Authored by Tom Mitchelhill via CoinTelegraph.com,

The launch of the highly controversial LIBRA memecoin, which Argentine President Javier Milei briefly promoted, has embroiled the crypto industry in an emerging global scandal.

Disregarding for a moment the impact of the token’s launch on international politics — with President Milei’s own sister reportedly receiving payments from LIBRA founder Hayden Davis and Milei facing calls for impeachment — the coin has sparked major controversy involving key industry leaders in the Solana ecosystem.

The price of SOL has also tumbled more than 17% since the launch of LIBRA on Feb. 14, falling from $204 to $169 at the time of writing, according to from Cointelegraph.

SOL has dropped more than 17% in the last five days. Source: Cointelegraph

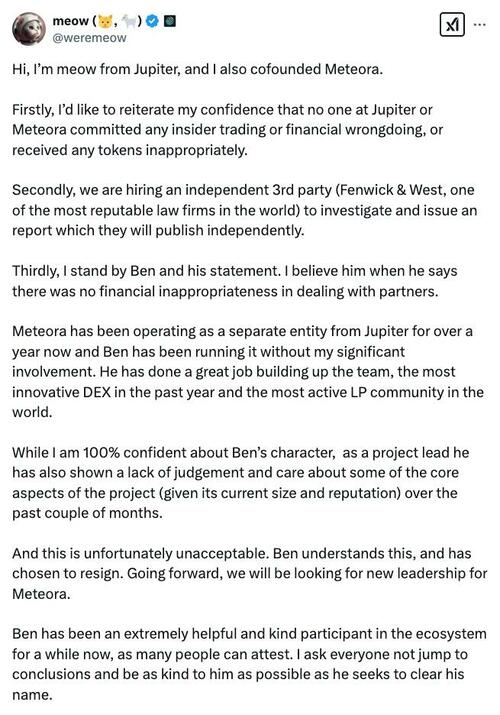

Meteora co-founder Ben Chow chose to resign from his role at the decentralized exchange, according to a Feb. 18 statement made on X by Jupiter’s pseudonymous founder Meow, who is also a co-founder of Meteora.

Meow said the resignation was related to Chow’s “lack of judgement and care” relating to core aspects of Meteora’s business.

Source: Meow

Over the last three months, the Meteora platform has facilitated a series of high-profile memecoin launches for viral influencer Haliey Welch (HAWK), US President Donald Trump (TRUMP), First Lady Melania Trump (MELANIA), and most recently, Libra (LIBRA).

In the wake of these launches, several market participants have accused members of the Meteora team of insider trading and other unethical financial activity.

DeFiTuna founder surfaces allegations against Meteora

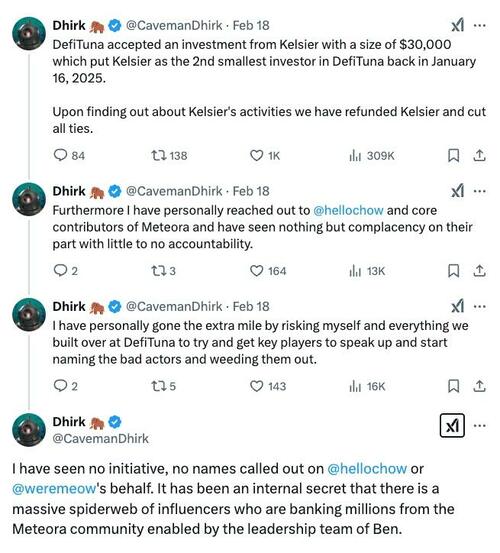

On Feb. 18, DeFiTuna founder Moty Povolotsky — who goes by Caveman Dhirk on X — claimed that Chow had enabled a network of influencers who profited significantly from the celebrity launches, despite the threat posed to retail market participants.

Source: Moty Povolotsky

“It has been an internal secret that there is a massive spiderweb of influencers who are banking millions from the Meteora community enabled by the leadership team of Ben,” he wrote.

