Authored by Alex Kimani via OilPrice.com,

-

Physical nickel markets have become oversupplied in 2023.

-

A new wave of supply from Indonesia has put prices under pressure.

-

International Nickel Study Group: the nickel market will face a supply-demand surplus of 239,000 tonnes.

Last year, the nickel markets came into the limelight courtesy of the historic nickel short squeeze that sent nickel prices soaring to an astonishing $100,000 per tonne.

The massive surge doubled the previous all-time high over the course of one morning and plunged the London Metal Exchange into an existential crisis. And, just like the famous copper squeeze of more than a century ago, the nickel market snafu was largely linked to enormous short positions held by a single man: Chinese metal trader Xiang Guangda, the founder of China-based Tsingshan Holding, the world’s biggest nickel producer.

And now the exact opposite is happening in the nickel markets, only that this time around it’s the physical nickel markets and not nickel futures or a single trader that are to blame for the crash. Nickel prices have crashed in the current year, falling 21% in the year-to-date to $23,300 per tonne thanks to a massive supply glut as Indonesian production continues to outpace global demand. According to the International Nickel Study Group (INSG), the nickel market will face a supply-demand surplus of 239,000 tonnes, the largest in at least a decade and more than double last year's excess of 105,000 tonnes. That revised figure is also way higher than the group’s last forecast in October when it expected the surplus to clock in at 171,000 tonnes in 2023.

Although global nickel demand is on track to register healthy 6.1% growth in 2023, matching last year’s demand growth, it won’t be anywhere near enough to absorb the wave of new production coming out of Indonesia.

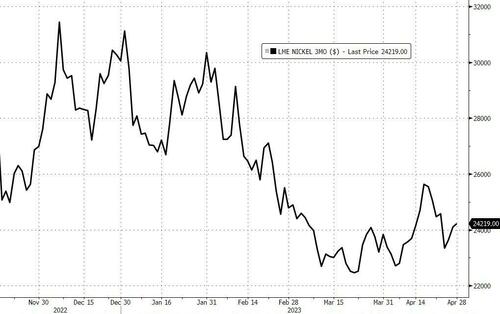

Spot Nickel Prices (USD/metric ton)

Source: Bloomberg

It’s quite surprising that nickel demand even rose at all in 2022 considering the World Stainless Association reported that stainless steel output fell 5.2% during the year. The stainless steel industry is the biggest consumer of nickel, gobbling up 75% of global production in a typical year. China is mainly to blame for the weakening nickel demand after the removal of subsidies and the shift towards non-nickel chemistries.

That said, EVs are quickly becoming an important nickel consumer. According to research house Adamas Intelligence, 17,137 tonnes of nickel were deployed in EV batteries in the month of February alone, good for 19% month-on-month and 47% Y/Y growth.

Although the EV sector is growing at a brisk clip, it will still struggle to absorb surging production from the likes of Indonesia. INSG's most recent monthly bulletin has reported that the country's nickel mine output grew a huge 48% to 1.58 million tonnes in 2022 and by another 44% in the first two months of the current year. Indonesia slapped a full ban on the export of ore in 2020, meaning that all that mine output is now being converted to nickel products.

But not all nickel grades are facing a supply glut.

Indeed, whereas the supply of Class II nickel--containing less than 99.8% nickel--continues to grow rapidly, supply of Class I nickel--the grade traded on the LME--has declined 28% so far this year to 40,032 tonnes, the lowest level since 2007. Shanghai registered nickel stocks are even lower at just 1,496 tonnes thanks to China's imports of refined nickel being increasingly replaced with intermediate products heading for the EV sector. The contango across the benchmark cash-to-three-months spread has contracted from over $200 per tonne in early April to just $12 currently, suggesting traders are growing more bearish about future nickel prices.

China Nickel pig iron 8-12% (Yuan / metric tonne)

Source: Bloomberg

Commodities Pullback

But the nickel markets are hardly alone. After a raging bull market in 2022, global commodity markets have been pulling back in 2023 with the World Bank predicting that global commodity prices will decline this year at the fastest clip since COVID-19 pandemic struck in late 2019.

According to the bank, overall commodity prices will contract 21% in 2023 relative to 2022, with energy prices projected to fall 26%. Brent crude oil is expected to average $84 a barrel this year, down 16% Y/Y, while U.S. and European natural-gas prices are forecast to be cut in half. Meanwhile, coal prices are expected to fall 42% in 2023 while fertilizer prices are also projected to decrease 37%, marking the largest annual drop since 1976. However, fertilizer prices are still close to their recent high seen during the 2008-09 food crisis.

