By Michael Msika, Bloomberg Markets Live reporter and Strategist

For as long as most people can remember, London has been Europe’s biggest equity market. Given the crisis of confidence in British assets, that may soon change.

This year’s decline in UK stocks has pushed the market’s total capitalization to within touching distance of its nearest challenger, Paris. At the equivalent of $2.46 trillion, the gap between them is only $133 billion, close to the lowest on record.

The differential between the UK and French markets has been gradually eroding since Britons voted to leave the European Union in 2016. But the unprecedented market turmoil unleashed in the past week by Prime Minister Liz Truss has dealt a crucial blow, damaging economic confidence and sending the pound to a record low.

“London’s crown as the top European trading center was already losing its shine even before this latest confidence crisis and the plunge in sterling, with the impact of post-Brexit trade issues still weighing on sentiment,” says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.“With concerns deepening about the Truss administration’s handling of the economy, optimism appears to be seeping away.”

Wednesday’s intervention by the Bank of England to calm markets has only “bought time” in stabilizing the pound and seeking to avoid broader deterioration in UK household finances and asset markets, say Jefferies strategists led by Sean Darby.

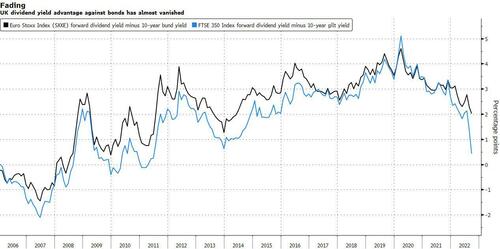

With Gilt yields rallying to the highest since 2008 this week, UK stocks are losing their appeal relative to bonds faster than their European peers. The spread between the FTSE 350 index’s forward dividend yield and the 10-year Gilt yield has fallen to just 0.5 percentage points, the lowest since 2011, offering a sharp contrast to that of euro-area peers, still around 2 percentage points.

The weakness of sterling since the Brexit vote has contributed to the decreasing value of London’s equity market, making British companies more attractive to foreign bidders. The UK has become a fertile ground for takeovers, also reflecting cheap valuations and lack of protectionism.

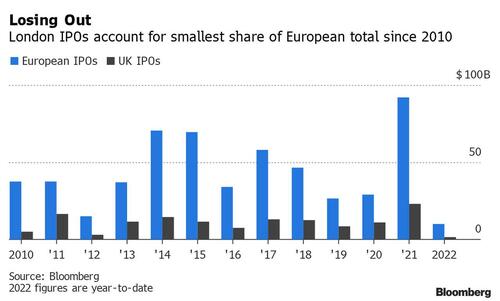

Another factor has been London’s increasingly fragile position as one of Europe’s premier listing venues. Just $1.38 billion has been raised through initial public offerings in the UK this year, representing 14% of the European total, the smallest share in more than a decade. according to data compiled by Bloomberg.

It’s not all doom and gloom. The weak currency is providing a big tailwind to UK large cap earnings, with 75% of FTSE 100 revenues coming from overseas. That means the blue-chip index is likely to continue outperforming the mid-cap FTSE 250, as long as recession fears persist and sterling remains under pressure, according to Liberum Capital strategist Susana Cruz.

By Michael Msika, Bloomberg Markets Live reporter and Strategist

For as long as most people can remember, London has been Europe’s biggest equity market. Given the crisis of confidence in British assets, that may soon change.

This year’s decline in UK stocks has pushed the market’s total capitalization to within touching distance of its nearest challenger, Paris. At the equivalent of $2.46 trillion, the gap between them is only $133 billion, close to the lowest on record.

The differential between the UK and French markets has been gradually eroding since Britons voted to leave the European Union in 2016. But the unprecedented market turmoil unleashed in the past week by Prime Minister Liz Truss has dealt a crucial blow, damaging economic confidence and sending the pound to a record low.

“London’s crown as the top European trading center was already losing its shine even before this latest confidence crisis and the plunge in sterling, with the impact of post-Brexit trade issues still weighing on sentiment,” says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.“With concerns deepening about the Truss administration’s handling of the economy, optimism appears to be seeping away.”

Wednesday’s intervention by the Bank of England to calm markets has only “bought time” in stabilizing the pound and seeking to avoid broader deterioration in UK household finances and asset markets, say Jefferies strategists led by Sean Darby.

With Gilt yields rallying to the highest since 2008 this week, UK stocks are losing their appeal relative to bonds faster than their European peers. The spread between the FTSE 350 index’s forward dividend yield and the 10-year Gilt yield has fallen to just 0.5 percentage points, the lowest since 2011, offering a sharp contrast to that of euro-area peers, still around 2 percentage points.

The weakness of sterling since the Brexit vote has contributed to the decreasing value of London’s equity market, making British companies more attractive to foreign bidders. The UK has become a fertile ground for takeovers, also reflecting cheap valuations and lack of protectionism.

Another factor has been London’s increasingly fragile position as one of Europe’s premier listing venues. Just $1.38 billion has been raised through initial public offerings in the UK this year, representing 14% of the European total, the smallest share in more than a decade. according to data compiled by Bloomberg.

It’s not all doom and gloom. The weak currency is providing a big tailwind to UK large cap earnings, with 75% of FTSE 100 revenues coming from overseas. That means the blue-chip index is likely to continue outperforming the mid-cap FTSE 250, as long as recession fears persist and sterling remains under pressure, according to Liberum Capital strategist Susana Cruz.