By Ye Xie, Bloomberg markets live reporter and analyst

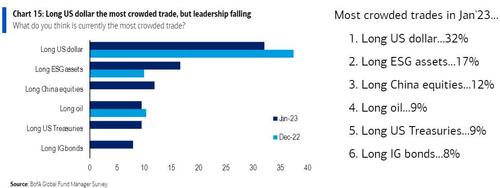

What a difference two months can make. In November, selling short Chinese stocks was considered by fund managers in a Bank of America survey as one of the most crowded trades. Now, bullish bets on Chinese equities made the list. It underscores the tremendous volatility Chinese assets have endured in recent months.

The BofA survey published this week showed that 12% of investors believed going long Chinese equities was one of the most-popular positions in global markets. It trailed only long-dollar and long-ESG positions, which garnered 32% and 17% of the votes, respectively. Two months ago, fund managers considered betting against Chinese stocks to be the second-most crowded trade after long-dollar positions.

The 180-degree shift in sentiment is hardly a surprise. Until late October, investors had been dumping Chinese assets as Covid restrictions sank the economy and President Xi Jinping installed his loyalists to the top leadership at the Party Congress. Over the past two months, China abandoned the Covid Zero policy, propped up the ailing housing market and turned more supportive on tech companies. Since hitting the lowest since 2009 in late October, the Hang Seng Index has jumped 48% in dollar terms as the best performer among the world’s major stock benchmarks.

A crowded position is generally viewed as a negative. When many investors are positioned the same way, there’s no marginal new buyers to push the market higher. And when the fundamental story changes and everyone heads for the exit, it exacerbates the selloff.

So should we be worried about investors being too sanguine? Not necessarily.

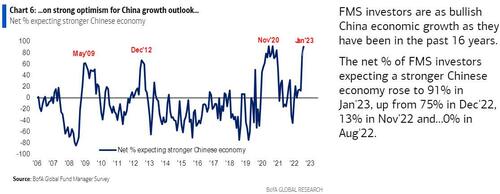

On the positioning front, the BofA survey does show fund managers are “unabashedly bullish” on China. A net 91% of fund managers expect a stronger Chinese economy, the highest percentage in 17 years.

In a separate survey of Asian managers, 42% said they are overweight China, up from 14% in October. In addition, 90% of them think Chinese stocks can deliver positive returns this year, even if US equities fall.

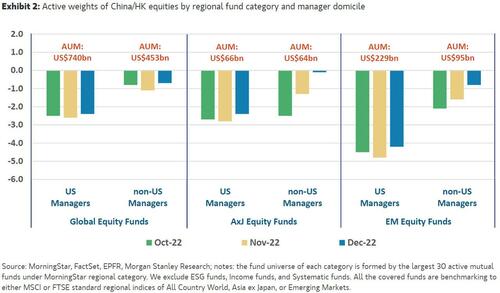

Still, it’s debatable whether the perception of China being crowded is accurate. While Asian investors are more bullish, US investors haven’t been fully on board with the “everything is great” narrative. A recent Morgan Stanley analysis showed that American fund managers have actually kept their underweight positions on China unchanged in recent months.

Secondly, there’s no clear catalyst to threaten the China recovery narrative when people are just returning to their work and when the policy objective is to get the economy going again. Until the recovery is well underway, it’s hard to prove the markets’ expectations on growth are unreasonable.

But leaving aside the question of whether the China trade is crowded or not, the volatility that the Chinese markets has shown over the past year clearly reduces the attractiveness for long-term investors.

By Ye Xie, Bloomberg markets live reporter and analyst

What a difference two months can make. In November, selling short Chinese stocks was considered by fund managers in a Bank of America survey as one of the most crowded trades. Now, bullish bets on Chinese equities made the list. It underscores the tremendous volatility Chinese assets have endured in recent months.

The BofA survey published this week showed that 12% of investors believed going long Chinese equities was one of the most-popular positions in global markets. It trailed only long-dollar and long-ESG positions, which garnered 32% and 17% of the votes, respectively. Two months ago, fund managers considered betting against Chinese stocks to be the second-most crowded trade after long-dollar positions.

The 180-degree shift in sentiment is hardly a surprise. Until late October, investors had been dumping Chinese assets as Covid restrictions sank the economy and President Xi Jinping installed his loyalists to the top leadership at the Party Congress. Over the past two months, China abandoned the Covid Zero policy, propped up the ailing housing market and turned more supportive on tech companies. Since hitting the lowest since 2009 in late October, the Hang Seng Index has jumped 48% in dollar terms as the best performer among the world’s major stock benchmarks.

A crowded position is generally viewed as a negative. When many investors are positioned the same way, there’s no marginal new buyers to push the market higher. And when the fundamental story changes and everyone heads for the exit, it exacerbates the selloff.

So should we be worried about investors being too sanguine? Not necessarily.

On the positioning front, the BofA survey does show fund managers are “unabashedly bullish” on China. A net 91% of fund managers expect a stronger Chinese economy, the highest percentage in 17 years.

In a separate survey of Asian managers, 42% said they are overweight China, up from 14% in October. In addition, 90% of them think Chinese stocks can deliver positive returns this year, even if US equities fall.

Still, it’s debatable whether the perception of China being crowded is accurate. While Asian investors are more bullish, US investors haven’t been fully on board with the “everything is great” narrative. A recent Morgan Stanley analysis showed that American fund managers have actually kept their underweight positions on China unchanged in recent months.

Secondly, there’s no clear catalyst to threaten the China recovery narrative when people are just returning to their work and when the policy objective is to get the economy going again. Until the recovery is well underway, it’s hard to prove the markets’ expectations on growth are unreasonable.

But leaving aside the question of whether the China trade is crowded or not, the volatility that the Chinese markets has shown over the past year clearly reduces the attractiveness for long-term investors.

Loading…