Moty stated that his firm had accepted an investment of $30,000 from Davis’ firm, Kelsier, on Jan. 16. However, he said that in the wake of the LIBRA launch, he “refunded Kelsier and cut all ties.”

But Meow claimed that no one from either Meteora or Jupiter had been involved in any wrongdoing regarding the launch of LIBRA or any other tokens:

“I’d like to reiterate my confidence that no one at Jupiter or Meteora committed any insider trading or financial wrongdoing, or received any tokens inappropriately.”

In an earlier Feb. 17 statement on X, Chow himself also denied any insider activity at Meteora surrounding the launch of LIBRA.

Chow said neither he nor the Meteora team ever received or managed tokens “on the side,” nor did they have any other knowledge concerning “offchain dealings” with the tokens.

“To maintain the high levels of confidentiality, very few people in Meteora have access to any launch information,” said Chow.

“Neither I nor the Meteora team compromised the $LIBRA launch by leaking information, nor did we purchase, receive, or manage any tokens.”

How celebrities launch memecoins on Meteora

Chow also explained the process of how celebrities and politicians go about launching a token on Meteora.

“They typically need to hire a ‘deployer’ and/or market-maker, which is a service we do not provide,” Chow said.

“These deployer teams are typically experts in using Meteora’s SDK or CLI and can design more sophisticated launches, as our tech allows for tons of customization. In the past, if a project did not have those resources, they would often ask me for deployer and/or market-making referrals,” he added.

He said there was nothing exclusive or unique about the relationship between Meteora and LIBRA deployer Davis.

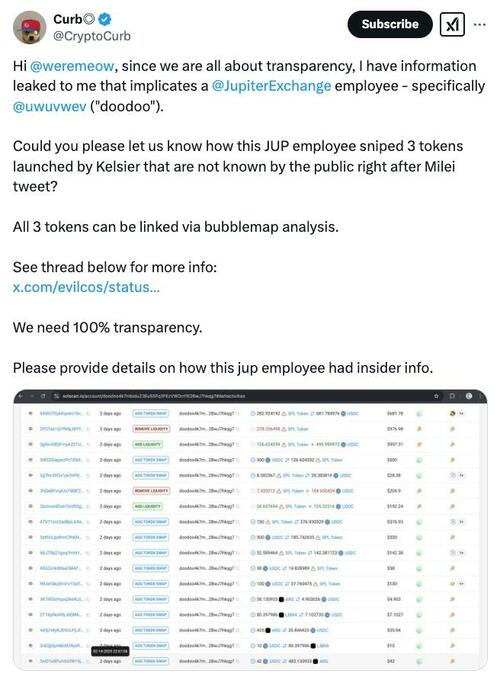

Other industry pundits, including the pseudonymous crypto trader Curb, claimed that a Jupiter employee engaged in sniping the token’s launch. However, due to the small amounts used by the wallet address in question — ranging from $10 to $250 — it’s unlikely these were attempts at sniping and are more likely to be erratic trading behavior.

Source: Curb

Jupiter launches investigation into LIBRA

In the wake of the LIBRA fallout, Meow announced that he would engage law firm Fenwick & West to investigate the situation and publish an independent report.

However, after receiving backlash from legal experts on X in regard to Fenwick & West’s prior dealings with crypto firms - it is currently facing a lawsuit over claims it was directly involved in helping FTX blur its relationship with Alameda Research in 2022 - Meow said he would reevaluate his call and decide whether to engage a different law firm instead.

Authored by Tom Mitchelhill via CoinTelegraph.com,

The launch of the highly controversial LIBRA memecoin, which Argentine President Javier Milei briefly promoted, has embroiled the crypto industry in an emerging global scandal.

