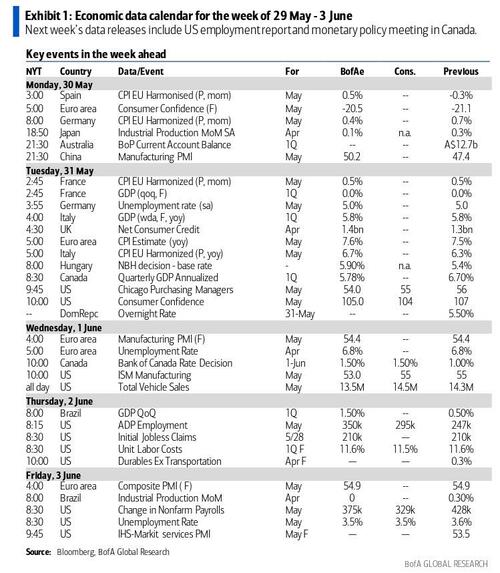

It’s a bit of a stilted week with the US taking today off for Memorial Day and the UK off on both Thursday and Friday to celebrate the Queen’s Platinum Jubilee. However, as DB's Jim Reid notes there’s lot of important data from both a growth and inflation perspective this week with the monthly jobs report from the US (Friday) and a slew of May CPIs from Europe (including the highest German CPI in 60 years reported today). Industrial activity will be in focus too with the Chicago PMI, the Dallas Fed manufacturing activity index (Tuesday), the ISM index (Wednesday) and several European PPIs due.

On Wednesday, June 1, markets will also be especially focused on central banks with the start of the Fed's balance sheet run off, the BoC decision and the Beige Book release. In Asia, next week will be packed with data for Japan and PMIs from China will be due.

Aside for the hotter than expected German CPI print, which came in well above expectations, and was the joint highest since 1950...

... producer prices will also be released across the continent, with April PPI due from Italy (today), France (tomorrow) and the Eurozone (Thursday). Finally, labor market indicators will be released throughout the week for Germany (tomorrow), Italy and the Eurozone (Wednesday).

Over in the US, all roads lead to payrolls on Friday where Deutsche Bank economists project gains of 325k vs last month's 428k reading that came in above of the median estimate of 380k on Bloomberg. The JOLTS and ADP reports will be due on Wednesday and Thursday, respectively. The JOLTS report is everyone's favorite insight into labor market tightness but it is a month behind the less useful payroll report.

Another important set of indicators will come for industrial activity, including the Chicago PMI and the Dallas Fed manufacturing activity index tomorrow, the ISM manufacturing index on Wednesday and April factory orders on Thursday. These follow misses on PMIs, the Richmond index and the durable goods orders last week, so markets will be paying attention as to whether these metrics will come in softer than expected as well. Finally, Conference Board's consumer confidence index, tomorrow, will be assessed in conjunction with the labor market data to gauge the strength of the consumer.

From central banks, investors will be awaiting this Wednesday when the Fed is due to start its balance sheet run off in order to gauge the preliminary impact on the markets. Elsewhere, the Bank of Canada's decision will also be due on Wednesday, following a +50bps move at the last meeting on April 13th. Analysts are expecting another 50bps.

Finally, the Fed will also release its Beige Book that day and its insights about current economic conditions will be digested together with the other timely US indicators. In speakers, this week, similar to last, will be packed with those from the ECB. Their views in light of the week's CPI prints will be of great importance. Fed speakers are detailed alongside those from the ECB and all the key data releases in the day-by-day calendar at the end.

In Asia, the highlight will be May PMIs for China released tomorrow and Wednesday and much attention will be paid to the growth dynamics after dismal industrial production and retail sales numbers released two weeks ago.

Over the weekend, EU diplomats failed to come to an agreement on the EU's proposed ban on Russian oil ahead of a 2-day summit with EU leaders starting today. Meanwhile, OPEC+ are set to meet on Thursday to discuss their production policy for July.

