There was something glaringly odd in today's PPI print.

But first, some background: as we detailed in our PPI post-mortem earlier, one day after CPI came in red hot, today's PPI unexpectedly missed expectations on the headline level, coming in at 2.1%, which despite being the hottest since April 2023..

... was below the 2.2% estimate. The miss - the smallest possible - proved to be so important to the market starved for any dovish news, that algos instantly ignored the fact that core CPI came in at 2.4%, hotter than the 2.3% expected.

Which bring us to the "odd" part.

Looking at the core number (excluding food and energy), we find that according to the BLS, the only reason PPI was even positive in March is because of services, where the biggest source of upside was the "index for securities brokerage, dealing, investment advice, and related services, which rose 3.1 percent." In other words, everyone was rushing to open a brokerage account so they can trade Jeo Boden or some other shitcoin.

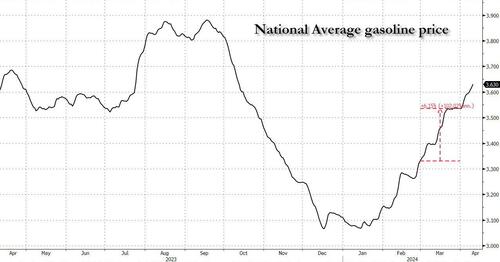

But what about what really increased in March, which as we have shown previously, was gas prices which rose just over 6% based on, well, how much the average gas price rose across the US in March!

Here things get hilarious, because according to the BLS in March, while PPI Services rose by 0.3%, prices for final demand goods was actually negative, dropping by 0.1% MoM.

And then, reading a little further into the BLS press release we find this surprise: "the decline is attributable to the index for final demand energy, which moved down 1.6 percent."

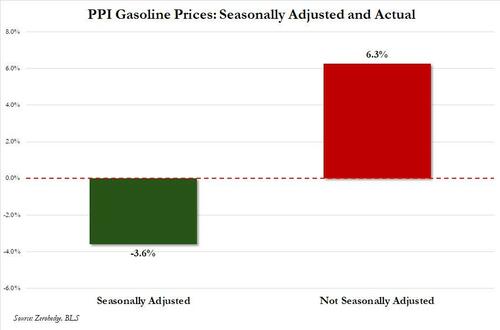

Which then brings us to the absolute punchline, because in the very next sentence, Biden's Bureau of Gaslighting Services writes that "leading the March decline in the index for final demand goods, prices for gasoline decreased 3.6 percent."

Hold on a second, didn't we just show that gas prices - actual, real gas prices, which everyone across the country has to pay - rose by 6% in March?

Yes we did, but what we didn't anticipate is the amount of BS Biden's henchmen are willing to shove down our throats. And indeed, to understand how gasoline could possibly drop by 3.6% in a month where it rose over 6% we have to look at the category description, where we find the little trick beloved by propaganda ministries everywhere: "seasonally adjusted."

That's right, as shown in the chart below, according to the BLS, the seasonally-adjusted gas price in March magically dropped by 3.6% even though the unadjusted, as in real, gas price rose by 6.3%, exactly what the AAA also reported in its daily summary of what gas prices across the US truly are.

Now, for those wondering "did I pay 3.6% less or 6.3% more for gas in March", we have the answer and unfortunately it is the one that leaves less money in your pocket (it always is). But for the BLS, the seasonal adjustment in this one category which actually soared, meant all the difference in the world because - you see - if Biden's propaganda ministers had used the real gas price, PPI would have been 0.4% higher and risen 2.4% YoY, both blowing away estimates, sending stocks tumbling, and making it impossible to manipulate the OER and shelter inflation data in next month's CPI to come up with a big miss (the current plan).

And that, ladies and gentlemen, is literally "gas-lighting."

Finally, for those asking if you can pay seasonally adjusted taxes (lower of course) using your seasonally adjusted checking account balance (higher of course), we suggest you try it. Just make sure you first have a good plan how to survive Bubba's nightly foreplay for all the years you will spend in prison right after.

There was something glaringly odd in today’s PPI print.

But first, some background: as we detailed in our PPI post-mortem earlier, one day after CPI came in red hot, today’s PPI unexpectedly missed expectations on the headline level, coming in at 2.1%, which despite being the hottest since April 2023..

… was below the 2.2% estimate. The miss – the smallest possible – proved to be so important to the market starved for any dovish news, that algos instantly ignored the fact that core CPI came in at 2.4%, hotter than the 2.3% expected.

Which bring us to the “odd” part.

Looking at the core number (excluding food and energy), we find that according to the BLS, the only reason PPI was even positive in March is because of services, where the biggest source of upside was the “index for securities brokerage, dealing, investment advice, and related services, which rose 3.1 percent.” In other words, everyone was rushing to open a brokerage account so they can trade Jeo Boden or some other shitcoin.

But what about what really increased in March, which as we have shown previously, was gas prices which rose just over 6% based on, well, how much the average gas price rose across the US in March!

Here things get hilarious, because according to the BLS in March, while PPI Services rose by 0.3%, prices for final demand goods was actually negative, dropping by 0.1% MoM.

And then, reading a little further into the BLS press release we find this surprise: “the decline is attributable to the index for final demand energy, which moved down 1.6 percent.”

Which then brings us to the absolute punchline, because in the very next sentence, Biden’s Bureau of Gaslighting Services writes that “leading the March decline in the index for final demand goods, prices for gasoline decreased 3.6 percent.”

Hold on a second, didn’t we just show that gas prices – actual, real gas prices, which everyone across the country has to pay – rose by 6% in March?

Yes we did, but what we didn’t anticipate is the amount of BS Biden’s henchmen are willing to shove down our throats. And indeed, to understand how gasoline could possibly drop by 3.6% in a month where it rose over 6% we have to look at the category description, where we find the little trick beloved by propaganda ministries everywhere: “seasonally adjusted.”

That’s right, as shown in the chart below, according to the BLS, the seasonally-adjusted gas price in March magically dropped by 3.6% even though the unadjusted, as in real, gas price rose by 6.3%, exactly what the AAA also reported in its daily summary of what gas prices across the US truly are.

Now, for those wondering “did I pay 3.6% less or 6.3% more for gas in March“, we have the answer and unfortunately it is the one that leaves less money in your pocket (it always is). But for the BLS, the seasonal adjustment in this one category which actually soared, meant all the difference in the world because – you see – if Biden’s propaganda ministers had used the real gas price, PPI would have been 0.4% higher and risen 2.4% YoY, both blowing away estimates, sending stocks tumbling, and making it impossible to manipulate the OER and shelter inflation data in next month’s CPI to come up with a big miss (the current plan).

And that, ladies and gentlemen, is literally “gas-lighting.“

Finally, for those asking if you can pay seasonally adjusted taxes (lower of course) using your seasonally adjusted checking account balance (higher of course), we suggest you try it. Just make sure you first have a good plan how to survive Bubba’s nightly foreplay for all the years you will spend in prison right after.

Loading…