The incessant stream of bad news for Boeing is starting to take its toll on airlines, according to Bloomberg, who noted this weekend that companies like United, Southwest and Ryanair are all stuck dealing with reduced deliveries from Boeing while the planemaker turns its attention to quality control.

Ahead of the busy summer travel season, airlines are adjusting schedules and seeking alternatives to Boeing 737s due to these delays, while also grappling with the fact that Airbus narrowbody delays. The timeline for Boeing's aircraft readiness remains uncertain as U.S. inspectors examine its factories, preventing definitive forecasts for a return to normal operations.

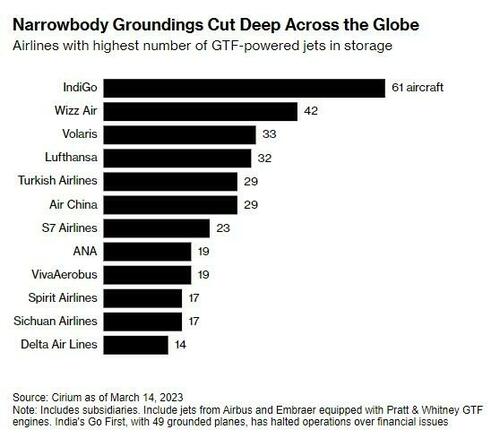

Airbus, Boeing's chief rival, is mostly booked until the decade's end, Bloomberg writes, leaving limited options for airlines. Both manufacturers face challenges in ramping up production to pre-pandemic levels, with Airbus also dealing with engine-wear problems that have grounded numerous planes, exacerbating the shortage amid soaring airline demand.

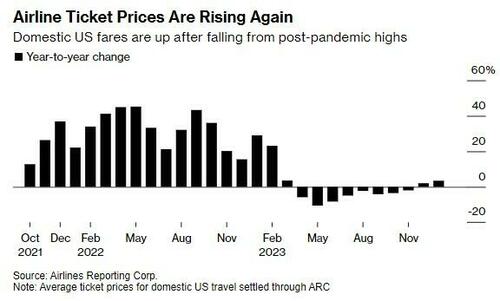

In the U.S., domestic flight prices have increased following a drop from post-pandemic peaks. For instance, lack of added capacity on routes such as New York to Los Angeles is expected to push business-class fares up by as much as 8.5% during the summer peak. Similarly, fares between Seattle and San Francisco, as well as Chicago and Las Vegas, could see rises of up to 18% and 9.6%, respectively, the report says.

While the overall direction of U.S. flight prices had seen a decline after a surge in 2022 and early 2023, the latest government data indicates a 3.6% increase from January to February, marking the most significant monthly rise since May 2022.

Boeing faces an uncertain 2024, with production of the 737 capped at 38 per month by regulators, despite only 42 being delivered in the first two months of the year. Company officials hope to reach this production rate later in the year.

John Plueger, chief executive officer of aircraft leasing company Air Lease Corp. told Bloomberg: “All they’re saying is as you’d expect: ‘We are working as hard as we can. We are sorry for your disruption. We’re doing the best we can. As soon as we have certainty, we will advise you.’ They are saying that.”

Steven Townend, who heads aircraft lessor BOC Aviation Ltd., said on Bloomberg this week: “This is not just a this-year problem. This has been a multiyear issue. It is going to take several years to really catch back up again.”

“You’ll see less flights and more full aircraft” this summer, said Plueger.

The incessant stream of bad news for Boeing is starting to take its toll on airlines, according to Bloomberg, who noted this weekend that companies like United, Southwest and Ryanair are all stuck dealing with reduced deliveries from Boeing while the planemaker turns its attention to quality control.

Ahead of the busy summer travel season, airlines are adjusting schedules and seeking alternatives to Boeing 737s due to these delays, while also grappling with the fact that Airbus narrowbody delays. The timeline for Boeing’s aircraft readiness remains uncertain as U.S. inspectors examine its factories, preventing definitive forecasts for a return to normal operations.

Airbus, Boeing’s chief rival, is mostly booked until the decade’s end, Bloomberg writes, leaving limited options for airlines. Both manufacturers face challenges in ramping up production to pre-pandemic levels, with Airbus also dealing with engine-wear problems that have grounded numerous planes, exacerbating the shortage amid soaring airline demand.

In the U.S., domestic flight prices have increased following a drop from post-pandemic peaks. For instance, lack of added capacity on routes such as New York to Los Angeles is expected to push business-class fares up by as much as 8.5% during the summer peak. Similarly, fares between Seattle and San Francisco, as well as Chicago and Las Vegas, could see rises of up to 18% and 9.6%, respectively, the report says.

While the overall direction of U.S. flight prices had seen a decline after a surge in 2022 and early 2023, the latest government data indicates a 3.6% increase from January to February, marking the most significant monthly rise since May 2022.

Boeing faces an uncertain 2024, with production of the 737 capped at 38 per month by regulators, despite only 42 being delivered in the first two months of the year. Company officials hope to reach this production rate later in the year.

John Plueger, chief executive officer of aircraft leasing company Air Lease Corp. told Bloomberg: “All they’re saying is as you’d expect: ‘We are working as hard as we can. We are sorry for your disruption. We’re doing the best we can. As soon as we have certainty, we will advise you.’ They are saying that.”

Steven Townend, who heads aircraft lessor BOC Aviation Ltd., said on Bloomberg this week: “This is not just a this-year problem. This has been a multiyear issue. It is going to take several years to really catch back up again.”

“You’ll see less flights and more full aircraft” this summer, said Plueger.

Loading…