Courtesy of DB's Jim Reid, here is a day-by-day calendar of events

Monday May 30

- Data: Germany May CPI, April import price index, Italy April PPI, Eurozone May economic, industrial, services confidence, Canada Q1 current account balance Central banks: Fed's Waller speaks

Tuesday May 31

- Data: US May MNI Chicago PMI, Conference Board consumer confidence index, Dallas Fed manufacturing activity index, March FHFA house price index, China May PMIs, Japan May consumer confidence index, April retail sales, industrial production, jobless rate, housing starts, France May CPI, April PPI, consumer spending, Germany May unemployment claims rate, UK April consumer credit, mortgage approvals, M4, Eurozone May CPI, Italy May CPI, Canada Q1 GDP

- Central banks: ECB's Villeroy, Visco and Makhlouf speak

- Earnings: Salesforce, HP

Wednesday June 1

- Data: US May ISM index, total vehicle sales, April construction spending, JOLTS report, China May Caixin manufacturing PMI, Japan Q1 capital spending, company profits, May vehicle sales, UK May nationwide house price index, France April budget balance, Italy May PMI, budget balance, new car registrations, April unemployment rate, Eurozone April unemployment rate, Canada May PMI

- Central banks: BoC decision, Fed's Beige Book, Fed's Williams and Bullard speak, ECB's Lagarde, Knot, Lane and Villeroy speak, BoE's Hauser speaks

Thursday June 2

- Data: US May ADP employment change, initial jobless claims, April factory orders, Japan May monetary base, Eurozone April PPI, Canada April building permits

- Central banks: Fed's Mester speaks, ECB's Villeroy and Hernandez speak

- Earnings: Meituan, Lululemon

Friday June 3

- Data: US May nonfarm payrolls, unemployment rate, average hourly earnings, participation rate, ISM services index, Germany April trade balance, France April industrial, manufacturing production, Italy May services PMI, Eurozone April retail sales, Canada Q1 labour productivity

- Central banks: Fed's Brainard speaks

Finally, focusing on just the US, the key economic data releases this week are the JOLTS job openings and ISM manufacturing reports on Wednesday, as well as the employment situation report on Friday. There are several speaking engagements from Fed officials this week, including remarks from Vice Chair Brainard, Governor Waller, and Reserve Bank presidents Williams, Bullard, and Mester. Some more details from Goldman:

Monday, May 30

- There are no major economic data releases scheduled.

- 11:00 AM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will discuss the economic outlook at an event at the Goethe University in Frankfurt hosted by the Institute for Monetary and Financial Stability. A moderated Q&A is expected. On May 10, when discussing Fed tightening, Waller said, “This is the time to hit it. You want to do this when the economy is strong…From my view, do it now, front-load it, get it done, and then we can judge how the economy is proceeding."

Tuesday, May 31

- 09:00 AM FHFA house price index, March (consensus +2.0%, last +2.1%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, March (GS +2.0%, consensus +1.90%, last +2.39%): We estimate that the S&P/Case-Shiller 20-city home price index rose by 2.0% in March, following a 2.39% (20.2% yoy) increase in February.

- 09:45 AM Chicago PMI, May (GS 53.4, consensus 55.1, last 56.4): We estimate that the Chicago PMI declined 3pt to 53.4 in May, reflecting a drag from East Asian demand.

- 10:00 AM Conference Board consumer confidence, May (GS 101.3, consensus 103.9, last 107.3): We estimate that the Conference Board consumer confidence index declined 6pt in May, reflecting weaker signals from other confidence measures.

- 10:30 AM Dallas Fed manufacturing index, May (consensus 1.5, last 1.1)

Wednesday, June 1

- 09:45 AM S&P Global US manufacturing PMI, May final (consensus 57.5, last 57.5)

- 10:00 AM Construction spending, April (GS +0.3%, consensus +0.6%, last +0.1%): We estimate a 0.3% increase in construction spending in April.

- 10:00 AM ISM manufacturing index, May (GS 54.5, consensus 54.5, last 55.4): We estimate that the ISM manufacturing index declined by 0.9pt to 54.5 in May. Business surveys generally declined in the month, and covid-related disruptions in China likely weighed on East Asian demand.