Unfortunately, the World Bank says that falling food prices will bring little relief to the more than 350 million people facing food insecurity across the globe due to the fact that although food prices are expected to fall 8% in the current year, they will still be at the second-highest level since 1975.

Authored by Alex Kimani via OilPrice.com,

-

Physical nickel markets have become oversupplied in 2023.

-

A new wave of supply from Indonesia has put prices under pressure.

-

International Nickel Study Group: the nickel market will face a supply-demand surplus of 239,000 tonnes.

Last year, the nickel markets came into the limelight courtesy of the historic nickel short squeeze that sent nickel prices soaring to an astonishing $100,000 per tonne.

The massive surge doubled the previous all-time high over the course of one morning and plunged the London Metal Exchange into an existential crisis. And, just like the famous copper squeeze of more than a century ago, the nickel market snafu was largely linked to enormous short positions held by a single man: Chinese metal trader Xiang Guangda, the founder of China-based Tsingshan Holding, the world’s biggest nickel producer.

And now the exact opposite is happening in the nickel markets, only that this time around it’s the physical nickel markets and not nickel futures or a single trader that are to blame for the crash. Nickel prices have crashed in the current year, falling 21% in the year-to-date to $23,300 per tonne thanks to a massive supply glut as Indonesian production continues to outpace global demand. According to the International Nickel Study Group (INSG), the nickel market will face a supply-demand surplus of 239,000 tonnes, the largest in at least a decade and more than double last year’s excess of 105,000 tonnes. That revised figure is also way higher than the group’s last forecast in October when it expected the surplus to clock in at 171,000 tonnes in 2023.

Although global nickel demand is on track to register healthy 6.1% growth in 2023, matching last year’s demand growth, it won’t be anywhere near enough to absorb the wave of new production coming out of Indonesia.

Spot Nickel Prices (USD/metric ton)

Source: Bloomberg

It’s quite surprising that nickel demand even rose at all in 2022 considering the World Stainless Association reported that stainless steel output fell 5.2% during the year. The stainless steel industry is the biggest consumer of nickel, gobbling up 75% of global production in a typical year. China is mainly to blame for the weakening nickel demand after the removal of subsidies and the shift towards non-nickel chemistries.

That said, EVs are quickly becoming an important nickel consumer. According to research house Adamas Intelligence, 17,137 tonnes of nickel were deployed in EV batteries in the month of February alone, good for 19% month-on-month and 47% Y/Y growth.

Although the EV sector is growing at a brisk clip, it will still struggle to absorb surging production from the likes of Indonesia. INSG’s most recent monthly bulletin has reported that the country’s nickel mine output grew a huge 48% to 1.58 million tonnes in 2022 and by another 44% in the first two months of the current year. Indonesia slapped a full ban on the export of ore in 2020, meaning that all that mine output is now being converted to nickel products.

But not all nickel grades are facing a supply glut.

Indeed, whereas the supply of Class II nickel–containing less than 99.8% nickel–continues to grow rapidly, supply of Class I nickel–the grade traded on the LME–has declined 28% so far this year to 40,032 tonnes, the lowest level since 2007. Shanghai registered nickel stocks are even lower at just 1,496 tonnes thanks to China’s imports of refined nickel being increasingly replaced with intermediate products heading for the EV sector. The contango across the benchmark cash-to-three-months spread has contracted from over $200 per tonne in early April to just $12 currently, suggesting traders are growing more bearish about future nickel prices.

China Nickel pig iron 8-12% (Yuan / metric tonne)

Source: Bloomberg

Commodities Pullback

But the nickel markets are hardly alone. After a raging bull market in 2022, global commodity markets have been pulling back in 2023 with the World Bank predicting that global commodity prices will decline this year at the fastest clip since COVID-19 pandemic struck in late 2019.

According to the bank, overall commodity prices will contract 21% in 2023 relative to 2022, with energy prices projected to fall 26%. Brent crude oil is expected to average $84 a barrel this year, down 16% Y/Y, while U.S. and European natural-gas prices are forecast to be cut in half. Meanwhile, coal prices are expected to fall 42% in 2023 while fertilizer prices are also projected to decrease 37%, marking the largest annual drop since 1976. However, fertilizer prices are still close to their recent high seen during the 2008-09 food crisis.

Unfortunately, the World Bank says that falling food prices will bring little relief to the more than 350 million people facing food insecurity across the globe due to the fact that although food prices are expected to fall 8% in the current year, they will still be at the second-highest level since 1975.

Loading…