By Simon White, Bloomberg Markets Live commentator and reporter

Liquidity constraints and uncertainty around investor preferences mean that QT is unlikely to operate as smoothly as optimists predict. Bill Dudley in a Bloomberg Opinion article today suggests that QT is unlikely to “cause any major disruptions”. This implicitly makes assumptions we cannot be certain of.

In simple terms, the heavy lifting of the Fed’s balance-sheet decline can be done by the ~$2.5 trillion held in the reverse repo facility (RRP), or the $3.2 trillion held in bank reserves. If the decline is predominantly met by a fall in the RRP, this is the best, least disruptive outcome. Reserves held by users of the RRP -- at least 80% money market funds (MMFs) -- are mainly “low velocity” and therefore their loss should have a more limited impact on the broader economy.

But the Fed has no control over how its balance sheet declines. When the Fed allows a Treasury to mature, it has no agency over how the Treasury pays back the Fed, or who buys the re-issued debt.

If the reserves ultimately come from a MMF, then they can draw down on their RRP at the Fed and the net impact is limited; but if ultimately a tax payer meets the obligation, then this involves a decline in bank reserves, negatively impacting economic activity.

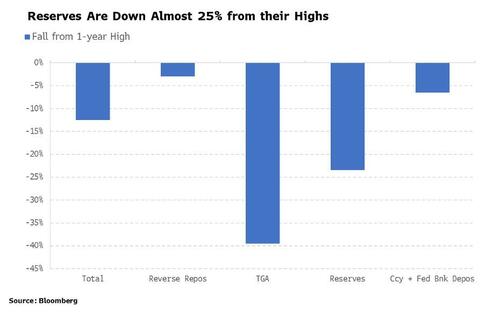

So far, reserves are down almost 25% from their 1-year peak while the RRP is down only 3%.

Yet Dudley posits that the RRP is likely to do much of the heavy lifting as QT continues, since tightening liquidity leads to higher bank-deposit rates, and therefore money will flow seamlessly from MMFs to banks -- meaning bank reserves rise as the RRP declines. However, this presupposes banks will be happy to take on the extra reserves and clients will be happy to deposit them.

That’s a big if. Reserves have a balance-sheet charge associated with them, and since the massive expansion in the Fed’s balance sheet, and the re-imposition of the charge last year, banks have been turning deposits away, with MMFs picking up a lot of the flow.

Banks may still not be eager for reserves if they don’t see lending opportunities (they are currently tightening lending conditions). Moreover, there’s no guarantee depositors will happily flip their money back to banks who originally turned it away.

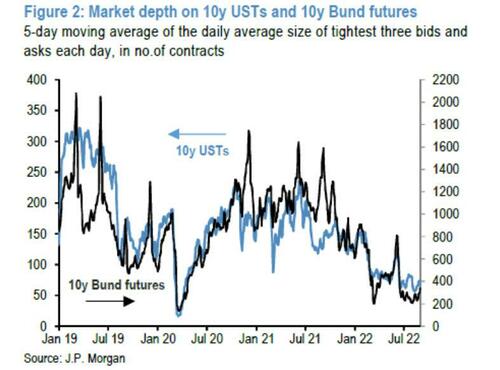

But it’s liquidity that’s the existential risk to the Fed’s tightening program. Liquidity in the Treasury market is extremely low at the moment. Liquidity conditions for rates markets this year resemble the conditions seen in the pandemic and the period after the Lehman crisis, JP Morgan shows.

As the Fed steps back as the major buyer of Treasuries, liquidity conditions will be further stressed, especially as the Treasury increases its borrowing requirements.

Thus even with Dudley’s optimism - and even with the standing repo facility, there to backstop rates when reserves get scarce - things may break, forcing a premature to end to QT.

* * *

And a quick note from ZH here: none of the above should be a surprise, or news, to anyone: exactly two months ago we wrote that iconic former Fed Analyst Marc Cabana called it, "Powell Will Be Forced To End QT Much Sooner Than Expected." Slowly but surely everyone is finally figuring it out...

By Simon White, Bloomberg Markets Live commentator and reporter

Liquidity constraints and uncertainty around investor preferences mean that QT is unlikely to operate as smoothly as optimists predict. Bill Dudley in a Bloomberg Opinion article today suggests that QT is unlikely to “cause any major disruptions”. This implicitly makes assumptions we cannot be certain of.

In simple terms, the heavy lifting of the Fed’s balance-sheet decline can be done by the ~$2.5 trillion held in the reverse repo facility (RRP), or the $3.2 trillion held in bank reserves. If the decline is predominantly met by a fall in the RRP, this is the best, least disruptive outcome. Reserves held by users of the RRP — at least 80% money market funds (MMFs) — are mainly “low velocity” and therefore their loss should have a more limited impact on the broader economy.

But the Fed has no control over how its balance sheet declines. When the Fed allows a Treasury to mature, it has no agency over how the Treasury pays back the Fed, or who buys the re-issued debt.

If the reserves ultimately come from a MMF, then they can draw down on their RRP at the Fed and the net impact is limited; but if ultimately a tax payer meets the obligation, then this involves a decline in bank reserves, negatively impacting economic activity.

So far, reserves are down almost 25% from their 1-year peak while the RRP is down only 3%.

Yet Dudley posits that the RRP is likely to do much of the heavy lifting as QT continues, since tightening liquidity leads to higher bank-deposit rates, and therefore money will flow seamlessly from MMFs to banks — meaning bank reserves rise as the RRP declines. However, this presupposes banks will be happy to take on the extra reserves and clients will be happy to deposit them.

That’s a big if. Reserves have a balance-sheet charge associated with them, and since the massive expansion in the Fed’s balance sheet, and the re-imposition of the charge last year, banks have been turning deposits away, with MMFs picking up a lot of the flow.

Banks may still not be eager for reserves if they don’t see lending opportunities (they are currently tightening lending conditions). Moreover, there’s no guarantee depositors will happily flip their money back to banks who originally turned it away.

But it’s liquidity that’s the existential risk to the Fed’s tightening program. Liquidity in the Treasury market is extremely low at the moment. Liquidity conditions for rates markets this year resemble the conditions seen in the pandemic and the period after the Lehman crisis, JP Morgan shows.

As the Fed steps back as the major buyer of Treasuries, liquidity conditions will be further stressed, especially as the Treasury increases its borrowing requirements.

Thus even with Dudley’s optimism – and even with the standing repo facility, there to backstop rates when reserves get scarce – things may break, forcing a premature to end to QT.

* * *

And a quick note from ZH here: none of the above should be a surprise, or news, to anyone: exactly two months ago we wrote that iconic former Fed Analyst Marc Cabana called it, “Powell Will Be Forced To End QT Much Sooner Than Expected.” Slowly but surely everyone is finally figuring it out…