- 10:00 AM JOLTS job openings, April (consensus 11,400k, last 11,549k)

- 11:30 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will make opening remarks at an event on Monetary Policy Implementation and Digital Innovation hosted by the New York Fed and Columbia University. On May 16, Williams said, "It's about trying to get short-term interest rates expeditiously, over this year, back to more normal levels,” adding that 50bp at the June meeting “makes sense." On May 10, he noted “If it's needed to raise real rates above neutral to get inflation down, I have absolutely no reluctance to do so.”

- 01:00 PM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will discuss the economic and policy outlook at the Economic Club of Memphis. Audience and media Q&A is expected. On May 20, Bullard said that 50bp hikes are “a good plan for now,” but that “you can never make iron-clad promises.” He added, “I have also said we should get to 3.5% by the end of the year, which is higher than some of my colleagues. The more we can front-load and the more we can get inflation and inflation expectations under control, the better off we will be. In out years -- ’23 and ‘24 -- we could be lowering the policy rate because we got inflation under control.”

02:00 PM Beige Book

- The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the April Beige Book, districts reported moderate employment gains despite hiring and retention challenges. Consumer spending accelerated – as Omicron cases tapered – and manufacturing activity was solid, but firms reported continued supply chain backlogs, labor market tightness, and elevated input costs. We expect the labor market to remain tight and supply disruptions to continue to put upward pressure on prices in the near term. We therefore expect continued anecdotes of wage and price pressures in this Beige Book.

- 05:00 PM Lightweight motor vehicle sales, May (GS 13.7mn, consensus 14.3mn, last 14.3mn)

Thursday, June 2

- 08:15 AM ADP employment report, May (GS +225k, consensus +300k, last +247k): We expect a 225k rise in ADP payroll employment in May. Our forecast reflects slowing underlying job growth in the month as well as a drag from the inputs to the ADP model.

- 08:30 AM Nonfarm productivity, Q1 final (GS -7.4%, consensus -7.5%, last -7.5%); Unit labor costs, Q1 final (GS +12.5%, consensus +11.6 last +11.6%): We estimate nonfarm productivity growth was revised up by one tenth to -7.4% in Q1 (qoq ar) following last week’s GDP report. However, we expect that Q1 unit labor costs—compensation per hour divided by output per hour—were revised up by nine tenths to +12.5% (qoq ar).

- 08:30 AM Initial jobless claims, week ended May 28 (GS 205k, consensus 210k, last 210k); Continuing jobless claims, week ended May 21 (consensus 1,333k, last 1,346k): We estimate initial jobless claims declined to 205k in the week ended May 28.

- 10:00 AM Factory orders, April (GS +0.8%, consensus +0.7%, last +1.8%); Durable goods orders, April final (last +0.4%); Durable goods orders ex-transportation, April final (last +0.3%); Core capital goods orders, April final (last +0.3%); Core capital goods shipments, April final (last +0.8%): We estimate that factory orders increased by 0.8% in April following a 1.8% increase in March. Durable goods orders increased by 0.4% in the April advance report, and core capital goods orders increased by +0.3%.

- 12:00 PM New York Fed Executive VP Logan (non-FOMC voter) speaks: Current New York Fed Executive Vice President, and incoming Dallas Fed President, Lorie Logan will make closing remarks at an event on Monetary Policy Implementation and Digital Innovation hosted by the New York Fed and Columbia University. Q&A is not expected.

- 01:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss the economic outlook at a virtual event hosted by the Philadelphia Council for Business Economics. Audience Q&A is currently expected. On May 13, Mester said, “Unless there are some big surprises, I expect it to be appropriate to raise the policy rate another 50bp at each of our next two meetings.” She added that, if by the September meeting monthly inflation readings “provide compelling evidence that inflation is moving down, then the pace of rate increases could slow, but if inflation has failed to moderate, then a faster pace of rate increases may be necessary.”

