Swimming pools and hot tub installations exploded during Covid as homeowners transformed their backyards into private oases. At one point, pool companies had a backlog of two years, but now that has all evaporated. The latest sign the pool bubble has deflated is the largest US retailer of swimming pool supplies and related products has warned about a slowdown in traffic.

In a press release, pool supplies retailer Leslie's Inc. slashed its annual forecast after reporting a slowdown in consumer traffic in the three months ended July 1.

"Our fiscal third-quarter results were well below our expectations as low double digit traffic declines in our Residential and Pro businesses drove negative comps across both discretionary and non-discretionary categories. While abnormal weather continued to pressure traffic levels, customer surveys conducted towards the end of the quarter also indicated increased price sensitivity and that consumers entered the pool season with a greater than normal amount of chemicals leftover from last year," Leslie's Chief Executive Officer Mike Egeck wrote in a statement.

"While the update does underscore a softer environment for the pool industry, we believe the issues are largely idiosyncratic to Leslie's and independent retailers," Stifel analyst W. Andrew Carter told clients this week.

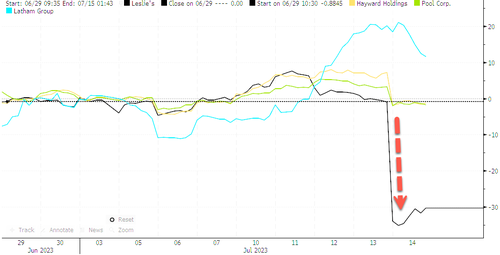

The slowdown in pool sales sent Leslie's shares down 30% on Friday. Other pool-related companies slumped as well on a weaker demand outlook.

And now, with pool demand sliding, we've noticed some hot tub companies are offering as much as a 40% discount for six to eight-person tubs. Another bubble has deflated as financial conditions get tighter and the consumers tap out.

Swimming pools and hot tub installations exploded during Covid as homeowners transformed their backyards into private oases. At one point, pool companies had a backlog of two years, but now that has all evaporated. The latest sign the pool bubble has deflated is the largest US retailer of swimming pool supplies and related products has warned about a slowdown in traffic.

In a press release, pool supplies retailer Leslie’s Inc. slashed its annual forecast after reporting a slowdown in consumer traffic in the three months ended July 1.

“Our fiscal third-quarter results were well below our expectations as low double digit traffic declines in our Residential and Pro businesses drove negative comps across both discretionary and non-discretionary categories. While abnormal weather continued to pressure traffic levels, customer surveys conducted towards the end of the quarter also indicated increased price sensitivity and that consumers entered the pool season with a greater than normal amount of chemicals leftover from last year,” Leslie’s Chief Executive Officer Mike Egeck wrote in a statement.

“While the update does underscore a softer environment for the pool industry, we believe the issues are largely idiosyncratic to Leslie’s and independent retailers,” Stifel analyst W. Andrew Carter told clients this week.

The slowdown in pool sales sent Leslie’s shares down 30% on Friday. Other pool-related companies slumped as well on a weaker demand outlook.

And now, with pool demand sliding, we’ve noticed some hot tub companies are offering as much as a 40% discount for six to eight-person tubs. Another bubble has deflated as financial conditions get tighter and the consumers tap out.

Loading…