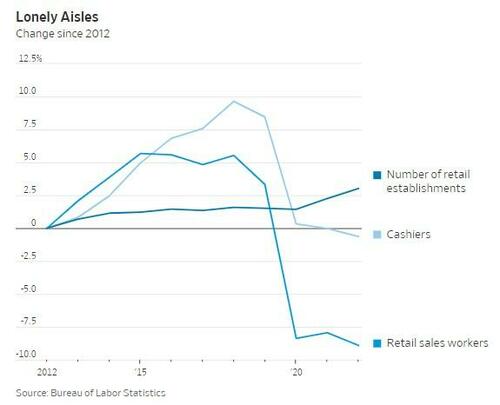

Across the retail industry, a trend is emerging: less employees, more self-checkouts and more items locked up behind safety doors.

The cause? Slowing sales and rising theft are eating into profits, according to the Wall Street Journal, who wrote this week that the "countermeasures" being used by retailers to fight theft and other shrink could make in-person shopping "even more miserable than it already is".

In addition to having to deal with normalized looting across the country thanks to Democratic DAs, retailers also are dealing with "the steepest annual wage growth since the 1980s," the report says. Average wages in the sector have now risen to about $20.54 per hour, the report says.

Remember that the next time some cashier wearing Airpods sighs when you ask them to take a stick of deodorant out of its alarmed hiding spot.

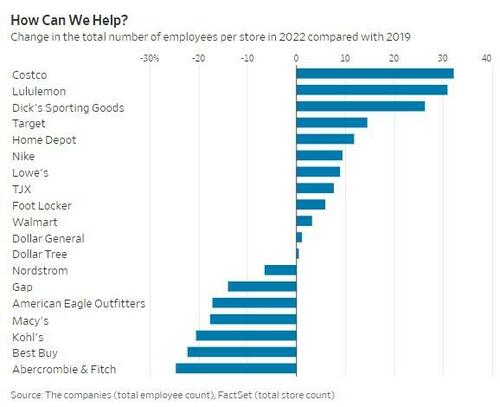

And so as a result, retailers have cut head cut and have not returned to their pre-pandemic staffing levels. Retail sales workers fell 12% from 2019 to 2022 and stores like Macy's and Kohl's have lost as many as 20% of their staff. Gap and Best Buy cut their staff by 25% and 22%, respectively. Only a handful of companies like Lululemon, Nike, T.J. Maxx and Costco have raised their employee headcounts.

Lorraine Hutchinson, retail-sector equity analyst at Bank of America says that the employees that are in stores now spend their time filling online orders.

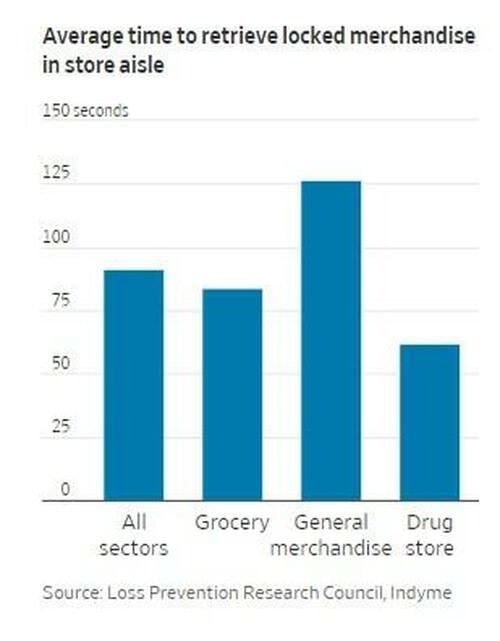

Shrink remains a key concern with retailers like Ulta now locking up 50% of its fragrances at stores. The practice has become so widespread that it is now a talking point on almost all retailer earnings calls.

David Bassuk, global leader of the retail practice at AlixPartners, commented: “Unfortunately, we’re facing a situation where shrink is a CEO topic. It used to be a store-manager topic.”

Neil Saunders, managing director of research firm GlobalData confirmed that retailers like Dollar General are seeing poorer performance due to a lower in-store employee footprint. He said that Macy's poor results were due to an "incredibly sloppy attitude to retail" and called their staffing a "complete breakdown". Dollar General has said they need to “further elevate the in-store experience and better serve its customers.”

Best Buy has been a positive example of the "new" retail: despite employing 35,000 fewer individuals in 2022 compared to 2019, the company has surpassed Wall Street's revenue expectations in eight out of the last ten quarters. By emphasizing cross-training, they've enabled their workers to perform multiple roles, from customer service to online order processing.

Moreover, in their recent earnings report, Best Buy indicated that automated virtual agents are handling 40% of customer inquiries without human intervention

Across the retail industry, a trend is emerging: less employees, more self-checkouts and more items locked up behind safety doors.

The cause? Slowing sales and rising theft are eating into profits, according to the Wall Street Journal, who wrote this week that the “countermeasures” being used by retailers to fight theft and other shrink could make in-person shopping “even more miserable than it already is”.

In addition to having to deal with normalized looting across the country thanks to Democratic DAs, retailers also are dealing with “the steepest annual wage growth since the 1980s,” the report says. Average wages in the sector have now risen to about $20.54 per hour, the report says.

Remember that the next time some cashier wearing Airpods sighs when you ask them to take a stick of deodorant out of its alarmed hiding spot.

And so as a result, retailers have cut head cut and have not returned to their pre-pandemic staffing levels. Retail sales workers fell 12% from 2019 to 2022 and stores like Macy’s and Kohl’s have lost as many as 20% of their staff. Gap and Best Buy cut their staff by 25% and 22%, respectively. Only a handful of companies like Lululemon, Nike, T.J. Maxx and Costco have raised their employee headcounts.

Lorraine Hutchinson, retail-sector equity analyst at Bank of America says that the employees that are in stores now spend their time filling online orders.

Shrink remains a key concern with retailers like Ulta now locking up 50% of its fragrances at stores. The practice has become so widespread that it is now a talking point on almost all retailer earnings calls.

David Bassuk, global leader of the retail practice at AlixPartners, commented: “Unfortunately, we’re facing a situation where shrink is a CEO topic. It used to be a store-manager topic.”

Neil Saunders, managing director of research firm GlobalData confirmed that retailers like Dollar General are seeing poorer performance due to a lower in-store employee footprint. He said that Macy’s poor results were due to an “incredibly sloppy attitude to retail” and called their staffing a “complete breakdown”. Dollar General has said they need to “further elevate the in-store experience and better serve its customers.”

Best Buy has been a positive example of the “new” retail: despite employing 35,000 fewer individuals in 2022 compared to 2019, the company has surpassed Wall Street’s revenue expectations in eight out of the last ten quarters. By emphasizing cross-training, they’ve enabled their workers to perform multiple roles, from customer service to online order processing.

Moreover, in their recent earnings report, Best Buy indicated that automated virtual agents are handling 40% of customer inquiries without human intervention

Loading…