Friday, June 3

- 08:30 AM Nonfarm payroll employment, May (GS +275k, consensus +325k, last +428k); Private payroll employment, May (GS +250k, consensus +300k, last +406k); Average hourly earnings (mom), May (GS +0.4%, consensus +0.4%, last +0.3%); Average hourly earnings (yoy), May (GS +5.3%, consensus +5.2%, last +5.5%);Unemployment rate, May (GS 3.5%, consensus 3.5%, last 3.6%): We estimate nonfarm payrolls rose by 275k in May (mom sa), a slowdown from the +428k pace in both of the previous two months. Job growth tends to slow during the spring hiring season when the labor market is tight—particularly in May before the arrival of the youth summer workforce—and Big Data employment indicators were generally weaker. Job postings data also indicate a sequential decline in labor demand, albeit to still very high levels. On the positive side, the May seasonal factors have evolved favorably in recent years and represent a tailwind of roughly 100k, in our view. We estimate a one-tenth drop in the unemployment rate to 3.5%, reflecting a rebound in household employment partially offset by a 0.1pp rise in labor force participation to 62.3%. We estimate a 0.4% rise in average hourly earnings (mom sa) that lowers the year-on-year rate by two tenths to 5.3%. We continue to expect upward pressure on wages despite a sequential improvement in worker availability, but we assume a modest drag in May from calendar effects.

- 09:45 AM S&P Global US services PMI, May final (consensus 53.5, last 53.5)

- 10:00 AM ISM services index, May (GS 57.0, consensus 56.5, last 57.1): We estimate that the ISM services index edged down to 57.0 in May, reflecting favorable seasonality and resilience in domestic services in the face of the Ukraine and China shocks.

- 10:30 AM Fed Vice Chair Brainard (FOMC voter) speaks: Fed Vice Chair Lael Brainard will discuss the Community Reinvestment Act at an event hosted by the Urban Institute. A moderated Q&A is expected. Vice Chair Brainard testified on digital assets before the House Committee on Financial Services on May 26, but did not discuss monetary policy. On April 12, she said that she expects “the combined effect of moving the policy rate to a more neutral level and commencing balance sheet reduction to have the effect of bringing inflation down, seeing some moderation in demand while the supply side catches up.” She also noted that “core goods, which has been the source of an outsized amount of core inflationary pressure, moderated more than I had anticipated. It’s very welcome to see the moderation in this category. And I will be looking to see whether we continue to see moderation in the months ahead.”

Source: DB, Goldman, BofA

It’s a bit of a stilted week with the US taking today off for Memorial Day and the UK off on both Thursday and Friday to celebrate the Queen’s Platinum Jubilee. However, as DB’s Jim Reid notes there’s lot of important data from both a growth and inflation perspective this week with the monthly jobs report from the US (Friday) and a slew of May CPIs from Europe (including the highest German CPI in 60 years reported today). Industrial activity will be in focus too with the Chicago PMI, the Dallas Fed manufacturing activity index (Tuesday), the ISM index (Wednesday) and several European PPIs due.

On Wednesday, June 1, markets will also be especially focused on central banks with the start of the Fed’s balance sheet run off, the BoC decision and the Beige Book release. In Asia, next week will be packed with data for Japan and PMIs from China will be due.

Aside for the hotter than expected German CPI print, which came in well above expectations, and was the joint highest since 1950…

… producer prices will also be released across the continent, with April PPI due from Italy (today), France (tomorrow) and the Eurozone (Thursday). Finally, labor market indicators will be released throughout the week for Germany (tomorrow), Italy and the Eurozone (Wednesday).

Over in the US, all roads lead to payrolls on Friday where Deutsche Bank economists project gains of 325k vs last month’s 428k reading that came in above of the median estimate of 380k on Bloomberg. The JOLTS and ADP reports will be due on Wednesday and Thursday, respectively. The JOLTS report is everyone’s favorite insight into labor market tightness but it is a month behind the less useful payroll report.