Disregarding for a moment the impact of the token’s launch on international politics — with President Milei’s own sister reportedly receiving payments from LIBRA founder Hayden Davis and Milei facing calls for impeachment — the coin has sparked major controversy involving key industry leaders in the Solana ecosystem.

The price of SOL has also tumbled more than 17% since the launch of LIBRA on Feb. 14, falling from $204 to $169 at the time of writing, according to from Cointelegraph.

SOL has dropped more than 17% in the last five days. Source: Cointelegraph

Meteora co-founder Ben Chow chose to resign from his role at the decentralized exchange, according to a Feb. 18 statement made on X by Jupiter’s pseudonymous founder Meow, who is also a co-founder of Meteora.

Meow said the resignation was related to Chow’s “lack of judgement and care” relating to core aspects of Meteora’s business.

Source: Meow

Over the last three months, the Meteora platform has facilitated a series of high-profile memecoin launches for viral influencer Haliey Welch (HAWK), US President Donald Trump (TRUMP), First Lady Melania Trump (MELANIA), and most recently, Libra (LIBRA).

In the wake of these launches, several market participants have accused members of the Meteora team of insider trading and other unethical financial activity.

DeFiTuna founder surfaces allegations against Meteora

On Feb. 18, DeFiTuna founder Moty Povolotsky — who goes by Caveman Dhirk on X — claimed that Chow had enabled a network of influencers who profited significantly from the celebrity launches, despite the threat posed to retail market participants.

Source: Moty Povolotsky

“It has been an internal secret that there is a massive spiderweb of influencers who are banking millions from the Meteora community enabled by the leadership team of Ben,” he wrote.

Moty stated that his firm had accepted an investment of $30,000 from Davis’ firm, Kelsier, on Jan. 16. However, he said that in the wake of the LIBRA launch, he “refunded Kelsier and cut all ties.”

But Meow claimed that no one from either Meteora or Jupiter had been involved in any wrongdoing regarding the launch of LIBRA or any other tokens:

“I’d like to reiterate my confidence that no one at Jupiter or Meteora committed any insider trading or financial wrongdoing, or received any tokens inappropriately.”

In an earlier Feb. 17 statement on X, Chow himself also denied any insider activity at Meteora surrounding the launch of LIBRA.

Chow said neither he nor the Meteora team ever received or managed tokens “on the side,” nor did they have any other knowledge concerning “offchain dealings” with the tokens.

“To maintain the high levels of confidentiality, very few people in Meteora have access to any launch information,” said Chow.

“Neither I nor the Meteora team compromised the $LIBRA launch by leaking information, nor did we purchase, receive, or manage any tokens.”

How celebrities launch memecoins on Meteora

Chow also explained the process of how celebrities and politicians go about launching a token on Meteora.

“They typically need to hire a ‘deployer’ and/or market-maker, which is a service we do not provide,” Chow said.

“These deployer teams are typically experts in using Meteora’s SDK or CLI and can design more sophisticated launches, as our tech allows for tons of customization. In the past, if a project did not have those resources, they would often ask me for deployer and/or market-making referrals,” he added.

He said there was nothing exclusive or unique about the relationship between Meteora and LIBRA deployer Davis.

Other industry pundits, including the pseudonymous crypto trader Curb, claimed that a Jupiter employee engaged in sniping the token’s launch. However, due to the small amounts used by the wallet address in question — ranging from $10 to $250 — it’s unlikely these were attempts at sniping and are more likely to be erratic trading behavior.

Source: Curb

Jupiter launches investigation into LIBRA

In the wake of the LIBRA fallout, Meow announced that he would engage law firm Fenwick & West to investigate the situation and publish an independent report.

However, after receiving backlash from legal experts on X in regard to Fenwick & West’s prior dealings with crypto firms – it is currently facing a lawsuit over claims it was directly involved in helping FTX blur its relationship with Alameda Research in 2022 – Meow said he would reevaluate his call and decide whether to engage a different law firm instead.

Loading…