Another important set of indicators will come for industrial activity, including the Chicago PMI and the Dallas Fed manufacturing activity index tomorrow, the ISM manufacturing index on Wednesday and April factory orders on Thursday. These follow misses on PMIs, the Richmond index and the durable goods orders last week, so markets will be paying attention as to whether these metrics will come in softer than expected as well. Finally, Conference Board’s consumer confidence index, tomorrow, will be assessed in conjunction with the labor market data to gauge the strength of the consumer.

From central banks, investors will be awaiting this Wednesday when the Fed is due to start its balance sheet run off in order to gauge the preliminary impact on the markets. Elsewhere, the Bank of Canada’s decision will also be due on Wednesday, following a +50bps move at the last meeting on April 13th. Analysts are expecting another 50bps.

Finally, the Fed will also release its Beige Book that day and its insights about current economic conditions will be digested together with the other timely US indicators. In speakers, this week, similar to last, will be packed with those from the ECB. Their views in light of the week’s CPI prints will be of great importance. Fed speakers are detailed alongside those from the ECB and all the key data releases in the day-by-day calendar at the end.

In Asia, the highlight will be May PMIs for China released tomorrow and Wednesday and much attention will be paid to the growth dynamics after dismal industrial production and retail sales numbers released two weeks ago.

Over the weekend, EU diplomats failed to come to an agreement on the EU’s proposed ban on Russian oil ahead of a 2-day summit with EU leaders starting today. Meanwhile, OPEC+ are set to meet on Thursday to discuss their production policy for July.

Courtesy of DB’s Jim Reid, here is a day-by-day calendar of events

Monday May 30

- Data: Germany May CPI, April import price index, Italy April PPI, Eurozone May economic, industrial, services confidence, Canada Q1 current account balance Central banks: Fed’s Waller speaks

Tuesday May 31

- Data: US May MNI Chicago PMI, Conference Board consumer confidence index, Dallas Fed manufacturing activity index, March FHFA house price index, China May PMIs, Japan May consumer confidence index, April retail sales, industrial production, jobless rate, housing starts, France May CPI, April PPI, consumer spending, Germany May unemployment claims rate, UK April consumer credit, mortgage approvals, M4, Eurozone May CPI, Italy May CPI, Canada Q1 GDP

- Central banks: ECB’s Villeroy, Visco and Makhlouf speak

- Earnings: Salesforce, HP

Wednesday June 1

- Data: US May ISM index, total vehicle sales, April construction spending, JOLTS report, China May Caixin manufacturing PMI, Japan Q1 capital spending, company profits, May vehicle sales, UK May nationwide house price index, France April budget balance, Italy May PMI, budget balance, new car registrations, April unemployment rate, Eurozone April unemployment rate, Canada May PMI

- Central banks: BoC decision, Fed’s Beige Book, Fed’s Williams and Bullard speak, ECB’s Lagarde, Knot, Lane and Villeroy speak, BoE’s Hauser speaks

Thursday June 2

- Data: US May ADP employment change, initial jobless claims, April factory orders, Japan May monetary base, Eurozone April PPI, Canada April building permits

- Central banks: Fed’s Mester speaks, ECB’s Villeroy and Hernandez speak

- Earnings: Meituan, Lululemon

Friday June 3

- Data: US May nonfarm payrolls, unemployment rate, average hourly earnings, participation rate, ISM services index, Germany April trade balance, France April industrial, manufacturing production, Italy May services PMI, Eurozone April retail sales, Canada Q1 labour productivity

- Central banks: Fed’s Brainard speaks

Finally, focusing on just the US, the key economic data releases this week are the JOLTS job openings and ISM manufacturing reports on Wednesday, as well as the employment situation report on Friday. There are several speaking engagements from Fed officials this week, including remarks from Vice Chair Brainard, Governor Waller, and Reserve Bank presidents Williams, Bullard, and Mester. Some more details from Goldman:

Monday, May 30

- There are no major economic data releases scheduled.

- 11:00 AM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will discuss the economic outlook at an event at the Goethe University in Frankfurt hosted by the Institute for Monetary and Financial Stability. A moderated Q&A is expected. On May 10, when discussing Fed tightening, Waller said, “This is the time to hit it. You want to do this when the economy is strong…From my view, do it now, front-load it, get it done, and then we can judge how the economy is proceeding.”

Tuesday, May 31

- 09:00 AM FHFA house price index, March (consensus +2.0%, last +2.1%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, March (GS +2.0%, consensus +1.90%, last +2.39%): We estimate that the S&P/Case-Shiller 20-city home price index rose by 2.0% in March, following a 2.39% (20.2% yoy) increase in February.

- 09:45 AM Chicago PMI, May (GS 53.4, consensus 55.1, last 56.4): We estimate that the Chicago PMI declined 3pt to 53.4 in May, reflecting a drag from East Asian demand.

- 10:00 AM Conference Board consumer confidence, May (GS 101.3, consensus 103.9, last 107.3): We estimate that the Conference Board consumer confidence index declined 6pt in May, reflecting weaker signals from other confidence measures.

- 10:30 AM Dallas Fed manufacturing index, May (consensus 1.5, last 1.1)

Wednesday, June 1

- 09:45 AM S&P Global US manufacturing PMI, May final (consensus 57.5, last 57.5)

- 10:00 AM Construction spending, April (GS +0.3%, consensus +0.6%, last +0.1%): We estimate a 0.3% increase in construction spending in April.

- 10:00 AM ISM manufacturing index, May (GS 54.5, consensus 54.5, last 55.4): We estimate that the ISM manufacturing index declined by 0.9pt to 54.5 in May. Business surveys generally declined in the month, and covid-related disruptions in China likely weighed on East Asian demand.

- 10:00 AM JOLTS job openings, April (consensus 11,400k, last 11,549k)

- 11:30 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will make opening remarks at an event on Monetary Policy Implementation and Digital Innovation hosted by the New York Fed and Columbia University. On May 16, Williams said, “It’s about trying to get short-term interest rates expeditiously, over this year, back to more normal levels,” adding that 50bp at the June meeting “makes sense.” On May 10, he noted “If it’s needed to raise real rates above neutral to get inflation down, I have absolutely no reluctance to do so.”

- 01:00 PM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will discuss the economic and policy outlook at the Economic Club of Memphis. Audience and media Q&A is expected. On May 20, Bullard said that 50bp hikes are “a good plan for now,” but that “you can never make iron-clad promises.” He added, “I have also said we should get to 3.5% by the end of the year, which is higher than some of my colleagues. The more we can front-load and the more we can get inflation and inflation expectations under control, the better off we will be. In out years — ’23 and ‘24 — we could be lowering the policy rate because we got inflation under control.”

02:00 PM Beige Book

- The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the April Beige Book, districts reported moderate employment gains despite hiring and retention challenges. Consumer spending accelerated – as Omicron cases tapered – and manufacturing activity was solid, but firms reported continued supply chain backlogs, labor market tightness, and elevated input costs. We expect the labor market to remain tight and supply disruptions to continue to put upward pressure on prices in the near term. We therefore expect continued anecdotes of wage and price pressures in this Beige Book.

- 05:00 PM Lightweight motor vehicle sales, May (GS 13.7mn, consensus 14.3mn, last 14.3mn)

Thursday, June 2

- 08:15 AM ADP employment report, May (GS +225k, consensus +300k, last +247k): We expect a 225k rise in ADP payroll employment in May. Our forecast reflects slowing underlying job growth in the month as well as a drag from the inputs to the ADP model.

- 08:30 AM Nonfarm productivity, Q1 final (GS -7.4%, consensus -7.5%, last -7.5%); Unit labor costs, Q1 final (GS +12.5%, consensus +11.6 last +11.6%): We estimate nonfarm productivity growth was revised up by one tenth to -7.4% in Q1 (qoq ar) following last week’s GDP report. However, we expect that Q1 unit labor costs—compensation per hour divided by output per hour—were revised up by nine tenths to +12.5% (qoq ar).

- 08:30 AM Initial jobless claims, week ended May 28 (GS 205k, consensus 210k, last 210k); Continuing jobless claims, week ended May 21 (consensus 1,333k, last 1,346k): We estimate initial jobless claims declined to 205k in the week ended May 28.

- 10:00 AM Factory orders, April (GS +0.8%, consensus +0.7%, last +1.8%); Durable goods orders, April final (last +0.4%); Durable goods orders ex-transportation, April final (last +0.3%); Core capital goods orders, April final (last +0.3%); Core capital goods shipments, April final (last +0.8%): We estimate that factory orders increased by 0.8% in April following a 1.8% increase in March. Durable goods orders increased by 0.4% in the April advance report, and core capital goods orders increased by +0.3%.

- 12:00 PM New York Fed Executive VP Logan (non-FOMC voter) speaks: Current New York Fed Executive Vice President, and incoming Dallas Fed President, Lorie Logan will make closing remarks at an event on Monetary Policy Implementation and Digital Innovation hosted by the New York Fed and Columbia University. Q&A is not expected.

- 01:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss the economic outlook at a virtual event hosted by the Philadelphia Council for Business Economics. Audience Q&A is currently expected. On May 13, Mester said, “Unless there are some big surprises, I expect it to be appropriate to raise the policy rate another 50bp at each of our next two meetings.” She added that, if by the September meeting monthly inflation readings “provide compelling evidence that inflation is moving down, then the pace of rate increases could slow, but if inflation has failed to moderate, then a faster pace of rate increases may be necessary.”

Friday, June 3

- 08:30 AM Nonfarm payroll employment, May (GS +275k, consensus +325k, last +428k); Private payroll employment, May (GS +250k, consensus +300k, last +406k); Average hourly earnings (mom), May (GS +0.4%, consensus +0.4%, last +0.3%); Average hourly earnings (yoy), May (GS +5.3%, consensus +5.2%, last +5.5%);Unemployment rate, May (GS 3.5%, consensus 3.5%, last 3.6%): We estimate nonfarm payrolls rose by 275k in May (mom sa), a slowdown from the +428k pace in both of the previous two months. Job growth tends to slow during the spring hiring season when the labor market is tight—particularly in May before the arrival of the youth summer workforce—and Big Data employment indicators were generally weaker. Job postings data also indicate a sequential decline in labor demand, albeit to still very high levels. On the positive side, the May seasonal factors have evolved favorably in recent years and represent a tailwind of roughly 100k, in our view. We estimate a one-tenth drop in the unemployment rate to 3.5%, reflecting a rebound in household employment partially offset by a 0.1pp rise in labor force participation to 62.3%. We estimate a 0.4% rise in average hourly earnings (mom sa) that lowers the year-on-year rate by two tenths to 5.3%. We continue to expect upward pressure on wages despite a sequential improvement in worker availability, but we assume a modest drag in May from calendar effects.

- 09:45 AM S&P Global US services PMI, May final (consensus 53.5, last 53.5)

- 10:00 AM ISM services index, May (GS 57.0, consensus 56.5, last 57.1): We estimate that the ISM services index edged down to 57.0 in May, reflecting favorable seasonality and resilience in domestic services in the face of the Ukraine and China shocks.

- 10:30 AM Fed Vice Chair Brainard (FOMC voter) speaks: Fed Vice Chair Lael Brainard will discuss the Community Reinvestment Act at an event hosted by the Urban Institute. A moderated Q&A is expected. Vice Chair Brainard testified on digital assets before the House Committee on Financial Services on May 26, but did not discuss monetary policy. On April 12, she said that she expects “the combined effect of moving the policy rate to a more neutral level and commencing balance sheet reduction to have the effect of bringing inflation down, seeing some moderation in demand while the supply side catches up.” She also noted that “core goods, which has been the source of an outsized amount of core inflationary pressure, moderated more than I had anticipated. It’s very welcome to see the moderation in this category. And I will be looking to see whether we continue to see moderation in the months ahead.”

Source: DB, Goldman, BofA